Moneta Markets Review for 2021 | Platform, Fees, Pros and Cons

Moneta Markets is a subsidiary of the well known Vantage International Group Limited (VIG) that is listed on the Main Board of Hong Kong Stock Exchange and operates VantageFX, one of the largest forex and CFD brokers in the world. Even though it was founded only recently, Moneta Market has rapidly become one of the fastest-growing CFD brokers in the industry and gained recognition among investors and traders.

To help you in selecting the right broker, we have reviewed Moneta Markets. In this review, we’ll cover the broker’s regulatory framework, trading platforms, features, fees and spreads, pros and cons, and more.

-

-

Moneta Markets: Forex & CFD Broker with 1:500 Leverage

Our Rating

- Up to 1:500 leverage

- Low fees

- Copy trading

- Useful research tools

There is no guarantee you will make money with this provider.

There is no guarantee you will make money with this provider.What is Moneta Markets?

Launched in 2021, Moneta Markets is a new online CFD and forex trading broker that offers access to more than 300 tradable instruments including FX currency pairs, stock indices, commodities, and Share CFDs. It is a subsidiary company of Vantage International Group Limited (VIG), which was established in 2009. VIG is licensed in 3 jurisdictions across the globe and handles an average trading volume of approximately $100 billion per month.

Like other CFD brokers such as eToro and IG Markets, Moneta Markets offers a wide range of investment products with its custom-build web-based and mobile app trading platform. Since its inception, this broker has won several awards including ‘Most Advanced Web-based CFD Trading Platform’ and ‘Best Customer Support’.

The broker is located in 4th Floor The Harbour Centre, 42 N Church St, George Town, Cayman Islands.

What are the Pros and Cons of Moneta Markets?

Pros:

- A regulated CFD and forex broker

- Offers a high leverage ratio of up to 1:500

- A selection of more than 300 financial instruments

- The platform has a number of useful features

- Free demo account is available

- User friendly trading platform

- Low trading fees

- Offers the DupliTrade that allows users to copy trades of other traders

- Swap free trading account is available

- Plenty of robust research options such as MonetaTV, WebTV, and the Market Sentiment tool

Cons:

- Not available in the United States

- Does not support the MetaTrader4

What can you Trade at Moneta Markets?

Traders at Moneta Markets get access to more than 300 financial assets across the most liquid markets that include forex, commodities, indices, cryptocurrencies, and shares CFDs. On its trading platform, you will be able to trade on:

- Forex – More than 45 currency pairs.

- Commodities – Over 15 commodities including gold, natural gas, crude oil, Brent crude oil, gasoline, etc.

- Share indices – Access to 15 global indices.

- Cryptocurrencies – 6 digital assets (bitcoin, ethereum, bitcoin cash, dash, litecoin, and ripple)

- Shares CFDs – More than 185 shares from the United Kingdom, the United States, European stock exchanges, and Hong Kong.

Fees, Costs, and Charges at Moneta Markets

Moneta Markets is a market maker broker and thus, makes its money from the buy and sell spread and by charging additional trading and financing fees. Overall, Moneta Markets offers some of the lowest trading costs in the market although the spreads are normally wider than what ECN/STP brokers offer.

Nevertheless, Moneta Markets does not charge any internal deposit and withdrawal fees nor inactivity fee. It does, however, charge swap/rollover fees for positions kept overnight for those who choose the standard account.

Moneta Markets Account Types

Moneta Markets only offers one type of account for all users, meaning trading conditions remain the same for all levels of traders. You can easily sign up for a new account with a minimum deposit requirement of $200. The broker does offer a swap-free trading account for those who are unable to receive or pay an interest rate on their trading positions due to religious beliefs.

Besides the Moneta Markets standard live account, Moneta Markets offers access to a free demonstration account for a period of one month.

Supported Countries

Moneta Markets accepts traders from most countries around the world except for the following countries: The United States, Afghanistan, Australia, Belarus, Belgium, Burma, Burundi, British Columbia (Canada), Central African Republic, Democratic Republic of the Congo, Egypt, Eritrea, France, Iran, Iraq, ISIL (Da’esh) & Al-Qaida, Lebanon, Japan, Libya, Mali, North Korea, Republic of Guinea, Republic of Guinea-Bissau, Russia, Crimea, Somalia, South Sudan, Sudan, Syria, Tunisia, Ukraine, Venezuela, Yemen, and Zimbabwe.

