Best Cryptocurrency Brokers in 2026

Cryptocurrency is a relatively new type of asset, but also one of the most popular investment today. Digital currencies are free of a lot of the regulations that tie down traditional assets and currencies. Plus, high volatility means that traders have tremendous opportunities for profit when trading cryptocurrencies.

If you’re thinking about making the leap to investing in digital currency, you need a trustworthy cryptocurrency broker. In this guide, we’ll highlight the three best crypto brokers and explain what you need to look for when choosing the best bitcoin broker.

-

-

How to Trade Cryptocurrency in 3 Quick Steps

Owning Cryptocurrency vs. CFDs

Before we dive into the best brokers for trading cryptocurrency, it’s important to realize that there is more than one way to trade and invest in digital coins. You can buy and sell cryptocurrencies directly, just like you could buy and sell stocks in the traditional stock market, and, you can also deal with contracts for differences or futures contracts, which allow you to speculate on the price of a digital coin without actually owning that coin.

So, is one type of trading better than the other? It depends on your goals as a trader.

Many traders prefer trading CFDs over actual currency because these contracts are more flexible. You can speculate on the price of a coin falling or rising, which you can’t easily do at most brokerages if you own the coin itself.

Another benefit of trading CFDs is that most brokerages allow you to use high leverages, which means that you can multiply the effective value of the cash you’re trading with. For example, at 10:1 leverage, you can buy $100 worth of Bitcoin with just $10 in your trading account. You can’t do that if you’re buying Bitcoin itself.

Finally, for traders who are new to the cryptocurrency world, CFDs can just be simpler to get started with. You don’t need to set up a digital wallet like you would when trading digital currencies directly.

However, trading CFDs does come with some drawbacks. The most significant is that fees from your brokerage can be high, especially if you’re holding leveraged contracts overnight. In that case, you’re essentially taking out a loan from your brokerage, and you’ll be charged high-interest fees in return. If you want to hold a currency for months or years to come because you believe in its future potential, you’ll likely end up saving money by buying and selling the coin itself rather than trading CFDs.

Some cryptocurrency brokers offer both direct currency trades and CFDs, while others offer only one or the other.

Best Cryptocurrency Brokers in 2026

1. Plus500 - For Trading Cryptocurrency through CFDs

Plus500 allow the trading of cryptocurrency through CFDs rather than digital assets themselves. The platform offers contracts for 13 different cryptocurrencies, plus a Bitcoin-Ethereum blend that gives you exposure to price changes in the two most popular digital coins.

Better yet, Plus500 allows you to trade crypto CFDs with up to 1:2 leverage. That means you can take significant stakes in a position without tying up a huge sum of money. If conditions force you to hold contracts overnight, Plus500 has some of the most reasonable fees that we’ve seen.

Where Plus500 falls short is in its research tools. This broker has its own proprietary charting software, but it includes very few technical studies. There also aren’t any social trading features within Plus500 to help you develop an opinion around new cryptocurrencies. The platform is user-friendly, but more suitable for experienced investors.

- Number of Cryptocurrencies: 13

- Direct Trading or CFDs: CFDs

- Research Tools: Yes

- Demo Account: Yes

- Account Minimum: $100

OUR RATING

- 1:2 Leverage: Free up your money for other trades

- Low Fees: Holding leveraged positions doesn’t cost a fortune

- Bitcoin-Ethereum Blend: Develop trades based on two cryptocurrencies

- Limited Charting: Built-in charts don’t come with many technical studies

- CFDs Only: You cannot buy digital coins directly with Plus500

CFDs are complex financial instruments and 80.5% of retail investor accounts lose money when trading CFDs.2. CryptoRocket - Best for Variety of Cryptocurrencies

CryptoRocket hosts about 37 cryptocurrencies, which is far more than you’ll be able to trade with just about any other broker. If you want to dive into trading some of the less popular and more volatile digital coins currently on the market, this is the broker you need. But, keep in mind that CryptoRocket only trades CFDs and doesn’t allow you to buy and sell these coins directly. The upside of this is that you get access to high leverages of up to 500:1.

This broker also stands out for hosting its accounts on MetaTrader 4, one of the most versatile trading platforms available today. On the platform, you get access to dozens of technical studies and drawing tools that help you research currencies. MetaTrader 4, also allows you to automate a trading strategy if you develop a successful formula.

For trading cryptocurrency, there’s almost nothing to dislike about CryptoRocket. It is user-friendly while also offering the tools that advanced traders need. The only limitation is that CryptoRocket only has a limited number of forex and commodity CFDs, and this limits your portfolio diversification options.

