How to Buy Cisco Stock for Beginners in 2021

Cisco Systems Inc. is a technology conglomerate that engages in the design, production, and sale of networking hardware and software as well as other telecommunication systems.

It shot to the limelight when it pioneered the Local Area Network (LAN) concept that connects geographically detached computers and computer systems by leveraging the Multiprotocol router system.

Over the last decades, the company has shown its capacity to generate constant cash flow, even during the 2008 financial crisis.

And this article, we explain everything you need to know about Cisco company and its stocks, detail a step-by-step plan on how to buy Cisco stocks, and discuss whether right now is the best time to invest in Cisco.

-

-

3 Quick Steps to Buy Cisco Stock

Don’t have time to read our guide in full? Follow the 3 steps outlined below to buy Cisco stock right now!

[three-steps id=”197199″]Where to Buy Cisco Stock

Before you can buy Cisco stocks, you first need to have an account on a licensed and regulated stockbroker.

To help you choose the most secure and reliable brokers, we have reviewed the top 3 online brokerages dealing in Cisco stocks.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

Detailed provider overview

1. eToro – Best Stock Broker for Worldwide Customers

Established in 2007, eToro is now one of the most popular online trading platforms. It is a legitimate platform that is regulated by the Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investment Commission (ASIC), and U.K's Financial Conduct Authority (FCA) .

It maintains offices in different parts of the world, including London, Limassol, Sydney, New Jersey, and Shanghai. Right now, the platform has over 7 million users from around the world.

The process of opening an eToro account is seamless and quick. There are two easy ways you can use to register on the platform. The first method involves submitting your name, email address, and phone number. With the second method, you only need to link the broker with your Facebook or Google account.

To start trading on the eToro platform, you will need to make a deposit in your account. The minimum initial amount you can deposit on the eToro platform is $50. And aside from Cisco Systems stocks, some other popular stocks you can trade on eToro are Facebook stocks, Google stocks, etc.

When choosing a stock trading platform, one of the critical features you should look out for is its ability to safeguard your funds. The security of traders’ funds is something eToro has put a lot of emphasis on. The platform employs a protective measure to keep your money safe at all times. Client funds are kept in segregated accounts in leading banks such as Goldman Sachs and Barclays. This is a regulatory requirement imposed by top-tier financial authorities to ensure that your funds will be safe even if the broker faces financial difficulties.

eToro’s social trading feature, also known as CopyTrader, will enable you to copy trading strategies of experienced traders. Also, you can follow people and be able to check their profiles as well as their previous trading performances. There are numerous statistics on each profile such as average holding time, news feed comments, and trades per week.

Our Rating

- User-friendly trading platform

- Simple account opening process

- Social trading platform

- High fees

75% of investors lose money when trading CFDs.2. Plus500 – Trade Cisco Stock With CFDs

Plus500 is a well-established online CFD trading platform that was founded in Israel in 2008. Right now, it has a physical presence in other parts of the world such as the UK, Singapore, Australia, and Cyprus. The platform features stocks of popular companies, including Cisco Systems.

There are two primary ways to open an account on the Plus500 platform. You can initiate the process on the official website or through the Plus500 trading platform. Downloading their trading app is very easy, and it will enable you to register on your mobile device. On the website, the company indicated that the platform is only unavailable in a handful of countries such as the US, Canada, Cuba, Syria, and Iran.

The minimum amount you can deposit on the Plus500 trading platform is $100 when using credit/debit cards or e-wallets and $500 when making a wire transfer. There is only one available account on the platform. To start trading, you will be required to submit proof of your identity and address. You can use your passport or government ID to verify your identity and a bank statement to prove your address.

Although there is no deposit fee, withdrawal is only free for the first five withdrawals each month. Any subsequent withdrawal is charged $10. Plus the broker maintains a minimum withdrawal amount of $50 for PayPal and $100 for credit/debit cards and wire transfer. You also have to withdraw using the same method you used for the deposits.

