How to Buy Tesco Stock For Beginners in 2021

Tesco is the largest supermarket chain in the UK, with physical stores in several other parts of the world. The company has also diversified into other markets, including but not limited to credit cards, loans, telecommunications, clothing, and insurance.

Tesco stock has, nevertheless, been struggling in recent years. Much of this is due to the growing competition from other supermarkets in the UK space, especially Lidl and Aldi.

The Tesco stock, however, remains a great addition to any your stock portfolio. And in this guide, we review two top brokers from whom you buy the stock before providing you with a step-by-step guide on how to buy your first Tesco stock on eToro.

-

-

How to Buy Tesco Stock in 3 Quick Steps

Want to buy Tesco stocks right now? Follow this 3-step guide:

[three-steps id=”196373″]Where to Buy Tesco Stock

As a highly established corporation with a multi-billion-dollar valuation, it will come as no surprise to learn that hundreds of online stock brokers allow you to buy and sell Tesco stocks with ease. To help you get started, we’ve narrowed our list of recommended brokers down to just two. Both platforms are heavily regulated, offer super-low trading fees, and support lots of deposit options.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

Detailed provider overview

1. eToro – Best Stock Broker for Worldwide Customers

eToro is a truly international online stockbroker thats licensed by multiple financial regulatory authorities including the UK's FCA, Australia's ASIC, and CySEC in Cyprus. And in addition to offering Tesco stocks, eToro lists thousands of other equities. This includes stock exchanges in the US, Canada, Hong Kong, Spain, and Australia, so it's ideal if you are looking to build a diversified investment portfolio.

To get started at eToro, you'll be required to deposit $50. You can do this through a debit/credit card, bank transfer, or an e-wallet like Paypal and Skrill. Apart from the bank transfer option that may take a few days to process, all deposits are instantly credited to your account. eToro's trading fees are highly competitive with the platform facilitating commission-free stock trades. This means that the only trading fee that you will incur is via the spread and the $5 fixed withdrawal fee.

eToro also makes our list because it is tailored to newbie traders. For example, if you're looking to invest in other companies, but you don't know which ones to pick, you can utilize the platform's Copy Trading feature. This allows you to identify a profitable expert trader and copy their investments.

eToro also supports stock CFDs and allows for both leveraged trades and short-selling.

Our Rating

- Catered to newbie traders

- 0% commission on ETFs and stocks

- Supports heaps of everyday payment methods

- Minimum withdrawal of $50

- High spreads

- MT4/5 not available

75% of investors lose money when trading CFDs2. Plus500 – Trade Tesco Stock through CFDs

Plus500 wins the CFD race. CFDs allow you to buy and sell stocks without you owning the underlying asset. This means that you will not be entitled to Tesco stock dividends. Alternatively, the CFD route allows you to short-sell Tesco shares, which is ideal if you think its stock price is about to fall.

CFD stocks at Plus500 also allow you to apply leverage. European traders, however, have their leverage capped to leverage of 5:1 on stock trades. Registering a trading account at Plus500 is easy and straightforward but requires a minimum initial deposit of $100. The broker also supports popular payment service providers like debit/credit cards, Paypal, or bank wire.

In addition to stocks, Plus500 offers dozens of other tradable financial instruments including cryptocurrencies, indices, energies, precious metals, and forex. This is ideal if you want a diversified portfolio, as you'll have access to thousands of financial instruments through a single hub.

Plus500 is heavily regulated. Not only does it hold licenses in the UK, Australia, Cyprus, and Singapore, but its parent company is listed on the London Stock Exchange.

Our Rating

- Fast order execution

- No commissions

- Tight spreads

- Stocks only available via CFDs

- Its educational resources are sparse

80.5% of retail investor accounts lose money when trading CFDsHow to Buy Tesco Stock from eToro

Here is the step by step guide on how to buy Tesco stocks on Toro:

Note: You will need to open an account, verify your identity, and deposit funds before you can buy Tesco stocks at eToro. The process takes minutes, so be sure to get this set up before proceeding.Step 1: Search for Tesco (TSCO) Stock

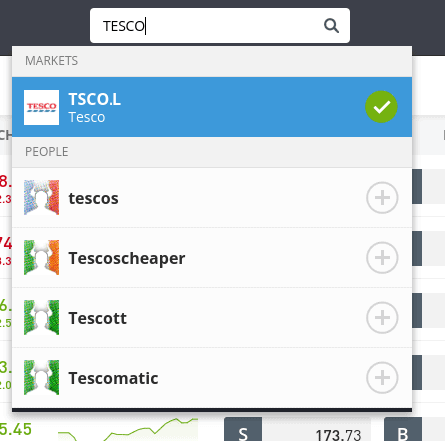

Login to your eToro trading account use the ‘search box’ on your account dashboard to look up ‘TESCO’ stocks

Step 2: Click on ‘Trade’

You should now see some market stats on Tesco shares, as well as a social trading comments box. Unless you plan to do some more research, click on the blue ‘Trade’ button to proceed with your stock investment.

