How to Buy WWE Stock

World Wrestling Entertainment (WWE) is best known for its wrestling league. But this company operates more than just professional wrestling going brand. WWE is a full-fledged media company, with its own music, podcast, television, and print subsidiaries.

With the current focus on digital entertainment, WWE stock is looking like an increasingly attractive purchase. The stock is currently trading at just under half it’s all-time-high, reached in 2019. This makes today the best time to buy WWE stock at a bargain price.

If you want to buy WWE stock, this guide will cover everything you need to know about trading the WWE stock. We’ll highlight three of the top online brokers that give you access to WWE stock. We’ll also cover the reasons the WWE stock is a good buy right now and discuss the company’s long and storied history.

-

-

How to Buy WWE Stock in 3 Quick Steps

Want to buy WWE stock and don’t have any time to read through the guide? Follow these 3 steps and buy the WWE stock right now.

[three-steps id=”200985″]Where to Buy WWE Stock

WWE trades on the New York Stock Exchange, so there’s no shortage of brokers that list this stock, but it’s important to make sure that you don’t sign up for just any brokerage. Choosing the right broker can help you get the best deal on WWE stock, as well as provide the tools you need to build up a diversified stock portfolio over time.

To help you find the best broker for buying WWE stock, we’ll highlight three of our favorite trading platforms available today.

1. eToro - Best for Social Trading

eToro stands out for the fact that this online brokerage is more than just a place for trading stocks. It’s also a social network where you can follow and interact with other traders. For example, you can see what other traders are investing in WWE stock and strike up a discussion with an expert trader or explore what different traders have in their portfolios. Even better, you can use discussion pages for individual stocks to gauge investor sentiment.

Importantly, eToro allows you to buy and hold shares directly. This is critical for buying WWE stock since it means that you will be eligible to collect dividends. At the same time, you can enjoy some of the advantages of trading derivatives with eToro. The broker lets you trade with leverage up to 30:1, for instance. eToro also offers investors a handful of useful tools, including basic technical charts.

The only downside to eToro is the broker’s fees. It doesn’t charge trade commissions, which is a major plus. However, you will have to pay withdrawal fees of up to $5. eToro’s spreads are competitive, but they’re not the best we’ve seen. Still, the added cost of this broker relative to competitors isn’t very large for the majority of traders.

Our Rating

- Hold Shares: Eligible to collect dividends from WWE stock

- Social Trading: Interact with other traders and copy their portfolios

- Leverage: Trade stocks on margin up to 30:1

- Withdrawal Fees: Add to the cost of trading

- Few Advanced Tools: Charts are best for novice investors

75% of investors lose money when trading CFDs.2. Plus500 - Trade CFDs with Low Spreads

Plus500 doesn’t allow you to buy and sell WWE stock, or any other stocks, for that matter, directly. Instead, you can trade contracts for differences (CFDs) with this broker. This derivative changes in value as if you owned WWE stock directly, but without requiring you to take possession of shares.

One big advantage of CFD trading with Plus500 is that you can trade with leverages of up to 1:5. However, keep in mind that since you don’t own shares outright, you won’t be able to collect any dividends that WWE pays out.

We also like Plus500 because the broker offers a handful of advanced tools for stock investors. You get access to technical charts and technical studies, as well as an economic calendar and customizable price alerts. Plus500 also has some of the tightest spreads we’ve seen and relatively few fees, so this brokerage is one of the most affordable options for buying WWE stock.

OUR RATING

- Trade with Leverage: Up to 1:5 for stock CFDs

- Affordable Trading: Low spreads and few fees

- Research Tools: Including technical charts and price alerts

- No Dividends: You cannot collect dividends when trading CFDs

- Limited Resources: No educational tools so not suitable for beginner traders

- Limited Trading: No scalping or hedging and no social or signal trading

76.4% of retail investor accounts lose money when trading.3. StashApp - Best for Dividend Reinvestment

If you’re looking to build a long-term stock portfolio around WWE, StashApp may be the best brokerage for you. This mobile-first broker is designed to help everyday people become conscientious investors. You can schedule automatic transfers from your bank account to your trading account, as well as rollover extra change from debit card transactions into your trading account. Even better for WWE investors, StashApp allows you to automatically reinvest your dividends in WWE stock.

If you don’t have a ton of money to invest, you don’t need to worry with StashApp. The platform doesn’t have a specified initial minimum deposit and it takes just $5 to start investing. After that, you can buy fractional shares of WWE or just about any other publicly traded US company in increments of just $1 at a time.