Our Rating

- No deposit fee

- Regulated by ASIC, MAS, CySEC, FCA

- Five free withdrawals per month

- Limited research resources and tools

80.5% of retail CFD accounts lose money.3. Stash Invest – Best USA Broker

Getting started on trading can be difficult, especially when you don’t have the capital to invest or enough stock trading experience. The main goal of Stash Invest is to make trading accessible even to people with limited resources. In fact, it can even allow you to buy fractional shares of stock. For example, if you want to buy CSCO stocks and a single share cost $200, you can buy a fraction of it for lesser amounts.

Stash Invest is available as a web browser and smartphone app. To sign up on the web platform, you will only need to provide your email and create a password. Also, the process of downloading the app from the App Store is straightforward.

On most online trading platforms, building an investment profile is a very complicated process. Fortunately, the process is very simple on Stash Invest. After signing up, you will be able to create a portfolio based on your personal investment goals and risk tolerance.

There is no minimum amount required to start trading on the platform, but if you invest $300 dollars in the first 30 days, you will also be eligible for a $50 bonus.

Additionally, Stash Invest app offers you a unique investment approach. As a replacement for picking a stock to invest in, you can choose a themed investment. This is an efficient way to not only make trading relatable but also affordable and easy.

Our Rating

- $50 bonus

- Allows fractional stock purchase

- Extensive educational content

- Delayed trading execution

- Costs $9 a month to unlock its best features

How to Buy Cisco Stock from eToro

eToro is one of the best stock brokers that you will allow you to easily buy Cisco stocks. And here is the step-by-step guide on how to buy Cisco stock on Toro:

Note: You will first need to open an account with eToro, upload your ID, and deposit some funds. You can then proceed to buy Cisco stock in a matter of minutes!Step 1: Search for Cisco stocks

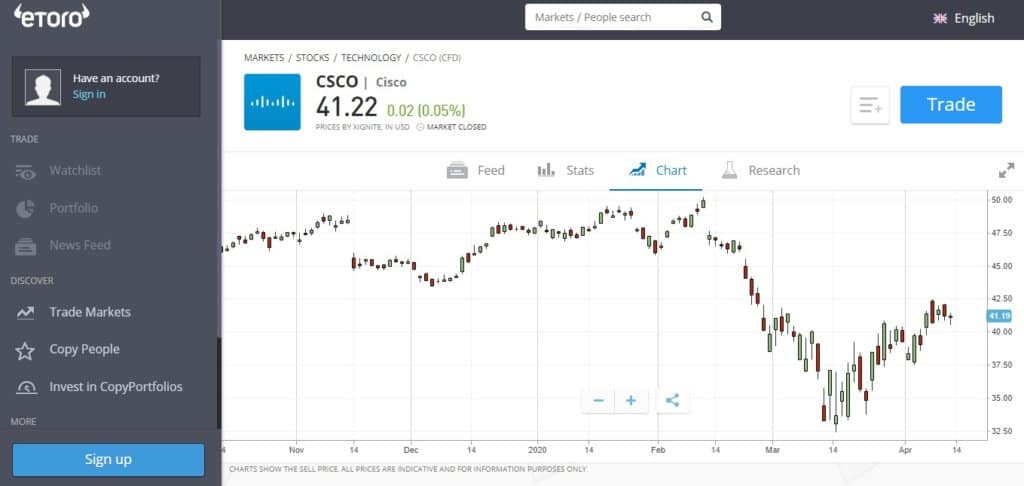

Go to the search bar on the top of the homepage and type the ticker or name of the stock you wish to buy, in this case, Cisco System or CSCO. Apart from the price chart, this page will provide important information about the stock such as balance sheet, income statement, and more.

Step 2: Click on ‘Trade’

You will now need to click on the ‘Trade’ button, which will then populate your order form.