Step 3: Set-Up Order and Buy Tesco Stock

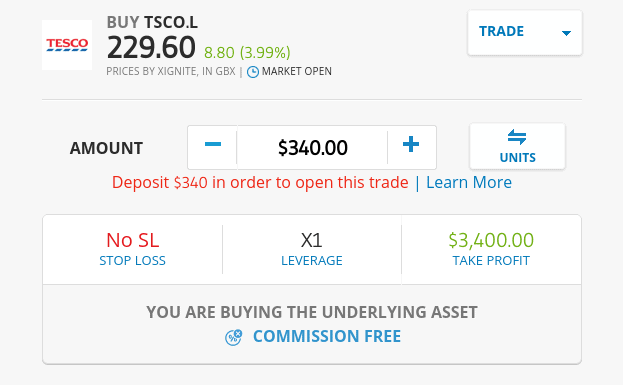

Complete the order by setting the trade parameters.

These include:

- Amount: You need to enter the amount of Tesco stocks that you wish to buy in the ‘amount’ box. Take note, this is NOT the number of shares. Remember, it’s the amount in dollars and cents, for example, if you want to invest $50, enter $50 into the box.

- Set Rate: Like most brokers, eToro gives you the option of a ‘market’ or ‘limit’ order. If you’re content with taking the current price, leave this set as a market order. If you want to buy Tesco stocks when they hit a certain price, you can enter this by changing the set rate to a limit order.

- Stop Loss: If you want to mitigate your losses (which you should), set up a stop-loss order. In doing so, your trade will automatically when the price of Tesco hits a certain price.

- Take Profit: This is similar to a stop-loss order but in reverse. Simply enter the price that you want your trade closed to lock in your profits automatically.

Finally, click on ‘Buy’ to complete your Tesco stock order.

Why Invest in Tesco?

We have listed some of the reasons why you might consider adding Tesco stock to your portfolio.

Projected 2021 Profits Double That of 2014

Going straight to the financials, Tesco profits are in excellent shape, especially when making the comparison to 2014. We take note to this year in particular, as this is when the infamous Tesco accounting scandal surfaced. Back in 2014, profits amounted to £974 million. And in 2021? This is projected to hit an impressive £1.8 billion and with 2021 profits estimated to hit £1.7 billion, this is more than achievable.

Largest Market Share Still in Place

Not so long ago, Tesco was head and shoulders above the competition in the UK retail industry. However, since the 2008 financial crisis, where UK consumers begun tightening their belts, fellow chains Aldi and Lidl have proven popular with grocery shoppers. As such, they have slowly but surely been nipping away at Tesco’s once-dominant market share. With that said, Tesco still retains its title as the most visited supermarket in the UK, which is welcome news for concerned shareholders.

Attractive Dividend Policy

Although Tesco stocks have underperformed in recent years, it’s dividend policy has remained constant. In the company’s most recent earnings report, it announced a dividend yield of 2.6%. While this isn’t the most attractive yield available on the FTSE100, analysts predict that this could inch closer towards the 4% mark in 2021. However, this is on the proviso that the supermarket chain hits its operating profit target of £1.8 billion.

Management Exiting Non-Profitable Markets

Tesco has attempted a major global expansion policy over the past decade. Some have been successful, while many have not. Fortunately, management has made it clear that they intend on exiting non-profitable markets in the coming years. At the forefront of this is the South East Asian space. This will allow the company to concentrate its efforts on retaining its UK market share.

About Tesco Stock

Company and Stock history

Launched in 1919, Tesco started its business venture as a market stall collective. It wasn’t until 1931 that it opened its first physical store. Fast forward to 2021 and the supermarket chain now has 7,000 stores globally, with more than 460,000 employees under its wings. Over the past two decades, Tesco has engaged in a diversification plan to reduce its reliance on groceries.

