How to Buy IBM Stock For Beginners in 2021

Buying IBM stocks online is relatively straightforward. You simply need to choose an online broker that gives you access to NYSE-listed companies, create a trading account, deposit some funds, and then decide how many shares you wish to buy.

But there are hundreds of online stock brokerages that give you access to IBM shares. So how do you decide on the best stock trading platform to create an account with?

Well, in this IBM stock investment guide, we tell you of the leading online stock brokerages from whom you can buy IBM stock and provide you with a step-by-step guide on how to make your first purchase.

More importantly, we review the IBM company and the historical performance of its stock, highlight its viability as an investment tool, and detail some of the reasons you should/should not buy the stock.

-

-

How to Buy IBM Stock in 3 Quick Steps

Want to buy the IBM stock right away? Follow this 3-step buying guide:

[three-steps id=”196864″]Where to Buy IBM Stock

Here, we detail the three top online brokerages where you can buy and sell IBM stocks:

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

Detailed provider overview

1. eToro – Best Stock Broker for Worldwide Customers

If you're looking for the safest and most convenient way to buy IBM stock in minutes, register an account with eToro. The online broker lists thousands of blue-chip stocks, including that of IBM. The sign-up process takes minutes. Once you've verified your account by uploading a copy of your passport or driver's license, you can then deposit funds with a debit/credit card, e-wallet, or bank transfer.

Minimum deposits start at $50, although you can invest as little as you like into IBM as eToro allows for fractional share investing. This allows you to diversify your risk by adding several other companies to your stock portfolio. eToro does not charge any deposit fees but maintains a fixed $5 fee for all withdrawals. Most importantly, you will not be charged any trading commissions when buying and selling IBM stocks on the platform.

eToro is also notable for its Copy Trading feature, which is perfect if you're just starting out in the world of stocks and shares. Thi aspect of social trading makes it possible for you to copy the trades and trade setting of expert traders on the site and replicate them on your account.

eToro is licensed by the UK's FCA, Australia's ASIC, and CySEC in Cyprus.

Our Rating

- Catered to newbie traders

- 0% commission on ETFs and stocks

- Supports heaps of everyday payment methods

- Minimum withdrawal of $50

- High spreads

- MT4/5 not available

75% of investors lose money when trading CFDs2. Plus500 – Trade IBM Stock With CFDs

Plus500 is pure CFD online brokerage and, therefore, not suitable to dividend investors. This implies that you don't get to own the underlying stock you invest in, as CFD trading involves speculating on the future price of IBM. The upside to this is that you have the option of applying leverage, meaning you can trade with more than you have in your account.

Stock traders on the platform have access to leverages of up to 5:1. Therefore, a $100 investment at Plus500 would allow you to trade stocks worth $500. CFDs also allow you to short-sell stocks. In the case of IBM, this means that you can speculate on the value of the company going down. Plus500 allows you to get started with a minimum investment of $100, and both deposits and withdrawals are free. You can deposit money into your account via a debit or credit card, bank account, or Paypal.

Once you're all set up, Plus500 allows you to buy and sell stock CFDs commission-free and spreads are variable but highly competitive.

Plus500 is licensed by the FCA, CySEC, ASIC, and Singapore's MAS. The company is also publicly-listed on the London Stock Exchange, which highlights just how quickly the online broker has grown since its inception in 2008.

Our Rating

- Fast order execution

- Commission-free stock CFD trading

- Tight spreads

- Stocks only available via CFDs

- Its educational resources are sparse

80.5% of retail CFD accounts lose money.3. Stash Invest – Best USA Broker With Low Deposits

Stash Invest is a mobile stock broker app that caters its services to newbie traders in the US. Its overarching selling point is that Stash makes the stock trading and investment process super-easy for those without any experience. You only need to open an account and link it with your US checking account, after which you can then deposit a minimum of $5 into your account.