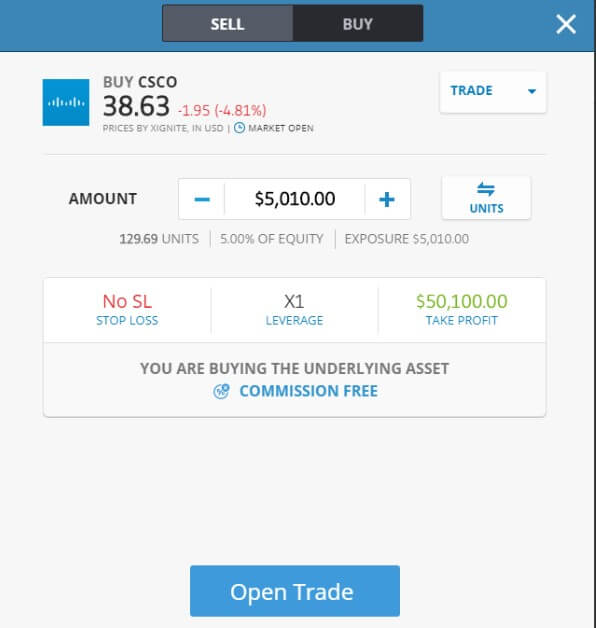

Step 3: Set-Up Order and Buy Cisco Stock

In order to buy Cisco stock, you will need to set up your trading parameters. Importantly, you need to refrain from applying leverage and shorting the stock if you wish to own your Cisco shares outright. If you don’t, you will be buying stocks in the form of CFDs.

To complete your order, enter the following details:

- Amount: This is the amount that you wish to invest in Cisco. Don’t forget, you are not required to buy whole shares, so you can buy as little or as much as you like.

- Set Rate: You are given the option of taking the next available market price (market order), or choosing your own entry point (limit order). If its the latter, enter the price that you wish the trade to be placed at.

- Stop Loss: Stop loss is a market trigger price that sells your position if the markets turn against you. It is the minimum price you would like to sell your shares; leaving the SL blank exposes you to the loss of all your invested funds should the markets turn against you.

- Take Profit: Enter a take-profit price if you have a particular target in mind. If not, leave it blank.

Finally, click on ‘Buy’ to complete your order.

Why Invest in Cisco?

Dominance in the Market

According to the Synergy Research Group (SRG), Cisco dominated the switches and routers market by 51% as of the last quarter of 2018. Its competitors such as Huawei managed to only claim 14% of the market.

This dominance has enabled the company to generate remarkable profitability. During the fourth quarter of 2019, the Cisco Systems managed a gross margin of 63.91% and an operating margin of 27.5%.

Even though most of Cisco competitors have tried to lower prices on their products, they have not been able to dent its market share. Also, despite the emergence of new technologies like cloud computing and software-based networking, the company is still a formidable force in the networking market.

Nice Dividends

Cisco started paying dividends in 2011 and has become one of the best dividend stocks in the technology industry.

High Free Cash Flow Per Share Growth Rate

Cisco Systems has faced several challenges in the past. First, the trade war between the US and China affected the demand for its products. In 2021, the coronavirus pandemic has cast doubt on the spending power for most of its major customers. Also, delays in some of its projects such as rolling out 5G are creating short-term obstacles.

Nonetheless, its average free cash flow per share growth rate has been 22.60% per year. This free cash flow has given the company the ammunition to buy back its shares at discounted prices.

Growth Businesses

Whereas the switching and routing businesses have been going slowing recently, other segments of the company are picking up.

For instance, Cisco security segment’s revenue rose by 21% to $707 million in the third quarter of 2019. Due to the growing number of cyber-attacks, there has been an increasing demand for security products and services. Recently, the company has also added several companies such as Lancope, CloudLock, OpenDNS, and Portcullis to its security portfolio in a bid to spur growth in the future.

Moving to Software

The company is also gradually shifting its focus to the software-optimized business model. This is because the software business is growing at a very fast rate, with 65% of its software revenue coming from subscriptions. Although hardware still remains an integral part of Cisco’s business, the company is moving towards a more integrated approach by selling solutions instead of only hardware. It is projected that the move will help the company boost its revenue margins even further.

About Cisco Stock

Company Background

Cisco Systems Inc. is a multinational technology company founded in San Jose, California.

