FICO Score Range: What’s Considered Good?

Your credit score is extremely important when you want to borrow money. After all, it’s the number that lenders will look at to determine whether to offer you a loan and what interest rate to charge you. If you’ve never looked into credit scores before, it’s probably not immediately clear what your number means for your lending prospects.

In this article, we’ll take a look at one of the most popular credit score models that lenders across the country use: FICO scores. We’ll explain what the FICO score range is to help you understand what’s considered a good credit score and what’s considered a bad one. We’ll also explore some of the ways that you can improve your FICO credit score so that you can put yourself in the best position possible for getting an affordable loan.

-

-

FundsJoy Personal Loans - Best For High Limits

Our Rating

- Borrow Between $200 - $5000

- Approval Time is Exceptional

- Easy Application Process

Understanding the FICO Score Range

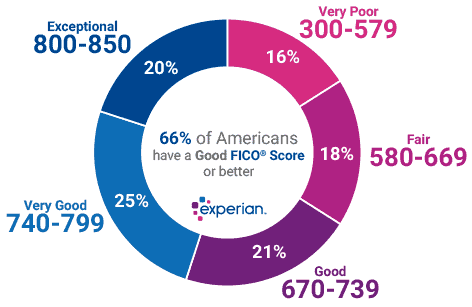

Your FICO credit score is a single number that ranges between 300 and 850. The higher the score, the better your credit in the eyes of lenders and the more likely lenders will be to offer you a loan with favorable terms.

We can further break the FICO credit score down into five sub-ranges as a way to generally describe your credit:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

Generally, any credit score above 580 is considered to be okay. At this level or higher, you’ll easily be able to find a lender who is willing to work with you. Often, credit unions and reputable personal lenders require a minimum credit score of 580 to be approved for a loan.

If your credit score is 670 or higher, you are at or above the creditworthiness of the average American. You should have no problem finding a lender if you fall into the “Good,” “Very Good,” or “Exceptional” credit categories.

Credit scores below 580 are considered to be poor. With poor credit, you’ll need to look specifically for lenders who are willing to work with bad credit.

What Determines Your FICO Credit Score?

FICO credit scores generally weigh five different categories to calculate your score:

Payment History (35%): Have you paid your debts on time? This part of your credit score goes down when you miss a payment and goes up when you consistently make debt payments over a long period of time.

- Amount Owed and Credit Utilization (30%): How much do you currently owe to lenders? Even more important, how much of your total available credit (from credit cards and other lines of equity) are you currently borrowing? This utilization ratio gives lenders an idea of your overall financial health.

- Length of Credit History (15%): The longer you have had lines of credit open in your name, the better your FICO credit score will be. Simply put, lenders have more data about your borrowing history and your likelihood to repay a debt.

- Credit Mix (10%): This part of your FICO credit score hinges on how many different types of debts you have taken out over time. If all your debt is on credit cards, that will hurt your credit score relative to spreading that debt across a credit card, auto loan, personal loan, and mortgage.

- New Credit (10%): If you’ve recently borrowed money or opened up a new line of credit, your credit score could drop slightly. Think of it this way: if you took out five different loans in the past three months, that would be a potential red flag to new lenders.

There’s More than One FICO Score

Unfortunately, credit scores aren’t as simple as a single number. That’s because FICO has put out different versions of its credit scoring algorithm over time and for different industries. As a result, different lenders may be using different formulas to determine your credit score.

FICO 9 vs. FICO 8

The number one reason different lenders could see different credit scores for a single individual is that the FICO algorithm has gone through updates over time. The company recently released FICO 9, but many lenders and credit agencies are still using FICO 8 to calculate credit scores. In fact, some lenders could be using a credit scoring algorithm as old as FICO 5, which was released in 2005!

The differences between FICO scoring algorithms can be significant. FICO 9, for example, gives less weight to overdue medical debts than other types of debt, which can make a big difference in some individuals’ credit scores. FICO 9 also makes it easier for renters to improve their credit scores by factoring in on-time rent payments, which FICO 8 ignores.

Right now, the vast majority of lenders are still using FICO 8 to calculate your credit score, but it’s worth shopping around at different lenders if you’re on the border between credit score sub-ranges. You might be able to get a better loan offer from lenders using FICO 9.

Industry-specific FICO Scores

To make matters more confusing, we’ve only focused on “base” FICO scores up to this point. There are also industry-specific scores, which range from 250-900 instead of 300-850.

These industry scores use algorithms that are tailored for auto loans, for example, as well as for mortgages, credit cards, and other types of credit. If you’re almost finished paying off an auto loan but have a lot of credit card debt, your auto-specific credit score might be much higher than your credit card-specific score.

