How to Buy Liberty Tripadvisor Stock Online in 2022

TripAdvisor describes itself as the world’s largest travel site. It is American based and specializes in helping different individuals find the best hotels, things to do, restaurants, and flights by constantly reviewing various travel-related service providers around the world.

In this guide, we explore the company’s types of stocks, the difference between Tripadvisor and Liberty TripAdvisor Holdings, and review the top three online brokers from whom you can buy the Tripadvisor stock.

-

-

Where to Buy Liberty Tripadvisor Stock

There are three ways in which you can invest in Tripadvisor. The first is to buy Tripadvisor stock (TRIP), while the second and third options are to buy Liberty TripAdvisor Holding stocks (LTRBA, and LTRBP), a holdings company that owns around 23% of Tripadvisor’s common stock. Among the three stocks, Tripadvisor (TRIP) is the most liquid, and popular.

Keep in mind that you will need to use an online stock trading broker to buy Tripadvisor stocks.

Below, we have listed the top three brokers.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

How to Buy Liberty Tripadvisor Stock

If you are looking to buy Tripadvisor stocks, then here is a guide to buying the stock with a popular trading platform.

Step 1: Search for Liberty Tripadvisor Stocks

After you have completed the registration process, you will be directed to the trading platform. You can use the search bar to search for Tripadvisor stocks. Simply type in Tripadvisor or TRIP at the top search bar. Once you click on the stock, you will immediately be transferred to the Tripadvisor stock page where you can get view the charts, stats, Twitter feed, and trading tools such as market sentiment, news, and analyst recommendations.

Step 2: Click on ‘Trade’

To proceed with your transaction, click on the ‘Trade’ button.

Step 3: Buy Liberty Tripadvisor Stock

Next, you can insert an order to buy or sell Tripadvisor (TRIP) stock. You will have to enter the amount of the trade, the order type (market/limit order), the leverage ratio, and stop-loss order to set the maximum amount you are willing to lose in terms of pips on a trade. Then, click the ‘Open Trade’ button to complete your purchase.

Why Invest in Liberty Tripadvisor?

Tripadvisor is the world’s largest travel platform owned by Expedia as well as by Liberty TripAdvisor Holdings. The platform collects reviews from members of the community about hotels and accommodations, restaurant experiences, airlines, flights, and cruises.

Tripadvisor is an Industry Leader

Once the coronavirus pandemic ends, the world is most likely go back to business as usual and people are expected to start traveling again. TripAdvisor is a platform that benefits the traveler community as well as airlines, hotels, and the global travel industry.

Undervalued Stock

Right now, Tripadvisor (TRIP) is trading at historically low levels, mostly due to the coronavirus pandemic that has paralyzed the travel, tourism, and hospitality industries. TripAdvisor’s share price dropped significantly due to a decrease in monthly visitors since February 2020. However, most analysts advise that you ‘Hold’ the stock and provide a consensus price target that ranges from $27.64 to $46.36, according to MarketBeat.

As to Liberty TripAdvisor Holdings Series A (LTRPA) – The stock is trading at $1.53 with a Hold consensus rating and a price target of $11.82.

Global Diversity

Tripadvisor has versions in 48 markets and 28 languages worldwide. You may say that Tripadvisor is the highest authority in the world of international traveling sites, accommodation, flights, and activities. TripAdvisor has a global and diverse customer base and an enormous impact on the tourism of entire countries.

Furthermore, in 2019, Tripadvisor reached 463 million average monthly unique visitors. That figure makes Tripadvisor one of the most visited websites in the world and the number one traveling website in the world.

Huge Collection of Database

Today, TripAdvisor lists around 1.4 million hotels, holds one of the largest collections of travel photos online, and features accommodation and traveling reviews in more than 48 countries. Overall, Tripadvisor features approximately 859 million reviews and users’ opinions for approximately 8.6 million traveling and entertainment establishments across the world. According to Wikipedia, Tripadvisor also features 842,000 rental properties, 5.2 million restaurants, and 1.2 million travel experiences worldwide, as of 2019.