The company is involved with the development, designing, manufacturing, and sale of networking hardware and software telecommunication equipment as well as other technology products and services.

With its acquisition of several subsidiaries, the company now also specializes in specific technology markets such as domain security, internet of things (IoT), and energy management.

Cisco Stock

The NYSE symbol of Cisco stock is CSCO.

The company had its initial public offering in 1990. Cisco’s stock value rose by 100,000% between 1990 and 2000. However, like other huge companies, its price was negatively affected by the dot.com bubble burst.

After the Cisco stock had a breakout in October 2017, its value continuously increased up to July 2019, gaining 70% within only two years.

Fast forward to January 2021, during Cisco’s fiscal Q2, the company paid a cash dividend of $1.5 billion and spent $870 million to buy back its shares.

Moreover, during the first quarter of 2021, the highest price of Cisco stock was $49.93. On the other hand, its lowest price was $33.20.

What Else Should I Know About Cisco Systems?

The company was founded by Sandy Lerner, who partnered with her husband, Leonard Bosack. Both were computer scientists at Stanford University. In fact, the first product produced by the company has roots in the university’s campus technology.

In the early ’80s, students and staff at the university used technology to enable all the computer systems to talk to one another, creating a multiprotocol router dubbed as the ‘Blue Box.’ The box used software developed by Stanford research engineer William Yeager. Because of its great core architecture and its ability to scale well, Yeager’s invention played a key role in Cisco’s early success.

Apart from Lerner and Bosack, the first Cisco team also comprised of Kirk Lougheed, Greg Satz, and Richard Troiano. The first CEO was Bill Graves, who held the position for a year before John Morgridge took over. In 1990, Cisco went public with a market capitalization of $224 million and got listed on the American stock exchange, commonly known as NASDAQ.

Now, Cisco Solutions are network foundations for corporations, government agencies, educational institutions, and services providers all over the world. The company claims that 85% of internet traffic flows through their systems.

The name ‘Cisco’ comes from the city name San Francisco, where the company was founded. It offers a wide range of products and services in such categories as switching, next-generation (NGN) routing, data center, security, service provider video, etc. The company generates revenue through the sales of products and services through direct sales force or channel partners.

Should I Buy Cisco Stock?

If you are a long-term investor, it is highly recommended that you buy Cisco stocks.

Going into 2021, it is projected that the stock market will be led by technology companies. Currently, Cisco still dominates the networking and communications market. Its products and services are used worldwide to transport data, video, and voice traffic.

Amid the bearish market and the imminent global recession, Cisco remains one of the biggest tech companies in terms of its positive cash on the balance sheet. As a result, the stock offers an impressive dividend.

When the dust settles and the economy grows again around 2023, some analysts are projecting that Cisco could go shopping and make noticeable acquisitions. In January 2021, during Cisco’s fiscal Q2, the company paid a cash dividend of $1.5 billion and spent $870 million to buy back its shares.

It is projected that Cisco will get a major boost in the deployment of 5G wireless networks. However, the development of the 5G networks has been significantly affected and delayed in 2021.

Additionally, acquisitions have considerably contributed to Cisco’s revenue growth. Recent acquisitions have been related to software. For instance, in July 2019, Cisco acquired Duo Securities, which was one of the biggest acquisitions the company has ever made. Apart from acquisitions, new accounting rules such as ASC 606 have bolstered the company’s revenue.

On the downside, the Investor’s Business Daily (IBD) Stock Checkup indicates that Cisco stock has a relative strength of 56. The best performing stock tends to have a relative strength of 80 and above. Also, Cisco stock has an accumulation/distribution rating of C. This rating measures institutional buying and selling and is based on A+ TO E scale, where A+ indicates heavy buying while E heavy selling. Cisco’s C indicates that it is neutral.

Nevertheless, it may improve when the volatility in the market subsides. The company has a track record of beating other tech stocks during economic downturns. This makes it a great investment option for long-term investors.

Conclusion

In the current market environment, it may not be advisable for short-term investors to buy Cisco stocks. However, due to the drop in price, it is a great opportunity for long-term investors.