Stash Invest also allows you to buy fractional shares in companies like IBM, so you can create a risk-averse portfolio by investing in dozens of different companies. In fact, you can buy stocks from just 1 cent at Stash, so a $5 deposit would allow you to invest in 500 individual firms. Unlike the other brokers on our list, you will need to pay a monthly fee to use Stash Invest.

This starts at just $1 per month for the standard investment account and up to $9 per month if you want to create a tax-efficient retirement account. Stash Invest won't be suitable if you're looking to gain exposure to international markets, as it only trades companies listed on NASDAQ and NYSE. It is also somewhat frustrating that the app doesn't allow you to deposit or withdraw funds with a debit/credit card or e-wallet.

Stash Invest is regulated by the Securities and Exchange Commission (SEC) as a Registered Investment Adviser.

Our Rating

- $5 minimum deposit

- Allows fractional stock purchases

- Monthly fee from just $1

- Limited number of shares hosted

- No access to international stock exchanges

How to Buy IBM Stock from eToro

Here is a step by step guide on how to buy your first IBM stock on Toro:

Note: As with all online stock brokers, you will need to open an account with eToro before you can buy shares. You will also need to furnish them with your ID for density verification and make the minimum initial deposit of $50.Step 1: Search for IBM Stock

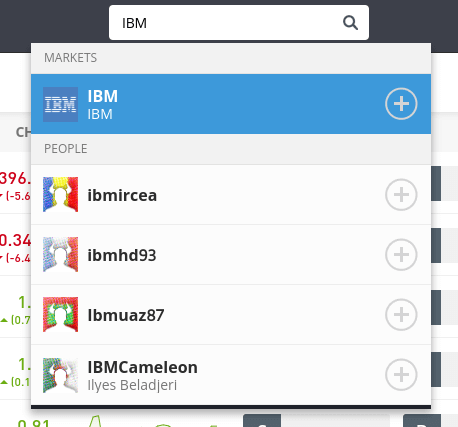

Login to your eToro trading account use the ‘search box’ on your account dashboard to look up ‘IBM’ stocks

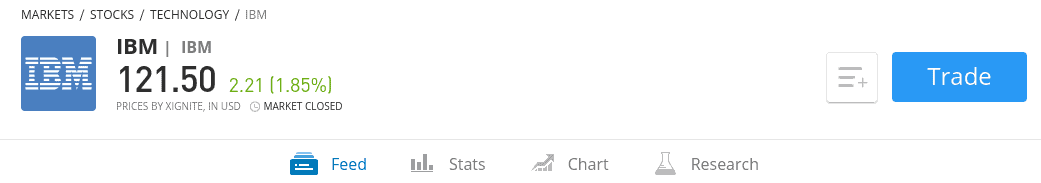

Step 2: Click on ‘Trade’

If you want to perform some additional research on IBM stocks prior to making a commitment, this is the page to do it. When you’re ready to proceed, click on the ‘Trade’ button.

Step 3: Set-Up Order and Buy IBM Stock

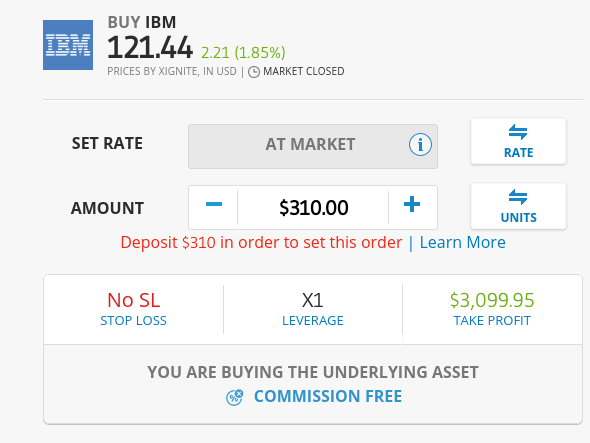

Complete the buy order by setting the trade parameters.

