Cash Loans Near Me – What are my Options?

If you have a bill that needs to be paid in cash soon, probably it is overdue rent or your car payment, you should consider a cash loan near you. And in case you are wondering, no, a credit card loan or a check loan will not cut it because they tend to take longer to process.

The application process in a physical store is fast. Although it doesn’t beat the convenience of completing the application from the comfort of your couch, you are guaranteed of walking out with the cash loan and having all your questions answered.

Since you are reading this, it’s safe to assume that you have decided to take a cash loan. But the problem is, how in the world do you find the locations? In this guide, we shall outline everything you need to know to make the process of finding the locations easier. You just might love the experience of in-store application than an online application.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

How to Find Cash Loans Near Me

To get you started, below are some steps to guide you through finding a cash loan near you.

However, if you are pressed for time and would rather get information on the cash loan lenders

Determine if cash loans are legal in your state

Cash loans were intended to be a savior for those who find themselves in financially sticky situations. But with time, individuals grew increasingly reliant on these loans and were stuck in a ferocious debt cycle. A product that was initially good turned into a monster in the eyes of the federal and state government. Consequently, some states imposed a ban on cash loans. And those that allowed it made strict rules to govern the industry and ensure lenders are responsible and are not in the business of robbing people blind.

If you live in a state that doesn’t accept such lenders, you should consider other alternatives, including credit card loans, instalment loans and traditional bank loans.

Note: Some states also have regulations on the rate caps, maximum loan and a grace period (if any).At the moment, the states that prohibit cash loan include;

- Arkansas

- Arizona

- Connecticut

- Georgia

- Massachusetts

- Maryland

- New York

- New Jersey

- Pennsylvania

- North Carolina

- West Virginia

- Vermont

- District of Columbia

Some states in which cash loans are heavily regulated include;

- Colorado

- California

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maine

- Kentucky

- Michigan

- Minnesota

- Mississippi

- Nebraska

- Montana

- New Hampshire

- Oklahoma

- Ohio

- Virginia

- Washington

Perform an online search for all lenders in your area

To date, the best way of finding anything is through a simple online search. All cash loan lenders with brick and mortar locations have an online presence as well to cater to borrowers who may not be tech-savvy or for some reason (like immediate cash) prefer getting services from physical locations.

List every vendor you come across that offers cash loan services in your area and then proceed to check if they have physical locations. As you do this, be wary because not all online lenders are genuine. Some are looking for an opportunity to prey on borrowers at their worst.

The number of results you get will depend on the state you live and the legal parameters that operate.

Compare rates

Cash loan lenders are business. They offer emergency loans at interest. And though the federal and state governments have interest caps, not every lender will offer the maximum interest. In addition to the interest rate, some will charge extra fees like processing fees and lateness fees.

Do not make the mistake of considering the interest rate only as this alone does not constitute the cost of the loan. Instead, look at the APR. This rate will guide you to the true cost of the loan in question — generally, the lower the APR percentage the cheaper the loan.

And while you are at it, factor the number of days a lender gives to repay the loan. On this, bear in mind that states impose limits on terms and loan amounts. The most common state-imposed maximum is $500 or about 25% of your gross income. Generally, same day cash loans last until the next payday. This means that a normal loan will last between two and four weeks.

Create a list of top contenders

Once you determine the lenders in your area and know which ones offer good rates, create a list of the best for a store visit. Why is this important? Well, because the rates on the websites aren’t always the final rates. There is always room to bargain if you have a way with words, and if you are taking a substantial amount of loan.

Also, the beauty of visiting a store is to determine if you like their customer service on a personal level. If you are going to get into a loan contract with an establishment, then it best be the one you feel understands your needs and will be flexible.

Pick a lender and complete the loan application

Once you are done doing a survey, pick one emergency loan lender you are comfortable with and fill out the form. Some may allow you to start the application online and pick up cash at the store.

Note: At this point, you should have checked the loan costs, whether the lender is legal and certified in your area and the fine print of the loan (including the amount payable on your next payday).When should you prefer an online loan?

