What is a CD Ladder? – How to Build a CD Ladder 2021

CD are considered one of the most appealing saving plans due to the fact that they carry a higher interest guarantee. With most accounts having their annual returns well above the 2.50% mark, they pay higher than your average savings account. The interests offered here are fixed and certificate of deposit (CD) account doesn’t attract additional overheads like account management charges or processing fees.

The savings account, however, has one major drawback; they are a fixed term investment. You cannot access the funds saved herein before the maturity of the savings term that usually ranges from three months without forfeiting all or a percentage of the interest earned.

The fact that their interest rates are fixed means that you also won’t benefit from any increments should the banks decide to raise this interest upwards. These have effectively birthed CD Laddering. But what is it and how does it work?

What is CD laddering – How does it work?

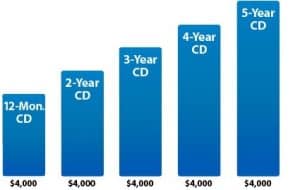

This process is rather crude and has since been replaced by the more effective CD Laddering that involves investing this cash in five $2,000 accounts maturing in 1, 2, 3, 4, and 5 years respectively. This still gives you access to funds should you need them, allows you to take advantage of interest rates and – more importantly – shield you from significant interest loss should interest fall.

After the maturity of the one-year CD, you may consider investing it in another five year CD at a higher interest rate. You then continue the same trend with the second and all the laddered CDs with the aim of reaching a point where all you’re your savings portfolio comprises of several long-term CDs that earn you maximum interest. And it all starts with finding a financial service provider, especially the digital banks – with the highest CD rates.

How to create a CD Ladder?

Interestingly, there is no one-fit-all strategy for creating a CD Ladder. You can only customize it to suit your individual needs. Some of the factors that you, however, need to put into consideration when deciding on the best laddering strategy include your need for incomes and ease of CD rate liquidation as well as the preferred term of the CD Ladder. You may also consider factoring in such projected economic changes as possibility of interest rates going up or down in the foreseeable future.

Why invest in CD laddering?

- Increased accessibility to your funds

Accessibility is perhaps the biggest advantage of CD laddering. With this option, you can access your money within convenient intervals without losing interest or incurring any withdrawal penalties. Simply create a perfect ladder for your savings to ensure you have annual access to your CDs. Laddering ensures different accounts mature every year allowing you to reinvest in better opportunities. It is also a better offer especially if you need to access your money at frequent intervals.

- Better interest rates

With laddering, you can save part of your money in CDs that mature at a later time to enjoy the higher rates associated with such accounts. However, you will still have certificates maturing at frequent intervals. With a solid ladder structure, you can enjoy high interest rates for all your CDs. It is also possible to have certificates maturing every year at high rates if you reinvest your short-term CDs for longer periods. What’s more, CDs offer fixed interest rates that do not change for the entire duration. The calculated returns remain the same for each certificate provided you do not withdraw prematurely.

- Increased flexibility

CD laddering allows you to determine how you would like to split and invest your savings. Instead of a single CD renewed after a specified period of time, you can create multiple accounts maturing at staggering intervals. Besides the minimum deposit required, you have total control over how much you want to save and can determine the returns even before opening an account.

- Safe and secure investment

CD laddering accounts are not only insured and protected, but are also very secure. Unlike other personal savings accounts, the interest rate remains unchanged throughout the period of investment. This allows you to calculate how much money you will have when your certificate matures. What’s more, you can reinvest your short-term CDs when interest rates go up. If the rates fall, you will still enjoy the high rates of your long-term certificates. Most banks are also insured members so your savings will be safe.

