Best Credit Card Consolidation Providers 2020

Holding large amounts of debt across multiple credit cards can be a costly endeavor. With recent estimates claiming that the average credit card APR rate in the US now stands at between 17.03% to 24.05% – the monthly interest payments alone can leave you in financial distress.

However, the good news for you is that there is a simple way to consolidate all of your outstanding balances on to a single card. Most importantly – you can stop paying interest, period. In order to achieve this goal, you simply need to obtain a 0% balance transfer card that allows you to pay-off your outstanding credit card debts.

If you’re keen to stop handing over your hard-earned money to cover your monthly interest payments, be sure to read our comprehensive guide on the Best Credit Card Consolidation Providers in 2019.

Why consider credit card consolidation?

If you are yet to engage in a credit card debt consolidation program, it is important to ensure that you have a firm as to how the process actually works. First and foremost, we will make the assumption that you are currently holding outstanding debts on one or more credit card.

In fact, if you’ve got multiple credit cards, then you’ll know that trying to keep on top of your monthly payments can be a logistical nightmare. Furthermore, as credit card debt is one of the most expensive forms of financing, you’re likely being hit with super high-interest payments every month.

With that being said, a credit card consolidation exercise seeks to make your life easier – both in terms of meeting your monthly payments and reducing your debt interest obligations. Here’s a quick example of why you might need to arrange debt consolidation on your credit cards.

- You currently hold four credit cards, with each card maxed out with debts of $5,000.

- As such, your total outstanding balance is $20,000.

- To keep things simple, let’s say that each card comes with an APR rate of 20%.

- If you were to just pay the minimum each month, you would effectively be paying $2,232.28 in annual interest – which is huge.

- Moreover, as your four credit cards come with a different repayment date throughout the month, you often find yourself missing a payment.

As you’ll see from the above example, having a number of outstanding credit cards can be a very costly endeavor. Moreover, by having multiple repayment dates throughout the month, you stand a very realistic chance of missing a payment, which will, of course, lead to further financial complications.

How does credit card consolidation work?

So now that you know why you should consider engaging in a credit card debt consolidation program, let’s explore how the process actually works. Sticking with the same example as above, let’s see how a newly obtained 0% balance transfer credit card can provide a simple, yet highly effective solution to your interest-bearing woes.

- As noted above, you currently have $20,000 in outstanding balances across 4 credit cards, all of which come with an APR rate of 20%.

- As such, you take out a new credit card that comes with a 0% balance transfer offer for 18 months.

- Once approved, you proceed to use your new card to pay off your entire $20,000 credit card balance. Great!

- You now owe $20,000 on your newly obtained credit card.

- This means that as long as you always meet your minimum monthly payment, you effectively have 18 months to repay the $20,000 debt without paying any interest whatsoever.

As you’ll see from the above example, the balance transfer process operates in a similar way to a loan, insofar that you can split the $20,000 debt across the full 18 months. As such, by paying $1,111.11 each and every month, you’ll be debt-free without having paid a single cent in interest!

Am I better obtaining a consolidation loan?

If you’re yet to proceed with your debt consolidation plan, you might be wondering whether or not you’re better off obtaining a loan. The simple answer to this is no. The overarching reason is that loans will always come with interest, as there is no such thing as a ‘0% loan’.

This wouldn’t make financial sense for the lender, as they would be risking their money without making a return. On the contrary, credit card providers do this in the hope that you will continue using the card once the 0% introductory period expires.

However, it is crucial to note that in certain instances, you might have no option but to instead consider a debt consolidation loan. Here’s why.

🚫 Size of your debt:

The first barrier that might prevent you from facilitating your credit card consolidation plan is the size of your debt. In a nutshell, credit cards typically come with much lower credit limits in comparison to traditional loans. As such, you might not be able to obtain a credit card with a high enough balance to clear all of your outstanding credit cards.

For example, let’s say that you currently have $15,000 in outstanding balances, across three individual credit cards. However, if you are only able to obtain a 0% balance transfer credit card with a $5,000 limit, then you won’t have enough to meet your goal. In this instance, you might need to consider a consolidation loan to make up the difference.