It might be better to borrow your cash loan online if:

- You do not have a car – an online cash loan is better if you don’t have means of transportation and you cannot walk to the nearest store. With online lenders, the application process, receiving funds and repaying the loan is online.

- You do not need funds immediately – if your emergency can wait for more than 24 hours, then you can save yourself the trip to a store location

- You are familiar with the loan process – if this is not your first emergency loan, then you might not have a lot of answers about what to expect and the process. As such, you can save yourself the hassle of visiting a store and complete the application online.

Pros and Cons of Cash Loans

Pros:

- Easy application – Instant cash loans lenders offer short and straight forward loan forms through their web platforms. Some offer physical forms. It takes less than three minutes.

- Quick approval – lenders have designed these loans for emergencies. They, therefore, perform approvals fast (typically within an hour)

- They offer bad credit cash loans

Cons:

- High-interest rates – the nature of cash loans (unsecured, bad credit loans and fast approval), means that the risk is high. As a reward, they get to charge high APRs

- The process is tiring as you have to walk from one store to the next

- The stores are only open during normal working hours

Best Cash Loan Lenders With Stores

Cash StoreThis lender has been serving borrowers since 1996. Cash Store offers borrowers a lot more than payday loans. Provided you live in any of the stores they have stores, you can walk in and out with your loan in a couple of minutes.

But aside from their locations, Cash Store has a functional website complete with a comprehensive FAQ section. In this section, you’ll find answers to many questions, including how much you can borrow, the loan costs, payment deadlines and more. Additionally, you can opt to complete an online form or walk into a store. First-time borrowers are eligible for a special offer. And if you refer a friend, you get an offer as well.

Cash Store offers several loan products. However, if you are looking for an emergency loan, you will have to walk into a store location. And the cash loans are available in Michigan and Illinois only.

Pros:

- You save money when you refer the lender to friends

- They offer discounts to first-time borrowers

- They offer a quick turn around on their loans

Cons:

- There is no online application for cash loans

- It operates in seven states

- The cash loans are limited to Michigan and Illinois

OportunOportun is a storefront and an online lender that offers small loans to individuals who find themselves in financial fixes. It offers loan amounts of between $300 and $9000 and doesn’t require a minimum credit score.

You will also be pleased to note that the Community Development Financial Institution certifies Oportun. Because of this, its main mission is to foster community development. It is also required to offer financial education and empowerment opportunities in the process.

Opportune doesn’t require borrowers to have a US bank account when applying, and more than 50% of their borrowers don’t have credit scores. But even though the company doesn’t require a bank account, you will have to provide proof of income in for of pay stubs or bank statements.

Pros:

- Offers financial education as we as counseling

- Fast funding

- Doesn’t perform a credit check

- Don’t need your bank account information

Cons:

- Has high rates

- It’s only available in limited states

USA Cash ServiceYou can apply for a cash loan if you live in California, Utah, Nevada or Idaho. If you are worried about getting in bed with a legal lender, you should rest easy when dealing with USA Cash Services. They are licensed in every state they operate in. Moreover, to keep your information private, the company uses SSL encryption. And last but not least, the company adheres to its privacy policy to the letter.

They have been lending borrowers since 1995, which makes them experienced in the industry and qualified to offer borrowers products that meet their needs.

The stores operate from Monday to Saturday. On weekdays, they operate between 8 am, and 8 pm and on Saturday between 10 am and 2 pm. When you visit a store, you should carry a checkbook, proof of income, a photo ID and proof of income.

Pros:

- Fast approvals

- Licensed and adhere to federal and state regulations

- They are experienced

Cons:

- Only available in some limited states

- High-interest rates

Speedy CashSpeedy Cash has been offering loans since 1997. They allow borrowers to apply in person at their stores, or online in the different states they operate in. The beauty of working with this lender is that they offer more than payday loans. Other products include title loans or instalment loans like Advance America (a top lender in the US).

Even if you don’t have a great credit score, Speedy Cash can offer a loan through any of their cash locations. Alternatively, you can apply for the loan and have it loaded onto your prepaid debit card. The latter option will grant you access to the loan amounts without incurring ATM fees. This is great especially if you need the loan down to the last dime.