These include determining the:

- Amount: This is the exact amount that you wish to invest in IBM stocks in dollars and cents. For example, if you want to buy $310 worth of shares, enter ‘310’ into the box.

- Set Rate: You need to decide whether you want to take the next available price, or choose an entry price yourself. If it’s the latter, change the set rate to a ‘limit order’ and enter your preferred entry price. If not, leave it set as a ‘market order’ and eToro will execute your trade at the current market price.

- Stop Loss: You also have the option of setting up a stop-loss order. By entering a price that you wish to exit your trade at, you will mitigate your losses in the event IBM stocks go down in value.

- Take Profit: Much like a stop-loss order, this allows you to exit your trade automatically, but when you are in profit.

Finally, click on ‘Buy’ to complete your IBM stock order.

Why Invest in IBM?

IBM is a multi-billion dollar technology company that has performed incredibly well since its inception in 1911. And here are some of the reason we believe you should invest in IBM stocks today:

Profits have almost doubled in the last two years

A good place to start is the financials. As per IBM’s earnings report in Q4 2019, IBM announced operating profits of over $9.4 billion. To put this into perspective, IBM reported operating profits of $5.8 billion during the same quarter of 2017. This translates to more than 74% increase in price in less than three years. Analysts predict that this upward trajectory is likely to slow down in the coming years, with a 2025 growth profit target of 7.3%.

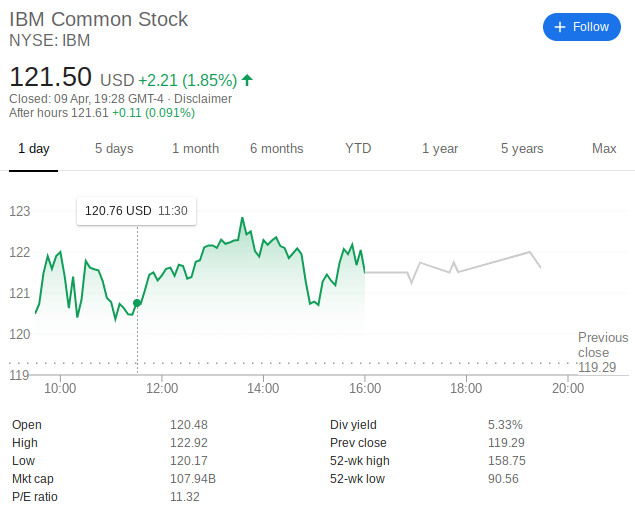

The all-time high stock value is still within reach

The IBM stock hit an all-time high in 2013, with its share valued at $215. In April 2021, the IBM share stock trades around the $121 mark. This represents a huge discount in relation to its prior highs and a huge potential for an upward correction, especially when you take into account recent success in the tech industry backed by a strong balance sheet.

A Pioneer of Innovation and Cutting-Edge Technologies

IBM is a hallmark US institution that, time and time again, re-invents itself in order to stay ahead of the technological curve. Among a number of other notable projects, IBM is now looking to lead the cloud computing race, AI technology, Big Data, and the development of the Quantum computer. Similarly, CEO Satya Nadella has dedicated vast resources to the development of cognitive software products, which is another emerging technology that is sure to play a major role in the future of artificial intelligence.

Juicy Dividends Policy to Compliment Stock Groth Upside

IBM is a notable addition to your portfolio if you’re looking to target attractive dividend-paying stocks with an average annual yield of 4.5%.

About IBM Stock

Company and Stock history

IBM was first launched in 1911 as a Computing-Tabulating-Recording Company. Rebranding to International Business Machines or simply ‘IBM’ a few years later, its initial product range centered on accounting computing systems. Fast forward to 2021 and the company is now behind a plethora of innovative technologies. On top of its flag-ship involvement is the desktop computer, as well as its interests in artificial intelligence, cognitive software, and cloud computing.

