TradeOr Review 2021: Platform, Fees, Pros and Cons

If you are looking for a new online trading platform that takes a bitcoin-friendly approach and offers you to trade with a zero-commission fee, you might want to consider TradeOr broker. This new brokerage firm offers investors to buy and sell a large number of markets and products through its innovative user-driven platform.

In this review, we’ll cover everything you need to know about TradeOr to determine whether the broker is right for your trading needs. We’ll take a close look at the broker’s trading fees, payment methods, trading platform, selection of products, trading tools and features, and the safety of funds.

-

-

What is TradeOr?

TradeOr is a new online trading platform that enables investors to buy and sell various financial assets via its own proprietary trading platform. This broker, which offers users to fund transactions with Bitcoin, is offering traders a wide selection of assets that include FX currency pairs, cryptocurrency pairs, metals, ETFs, energies, and stocks.

TradeOr takes pride in offering an innovative all in one trading solution where investors get access to its user-friendly platform while at the same time, trading in a safe and secure trading environment.

Special features

Overall, TraderOr is rich in features though it does not offer many tools for professional traders. This platform is more suited for beginner traders and those who are looking for simple and efficient trading tools. Some of the features offered by TradeOr include:

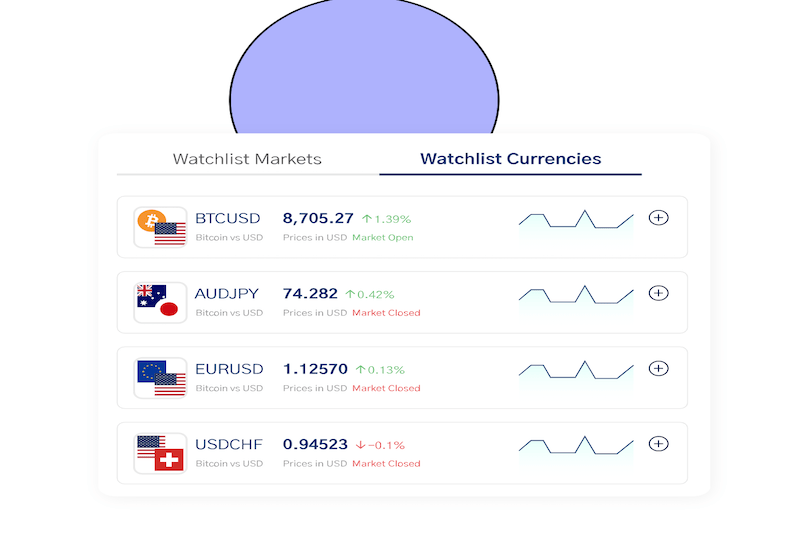

- Watchlists

TradeOr allows users to create their own watchlists to track favorite assets. These are separated into two categories – the Watchlists Markets and Watchlists Currencies. On top of that, you can set price alerts on certain instruments on your watchlists.

- Bitcoin-Friendly Platform

One of the key points of TradeOr is that it offers a Bitcoin-friendly platform where users can use Bitcoin to fund transactions. This basically means that all transactions made on TradeOr’s platform are instant and safe. Having said that, you do need to buy Bitcoins on a reputable Bitcoin exchange and get a Bitcoin wallet before can you start trading with TraderOr.

- Price Alert Service

Another useful feature offered by TradeOr is a price alert notification service that enables users to stay updated with important price moves.

- Leverage of 100:1 or more

TradeOr provides leverage of 100:1 or more. For those unaware, Leverage is a trading tool that allows investors to increase their exposure to the market by allowing them to pay less of the total of the investment. For example, when you get a 100:1 leverage on an asset, you can open a position size of £10,000 using only £100.