Pros

- You can easily access your money

- It is more flexible and convenient

- Offers higher interest rates and returns

- Very secure

Cons

- The certificate has to mature in order to withdraw

- Short-term CDs have very low interest rates

Criteria used to rank the most viable CD Laddering financial institutions:

- Minimum deposit

- Eligibility requirements

- Ease of account opening

- Interest rates

- Early access policy

- Types of CDs available

- Account overheads

Top 10 CD laddering offers

Pros:

- Very easy to open and manage account

- Has significantly higher interest rates compared to banks

Cons:

- A $5,000 minimum deposit is required for each account

Pros:

- Low minimum deposit

- Opening and managing account is very easy

- Has flexible terms

- Earns decent passive income

Cons:

- Interests are lower than most premium credit unions

Pros:

- Has one of the lengthiest CD terms available

- Very easy to open and manage account

- Secure member of the FDIC

- Has high interest rates for longer terms

Cons:

- Must deposit $2,500 in your CD account

Pros:

- Offers some of the highest interest rates in the market

- No minimum deposit is required to open an account

- Has various offers for laddering

- You can create and manage your account online

Cons:

- No checking account is offered

- Very limited ATM network outside London

Pros:

- Very high annual percentage yield for three year terms

- Very easy to open account

- Safe and secure platform for your savings

- Earns you a decent passive income

Cons:

- Very high minimum deposit ($10,000)

- Has no ATMs and branches

Pros:

- Very easy to open account

- Has higher annual percentage yield than most banks

- Reliable and secure

- Excellent customer service

Cons:

- Requires a minimum deposit of $2,000

- No checking accounts or branches

Pros:

- High interest rates compared to most banks

- Reliable secure bank to keep your savings

- Very easy to open account

- Low minimum requirements

Cons:

- Only available to US citizens

Pros:

- Has both short and long term offers

- High interest rates and annual yield

- Easy to open account

- Very secure and reputable

Cons:

- An opening deposit of $5,000 is required

Pros:

- Trustworthy financial service provider

- Account opening is very easy

- Your savings are insured and secure

Cons:

- Interest rates are lower than most options in the list

- Requires a minimum deposit of $2,500

Pros:

- Secure savings options

- Has decent interest rates

- Easy account creation and management

- Exceptional customer service

Cons:

- High minimum deposit of $5,000

- No checking account

What to look for when creating a CD Ladder:

- Bank reputation

Choose banks and financial institutions with a thriving reputation in the area. You can look up reviews from customers and expert rating sites to gather more insights about the nature of services provided, customer service, offers and quality.

- Account opening and management policies

Most banks have minimum and friendly requirements for opening personal savings accounts. Simply go through all the terms and compare them with other alternatives before making your final decision. Also note the minimum deposit required for every CD account you open.

- Interest rates

Banks with higher interest rates are obviously more attractive. Compare annual percentage yields against length of time to determine the best deals for your savings. You can also check if early access is allowed and how it affects your interests.

- Security features

Choose secure banks that can guarantee your money will be safe. They should also be members of FDIC (US) or FSCS (UK). They should also offer seamless customer support and communication. Other security features include regular virus sweeps, encrypted communication, firewall and SSL.

- Money accessibility

Some banks offer checking accounts and ATM deposits/withdrawals while others don’t. Some have local branches while others only offer online platforms. Make sure you understand and are comfortable with the nature of the CD service provider before depositing cash with them.

Bottom line

Certificate of deposit savings accounts offer an ideal way to lock up your savings with guaranteed returns. Laddering simply helps you increase the total returns by enjoying higher interest rates without sacrificing access to your money. If you are in urgent need of cash, creating a ladder ensures you have access within a shorter period of time compared to single renewable CDs. It is imperative that you carefully evaluate your financial plan before opening CD laddering accounts. While this option can help you earn pre-determined interest on your savings, it does not suite everyone. Like most fixed rate savings accounts, you will not be able to withdraw money until the term matures. And any attempt to access part of the funds or liquidate the CD requires that you forfeit a significant portion of the interest already earned. It is therefore suitable if you have a lump sum of cash you will not use for a year or so.

FAQs

What is a CD Ladder?

Can I lose money when CD laddering?

What is the best maximum term for the CD ladders?

How do I create a CD ladder?

What If I need access to my cash before the maturity of either CD ladder?

What is the minimum/maximum CD Laddering period?

Why should I consider CD laddering?

What is the difference between saving in one CD and staggering the savings in a CD Ladder?