The company also has a stake in the blockchain technology, where it has partnered with Stellar Lumens. The partnership aims to solve the slow and expensive prose of sending cross-border payments by leveraging blockchain and cryptocurrencies. IBM listed on the NYSE in 1962 and hit its all-time high stock price of $203 in 2013.

Since then, its stocks have been somewhat volatile. For example, the company was badly hit by the 2007/8 financial crisis that saw its stock process drop to a record low of $110 in early 2019. However, the tech company has since reversed its fortunes and hit $153 in Q1 2021, before succumbing to the economic impact of the Coronavirus pandemic. At the time of writing in April 2021, IBM’s stock price hovers around $121.

In recent years, IBM CEO Satya Nadella has expressed his desire to utilize the company’s vast cash resources to engage in ongoing acquisitions. At the forefront of this was IBM’s purchase of Red Hat, that’s valued at over $36 billion. This represents almost ten times the revenues that IBM reported in 2018.

Should I Buy IBM Stock?

Analysts are split on whether IBM stock represents a viable long-term investment. On the positive side, the NYSE-listed company has an attractive dividend policy with annualized yields averaging 4.5% in recent years. The tech-company has also embraced the highly ambitious acquisition strategy, kicking it off with the recent $36 billion purchase of Red Hat and we can only expect more in the coming years.

Ultimately, it’s your decision as to whether or not you think IBM stocks have a bright future. As such, we would suggest performing your own research before making a significant investment in the century-old technology company.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Glossary of Stocks Terms

StockA stock is a representation of a company’s equity. When a company wants to raise capital, it issues stocks to the public. It is the aggregation of the total stocks owned by one individual that inform their shareholding of the company.

SharesA share is an indivisible unit of capital that expresses the ownership relationship between a shareholder and a particular company, mutual fund, REITs or limited partnership. A share indicates a portion of ownership (claim) that one has on a company or fund.

DividendDividend refers to the portion of the company’s profits that is distributed to its stockholders. It can be on a quarterly or annual basis.

Bull marketA bull market is an economic condition where the stock markets are in an extended period of consistent increase in stock prices.

Bear MarketA stock market is said to be bearish if it is involved in extended periods of continuous price decrease of the stock prices.

Stock ExchangeA stock exchange is an institution or a platform where shares and stocks and a host of other money market instruments are traded.

Return On Investment (ROI)The return on investment is the profit you make from trading in or investing in shares and stocks of a particular company. It often comes from selling the investment at a higher price than was originally bought or benefiting from dividends and other profit-sharing schemes as a result of owning and holding onto a particular investment.

BrokerA broker may be a person or entity that engages in the buying and selling of different types of investments on behalf of other individuals or entities at a fee (or commission).

Day TradingDay Trading is the practice of buying a money market investment product and selling it as soon it reports price increase or loss, within the same day. Traders engaged in day trading are referred to as “day traders” or “active traders”

ArbitrageArbitrage is the act of buying and selling security at different stock exchanges or markets with varying prices. If, for instance, stock ABC sells at $11 on one exchange and $11.75 on the other, arbitraging involves buying from at the low price exchange and profiting by selling it at the higher-priced exchange.

IndexA stock index is a statistical measure of the change in the stock and securities market. It comprises a hypothetical portfolio of different companies whose change in prices is calculated to determine market performance.

Initial Public Offering (IPO)The Initial Public Offering refers to the sale of company stock to the public for the first time. It is the act of taking a company public and is highly regulated by such financial regulators like the SEC in the USA and FCA in the UK.

OptionsOptions are derivative financial instruments whose price is based on the value of their underlying tradable security like shares and stocks. They are contracts that give the holder an option to buy or sell the underlying asset at a later date. Unlike futures, an options contract holder has the choice to buy/sell or not.

Call optionsThis is an options contract that gives the holder an option to buy the underlying asset before the expiry date.

Sell optionsThis option gives its holder the choice of selling the underlying asset before its expiry date

Mutual FundsA mutual fund refers to a company that pools funds from different investors and invests these funds in stocks, bonds, and other financial market securities. They then distribute the capital gains from these invests to their members.