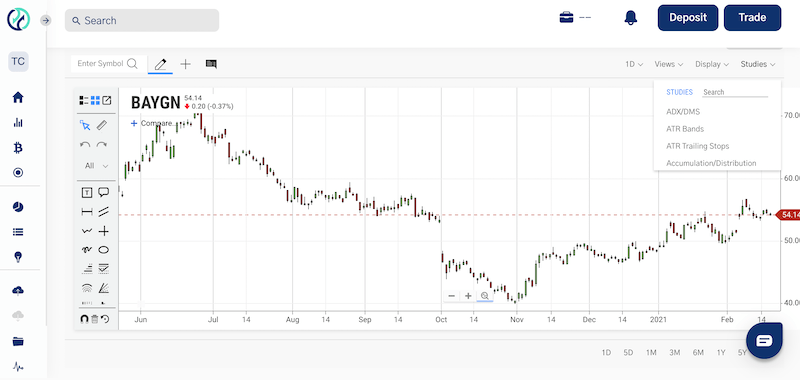

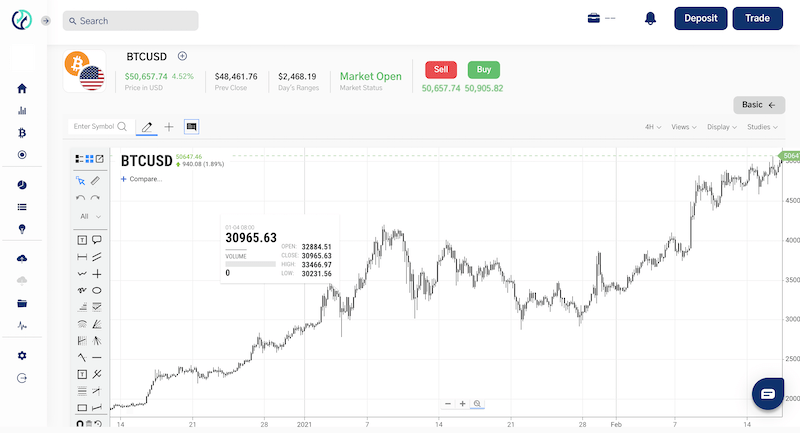

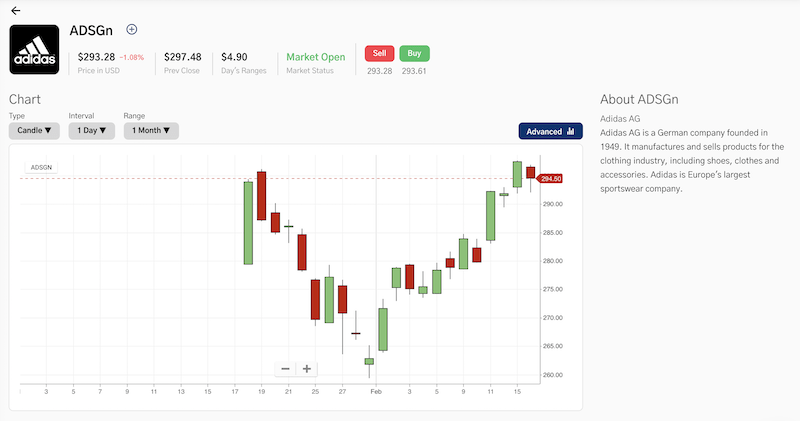

- ChartIQ

TradeOr gives you access to the ChartIQ, which is a very impressive charting system that works seamlessly on a web browser platform. In that matter, even though TradeOr’s primary goal is to make trading simple, the chart IQ is an effective charting package with a wide array of technical indicators, chart styles, and timeframes.

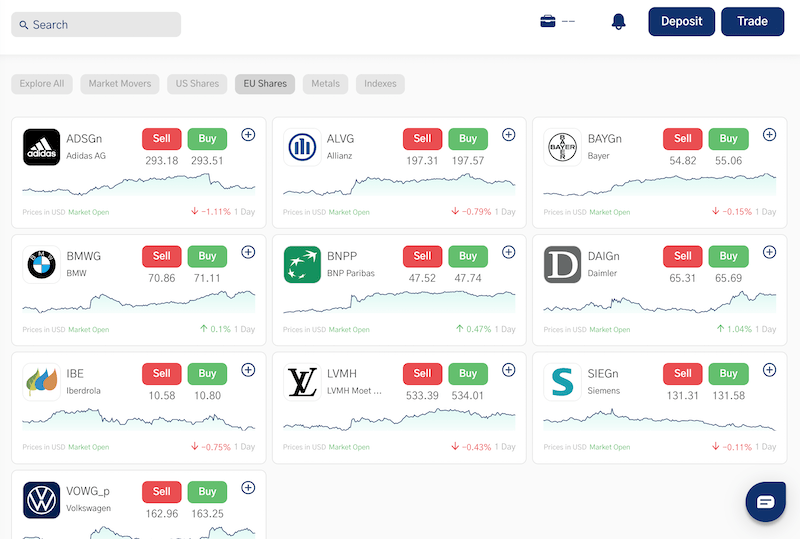

Tradable securities

The variety of markets and products at TraderOr is fairly limited compared to other brokerage firms in the market, largely due to the fact that it is a relatively new broker. At present, it appears that the broker offers around 120 financial assets across the following markets: FX currency pairs, stocks (US and EU shares), stock indices, cryptocurrency pairs, ETFs, metals, and energies.