Once again, this is part of why it’s so important to shop around. One credit card company might look only at your base FICO score to determine if you’re eligible to open an account, while another might look at your credit card-specific score. There are also multiple versions of each industry-specific algorithm. For example, some auto lenders are using FICO Auto 8, while others are still using FICO Auto 5.

Why is Having a Good Credit Score Important?

Having a good credit score is so important because it plays a huge role in the terms of any loan offer you receive.

Ultimately, your credit score tells lenders how likely you are to repay your debt. The lower your credit score, the more risk the lender takes on that you won’t pay back your loan in full. To compensate for that risk, lenders will demand more guarantees and higher interest rates.

The difference in interest rates can be significant. To understand this, let’s look at how interest rates change with credit score for a typical 30-year mortgage.

If your credit score is 800 or above, mortgage interest rates average around 3.4%. If your credit score drops below 700, your rate could go up to 3.8%. Below 600, and it shoots up to more than 5%.

With that in mind, let’s say you take out a $200,000 loan. With a 3.4% interest rate, you’d have to pay back a total of $319,000 over 30 years. At a 5% interest rate, you would owe a total of $386,000. That’s a total difference of $67,000, one-third of the amount that you originally borrowed, all because of a difference in your FICO credit score.

So, having a good credit score can help you save a significant amount of money on a loan.

Ways to Improve Your FICO Credit Score

At this point, you’re probably wondering how you can boost your credit score. Thankfully, you have a couple different options to raise your FICO credit score and improve your loan options.

Make Payments On Time

The single best way to not only improve your credit score, but also to prevent it from dropping over time is to make payments on time. Whether you’re paying back credit card debt, paying monthly instalments on a personal loan, or paying your mortgage, being consistent in your payments reflects extremely favorably on your FICO credit score.

Importantly, you only have to make the minimum payments on bills in order to build your credit. If you do miss a payment, make sure to catch up as soon as possible. The longer a bill sits unpaid, the worse the damage to your credit score.

Use Less Credit

You can also bump up your credit score by minimizing the amount of credit you use relative to your total available. For example, if your credit card allows you to borrow up to $10,000, your credit score will climb over time if you only borrow up to a maximum of $3,000 at a time. If you consistently borrow the full $10,000, that can hurt your credit score over time even if you pay it back on time.

You can game the system to some extent by opening multiple credit cards. Using 30% of your available credit across each of three cards is actually better for your credit score than using 90% of your available credit on one card.

If you know you’ll be applying for a loan soon and your credit utilization is above 30%, you can get your score higher quickly simply by paying off some of your credit card or loan debt.

Build Up Your Credit History and Credit Mix

Over the long term, you can improve your credit score by establishing a strong track record. Building up your credit history by consistently having several lines of credit open will improve your score, even if you hardly use the available credit.

Where possible, mix up the types of credit you have. The FICO credit scoring algorithm looks more favorably upon individuals with multiple types of credit than upon individuals who have only ever used credit cards.

Conclusion

Your FICO credit score plays an important role in determining whether you’ll be eligible for a loan and the quality of terms you’ll be offered. Understanding FICO credit scores can be tricky considering that there are multiple different scoring algorithms. If you focus on your base credit score, that’s a good way to figure out where in the FICO score range you fall. That also offers a starting point for improving your credit score so that you can get access to more lenders and better loan offers.

FundsJoy Personal Loans - Best For High Limits

Our Rating

- Borrow Between $200 - $5000

- Approval Time is Exceptional

- Easy Application Process

Glossary of Loan Terms

FAQs

Is there a minimum FICO credit score I need in order to get a loan?

Minimum credit scores vary from lender to lender. Some lenders will only work with prospective borrowers who have a FICO credit score of 580 or more. Other lenders don’t specify a minimum credit rating and will work with you regardless of where you fall on the FICO score range. If you have bad credit, it’s a good idea to check with prospective lenders about a minimum score requirement before applying.

How can I check my FICO credit score?

There’s no way to check your FICO credit score directly by asking FICO for it. Instead, you have to go through a credit reporting agency, bank, credit card company, or credit union. A huge variety of lenders, including most major banks and credit cards, include free credit reports for all their customers. If you don’t already have access to your score, Discover allows even non-customers to check their credit score for free.

Does my income factor into my FICO credit score?

No, income is not included in the calculation of your FICO credit score. Other demographic data, such as where you live, your age, your ethnicity, and your employment history, are also not taken into account in FICO credit scores. However, your lender may offer a loan decision based on your income and employment history.

How long does negative information continue to impact my FICO credit score?

In general, negative information continues to impact your FICO credit score for up to seven years. However, keep in mind that negative marks are weighted according to how new they are. A missed payment five years ago will have a much smaller effect on your credit than one from five months ago.

Types of Loan – A-Z Directory

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up

Payment History (35%):

Payment History (35%):