Over-the-CounterThe process through which stocks for companies that are not listed with accredited stock exchanges like the NYSE are traded. It is a broker-dealer network for unlisted stocks for companies that do not meet listing requirements set by the organized exchanges.

OverboughtA stock is said to be overbought if it is traded excessively over a short period of time and at unjustifiably high prices.

OversoldA stock is said to be oversold if it is consistently traded below its true value.

Ask PriceAlso referred to as the offer or asking price, this refers to the lowest price that the seller will take for a stock.

Bid PriceBid price refers to the maximum price that a buyer is willing to pay for a stock.

VolumeIn the stock trading context, Volume refers to the number of shares that change hands within a given period of time, be it a day, month or annually. It is trading/investment indicator where rising trade volumes point to a healthy stock while dwindling volumes are indicators of investor pessimism towards a stock.

VolatilityRefers to the statistical measure of the change in price of a stock over a given period of time. It is a measure of the rate and the time it takes for a stock price to move from high to low and how long it remains within a certain price range. The higher the volatility, the higher the risk.

52-Week HighThis refers to the highest closing price recorded by a given stock in the last 52 weeks.

52-Week LowThis refers to the lowest closing price that a particular stock recorded in the last 52 weeks.

Bid-Ask SpreadThe bid-ask spread refers to the difference between the lowest price that a seller is willing to take for their stock and the highest price that a buyer is willing pay for the stock. It is the difference between the quoted ask and bid prices.

Market OrderA market order is an instruction by an investor to the broker or brokerage platform asking them to buy/sell a stock or any other security at the best price available at that moment. It is often issued when an investor wishes to enter or exit the market quickly and at the prevailing rates.

Limit OrderA limit order is an order that triggers a sale or buy when a predetermined or better price is met. For a buy limit order, the buy order is executed once the set limit price or a better price is triggered. The sell limit order on the hand triggers the sale of stocks if the limit price or better price is hit.

Stop OrderAlso referred to as a stop loss order, it is an order that triggers a buy or sell action once a predetermined price level is hit. It is designed to help you minimize possible loss on a given trade should the markets move against your bet.

Take ProfitTake profit is a type of limit order dictating the price level at which the broker or brokerage platform is to close a trade for profit.

Capital GainsCapital gain refers to the value rise of a tradable financial instrument that makes its selling price higher than the buying price. It can also be referred to as the profit realized from liquidating a capital investment like stocks.

ETFsAn ETF is a collection of many tradable instruments like bonds, stocks, and commodities. These are listed on the exchanges and traded like ordinary stocks.

Debt-to-Equity RatioThe debt-to-equity (D/E) ratio is a financial ration tool used to measure the financial health of a company by gauging value of its equity in relation to debt. It is achieved by dividing the company’s total liabilities in relation to its shareholder’s equity.

Dividend InvestingThis is an investment strategy where the investor only buy shares that have consistently paid out high dividends in the past or others with the fastest dividend rates. Dividend investing strategy advocates are more interested in how much a shares pays in dividends than its price fluctuations.

Growth StocksGrowth stocks refers to the stocks of companies that are expected to grow at a faster rate than the industry average and report consistent and sustainable cashflows. The company sales and revenues are also expected to increase at a faster than that of an average company in the same industry.

Penny StocksThese are also referred to as micro-cap or nano-cap stocks and refers to the stocks of relatively small companies valued less than $5 and only trade via the Over-The-Counter markets.

Blue ChipA blue chip refers to a nationally recognized and financially sound company with a long and stable record of consistent growth. It is company whose financial might and nature of operation make it well suited to face turmoil and remain profitable in the uncertain economic conditions..

Short SellingShort selling is a trade/investment strategy where the investor is banking on the decline of the shares of a particular company. They therefore borrows these shares, sells them at the current market price and buys them back after they lose value, effectively profiting from the price difference.