This includes exposure to the insurance, telecommunications, clothing, loan, and credit card sectors. Tesco is now a PLC listed on the London Stock Exchange under the ticker symbol TSCO. In fact, it was first listed way back in 1947, where its stocks were originally priced at just £0.25.

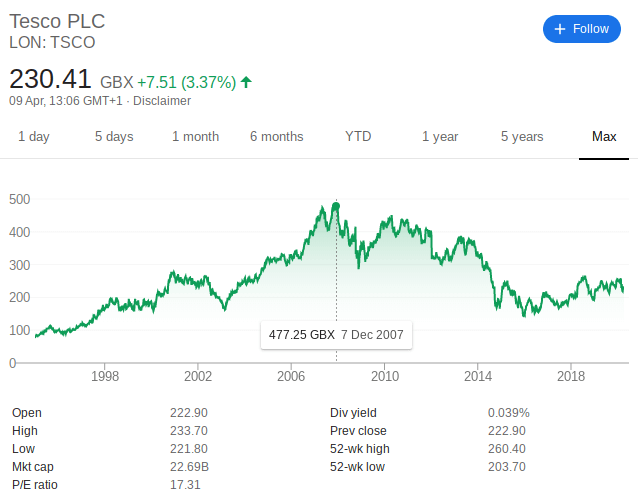

As of Q2 2021, Tesco stocks are priced at just over 231p, although the company has initiated multiple stock-splits along the way. At the time of writing, the company has a market capitalization of £22.6 billion, meaning that it forms part of the FTSE100. With that said, Tesco stocks last hit their all-time high in 2007, where its shares peaked at 477p. Since then, the company has been on a downward trajectory.

Much of this was came about in 2014 after the infamous accounting scandal.

Should I Buy Tesco Stock?

There are certainly a number of positives going for Tesco at present. Not only is management looking to cut operating costs by exiting non-profitable international markets, but the company is well on course to meets its 2021/2021 targets. If it does, this will result in the company doubling the operating profits that it reported in 2014.

It is also notable that Tesco still retains the lion share of the UK supermarket scene, albeit, under pressure from budget stores Lidl and Aldi. Tesco stock has been struggling for about 13 years; this market downfall began on the back of the 2007/08 financial crisis, and then the company’s infamous accounting scandal in 2014.

Nevertheless, if you are feeling bullish on Tesco and think its stocks represent a discount purchase, buy at this dip.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Glossary of Stocks Terms

StockA stock is a representation of a company’s equity. When a company wants to raise capital, it issues stocks to the public. It is the aggregation of the total stocks owned by one individual that inform their shareholding of the company.

SharesA share is an indivisible unit of capital that expresses the ownership relationship between a shareholder and a particular company, mutual fund, REITs or limited partnership. A share indicates a portion of ownership (claim) that one has on a company or fund.

DividendDividend refers to the portion of the company’s profits that is distributed to its stockholders. It can be on a quarterly or annual basis.

Bull marketA bull market is an economic condition where the stock markets are in an extended period of consistent increase in stock prices.

Bear MarketA stock market is said to be bearish if it is involved in extended periods of continuous price decrease of the stock prices.

Stock ExchangeA stock exchange is an institution or a platform where shares and stocks and a host of other money market instruments are traded.

Return On Investment (ROI)The return on investment is the profit you make from trading in or investing in shares and stocks of a particular company. It often comes from selling the investment at a higher price than was originally bought or benefiting from dividends and other profit-sharing schemes as a result of owning and holding onto a particular investment.

BrokerA broker may be a person or entity that engages in the buying and selling of different types of investments on behalf of other individuals or entities at a fee (or commission).

Day TradingDay Trading is the practice of buying a money market investment product and selling it as soon it reports price increase or loss, within the same day. Traders engaged in day trading are referred to as “day traders” or “active traders”

ArbitrageArbitrage is the act of buying and selling security at different stock exchanges or markets with varying prices. If, for instance, stock ABC sells at $11 on one exchange and $11.75 on the other, arbitraging involves buying from at the low price exchange and profiting by selling it at the higher-priced exchange.

IndexA stock index is a statistical measure of the change in the stock and securities market. It comprises a hypothetical portfolio of different companies whose change in prices is calculated to determine market performance.

Initial Public Offering (IPO)The Initial Public Offering refers to the sale of company stock to the public for the first time. It is the act of taking a company public and is highly regulated by such financial regulators like the SEC in the USA and FCA in the UK.