Which Regulators Govern Moneta Markets?

Moneta Markets is a subsidiary company of Vantage International Group Limited which is authorized and regulated by the Cayman Islands Monetary Authority (CIMA), Securities Investment Business Law (SIBL) number 1383491. It operates as an offshore broker owned by Vantage International Group Limited and complies with the laws and regulations of the Cayman Islands Monetary Authority (CIMA) as well as the Australian laws.

While there’s no compensation fund offered by Moneta Markets, client funds are kept safe in a segregated account at the National Australia Bank (NAB).

Getting Started with Moneta Markets

To start trading, you first need to open a Moneta Markets brokerage account. Account opening on Moneta Markets is pretty straightforward, and all you need to do is to follow the four steps below:

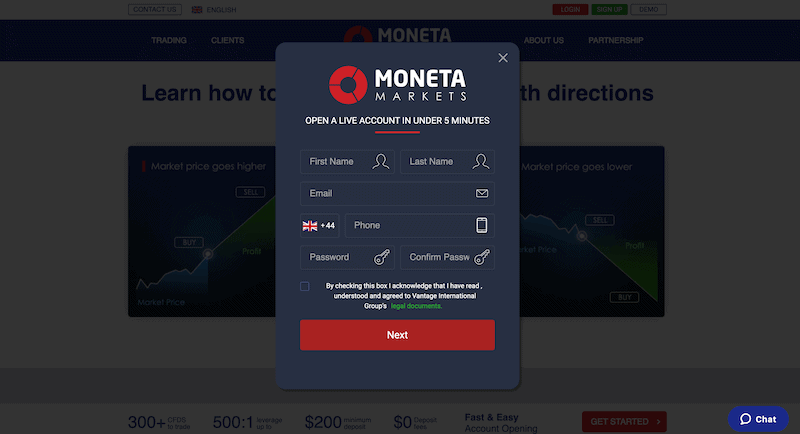

Step 1: Open an Online Trading Account

The first step you’ll have to take is to visit Moneta Markets’ homepage and click on the ‘Sign-Up’ button at the right corner of the screen. The broker will then ask you to enter some personal information including your first and last name, email address, phone number, country of residence, and create a password.

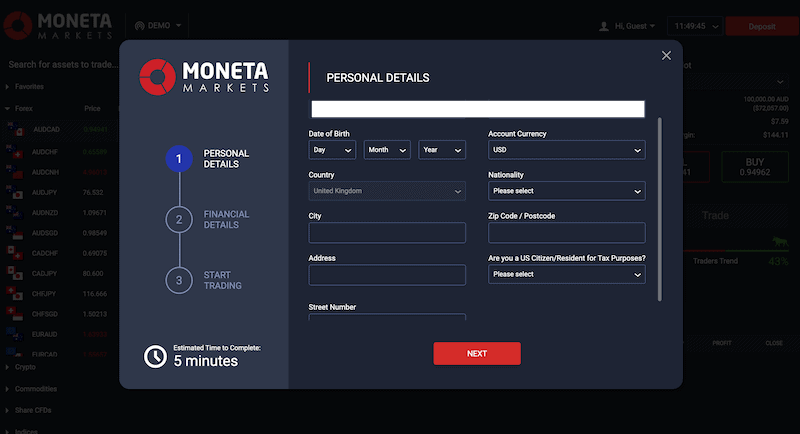

As Moneta Markets is a regulated broker, you will also have to complete a questionnaire before start trading. You will have to enter your personal details and financial details. The estimated time to complete the questionnaire is 5 minutes.