- Number of Cryptocurrencies: 37

- Direct Trading or CFDs: CFDs

- Research Tools: Yes

- Demo Account: Yes

- Account Minimum: $50

Our Rating

- Diversity of Coins: Trade any of 37 cryptocurrencies

- Huge Leverage: Up to 500:1 for Bitcoin

- Technical Analysis: Accounts come with MetaTrader 4

- Limited to Crypto: Not many forex and commodity CFD options

- CFDs Only: Cannot buy and sell coins directly with CryptoRocket

What Should You Look for in a Cryptocurrency Broker?

Here are some of the factors you should put into consideration when choosing an online crypto broker:

Currencies Available

One of the most obvious ways in which cryptocurrency brokers differ is in the number of supported cryptocurrencies that they offer for trading.

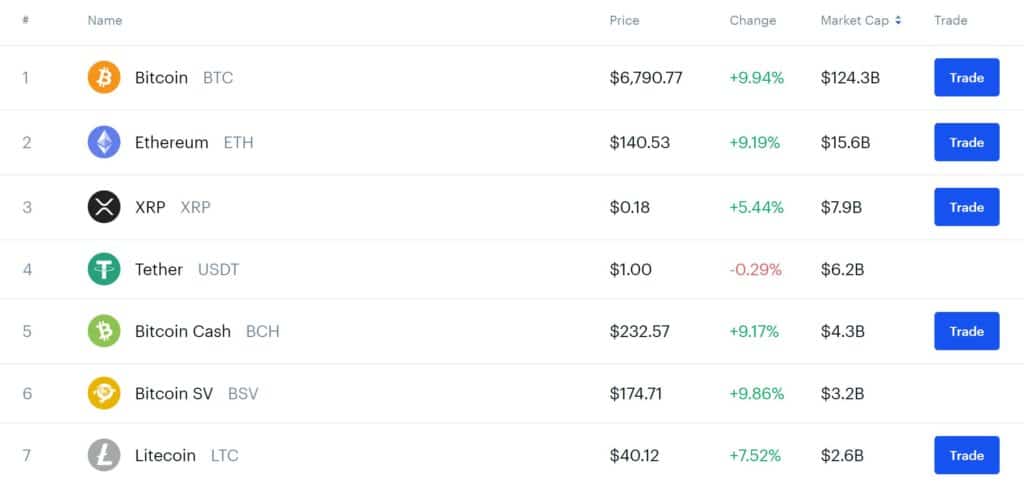

A number of traditional stockbrokers now offer Bitcoin futures trading, but that hardly qualifies them as cryptocurrency brokers. Most quality crypto brokers offer at least a dozen of the most popular coins, including Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash. Brokerages like CryptoRocket offer an impressive 36 coins to trade.

If you can’t find the cryptocurrency you want to trade at a brokerage, you’ll need to go through the best bitcoin exchanges instead. This is often much more complex and expensive, as you need to convert dollars to Bitcoin, and then Bitcoin to your desired currency. For currencies with low liquidity, it can be extremely difficult to exit a trade.

Leverage

Leverage is a powerful tool for increasing your effective profits with just a small initial investment. With the 500:1 leverage offered at trading platforms like CryptoRocket, for example, you can buy $25,000 worth of Bitcoin with your $50 minimum deposit. For aggressive traders, having access to more leverage can allow you to make bigger bets with less money.

But, be careful that leverage cuts both ways. It also dramatically increases your risk, since every change in the price of a coin has a multiplicative effect on the value of your position. You’ll also need to watch out for interest fees if you hold leveraged positions overnight.