OptionsOptions are derivative financial instruments whose price is based on the value of their underlying tradable security like shares and stocks. They are contracts that give the holder an option to buy or sell the underlying asset at a later date. Unlike futures, an options contract holder has the choice to buy/sell or not.

Call optionsThis is an options contract that gives the holder an option to buy the underlying asset before the expiry date.

Sell optionsThis option gives its holder the choice of selling the underlying asset before its expiry date

Mutual FundsA mutual fund refers to a company that pools funds from different investors and invests these funds in stocks, bonds, and other financial market securities. They then distribute the capital gains from these invests to their members.

Over-the-CounterThe process through which stocks for companies that are not listed with accredited stock exchanges like the NYSE are traded. It is a broker-dealer network for unlisted stocks for companies that do not meet listing requirements set by the organized exchanges.

OverboughtA stock is said to be overbought if it is traded excessively over a short period of time and at unjustifiably high prices.

OversoldA stock is said to be oversold if it is consistently traded below its true value.

Ask PriceAlso referred to as the offer or asking price, this refers to the lowest price that the seller will take for a stock.

Bid PriceBid price refers to the maximum price that a buyer is willing to pay for a stock.

VolumeIn the stock trading context, Volume refers to the number of shares that change hands within a given period of time, be it a day, month or annually. It is trading/investment indicator where rising trade volumes point to a healthy stock while dwindling volumes are indicators of investor pessimism towards a stock.

VolatilityRefers to the statistical measure of the change in price of a stock over a given period of time. It is a measure of the rate and the time it takes for a stock price to move from high to low and how long it remains within a certain price range. The higher the volatility, the higher the risk.

52-Week HighThis refers to the highest closing price recorded by a given stock in the last 52 weeks.

52-Week LowThis refers to the lowest closing price that a particular stock recorded in the last 52 weeks.

Bid-Ask SpreadThe bid-ask spread refers to the difference between the lowest price that a seller is willing to take for their stock and the highest price that a buyer is willing pay for the stock. It is the difference between the quoted ask and bid prices.

Market OrderA market order is an instruction by an investor to the broker or brokerage platform asking them to buy/sell a stock or any other security at the best price available at that moment. It is often issued when an investor wishes to enter or exit the market quickly and at the prevailing rates.

Limit OrderA limit order is an order that triggers a sale or buy when a predetermined or better price is met. For a buy limit order, the buy order is executed once the set limit price or a better price is triggered. The sell limit order on the hand triggers the sale of stocks if the limit price or better price is hit.

Stop OrderAlso referred to as a stop loss order, it is an order that triggers a buy or sell action once a predetermined price level is hit. It is designed to help you minimize possible loss on a given trade should the markets move against your bet.

Take ProfitTake profit is a type of limit order dictating the price level at which the broker or brokerage platform is to close a trade for profit.

Capital GainsCapital gain refers to the value rise of a tradable financial instrument that makes its selling price higher than the buying price. It can also be referred to as the profit realized from liquidating a capital investment like stocks.

ETFsAn ETF is a collection of many tradable instruments like bonds, stocks, and commodities. These are listed on the exchanges and traded like ordinary stocks.

Debt-to-Equity RatioThe debt-to-equity (D/E) ratio is a financial ration tool used to measure the financial health of a company by gauging value of its equity in relation to debt. It is achieved by dividing the company’s total liabilities in relation to its shareholder’s equity.

Dividend InvestingThis is an investment strategy where the investor only buy shares that have consistently paid out high dividends in the past or others with the fastest dividend rates. Dividend investing strategy advocates are more interested in how much a shares pays in dividends than its price fluctuations.

Growth StocksGrowth stocks refers to the stocks of companies that are expected to grow at a faster rate than the industry average and report consistent and sustainable cashflows. The company sales and revenues are also expected to increase at a faster than that of an average company in the same industry.

Penny StocksThese are also referred to as micro-cap or nano-cap stocks and refers to the stocks of relatively small companies valued less than $5 and only trade via the Over-The-Counter markets.

Blue ChipA blue chip refers to a nationally recognized and financially sound company with a long and stable record of consistent growth. It is company whose financial might and nature of operation make it well suited to face turmoil and remain profitable in the uncertain economic conditions..

Short SellingShort selling is a trade/investment strategy where the investor is banking on the decline of the shares of a particular company. They therefore borrows these shares, sells them at the current market price and buys them back after they lose value, effectively profiting from the price difference.