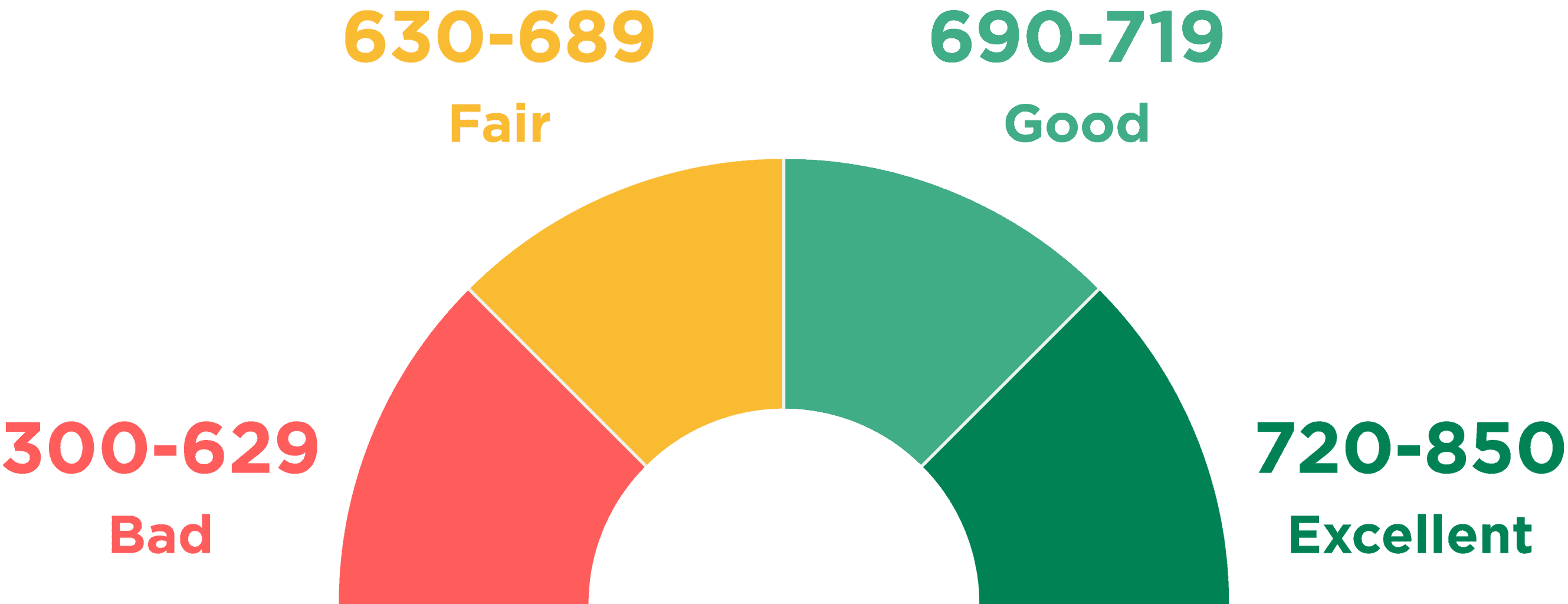

🚫 Credit rating: In the vast majority of cases, the very best 0% balance transfer credit cards are only available to those with good and excellent credit. The reason for this is that in reality, the credit card provider won’t make any money from a 0% interest introductory offer unless the customer makes purchases on the card, or doesn’t pay off the balance in full before the offer expires.

As such, they are reluctant to offer such a service to those with bad credit. If this is the case, then you will instead need to consider a specialist loan provider.

The Pros

- Stop paying interest on your outstanding balances

- 0% interest periods usually start from 14 months+

- Great if you’ve got a good or excellent credit rating

- Pay off your outstanding credit card debts in full

- Improve your credit rating

- Heaps of providers to choose from

- Super simple application and pay-off process

The Cons

- Not suitable if you have bad credit

- You might not get a high enough limit to pay all of your debts off

Criteria used to rank the best credit cards

❓ We only list providers that offer 0% interest for 14 months or more

❓ We only list providers that offer credit limits of $5,000 or more

❓ We only list providers that are regulated and well-established

❓ We only list providers that offer a reasonable standard APR rate

❓ We only list providers with a balance transfer fee of 5% or below

At the top of our list is that of the Chase Slate credit card. The card is perfect for your debt consolidation needs, not least because you’ll be accustomed to a super long 0% interest period of 15 months. As such, by paying $1,000 per month, you could clear $15,000 worth of debt across 15 months without paying a single cent of interest.

Not only this, but the Chase Slate credit card comes with an industry-leading 0% balance transfer fee. With some providers charging as much as 5%, this could potentially save you $750 in fees if you were to transfer $15,000.

In terms of the fundamentals, you will be required to have an excellent credit score to stand a chance of being approved, and you need to make your balance transfers within the first two months. Moreover, if you miss a payment, or the 15-month introductory period expires, then the standard APR rate ranges from 16.99% to 25.74%.