Account Minimum

The minimum deposit at TraderOr starts at £10, which is lower than most brokers in the industry.

Supported Countries

TradeOr serves retail traders from most countries but you may have to contact the broker to get information on whether it is available in your region. Otherwise, you can start the account creation process to find out if the broker service is available in your country. On another note, the broker discloses on its website that they may have to change the list of restricted or blocked countries from time to time.

Languages Supported

At present, TradeOr supports its website and trading application in English only.

Trading Platforms

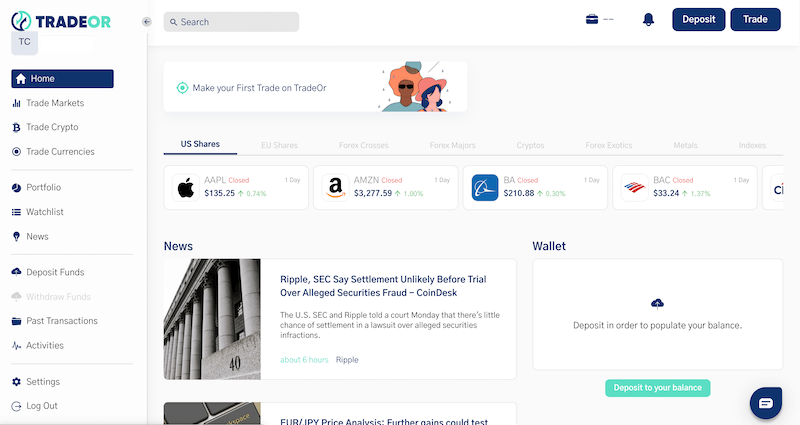

TradeOr offers only one trading platform to its users, which is its own proprietary trading system. The platform was not designed for professional traders that are looking for advanced trading features and tools. Instead, the TradeOr is a web-based trading platform that enables users to get access to the markets and easily trade with a few simple clicks. Crucially, the platform is not available as a mobile application but it runs on any mobile web browser.

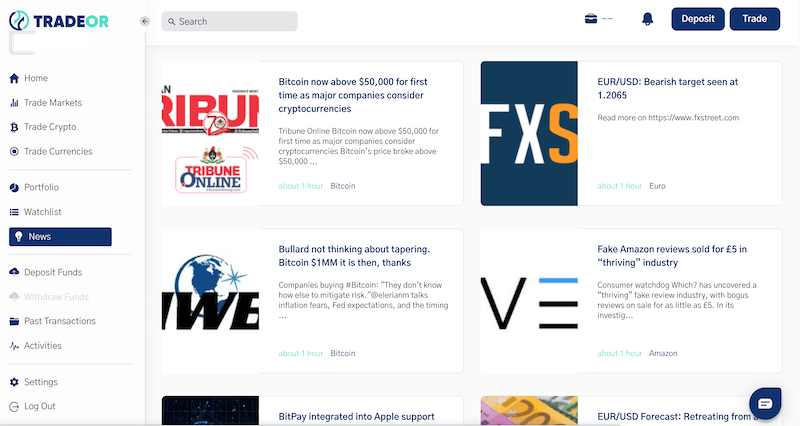

The navigation on the platform is organized so you get everything you need on one screen. With this platform, it’s likely that you’ll find your way around quickly. On the left side menu, you basically get all the basic tools you need to run your trading activity. This includes a news section, portfolio, watchlists, past transactions, trading activity, and account settings.

The TradeOr trading platform also offers heaps of advanced charting tools and technical indicators. Whenever you choose an instrument, you can view a basic chart or switch to the advanced mode where you can insert technical indicators and various timeframes.