Keep an eye on StashApp’s pricing structure, though. The company charges $1, $3, or $9 per month depending on your account structure. There are no trade commissions, so this monthly charge is a steal if you plan to place a lot of stock trades. But, if you want to buy WWE stock once and hold it for years to come, StashApp’s monthly fee might end up being relatively expensive for you.

Our Rating

- Automatic Transfers: Schedule transfers or rollover change

- Dividend Reinvestment: Automatically reinvest your dividends to grow wealth

- No Minimum Deposit: Start with $5 and then trade fractional shares for just $1

- Monthly Fee: Can be expensive if you don’t place many trades

- Stocks Only: StashApp doesn’t offer trading for other asset classes

How to Buy WWE Stock from eToro

Want to buy WWE stock but not sure how to get started? We’ll walk you through the process of placing an order for shares at eToro, our top-rated online broker.

eToro is a good choice for buying WWE stock because it has a low minimum deposit and enables you to buy shares directly so you can collect dividends. It also makes it easy to get started trading in minutes. But If you opted for a different broker, the steps for purchasing WWE stock will be similar.

To get started, just follow these steps:

Step 1: Search for WWE Stock

eToro lets you trade stocks on the New York Stock Exchange, NASDAQ, and on exchanges all over the world. You can browse through them all, or speed things up by searching for ‘WWE’ in the box at the top of the screen.

Step 2: Click on ‘Trade’

Click the ‘Trade’ button to set up an order for WWE stock.

Step 3: Set Up Order and Buy WWE Stock

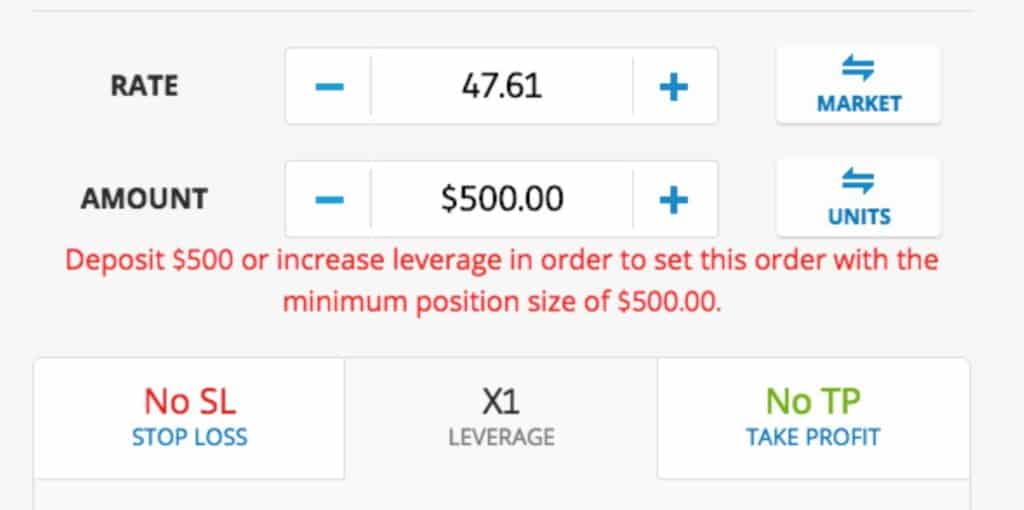

You’ll need to fill out an online order form that tells your broker how you want to go about buying WWE stock. The details are important, so let’s take a closer look at what all the parameters you have in front of you mean:

- Set Rate: This tells your broker how much you’re willing to pay for WWE stock. If you leave it as ‘At Market,’ you’ll pay the current market price for the stock. If you think the stock will go down a little more before it goes up, you can set a lower price here. In that case, your broker will only buy your shares if the price drops below your specified rate.

- Amount: How much WWE stock do you want to buy? The amount can be set in dollars (the default for eToro) or in shares.

- Stop Loss: The stop loss is the price at which you want your broker to sell your WWE shares automatically. This is used to protect you from a bad trade getting worse. You should always set a stop loss to ensure you can’t lose more than a preset amount of money on a trade. We recommend 5% to 10% below the rate you set for the stock.

- Take Profit: The take-profit level is like a stop loss, except for profits. It’s the price at which your broker should automatically sell your shares and lock in your profits. This can be a good option for conservative traders, but leave it empty if you want to hold WWE stock as a long-term investment.

When your trade is ready, click ‘Buy’ to enter your order.

Why Invest in WWE?