YieldYield refers to the profit/earnings generated from investing in a particular stock or market instrument over a given period of time and is expressed a percentage of the stock’s market value, face value or as percentage of invested amounts.

Capital StockCapital stock, also referred to outstanding shares, refers to all the regular shares issued by a company and held by all its shareholders including the restricted/locked-in shares held by company insiders, executives, and institutional investors. The number of capital stock is used in calculating key metrics including cash-flow per-share and earnings per share.

Earnings Per Share (EPS)EPS refers to the monetary value, the profit or earnings attributable to each outstanding shares held by a company. It is a financial ratio that is arrived at by dividing the company’s profit by its outstanding shares of the common stock.

Price Earning Ratio (PER)Also referred to as Price-to-earnings ratio, PER is a financial metrics tools used to check if a company’s shares are over/undervalued by dividing the shares current market price with its earnings-per-share.

FloatA company’s flat refers to the number of regular shares issued to investors that are available for trading. The float shares figure is arrived at by subtracting the locked-in shares held by company insiders and executives from its capital stock.

Gap-up StocksGap up stocks refer to company stocks that open the day trading at relatively higher prices than their previous day’s closing price. This is often attributed to the after-market trading activity.

Gap-Down StocksGap down stocks refers to company stocks that open the day trading at relatively lower prices that the previous day’s closing price. For instance if a company stock closes the day trading at $50 but opens the following day trading at $45, it is said to have a 5-point gap down.

Stock BuybackStock buyback, also referred to as share repurchase, occurs when a publicly listed corporation uses a part of its revenues to buy back its shares from the marketplace. The move effectively reduces the number of company shares in circulation, which translates to an increased share price.

HOLDHOLD is a financial recommendation issued by a qualified financial institutions or financial analyst advising investors/traders not to buy or sell a particular stock. It is a no-action situation where long position traders are advised not to sell and others investors advised not to buy into the stock.

Resistance LevelsThis refers to the upper-most price level that a particular stock or any other security reaches but doesn’t exceed due to dwindling number of buyers and an increasing number of sellers.

MacroeconomicIs a branch of economics that’s concerned with the study of how the economy and different large-scale markets are structured, how they behave, and how they perform.

RSIRelative Strength Index is a technical momentum indicator used in market analysis to determine if a stock is overbought or oversold by measuring the magnitude of a recent bullish or bearish price run. It has a scale of 0-100 where RSI readings of 70+ indicate a stock is overbought while an RSI reading below 30 is an indicator of an oversold security.

Moving AverageMoving Averages is a statistical calculation that is specially designed to identify the arithmetic mean of a given number of data sets or range of prices calculated over a given period of time. Each of these data set or price range is created by the average/mean price for that subset. For instance, a single data point on a moving averages scale may represent the average stock price for a day or trading session.

Bollinger BandsBollinger Bands are a technical indicator tool characterized by two statistical carts that run alongside each other indicating the changes in prices and volatility of a financial instrument like stock or commodity over a given period of time.

Fibonacci RetracementsFibonacci retracements refer to two horizontal lines that use the Fibonacci numbers to measure the percentage of price retracement in a bid to indicate where the resistance and support are most likely to occur.

FAQ

How much were Tesco stocks originally?

Tesco held its IPO in 1947, and initially priced its stocks at 25p. Not taking into account various stock splits along the way, Tesco’s all-time high stock price of 477p was hit in 2007.

Why does Tesco keep doing stock splits?

Tesco has initiated multiple stock splits since 1969. The reason behind this is to reduce the market price of its shares. You see, when share prices get too high, it often makes it unaffordable for the average buyer. Take note, splitting a stock does not reduce the value for shareholders per-say, as they are simply given extra shares proportionate to the number they currently hold.

Does Tesco pay dividends?

Yes, Tesco does pay dividends

Do I need to buy whole Tesco shares?

Not any more. There are a number of online brokers that allow you to buy fractional shares in Tescos, so you can invest as little as you like.

What stock exchange are Tesco stocks listed on?

Tesco is listed on the London Stock Exchange, and it forms part of the FTSE 100.

Who owns Tesco?

As Tesco is a public company, it is owned by its shareholders. The largest individual shareholder at the time of writing is BlackRock, who holds a 6.4% position.

See Our Full Range Of Buying Stocks Resources

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up