Fees and Commissions

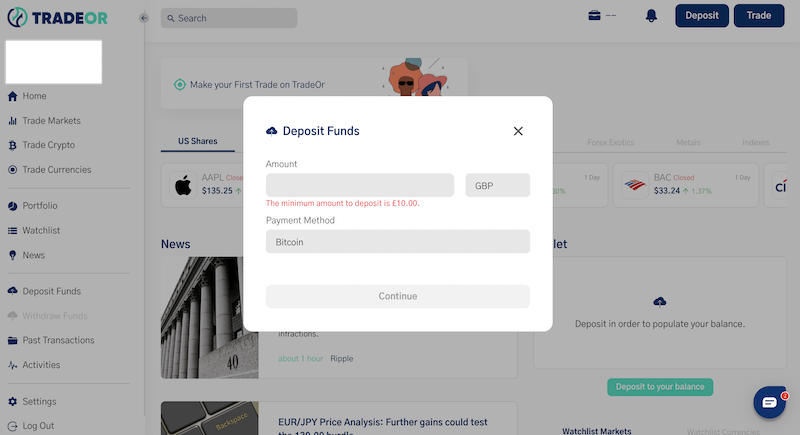

TradeOr does not charge any trading fees or commissions. Instead, it simply charges the bid and ask spread when a user gets in and out of a position. This means that TradeOr does not charge any account management fees or fixed deposit and withdrawal fees. This is because the broker uses Bitcoin as the primary payment option and as such, the only fee you have to pay is the blockchain network.

With that in mind, because TraderOr is a new broker and does not disclose much information about its pricing structure, we recommend that you contact the broker for more information about any fees and charges that you may be asked to pay.

How to withdraw funds

At TraderOr, withdrawing funds works in the same way as depositing. From the trading dashboard, you simply have to click on the withdraw button and request for bitcoin withdrawal to your digital electronic wallet.

Account Types

TradeOr offers one account type for all levels of investors. This means that things are very simple with TradeOr – all clients get the same fees, spreads, and trading tools. The minimum deposit requirement with this broker in order to open an online live trading account is £10.

On the negative side, however, TradeOr does not currently offer a demonstration account for investors to practice on before they risk their capital in real markets.

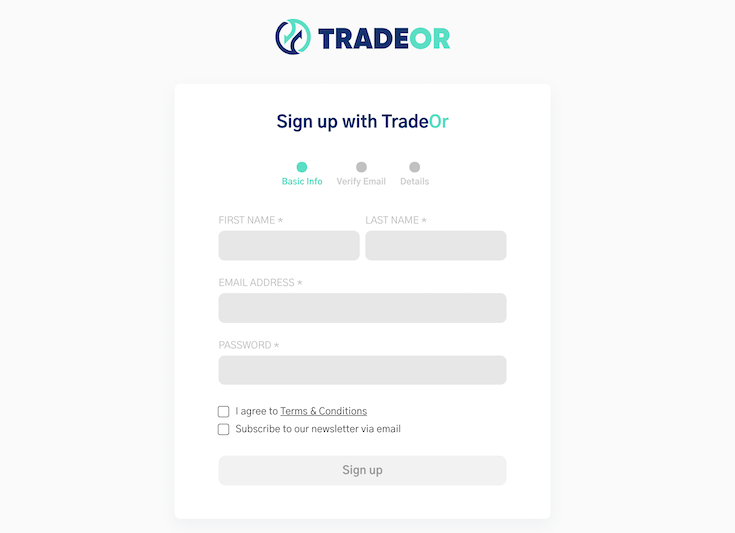

How to Sign Up on TradeOr

Like any other online trading platform, you’ll need to meet certain conditions before you can open an online trading account with TradeOr. Having said that, one of the key features of TradeOr in comparison to any other platform in the market is that it aims to make things easier, including the registration process.

At first, you’ll have to visit TradeOr’s website and sign up for an online trading account. In this step, you’ll have to submit your first and last name, email address and create a password.