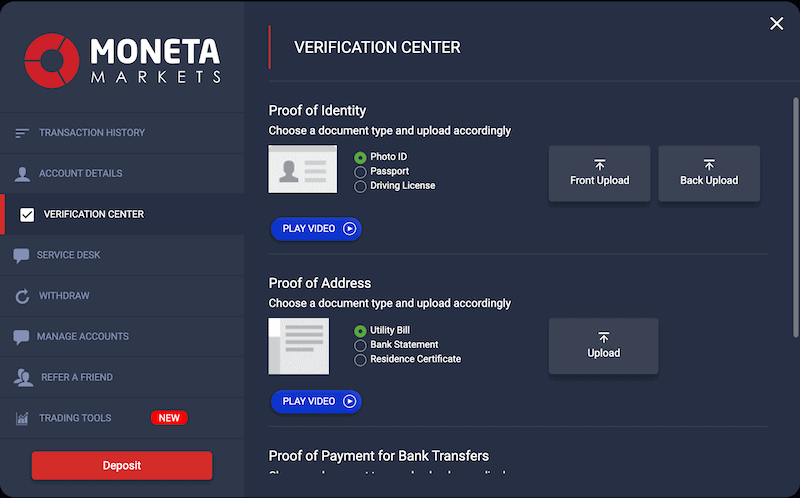

Step 2: Verify Your Account

Next, you’ll have to verify your identity by providing valid proof of ID and proof of address. This includes one of the following: a government photo ID, Passport, or driving license. For proof of address, you will be able to upload a utility bill, bank statement, or residence certificate.

If you decide to fund your account with a wire bank transfer, you’ll need to upload a copy of your bank transfer receipt.

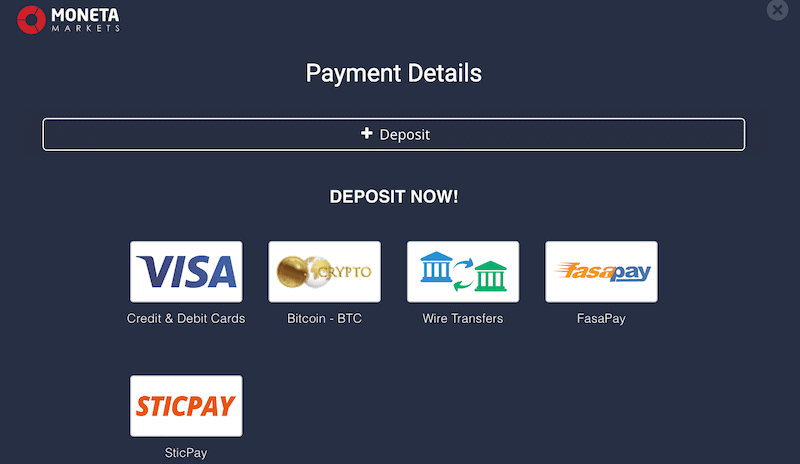

Step 3: Fund Your Account

The next thing to do is to fund your account by depositing funds. Simply click on the ‘Deposit’ button and choose one of the provided payment methods – Credit/debit card, bitcoin, wire transfer, FasaBay, and SticPay. As mentioned earlier, Moneta Markets requires you to deposit at least $200.

Step 4: Start Trading

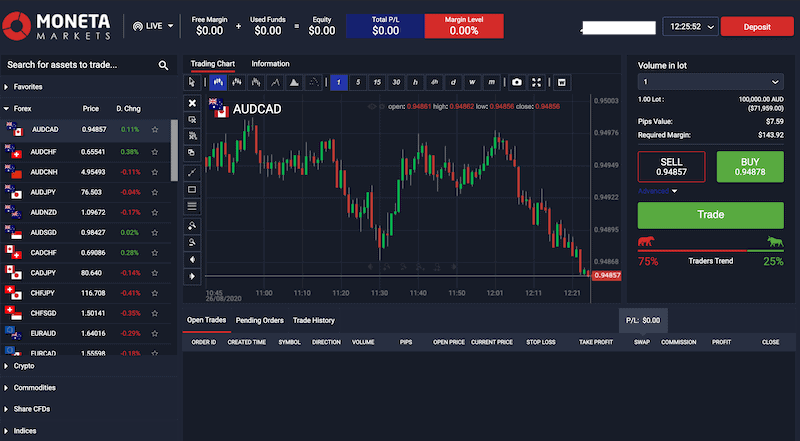

Now that your account has been approved and the funds have reached their destination, you can start trading. To place your first order, pick the instrument category you are interested in, insert the volume in lots you wish to buy or short sell the asset, and then click on ‘Trade’.

Trading Platform and Tools

Moneta Markets offers its own trading platform, the Moneta Markets WebTrader. The platform was designed to allow users to have an all-in-one platform that not only has a fully-pledged charting package, but also an in-built client portal for account management. While the trading platform lacks some of the most essential features for advanced traders such as the ability to utilize algorithmic trading, it has a user-friendly interface, a useful market sentiment feature, an economic calendar, and live news alerts from CNBC and ForexFactory.

Special Trading Tools and Features

Even though Moneta Markets is still in its early stages of development, the platform has a number of useful features.