About Liberty Tripadvisor Stock

Tripadvisor Company Background

Tripadvisor is an American online travel company that was founded in 2000 and is partly owned by Liberty Tripadvisor Holdings and Expedia. TripAdvisor Inc. is a separate public company than Liberty TripAdvisor Holdings and is traded on the NASDAQ stock exchange under a different ticker symbol (TRIP).

The idea behind Tripadvisor was to create a social media and engagement platform for travelers where they can review and recommend locations, hotels, airlines, etc. The platform was founded by Stephen Kaufer, Langley Steinert, Nick Shanny, and Thomas Palka, and soon become the largest traveling platform on the internet and a dominant player in the tourism industry. In 2004, Tripadvisor CEO Stephen Kaufer sold TripAdvisor for $210 million to InterActiveCorp (IAC), the parent company of the online travel company at the time, Expedia.

In 2019, Tripadvisor has generated revenues of approximately $1.56 billion, a decrease from the previous year’s total revenue of $1.62 billion.

Liberty TripAdvisor Holdings Company Background

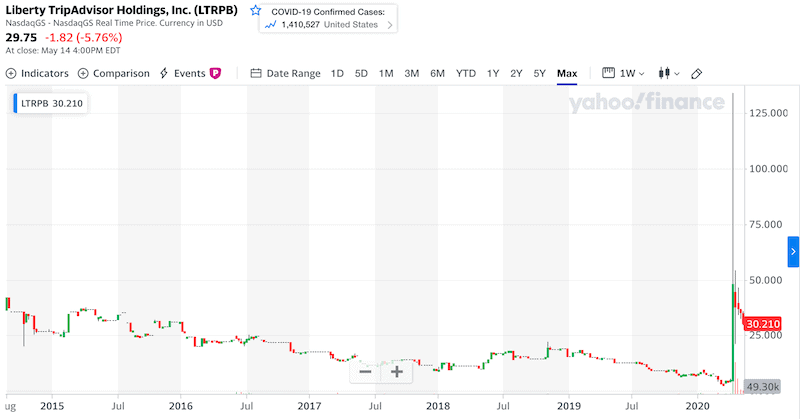

Liberty TripAdvisor Holding holds an ownership of 23% or 18.2 million shares of common stock & 12.8 million shares of Class B common stock of Tripadvisor. In addition, Liberty TripAdvisor Holdings has approximate 58% of the voting interest. The Company has two series of common stock, Series A, and Series B. Technically, there is no difference between Series B shares (LTRPB) and Series A shares (LTRPA) apart from the fact that series B shares have 10x voting rights.

Tripadvisor (TRIP) and Liberty TripAdvisor Holdings (LTRBA and LTRBP) Stocks

Tripadvisor (TRIP)