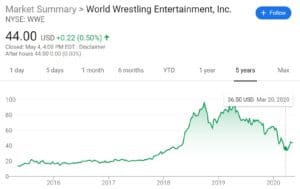

WWE has fallen on hard times since the stock hit a new all-time high in 2019. So, is right now a chance to buy at a bargain? Or is the price likely to continue losing value in the future?

While we can’t predict the future, we think WWE has never been a better value. Let’s take a look at the bullish case for this digital entertainment giant.

Note: Always conduct your own investment research in addition to reading our advice. You are responsible for your own investments.Promising Earnings Ahead

One of the signs most in favor of WWE is the company’s earnings projections. Despite the devastating effects of the coronavirus pandemic on the live sports industry, WWE’s earnings per share are expected to grow by 64.1% this year. That’s nearly double its historical growth rate of 33.7% per year, and it’s even more impressive when you consider that the industry is expected to lose around 15% of its earnings per share this year.

That earnings growth is a reflection of the company’s increasing ability to monetize its various media holdings. While the sports and entertainment industries are scrambling to get live spectators back in seats, WWE is able to go on thanks to broadcasting and event distribution services. The company’s famous wrestling competitions are able to go forward even in the coronavirus era, so expect WWE to get back on its feet long before many of its competitors.

Wide Appeal

Whether you’re a wrestling fan or not, it’s hard to argue that WWE doesn’t have an extremely wide appeal. The company’s live events draw in millions of viewers both in the US and abroad on a weekly basis. In recent years, WWE has made strides in the Middle East and has even hosted live tournaments in Saudi Arabia. Developing a user base outside the US means that this company has plenty of room for growth.

Another point in WWE’s favor here is that the company has taken wholeheartedly to diversity. Wrestling events are far from being composed entirely of white athletes. That may seem like a small detail with respect to the stock price, but it speaks to WWE’s commitment to building a wider viewership. It also helps that WWE is a step ahead of many other companies as diversity becomes an increasingly important issue for shareholders and activists.

Dividend Payouts

For long-term investors, there’s another reason to like WWE: it offers a steady dividend. The company has offered $0.12 per share dividend every quarter since 2013. At the current share price, that’s a payout of more than one percent.

While it would be nice to see dividend growth, it doesn’t hurt that WWE’s dividend appears to be sustainable based on the company’s recent revenue. It’s also reassuring for investors that the latest dividend was paid out without a hitch, even as profits were temporarily slashed by the coronavirus pandemic.

About WWE Stock

WWE was founded in the 1950s as a professional wrestling league. The league isn’t exactly a sport since nearly all of the events are choreographed and follow predefined storylines. That said, this dramatic purpose aligns nicely with WWE’s expanding role as a digital entertainment and media company built around its wrestling league.

The stock trades on the New York Stock Exchange, where it was first introduced in 1999. The price was relatively consistent at $15 to $25 per share until 2017 when the stock price jumped all the way up to $97 per share. A series of disappointing numbers for viewer and revenue growth brought the stock back down over the course of 2019 and 2020. It’s now trading at around $44 per share.

It’s worth noting that Vince McMahon, the owner of WWE, owns roughly 40% of the company’s stock and has more than 70% of the company’s voting power.

Should You Buy WWE Stock?

With WWE stock trading at less than half what it was worth just a few months ago, it’s worth taking a closer look at this company. There are several bright signs for WWE’s future, including the fact that it’s posting higher earnings even in the midst of the coronavirus pandemic. That, along with the company’s wide appeal and the fact that it offers a reliable dividend payout, makes it a potentially great choice for long-term investors.

Convinced that WWE is ready for a rebound? Choose one of our recommended brokers and buy WWE stock today to get in on the ground floor.

FAQs

Is WWE profitable?

WWE is profitable and has been for most of the company’s history, including before it’s IPO in 1999. The company made $322 million in gross profit in 2019 and posted a profit of $116 million for the quarter ending March 31, 2020.

What is WWE’s stock ticker symbol?

WWE’s stock ticker symbol is ‘WWE.’ The stock trades on the New York Stock Exchange.

Will WWE be acquired?

There have been rumors that WWE could be acquired at its current low price. It’s hard to say whether those rumors have merit. However, they seem unlikely given that the current owner, Vince McMahon, inherited the company from his father. In addition, recent stock sales by executives would suggest that there is no acquisition upcoming.

Can I buy fractional shares of WWE?

Yes, you can buy fractional shares of WWE as long as your brokerage allows it. eToro and StashApp both enable you to buy fractional shares. CFDs for WWE stock traded on Plus500 are often much cheaper than WWE shares themselves.

See Our Full Range of Stock Buying Resources

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up