With the increased threat of cyber-attacks, the security category is projected to continue growing at a rapid pace. Other products and services such as 5G enrollment will also enhance Cisco’s revenue significantly.

Once you’re ready to buy Cisco stocks, make sure to create an account on one of our recommended platforms above so you can be assured that your funds are safe and that you’ll always have a smooth stock trading experience.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Glossary of Stocks Terms

StockA stock is a representation of a company’s equity. When a company wants to raise capital, it issues stocks to the public. It is the aggregation of the total stocks owned by one individual that inform their shareholding of the company.

SharesA share is an indivisible unit of capital that expresses the ownership relationship between a shareholder and a particular company, mutual fund, REITs or limited partnership. A share indicates a portion of ownership (claim) that one has on a company or fund.

DividendDividend refers to the portion of the company’s profits that is distributed to its stockholders. It can be on a quarterly or annual basis.

Bull marketA bull market is an economic condition where the stock markets are in an extended period of consistent increase in stock prices.

Bear MarketA stock market is said to be bearish if it is involved in extended periods of continuous price decrease of the stock prices.

Stock ExchangeA stock exchange is an institution or a platform where shares and stocks and a host of other money market instruments are traded.

Return On Investment (ROI)The return on investment is the profit you make from trading in or investing in shares and stocks of a particular company. It often comes from selling the investment at a higher price than was originally bought or benefiting from dividends and other profit-sharing schemes as a result of owning and holding onto a particular investment.

BrokerA broker may be a person or entity that engages in the buying and selling of different types of investments on behalf of other individuals or entities at a fee (or commission).

Day TradingDay Trading is the practice of buying a money market investment product and selling it as soon it reports price increase or loss, within the same day. Traders engaged in day trading are referred to as “day traders” or “active traders”

ArbitrageArbitrage is the act of buying and selling security at different stock exchanges or markets with varying prices. If, for instance, stock ABC sells at $11 on one exchange and $11.75 on the other, arbitraging involves buying from at the low price exchange and profiting by selling it at the higher-priced exchange.

IndexA stock index is a statistical measure of the change in the stock and securities market. It comprises a hypothetical portfolio of different companies whose change in prices is calculated to determine market performance.

Initial Public Offering (IPO)The Initial Public Offering refers to the sale of company stock to the public for the first time. It is the act of taking a company public and is highly regulated by such financial regulators like the SEC in the USA and FCA in the UK.

OptionsOptions are derivative financial instruments whose price is based on the value of their underlying tradable security like shares and stocks. They are contracts that give the holder an option to buy or sell the underlying asset at a later date. Unlike futures, an options contract holder has the choice to buy/sell or not.

Call optionsThis is an options contract that gives the holder an option to buy the underlying asset before the expiry date.

Sell optionsThis option gives its holder the choice of selling the underlying asset before its expiry date

Mutual FundsA mutual fund refers to a company that pools funds from different investors and invests these funds in stocks, bonds, and other financial market securities. They then distribute the capital gains from these invests to their members.

Over-the-CounterThe process through which stocks for companies that are not listed with accredited stock exchanges like the NYSE are traded. It is a broker-dealer network for unlisted stocks for companies that do not meet listing requirements set by the organized exchanges.

OverboughtA stock is said to be overbought if it is traded excessively over a short period of time and at unjustifiably high prices.

OversoldA stock is said to be oversold if it is consistently traded below its true value.

Ask PriceAlso referred to as the offer or asking price, this refers to the lowest price that the seller will take for a stock.

Bid PriceBid price refers to the maximum price that a buyer is willing to pay for a stock.

VolumeIn the stock trading context, Volume refers to the number of shares that change hands within a given period of time, be it a day, month or annually. It is trading/investment indicator where rising trade volumes point to a healthy stock while dwindling volumes are indicators of investor pessimism towards a stock.

VolatilityRefers to the statistical measure of the change in price of a stock over a given period of time. It is a measure of the rate and the time it takes for a stock price to move from high to low and how long it remains within a certain price range. The higher the volatility, the higher the risk.