Is Speedy Cash all perfect? No, it’s not. For starters, it does not feature on Better Business Bureau. Moreover, it does not have a physical location in every state. This fact limits the instant option tremendously.

Pros:

- It offers loans amounts up to $5000

- You can pick cash at a store close to you

- The turnaround is the next business day

Cons:

- Installments loan is the only product offering high amounts

- You should have a valid phone number

- It is available in less than US states

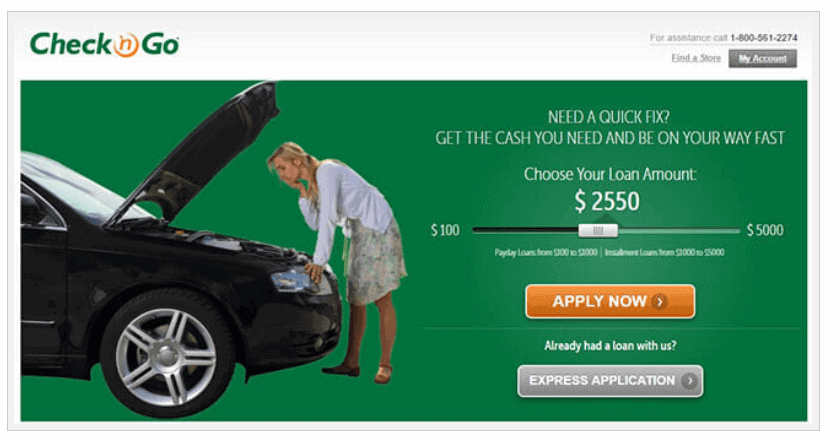

Check N GoCheck’n Go offers several loan products through their stores spread out in several states in the US. Some of the loan products the lender offers include credit card loans, installment loans, payday loans, and check cashing.

If you need money fast, you are better off walking into a Check ‘n Go store location close to you. Speaking of loan locations, Check ‘n Go has made it easier for you by availing an online store locator. Once you find a store location, the loan application process is simple. If your loan is approved, you will walk away with the money instantly.

Pros:

- It has a friendly support team

- It is available in a whopping 27 states

- It is licensed in all the states it operates in

- It has a simple instore and online application process

Cons:

- It as expensive fees

- It has limited loan amounts

Qualifications of In-store Payday Loan

Before a lender grants you a loan, they have to check if you pass their predetermined qualifications. Some of these include;

- You should be over 18 years or 21 years (depending on the state)

- You should be a permanent resident in the US

- You should have a US phone number

- You should be a US citizen (have an SSN or a Tax ID)

Note: For store applications, you do not have to give your email address. Moreover, you don’t need to give your debit card if you write a post-dated checkVerdict

Online and store location cash loan applications are similar. However, if you need your questions answered fast and want to get the money immediately, you should prefer an in-store application. On the other hand, if there is no store location in your area, an online application will have to do.

FAQ

How many cash loans can I have at a time?

Different lenders have different policies on simultaneous as well as consecutive cash loans. Some lenders even have cooling-off periods where borrowers can’t take extra loans, while others allow concurrent loans.

How fast are cash loans processed?

Cash loans seem to be faster than other emergency loans deposited into banks because they aren’t subject to processing periods by different payment methods. You can get cash immediately your application is approved at the store.

Can I still get an emergency loan with poor credit?

Yes, you can. Payday loan lenders do not do a hard credit check. They only consider the information you give on the form (especially your income and expenses).

Do cash loans improve my credit score?

Most lenders claim that they can help you improve your credit score over time. However, since they do not contact the credit bureaus before extending a loan, there are low chances they will after. Improvement of your credit score solely depends on the report the lender makes to these credit bureaus.

Is it a must I write a post-dated check?

No, it’s not a must. It all depends on the lender. Some will require that you authorize ACH – a process that allows them to automatically deduct money from your account when the loan is due.

Why is my employer information important?

Lenders are required to be responsible lenders. This means that if a lender approves a huge loan amount without determining if the borrower can repay the loan and the borrower defaults, it’s their fault. It’s because of this that lenders often adjust the loan amount instead of rejecting.

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up