[one_half] Key Points: 💳 0% for 15 months 💳 0% transfer fee 💳 APR rate of between 16.99% to 25.74% once offer expires 💳 No annual fees 💳 Only suitable for excellent credit rating

If you are looking to consolidate your credit card debt over the longest period of time, then the Citi Simplicity card is probably your best bet. The card comes with a 0% introductory rate that spans a whopping 21 months. This is especially useful if you are currently sitting on a large amount of credit card debt.

However, it is important to note that unlike the Chase Slate credit card, Citi Simplicity comes with a balance transfer fee. In fact, this comes at a rather expensive 5%, meaning that a $10,000 transfer would cost you $500 in fees. As such, you need to weigh up whether or not the extra 6 months is worth paying the fee.

Finally, the card comes with a standard APR rate of between 16.74% and 26.74%, which is applicable in the event that you miss a monthly payment, or the 21 month period expires.

[one_half] Key Points: 💳 0% for 21 months 💳 5% transfer fee 💳 APR rate of between 16.74% to 26.74% once the offer expires 💳 No annual fees 💳 Only suitable for excellent credit rating

Although most balance transfer credit cards require you to make your transfers within 60 days of opening the account, there might come a time where you need a little bit longer. If this is the case, then you should consider going with the Citi Diamond credit card.

Not only does the card come with a super long 0% introductory period of 18 months, but you have a staggering 4 months to make your transfers. Furthermore, you’ll also be offered 0% interest on all purchases made within the 18 months period, which is an added bonus. On the downside, the card doesn’t come with any notable rewards or cashback programs, however, this shouldn’t matter if you’re primarily looking to consolidate your credit card debts.

In terms of the specifics, you’ll likely need to have a credit rating of at least ‘Good’, and the standard APR after the introductory offer expires will sit between 15.74% and 25.74% – depending on your financial profile. Finally, you’ll need to pay a balance transfer fee of 5%.

[one_half] Key Points: 💳 0% for 18 months – balances and purchases 💳 5% transfer fee 💳 APR rate of between 15.74% and 25.74% once offer expires 💳 No annual fees 💳 Only suitable for excellent credit ratings

The reason that we like the Discover It card is that it has done a great job in covering all bases. Firstly, although shorter than the other credit card providers we have discussed so far, the card comes with a very respectable 14 months 0% introductory period. As such, if the size of your outstanding credit card balances isn’t too high, this should suffice.

When you do make the initial transfer, you will be required to pay a 3% transfer fee. This means that an $8,000 transfer would cost $240 in fees, which isn’t too bad. After the 14-month introductory period passes (or you miss a payment), the standard APR rate varies from 13.99%, up to 24.99%. To get the card, you’ll need a credit rating of ‘Good’ or ‘Excellent’.

On top of the above benefits, we really like the rewards program that the card comes with. You will get a huge 5% cashback when you make a qualifying purchase, up to a maximum monthly spend of $1,500. As such, if you were to spend the full $1,500 each month and subsequently pay your balance in full, you would get $75 back.

[one_half] Key Points: 💳 0% for 14 months 💳 3% transfer fee 💳 APR rate of between 13.99% and 24.99% once offer expires 💳 No annual fees 💳 5% cashback reward

Last on our list – but certainly not least, is the Platinum Visa credit card offered by the U.S. Bank. The hallmark offer that the card comes with a lucrative 0% interest rate for a staggering 18 months. Not only does this cover balance transfers, but purchases, too. If opting for a full-on balance transfer, this will come with a fee of 3%. However, this is still much lower than the 5% charged on both the Citi Simplicity and Citi Diamond cards.

On the other hand, the good news is that the card does not come with an annual fee, and all cardholders will be offered free ongoing access to their TransUnion credit profile, as well as a rather handy cell protection plan. Finally, U.S. Bank makes it very clear that were you to miss your minimum monthly payment, you will revert to the standard APR rate. This ranges from 14.49% up to a maximum of 25.49%.

[one_half] Key Points: 💳 0% for 18 months 💳 3% transfer fee 💳 APR rate of between 14.49% and 24.99% once offer expires 💳 No annual fees 💳 Only suitable for excellent credit ratings

FAQs

What is credit card consolidation?

Will applying for a 0% credit card hurt my credit profile?

What is the minimum eligibility requirement to get a 0% credit card?

Should I get a loan or a credit card to consolidate my debt?

How much will it cost to transfer my outstanding balances over?

What should I do if my 0% period is about to expire, but I haven’t cleared my balance?