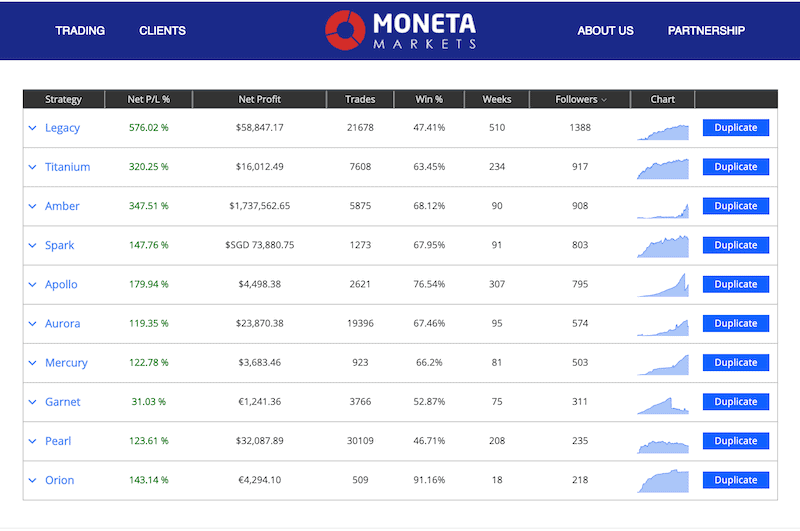

DupliTrade

Moneta Markets offers the DupliTrade, a unique tool that allows users to automatically duplicate the trades of a portfolio of other traders. This is a great feature particularly if you are a newbie in the trading sphere or do not have the time to conduct market research. If you are unsure about the trader you wish to follow, you can test the trader’s performance on a demo account.

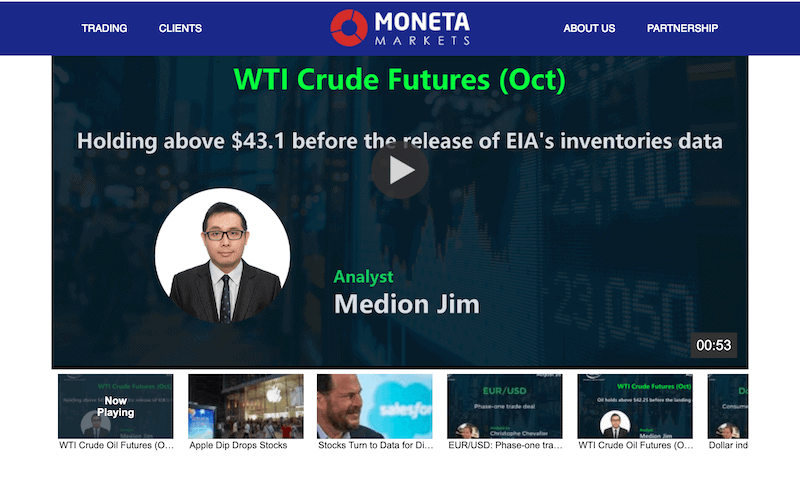

WebTV and MonetaTV

If you are looking for a broker that offers access to trading insights and financial market news, you can definitely turn to Moneta Markets. The broker features the WebTV that presents daily trading insights based on technical and fundamental analysis. It also includes around-the-clock market commentary.

If you are keen to find daily coverage of global financial markets, Moneta Markets has another section on its website, the MonetaTV, that gives users access to daily economic insights and daily trade ideas.

