Auto Title Loans Review 2020 – Read This Before Applying

When you are going through a rough patch and cannot get a loan from regular lending institutions, you should consider Auto Title Loans. This is a company that will provide you with a loan and use your car as collateral. The loans come with a low-interest rate and have a higher rate of approval.

But before you dive in head first, you should have a full picture of what you expect. As you already know, there are many loan companies in the US and though taking a loan can get you out of problems today, you need to ensure it will not land you in even more trouble later on.

To help you make the right decision, below is a comprehensive guide on Auto Title Loans.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

-

-

What is Auto Title Loans?

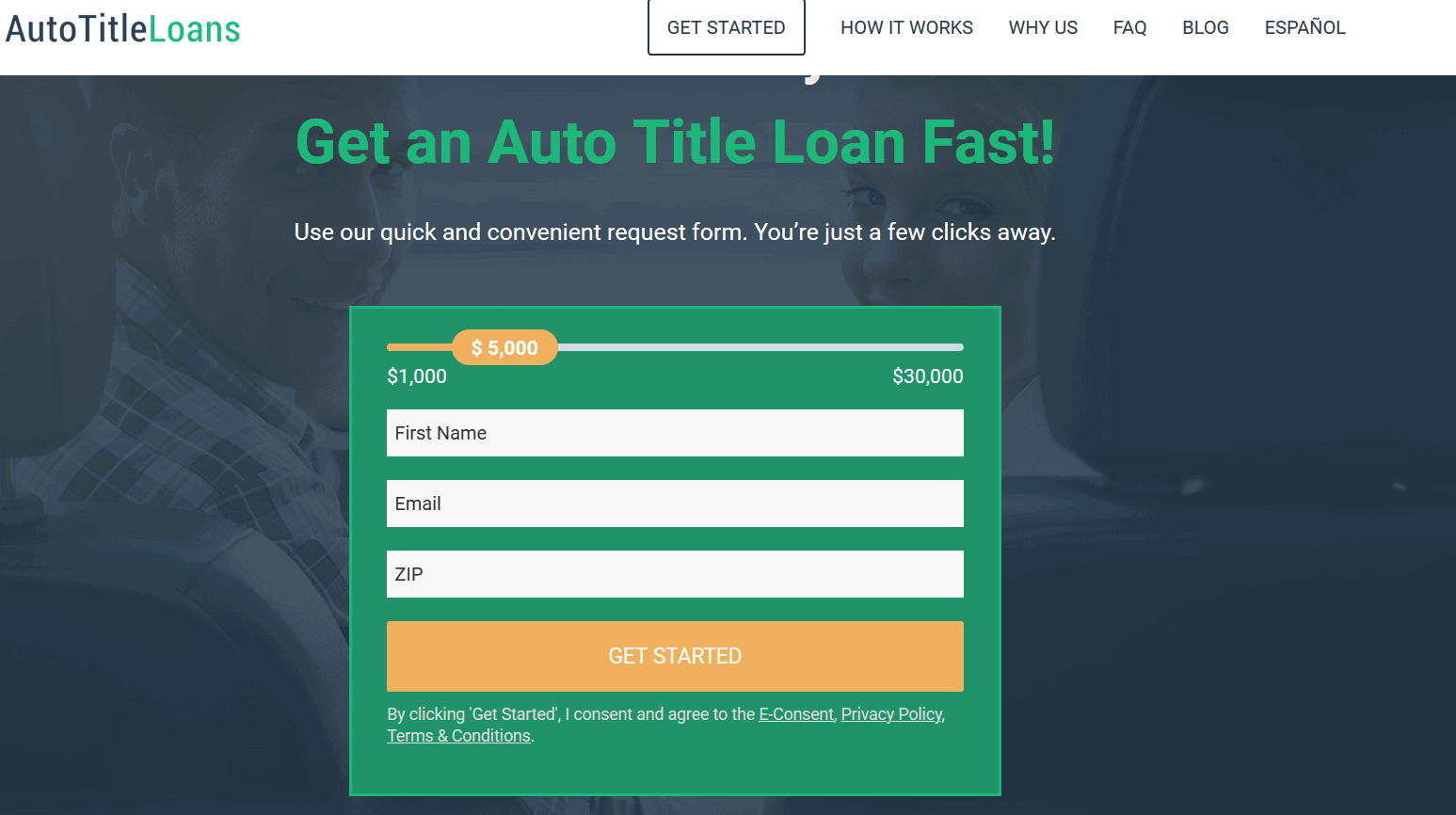

Auto Title Loans is a lending company focused on offering individuals short term loans. But it’s not like regular lending companies, in the background, there is a network of lenders that it connects to, so you can think of Auto Title Loan as a loan connection service.