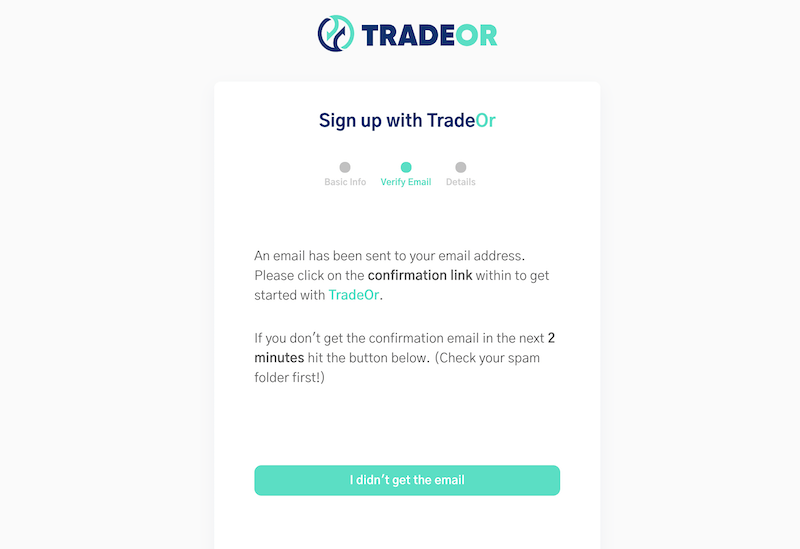

In the next step, you’ll be asked to verify your email. Then, in the email you received, you’ll be required to complete the sign-up process. TraderOr will then ask you to enter some personal information that includes your address, country, city, mobile phone number, postal code, default currency, date of birth, and gender.

As soon as you have completed the registration process, you’ll be transferred to TradeOr’s trading dashboard. The first thing you’ll see is a pop-up window to enable multi-factor authentication, a security tool that requires users to provide two or more credentials in order to authenticate identity. Take note that this is a must-have safety tool that TradeOr requires in order to be able to start trading on its platform.

Another step that TradeOr requires you to take before you can deposit funds is to verify your mobile phone number. Once you click on the verify button at the top of the screen, the broker immediately sends an SMS code to your mobile device.

Deposit Funds

Now that your account is set up, you can add funds to your trading account. TradeOr maintains a minimum deposit requirement of £10 which can be funded with Bitcoin only.

How to Buy and Sell Stocks on TradeOr

As mentioned severally in this review, TradeOr main goal is to make trading simple and straightforward. This includes the buying and selling process of stocks from the US and European markets.

To start, you’ll have to find the stock you want to buy by searching it in the search bar or navigate to the Trade Markets section where you can explore the stocks offered by the broker.

Once you set your mind on the stock you wish to buy, click on it and you will be channeled to the stock instrument page where you can buy and short sell the stock.

Safety and Regulation

TradeOr does not disclose much information about its regulatory framework, and it seems that the broker did not yet obtain authorization from reputable regulators in the financial industry. While this might be a concern for some investors, it is clear that TradeOr takes another approach to protect clients’ funds and data.

As such, the broker’s KYC process keeps clients’ data safe and secure. On top of that, users must utilize the 2FA authentication. As for the safety of funds, TradeOr offers Bitcoin as the only payment option, which is considered safe due to the security mechanism of the blockchain technology.

Education, Research and Data

When it comes to market research and educational material, this is an area where the broker falls short. Unfortunately, we could not find any guides or helpful articles that may help beginner investors to understand the markets and get familiar with TraderOr’s trading platform and tools.

At the same time, we did like the broker’s news section on its trading platform that aggregates financial news and information from mainstream websites.

Customer Service

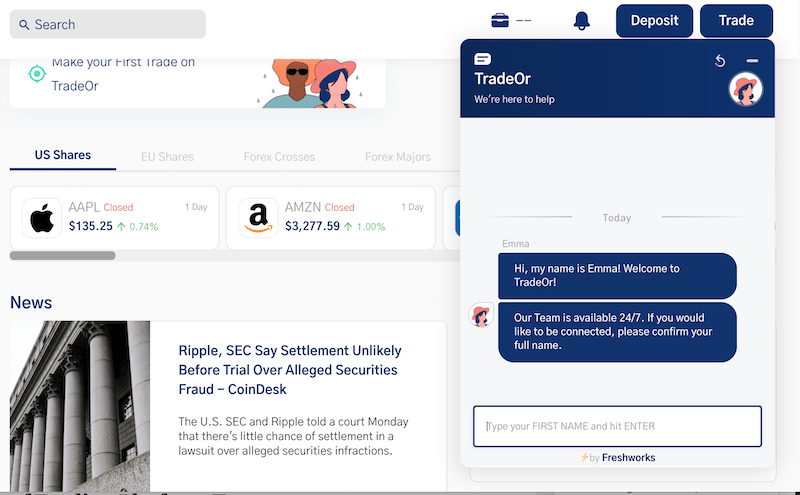

For a new broker in the industry, TradeOr has a strong customer support team that is available to answer questions 24/7. First, potential and existing clients can contact the support team via Submit a Ticket form or on one of the social media platforms that TradeOr is available on – Instagram, Twitter, and Facebook. In addition, the broker offers users to contact the support team via email at [email protected].