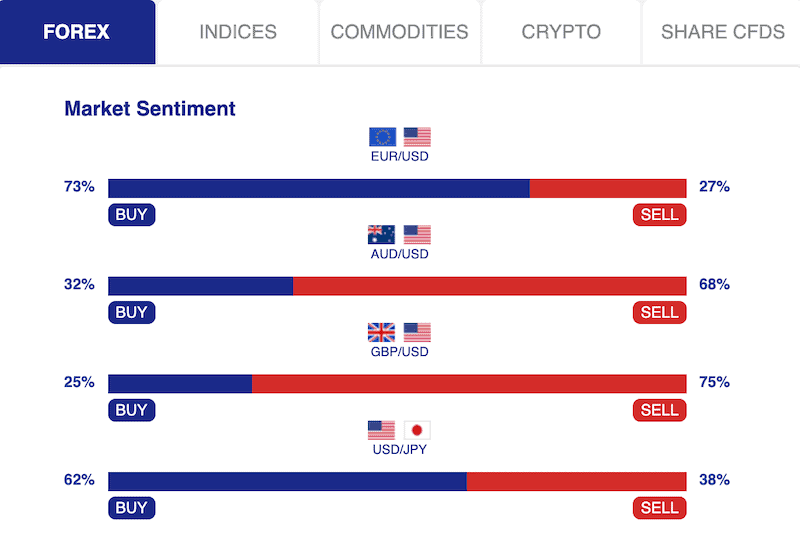

Market Sentiment Tool

Moneta Markets also offers a great market sentiment tool that shows the percentage of Moneta traders that are long or short a specified asset. The market sentiment tool essentially enables you to get to the overall attitude of investors toward a particular security or the financial market.

Payment Methods at Moneta Markets

You can make a deposit to fund your Moneta Markets account via credit/debit card, bitcoin, bank wire transfer, FasaPay, and SticPay. Funds can be deposited in the following currencies: USD, AUD, EUR, GBP, NZD, SGD, JPY, and CAD.

As for the processing time, some of the deposits are instantaneous. Those include credit/debit card, FasaPay, JCB, or Sticpay. If you fund your account with bitcoin, it takes one business day for the funds to appear in your account and with a bank wire transfer, it takes 2-5 business days for the funds to appear in your account.

Moneta Markets does not charge any internal fees for deposits or withdrawals.

Education

When it comes to research and educational resources, Moneta Markets offers a full Market Masters video course featuring over 100 advanced trading tutorials. The course includes 12 lessons and covers the most basic information one needs to know in order to start trading the markets.

Further, you can also find very useful tutorials about the Moneta Markets WebTrader Platform. This includes three video tutorials explaining how to place a market order, how to place a pending (limit) order, and how to add indicators to charts.

Customer Support

Moneta Markets has excellent customer support which can be reached via email, phone, and live chat. The customer support team is available 24/5 and its website’s content is available in the following 14 languages: English, French, German, Italian, Spanish, Vietnamese, Korean, Arabic, Portuguese, Thai, Malaysian, Simp. Chinese, Indonesian, and Japanese. An FAQ section is alos available on the broker’s website and aims to answer the most common questions that clients have about Moneta Markets.

Conclusion

Overall, Moneta Markets has developed an impressive platform for online trading purposes with a range of over 300 products, a high leverage ratio of up to 1:500, and some of the most useful and innovative features to be found in the industry such as the market buzz, market sentiment tool, and the DupliTrade. As a result, the Moneta Markets WebTrader trading platform has won the award of ‘2021s Most Advanced Web-Based Trading Platform of the Year’. The fact that Moneta Markets is regulated and authorized adds to the appeal of this broker.

The bottom line, Moneta Markets offers you the opportunity to trade on an award-wining trading platform with a well regulated online broker.

Moneta Markets: Forex & CFD Broker with 1:500 Leverage

Our Rating

- Up to 1:500 leverage

- Low fees

- Copy trading

- Useful research tools

There is no guarantee you will make money with this provider.

There is no guarantee you will make money with this provider.FAQs

How much does it cost to trade at Moneta Markets?

The trading fees at Moneta Markets will vary depending on the asset you are trading. If the underlying security is typically liquid, then you can expect to trade with low spreads. Generally, the only commission you will have to pay with this broker is the buy and sell spread of the asset.

Is Moneta Markets regulated?

Yes, Moneta Markets is a trademark of Vantage International Group Limited which is licensed and authorized by the Cayman Islands Monetary Authority (CIMA), the Australian Securities and Investments Commission (ASIC), and the Financial Conduct Authority (FCA).

What are the requirements in order to open an online trading account at Moneta Markets?

To open a trading account at Moneta Markets, you’ll have to verify your identity by uploading proof of ID and proof of address. You will also have to meet a minimum deposit requirement of $200.

What payment methods can I use at Moneta Markets ?

Moneta Markets allows you to deposit and withdraw funds with credit/debit card, bitcoin, wire transfer, FasaBay, and SticPay.

What trading platform does Moneta Markets offer?

You will have access to Moneta Markets’ in-house trading software called the Moneta Markets WebTrader. The platform is available on any web-browser and as a mobile app on your smartphone.

See Our Full Range Of Forex Brokers Resources – Brokers A-Z

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up