The initial application process takes a couple of minutes. However, once your application is submitted, and you are matched with a lender, you give your car title as collateral for a loan between $500 and $10,000.

It’s important to note that when you get the loan, you’ll not deal with Auto Title Loans but the specific lender you have been matched with. As such, the rules and regulations that apply are those stipulated by the lender.

Also, even though no loan is guaranteed on the platform, Auto Title Loans accepts applications from individuals with bad credit as well. Since you have a car title as collateral, the interest is bound to be lower in comparison to other bad credit loans.

Auto Title Loans is a connection company. It offers secured loans. They do not charge application fees.Pros and cons of Auto Title Loans?

Pros:

- It is a quick process – Auto Title Loans have a quick application process. When you complete the application, you will be connected with a potential lender in a matter of minutes.

- Variable loan amounts – the loan amount you can borrow depends on the value of your car. Most lenders are willing to offer a loan that is 80% of the value of your vehicle. The loan should be in the range of $500 and $10,000.

- Low-interest rates – short term loans have a notorious reputation for being expensive. But in this case, since you give your car as collateral, the risk is reduced for the lender, and in turn, the lender offers lower interest rates.

- Fast deposits – after you get a match and your loan is approved, you will have the funds in your account within 24 hours (a business day). However, the time it takes to deposit money into an account depends on the lender you end up with.

- You keep your car – even though you hand over the title of the car, you get it back once you finish paying off the loan. While you service the loan, you keep the car. However, bear in mind that some lenders may require that you purchase extra insurance if your current one is not according to their standards.

- Anyone qualifies – since you will place your car as collateral, most same day loan lenders will not run a credit check. In any case, even if you have a bad credit score, the car title is enough security.

Cons:

- There is no list of the lenders in the network – unlike other lending connection services, Auto Title Loan is not transparent with their list of lenders. As such, you don’t know which lender you’ll be matched to until they get back to you.

- Theirs is no guarantee – Auto Title Loans doesn’t guarantee that they will connect you to a lender and in the event they connect you, it’s still not a guarantee that your loan will be approved.

- Risk repossession – if you cannot repay the loan by the agreed due date, the lender has the right to repossess the car. And because of this, you need to be extra careful with the amount you borrow and the lenders you get into a contract with. Before you apply for the loan, ensure you can afford the repayments.

- It might not end with repossession – if selling your car isn’t enough for them to get back their money, the lender will come back to you for the balance. This rarely happens because lenders finance loans that are between 50% and 80% of the value of the car.

How does Auto Title Loans Work?

Auto Title Loans is a connection service. This means that they do not offer loans. Instead, they connect you to a network of lenders in the industry with the service. Essentially, with a single application, you are applying to multiple lenders.

As the name suggests, Auto Title Loans allows you to get short term loans with your car title as the collateral. Once you submit your application, they first check if it meets their eligibility criteria and then broadcast it to their network of lenders.

After several minutes, you get a match to a lender who then checks if you meet their criteria for the loan. The lender seeks to verify your affordability of the loan, which includes verifying the value of the car. How does a lender determine the value of the car? Simple, they request that you take your car to an authorized inspection center in the U.S.

Now, lenders in Auto Title Loans try to make the process convenient and flawless by partnering with local garages in the U.S. with these partnerships; there might be a location several minutes away from your residence. The inspection doesn’t take a lot of time. At this point, if you have any questions about the loan, you should contact the lender directly and not Auto Title Loans.

What Loan Products Does Auto Title Loans Offer?

Auto Title Loans doesn’t provide any loan facilities. By now, it should be clear that its role in the industry is to connect lenders to borrowers.

With that said, what kind of lenders does the company connect you to? The company connects you to lenders who offer secured loans. The secured loans are linked to car titles. You can get a lot more money through this service than with payday loans.

The lender doesn’t dictate what you use the money on. All they care about is that you repay within the agreed time.

What Other Store Services Does Auto Title Loans Offer?

Apart from connecting you to reputable lenders in the industry, Auto Title Loans doesn’t offer other services.

Auto Title Loans Account Creation and Borrowing Process

Remember, the goal here is to connect you to a loan provider. As such, Auto Title Loans don’t have a lot of requirements. They have a comprehensive form that captures information that is most relevant for lenders to have a feel of the kind of individual they will be working with.