More importantly, once you become a client of TradeOr, you’ll be able to contact the support team via a live chatbox that is available on the trading dashboard.

The only drawback of TradeOr customer service support is the lack of a phone number and FAQ section.

TradeOr Pros and Cons

Pros

- A commission-free pricing structure

- Innovative and simple to use trading platform

- A low minimum deposit of just £10

- Great charting package

- No hidden fees

- Bitcoin-friendly platform

- 24/7 customer support service

- Up to 500:1 leverage

- Provides the 2FA factor authentication tool

Cons

- No demo account

- A limited selection of account types

- No phone number

- Does not offer a mobile app

Final Thoughts

TradeOr is a new CFD broker in the industry that gives users access to the most popular assets in the market via its own proprietary innovative trading platform. With this broker, you can buy and sell assets with zero commission and get a leverage of up to 100:1 or even more on certain assets.

What really sets TradeOr apart from other trading platforms is the innovative and easy-to-platform it offers, the ability to use Bitcoin as a payment method, the competitive fee structure, and the different methods it takes to keep clients’ funds and data safe and secure.

TradeOr – Innovative CFD Broker with Low Fees

74% of retail traders lose money when trading CFDs.

Glossary of Trading Platform Terms

Platform FeeThe trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. It can be a one –time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. Others will charge on a per-trade basis with a specific fee per trade.

Cost per tradeCost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades.

MarginMargin is the money needed in your account to maintain a trade with leverage.

Social tradingSocial trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders.

Copy TradingCopy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. The copiers -in most cases - are then required to surrender a share of the profits made from copied trades – averaging 20% - with the pro traders.

Financial instrumentsA Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties.

IndexAn index is an indicator that tracks and measures the performance of a security such as a stock or bond.

CommoditiesCommodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver.

Exchange-Traded Funds (ETFs)An ETF is a fund that can be traded on an exchange. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. ETFs allow you to trade the basket without having to buy each security individually.

Contract for difference (CFD)CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. CFD’s will basically allow you to speculate on the future value of securities such as stocks, currencies and commodities without owning the underlying securities.

Minimum investmentThe minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Daily trading limitA daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

Day tradersA day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes.

FAQs

Can US residents trade with TradeOr?

At the time of writing, it is not yet clear what countries are supported by TradeOr. The broker claims that they may change the list of restricted or blocked countries and as such, it is recommended to contact them for further information.

Is TradeOr regulated?

TradeOr is not regulated by any regulator but it does follow KYC procedures and ensures clients’ funds and data are safe and secure.

How can I contact TradeOr in order to open a trading account?

The easiest way to contact TradeOr is to visit the broker’s website and submit a ticket form. You can also contact the team via its live chat service that is available on the broker’s homepage.

Can I use automated trading with TradeOr?

No, you can’t automate your trading with TradeOr as this broker offers a simple to use and user friendly trading platform.

Can I trade cryptocurrencies with TradeOr?

Yes, TradeOr offers a selection of 11 cryptocurrency pairs that include BTC/USD, ETH/USD, DASH/USD, IOTA/USD, EOS/USD, LTC/USD, OMG/USD, XRP/USD, and ZEC/USD.

See Our Full Range Of Broker Resources – Brokers A-Z

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

TradeOr is a new online trading platform that enables investors to buy and sell various financial assets via its own proprietary trading platform. This broker, which offers users to fund transactions with Bitcoin, is offering traders a wide selection of assets that include FX currency pairs, cryptocurrency pairs, metals, ETFs, energies, and stocks.

TradeOr is a new online trading platform that enables investors to buy and sell various financial assets via its own proprietary trading platform. This broker, which offers users to fund transactions with Bitcoin, is offering traders a wide selection of assets that include FX currency pairs, cryptocurrency pairs, metals, ETFs, energies, and stocks.