YieldYield refers to the profit/earnings generated from investing in a particular stock or market instrument over a given period of time and is expressed a percentage of the stock’s market value, face value or as percentage of invested amounts.

Capital StockCapital stock, also referred to outstanding shares, refers to all the regular shares issued by a company and held by all its shareholders including the restricted/locked-in shares held by company insiders, executives, and institutional investors. The number of capital stock is used in calculating key metrics including cash-flow per-share and earnings per share.

Earnings Per Share (EPS)EPS refers to the monetary value, the profit or earnings attributable to each outstanding shares held by a company. It is a financial ratio that is arrived at by dividing the company’s profit by its outstanding shares of the common stock.

Price Earning Ratio (PER)Also referred to as Price-to-earnings ratio, PER is a financial metrics tools used to check if a company’s shares are over/undervalued by dividing the shares current market price with its earnings-per-share.

FloatA company’s flat refers to the number of regular shares issued to investors that are available for trading. The float shares figure is arrived at by subtracting the locked-in shares held by company insiders and executives from its capital stock.

Gap-up StocksGap up stocks refer to company stocks that open the day trading at relatively higher prices than their previous day’s closing price. This is often attributed to the after-market trading activity.

Gap-Down StocksGap down stocks refers to company stocks that open the day trading at relatively lower prices that the previous day’s closing price. For instance if a company stock closes the day trading at $50 but opens the following day trading at $45, it is said to have a 5-point gap down.

Stock BuybackStock buyback, also referred to as share repurchase, occurs when a publicly listed corporation uses a part of its revenues to buy back its shares from the marketplace. The move effectively reduces the number of company shares in circulation, which translates to an increased share price.

HOLDHOLD is a financial recommendation issued by a qualified financial institutions or financial analyst advising investors/traders not to buy or sell a particular stock. It is a no-action situation where long position traders are advised not to sell and others investors advised not to buy into the stock.

Resistance LevelsThis refers to the upper-most price level that a particular stock or any other security reaches but doesn’t exceed due to dwindling number of buyers and an increasing number of sellers.

MacroeconomicIs a branch of economics that’s concerned with the study of how the economy and different large-scale markets are structured, how they behave, and how they perform.

RSIRelative Strength Index is a technical momentum indicator used in market analysis to determine if a stock is overbought or oversold by measuring the magnitude of a recent bullish or bearish price run. It has a scale of 0-100 where RSI readings of 70+ indicate a stock is overbought while an RSI reading below 30 is an indicator of an oversold security.

Moving AverageMoving Averages is a statistical calculation that is specially designed to identify the arithmetic mean of a given number of data sets or range of prices calculated over a given period of time. Each of these data set or price range is created by the average/mean price for that subset. For instance, a single data point on a moving averages scale may represent the average stock price for a day or trading session.

Bollinger BandsBollinger Bands are a technical indicator tool characterized by two statistical carts that run alongside each other indicating the changes in prices and volatility of a financial instrument like stock or commodity over a given period of time.

Fibonacci RetracementsFibonacci retracements refer to two horizontal lines that use the Fibonacci numbers to measure the percentage of price retracement in a bid to indicate where the resistance and support are most likely to occur.

FAQ

Do I need to buy whole IBM shares?

Not anymore, in a time not so long ago, investors were forced to purchase IBM stock in minimum lots of 100 shares. As its stock price continued to grow, it has to initiate stock splits to make the shares more affordable. With that said, lots of online stock brokers now allow you to purchase ‘fractional’ shares, with the likes of Stash Invest allowing you to inject just 1 cent!

Does IBM pay dividends?

Yes, IBM has an attractive dividend policy in place for shareholders. This has averaged an annualized yield of 4.5% in recent years.

What does IBM stand for?

IBM stands for International Business Machines.

What is IBM’s all-time high stock price?

IBM last hit a new all-time high in 2013, where its shares were priced at just over $215.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up