52-Week HighThis refers to the highest closing price recorded by a given stock in the last 52 weeks.

52-Week LowThis refers to the lowest closing price that a particular stock recorded in the last 52 weeks.

Bid-Ask SpreadThe bid-ask spread refers to the difference between the lowest price that a seller is willing to take for their stock and the highest price that a buyer is willing pay for the stock. It is the difference between the quoted ask and bid prices.

Market OrderA market order is an instruction by an investor to the broker or brokerage platform asking them to buy/sell a stock or any other security at the best price available at that moment. It is often issued when an investor wishes to enter or exit the market quickly and at the prevailing rates.

Limit OrderA limit order is an order that triggers a sale or buy when a predetermined or better price is met. For a buy limit order, the buy order is executed once the set limit price or a better price is triggered. The sell limit order on the hand triggers the sale of stocks if the limit price or better price is hit.

Stop OrderAlso referred to as a stop loss order, it is an order that triggers a buy or sell action once a predetermined price level is hit. It is designed to help you minimize possible loss on a given trade should the markets move against your bet.

Take ProfitTake profit is a type of limit order dictating the price level at which the broker or brokerage platform is to close a trade for profit.

Capital GainsCapital gain refers to the value rise of a tradable financial instrument that makes its selling price higher than the buying price. It can also be referred to as the profit realized from liquidating a capital investment like stocks.

ETFsAn ETF is a collection of many tradable instruments like bonds, stocks, and commodities. These are listed on the exchanges and traded like ordinary stocks.

Debt-to-Equity RatioThe debt-to-equity (D/E) ratio is a financial ration tool used to measure the financial health of a company by gauging value of its equity in relation to debt. It is achieved by dividing the company’s total liabilities in relation to its shareholder’s equity.

Dividend InvestingThis is an investment strategy where the investor only buy shares that have consistently paid out high dividends in the past or others with the fastest dividend rates. Dividend investing strategy advocates are more interested in how much a shares pays in dividends than its price fluctuations.

Growth StocksGrowth stocks refers to the stocks of companies that are expected to grow at a faster rate than the industry average and report consistent and sustainable cashflows. The company sales and revenues are also expected to increase at a faster than that of an average company in the same industry.

Penny StocksThese are also referred to as micro-cap or nano-cap stocks and refers to the stocks of relatively small companies valued less than $5 and only trade via the Over-The-Counter markets.

Blue ChipA blue chip refers to a nationally recognized and financially sound company with a long and stable record of consistent growth. It is company whose financial might and nature of operation make it well suited to face turmoil and remain profitable in the uncertain economic conditions..

Short SellingShort selling is a trade/investment strategy where the investor is banking on the decline of the shares of a particular company. They therefore borrows these shares, sells them at the current market price and buys them back after they lose value, effectively profiting from the price difference.

YieldYield refers to the profit/earnings generated from investing in a particular stock or market instrument over a given period of time and is expressed a percentage of the stock’s market value, face value or as percentage of invested amounts.

Capital StockCapital stock, also referred to outstanding shares, refers to all the regular shares issued by a company and held by all its shareholders including the restricted/locked-in shares held by company insiders, executives, and institutional investors. The number of capital stock is used in calculating key metrics including cash-flow per-share and earnings per share.

Earnings Per Share (EPS)EPS refers to the monetary value, the profit or earnings attributable to each outstanding shares held by a company. It is a financial ratio that is arrived at by dividing the company’s profit by its outstanding shares of the common stock.

Price Earning Ratio (PER)Also referred to as Price-to-earnings ratio, PER is a financial metrics tools used to check if a company’s shares are over/undervalued by dividing the shares current market price with its earnings-per-share.

FloatA company’s flat refers to the number of regular shares issued to investors that are available for trading. The float shares figure is arrived at by subtracting the locked-in shares held by company insiders and executives from its capital stock.

Gap-up StocksGap up stocks refer to company stocks that open the day trading at relatively higher prices than their previous day’s closing price. This is often attributed to the after-market trading activity.