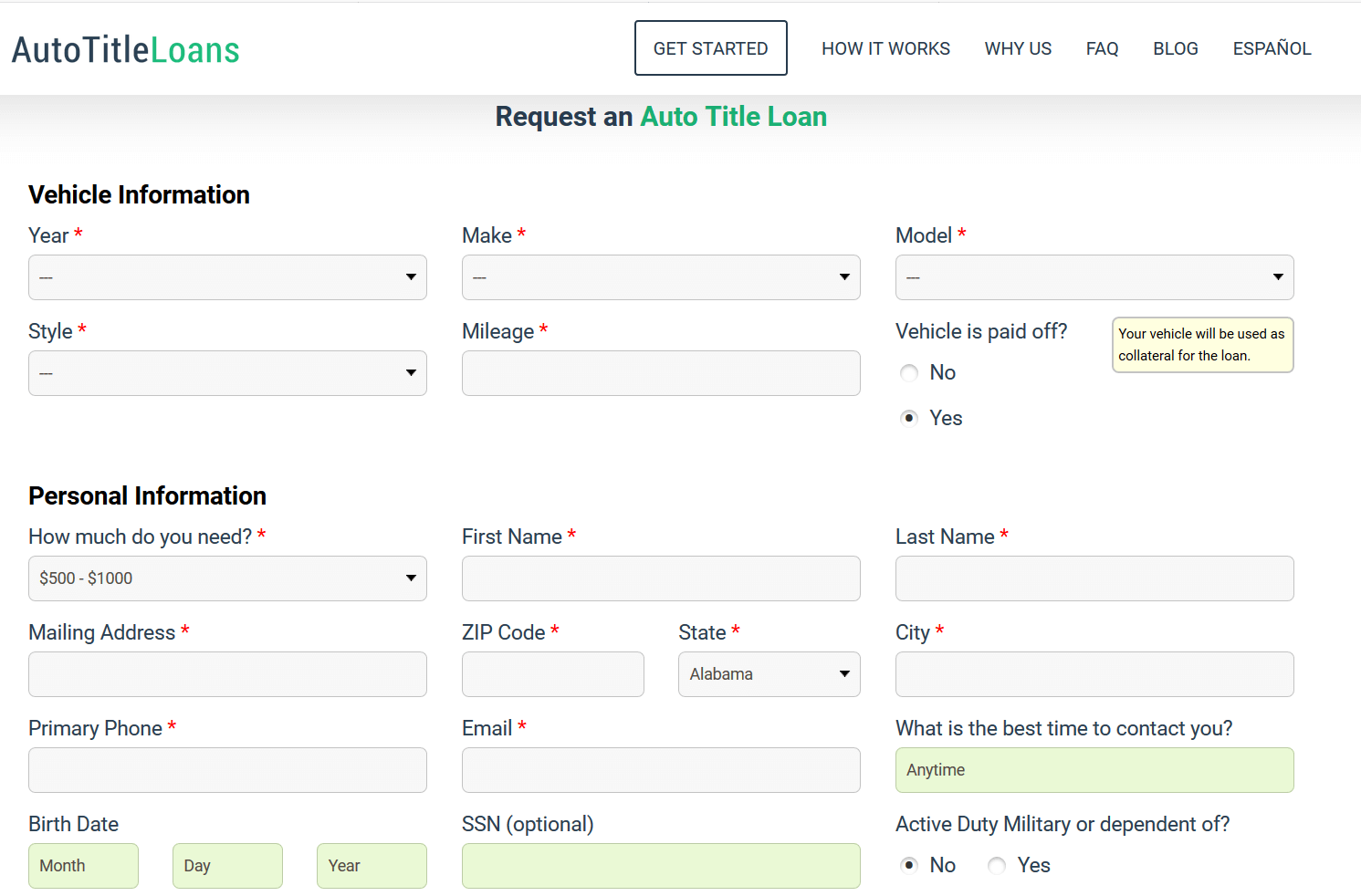

The form is available on a single page of the website. It has different sections including;

- Vehicle information – in this section, you fill in details about the car you are willing to put up as collateral. The car details include the make and model, the style the mileage, and if you have finished paying it off.

- Personal information – in this section, the company gets some details about who you are and where you live. You will fill in your name, date of birth and your current address.