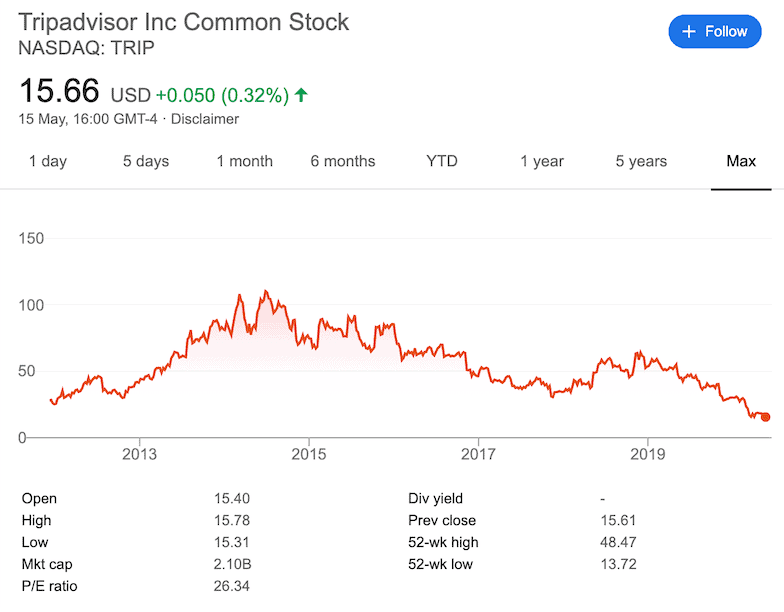

Tripadvisor reached its all-time high of $110.21 on June 27, 2014, and since then, the stock has been trading at lower levels. In 2020, TripAdvisor stock continued to stumble, losing 48.45% of its value. Yet, it’s quite clear that Tripadvisor’s stock price falls as the coronavirus pandemic has put a halt on the travel industry. Recently, the company has also released a quarter of its workforce – 900 e around employees.

Yet, most analysts still remain neutral in Tripadvisor’s stock, particularly in the long term. True, there are many concerns and risks associated with Tripadvisor’s stock that include the impact of the coronavirus pandemic, the increasing competition, the seasonality of the traveling industry, and the disappointing Q1 earnings results. But it’s important to take into consideration the fact that Tripadvisor is still the largest traveling platform in the world, with a successful platform business.

Liberty TripAdvisor Holdings (LTRBA and LTRBP)

The possibility of a healthy recovery is evidenced by the spike 2871% in one day in LTRBP stock that occurred between April 14 to April 15.

What Else Should I Know About Liberty Tripadvisor?

Tripadvisor is having a global presence, however, the majority of Tripadvisor’s revenue is generated in the United States. In 2019, around $821 million of the $1.56 billion of TripAdvisor’s global revenue was made in the United States. In a way that’s a pro and a con; if Tripadvisor will expand to new markets in the near future (particularly China), the company’s revenue can increase.

In terms of technical analysis, the stock found a bottom or support at $14.39 and created a double bottom formation. If the share price rises and breaks the $20.00 mark, the stock can make a significant move higher.

Conclusion

On the negative side, where the coronavirus pandemic has been a threat to the travel industry, the company has recently reported disappointing Q1 results, and the platform relies on search engine algorithms which can be a crucial factor for the company’s income.

However, it seems like the Tripadvisor stock is undervalued and the current one-year target price is $25.74.

You should also note that TripAdvisor was struggling before the COVID-19 outbreak and made significant changes to increase profitability. TripAdvisor has announced that it will trim its staff by one-quarter of the total number of the company’s workforce, about 900 employees.

The price of the stock has already fallen to fair value and investors have evaluated the situation correctly but from now on, the price target for Tripadvisor (TRIP) offers upside from where the stock is currently trading.

FAQs

How does Tripadvisor make money?

Tripadvisor’s main source of income is advertising, as well as booking fees from hotels and other travel services offered on the platform. Tripadvisor charges a processing fee of 3% on all bookings made on its website.

How can I get assistance with my Tripadvisor stock purchase?

Follow the steps above to complete your Tripadvisor purchase. If you need further assistance, you can contact the support team of one of our recommended brokers.

What is the ticker symbol for Tripadvisor and Liberty Tripadvisor Holdings?

Liberty TripAdvisor Holdings is listed on the NASDAQ exchange under the symbols LTRPA and LTRPB’. Tripadvisor is traded on the NASDAQ exchange under the ticker symbol ‘TRIP’.

Does Tripadvisor pay dividends?

No, Tripadvisor or Liberty Tripadvisor Holdings do not pay dividends on common stocks.

How many visitors does Tripadvisor have?

As of May 2020, Tripadvisor has 54.10 million monthly visitors on its platform, according to SimilarWeb. The platform, however, had 164.8 million users on January, before the outbreak of the coronavirus pandemic.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Tom Chen

View all posts by Tom ChenTom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up