Gap-Down StocksGap down stocks refers to company stocks that open the day trading at relatively lower prices that the previous day’s closing price. For instance if a company stock closes the day trading at $50 but opens the following day trading at $45, it is said to have a 5-point gap down.

Stock BuybackStock buyback, also referred to as share repurchase, occurs when a publicly listed corporation uses a part of its revenues to buy back its shares from the marketplace. The move effectively reduces the number of company shares in circulation, which translates to an increased share price.

HOLDHOLD is a financial recommendation issued by a qualified financial institutions or financial analyst advising investors/traders not to buy or sell a particular stock. It is a no-action situation where long position traders are advised not to sell and others investors advised not to buy into the stock.

Resistance LevelsThis refers to the upper-most price level that a particular stock or any other security reaches but doesn’t exceed due to dwindling number of buyers and an increasing number of sellers.

MacroeconomicIs a branch of economics that’s concerned with the study of how the economy and different large-scale markets are structured, how they behave, and how they perform.

RSIRelative Strength Index is a technical momentum indicator used in market analysis to determine if a stock is overbought or oversold by measuring the magnitude of a recent bullish or bearish price run. It has a scale of 0-100 where RSI readings of 70+ indicate a stock is overbought while an RSI reading below 30 is an indicator of an oversold security.

Moving AverageMoving Averages is a statistical calculation that is specially designed to identify the arithmetic mean of a given number of data sets or range of prices calculated over a given period of time. Each of these data set or price range is created by the average/mean price for that subset. For instance, a single data point on a moving averages scale may represent the average stock price for a day or trading session.

Bollinger BandsBollinger Bands are a technical indicator tool characterized by two statistical carts that run alongside each other indicating the changes in prices and volatility of a financial instrument like stock or commodity over a given period of time.

Fibonacci RetracementsFibonacci retracements refer to two horizontal lines that use the Fibonacci numbers to measure the percentage of price retracement in a bid to indicate where the resistance and support are most likely to occur.

FAQs

What is the price of Cisco stock?

On January 2, 2021, the Cisco stock opened at $48.06. Its price remained steady even up to early February. However, Cisco stock prices started dropping in the first week of March. By March 16, the stock price had dropped up to $33.23. It only bounced back at $42.66 on April 7, 2021. Its price is projected to increase by the end of 2021 or early 2021.

What do Wall Street analysts say about buying or selling Cisco stocks?

In 2019, 26 Wall Street analysts have issued buy, hold and sell ratings for Cisco stocks. There were 17 buy ratings and 9 hold ratings, which resulted in a consensus recommendation of buy for long-term investors. If you are looking for a stock that is expected to rise this 2021 and in the coming years, it’s highly recommended that you buy Cisco stocks.

What is the dividend yield for Cisco stock?

The company announced a quarterly dividend on February 12, 2021. Shareholders as of April 3, 2021, will receive a dividend of $0.36 per share on April 22. This indicates a $1.44 annualized dividend and a 3.48% yield. The company announced a quarterly dividend on February 12, 2021. Shareholders as of April 3, 2021, will receive a dividend of $0.36 per share on April 22. This indicates a $1.44 annualized dividend and a 3.48% yield.

How does Cisco’s stock buyback program work?

According to EventVestor, on February 13 2019, Cisco Systems’ board authorized a payback program that permitted the company to buyback $15 billion in shares. This program enabled the company to buy back up to 6.5% of its stock through the open market. The board authorizes the buyback program because they believe that the company’s shares are undervalued.

How do I buy Cisco stocks?

Cisco shares can be purchased through any online trading platform. Some of the popular platforms you can check out are eToro, Plus500 and Stash Invest.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

The company was founded by Sandy Lerner, who partnered with her husband, Leonard Bosack. Both were computer scientists at Stanford University. In fact, the first product produced by the company has roots in the university’s campus technology.

The company was founded by Sandy Lerner, who partnered with her husband, Leonard Bosack. Both were computer scientists at Stanford University. In fact, the first product produced by the company has roots in the university’s campus technology.