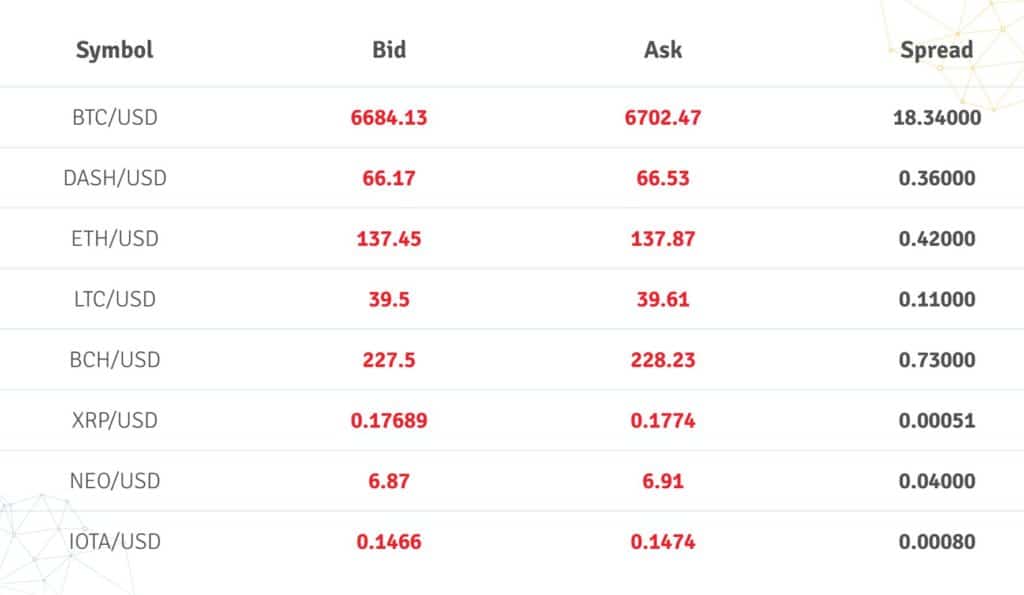

Spreads

The spread is the difference between what you pay for a coin or CFD and what the seller receives in return. This is one of the key ways that cryptocurrency brokers make money, especially when they don’t charge commissions on trades since they effectively pocket the spread.

When looking for a broker, it’s important to compare the spread to the cost of the asset in percentage terms. Higher spreads eat into your profits.

Fees

Unfortunately, the spread isn’t the only fee charged by most cryptocurrency brokers. Some charge commissions on every trade, while others charge inactivity fees if you don’t place a trade more than once every few months.

The fees you’ll most want to watch out for, especially if trading cryptocurrency CFDs with leverage, are overnight fees. When you hold a leveraged position overnight, your brokerage will charge you interest on the money you’re borrowing as part of your leveraged position.

Research Tools

Having access to in-depth research tools is essential to succeeding as a trader. Charting software enables you to trade based on technical triggers rather than gut feelings, as well as helps you develop rigorous strategies for profiting. Some platforms, like MetaTrader 4, can also be used to automate your trades.

Demo Account

Another tool that many cryptocurrency brokers provide to help you succeed is a demo account. This allows you to place simulated trades without risking real money. Using a demo account allows you to develop a trading strategy and prove that it’s consistently profitable before you put your money on the line. All of the cryptocurrency brokers we recommended come with demo accounts.

Deposit Methods

Finally, take a look at what deposit methods a prospective broker offers. Most brokers will take deposits by bank transfer or credit card. But, if you want to pay for your cryptocurrency trading with cryptocurrency, your options may be more limited.

Conclusion

Finding the right cryptocurrency broker can make a huge difference in your success as a trader. The best broker should put the research tools you need at your disposal, keep trading fees low, and offer leverage to enable you to make big bets. On top of that, you need a trader that offers direct cryptocurrency trading, CFD trading, or both depending on your trading goals.

Thanks to this guide, you now have recommendations for three high-quality cryptocurrency brokers and a better idea of what to look for when choosing the one that’s right for you.

FAQs

Do traditional stock brokers offer cryptocurrency trading?

A growing number of traditional stock brokerages are offering cryptocurrency trading in a limited form. In most cases, this means only offering Bitcoin futures for trading or restricting you to trading only several of the most popular digital coins.

How do cryptocurrency brokers make money?

Cryptocurrency brokers primarily make money off the spread, which is the price difference between what you pay for an asset and what it’s being sold for. Many brokers also charge fees for holding leveraged CFDs overnight, for rolling over CFDs into new contracts, and for inactivity in your account for several months. Don’t assume that a broker is inexpensive just because it does not charge trading commissions.

Can I buy cryptocurrencies that aren’t offered through a broker?

If the cryptocurrency you want to purchase isn’t offered through a broker, you can often buy it directly. However, to do this, you’ll need to first convert dollars to Bitcoin using a cryptocurrency exchange, and then trade Bitcoin to get your desired currency. This is a complex process and your risk is extremely high when trading digital currencies like this.

How do cryptocurrency wallets work and do I need one?

When you buy cryptocurrencies directly through your broker, they’re held in a digital wallet. This is essentially a piece of software that keeps track of how many coins of each digital currency you have, and that is encrypted so that it can only be accessed with your password. At most cryptocurrency brokers, your broker also has access to your wallet so that assets can be bought and sold more smoothly.

Our Full Range of Cryptocurrency Resources – Cryptocurrency A-Z

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up