- Employment – this is important even if you are taking a secured loan. Lenders need to know you can afford the repayment installments. You will provide some details on your monthly income and any benefits you get. If you are bankrupt, this is the section to declare it. If you are in credit counseling or a debt consolidation program, you should tick ‘yes’ for ‘Active bankruptcy.’

Eligibility Criteria for Auto Title Loans

Before you proceed to apply for a secured loan, you should check to ensure you meet the requirements as listed below;

- You should be 18+ years

- You should have a regular income. This doesn’t mean you should be actively employed. However, whatever you do should generate enough money to help with the loan repayment

- You should have a motorcycle, truck or car

In addition to this, different lenders have different requirements. For instance, some require you to have a bank in the U.S. if they accept your loan, they will deposit the money in the account you provide.

Information Borrowers Need to Provide to Get Auto Title Loans

To get a loan, you need to provide your;

- Personal details – including the loan amount, name, contacts, and physical address.

- Vehicle information – in this category, you’ll provide the make and model of the vehicle, year of manufacture and mileage.

- Employment information – here, you enter how much you make a month and any benefits you get, if any.

What States Accept Auto Title Loans?

The US has strict rules governing short term loans – and with good reason. The rules help to safeguard the interest of customers. No one wants to feel harassed after taking a loan. And on the flip side, lenders don’t want to be duped.

With the strict laws in this industry, not all states enjoy the services Auto Title Loans has to offer. The states they service include;

- Arizona

- Delaware

- Alabama

- Florida

- Idaho

- Georgia

- Kentucky

- Illinois

- Mississippi

- Minnesota

- Missouri

- Montana

- Wisconsin

- Virginia

- Utah

- Texas

- Tennessee

- South Dakota

- Rhode Island

- New Mexico

- Oregon

- Nevada

- New Hampshire

If you do not live in any of these states, you should search for Auto Title Loan lenders that operate in your state.

What are Auto Title Loans Loan Borrowing Costs?

The cost of the loan depends on the lender you get. But generally, the interest rates can be between 17% and 30% APR (fixed) for a loan between $500 and $5,000. The rates also apply to individuals with a credit score rating of between 300 and 700.

Auto Title Loans does not charge a fee for the application. So how do they make money? Well, they earn a commission from the lender. If any lateness fees apply, these are imposed by the lender and not Auto Title Loans.

Auto Title Loans Customer Support

You can reach customer support through the contact form on the website or call them on 844-293-134.

Is It Safe to Borrow from Auto Title Loans?

Yes, the platform is safe. Auto Title Loans use 256-bit encryption to ensure your personal information is safe. When you enter data on the questionnaire, you should rest assured that it is in safe hands. In addition to the 256-bit encryption, the platform uses SSL to safeguard data. And last but not least, the team of experts over at Auto Title Loans are trained to handle information online.

Auto Title Loans Review Verdict

Auto Title Loans come in handy when you are stuck and require money more than what regular payday loans can afford. However, you should know you run the risk of losing your vehicle to repossession in case you default on the loan. Though Auto title Loans connect you to reputable lenders, you still have to do your due diligence.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

Can I pull out of the process at any time?

When you are filling in the application form on Auto Title Loan, you can walk away at any moment. This is because the process doesn’t impose obligations or commitments. The form is free to use, and the lenders on the platform are trustworthy.

Is my information safe with the lenders on the network?

The fact that Auto Title Loans provides the platform and shares the information with lenders in the network doesn’t mean your privacy is violated. Every lender within the network is screened for professionalism and has a solid reputation. In addition to this, the lenders adhere to strict rules and regulations as defined by the U.S. and state governments.

Are Auto Title Loans similar to payday loans?

The car title loans offered are like payday loans in that they are short term loans, usually lasting thirty days. To get a loan, you give the lender your car title. The only difference is in the interest rate charged.

Can the loan affect my credit score?

A car title loan will not affect your credit score provided you don’t let it come to the point the lender is repossessing the vehicle. When a lender repossesses your vehicle, they are obligated to report to credit bureaus in the country. This report may impact your credit score negatively. Also, losing the car will destabilize your life.

Does Auto Title Loans perform credit checks?

Auto Title Loans do not perform a credit check. However, some of the lenders will do. Because this is a secured loan, most lenders aren’t too keen on how much money you have in your account.

Can I get a title loan without a regular income?

With some lenders in the industry, this is possible. However, Auto Title Loans is also concerned with building a solid reputation and upholding lending responsibility. Because of this, one of their requirements is that the customer should have a regular income. This proves that you can repay the loan without problems.

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up