How to Buy Aramco Stock in 2020 – A Beginner’s Guide

Looking to gain exposure to the multi-trillion-dollar oil industry? If so, you might be looking to buy Aramco stock. The Saudi Arabian multinational oil and gas firm recently initiated its much-anticipated ICO, meaning that its shares are now trading on the secondary market.

In this article, we show you how you can buy Aramco stock in the safest and easiest way. We also discuss the best brokers to do this with in 2020.

-

-

How to Buy Aramco Stock in 3 Quick Steps

Don’t have time to read our guide in full? Below are three quick steps that you need to follow to buy Aramco stock right now.

[three-steps id=”207858″]Where to Buy Saudi Aramco Stock

Although Saudi Aramco is one of the largest and most profitable companies in the world, it isn’t listed on a well-known stock exchange like the NASDAQ or New York Stock Exchange. Instead, the shares are actually listed on the Tadawu – the Saudi Stock Exchange.

This means that you are going to have very few options when it comes to finding a stock trading platform that offers its shares. The good news is that we have sourced two platforms in particular that give you access to Aramco stock. Let’s take a look at the best platforms on which to buy Aramco stock in 2020.

Detailed Provider Reviews

Want to learn more about our recommended brokers? Let’s take a more in-depth look.

1. eToro – Best Stock Broker for Worldwide Customers

eToro is an online broker that hosts a full range of asset classes. On top of stocks and shares, cryptocurrencies, ETFs, and forex, the platform also offers heaps of CFDs. While you can't yet buy Aramaco stock like you can do with most stocks on eToro, you can trade Aramco CFDs and apply leverage of up to 1:5.

This broker is one of the most affordable around, with 0% commission on stock trading. Instead, you only pay the spread, and these are very competitive at eToro. Other charges to consider are overnight fees and a flat $5 withdrawal fee.

eToro made its name as a social trading platform with innovative copy trading tools. This means you can select any of the 12 million investors on eToro's platform and then copy their portfolio and future trades like-for-like.

In terms of getting started, eToro allows you to deposit and withdraw funds with a debit/credit card, e-wallet such as PayPal, and bank account. Minimum deposits start at $200. Regardless of the currency you plan to fund your account with, everything is converted to USD.

eToro is a heavily regulated broker that holds several licenses. This includes the UK's FCA, Australia's ASIC, and Cyprus's CySEC. If you want to buy Aramco stock on your mobile, you can do so via the eToro app for iOS and Android.

Our Rating

- Buy stocks or trade CFDs

- 0% commission

- Social and copy trading tools

- Strictly regulated

- $5,000 CopyPortfolio minimum

75% of retail investor accounts lose money when trading CFDs with this provider2. Fidelity - US Stockbroker with Saudi ETFs

While eToro allows users in the UK and other countries to trade Aramco CFDs, US traders are slightly more restricted when it comes to investing in this company. However, it can be done at US stockbroker Fidelity.

Fidelity users can invest in Saudi Aramco through the iShares MCSI Saudi Arabia ETF. This exchange-traded fund is provided by BlackRock, the world's largest asset manager, and is the only single-country ETF for Saudi stocks.

The iShares MCSI Saudi Arabia ETF tracks the investment results of the MSCI Saudi Arabia IMI 25/50 Index, which consists of a set of Saudi companies or varying size, and offers US traders the chance to invest in a market that is otherwise largely shut off to foreign investors.

Fidelity is very competitive when it comes to pricing, with no commission on stock and ETF trades. It also offers a number of useful insights and tools, and as a secure and trusted broker with 24/7 support, you can trade in confidence with Fidelity.

If you're never invested in an ETF before, iShares offers a wealth of educational resources and insights to help you build up your knowledge, and you can invest commission-free.

Our Rating

- Allows US traders access to Saudi market

- No commission on ETFs

- Insights and research tools

- No forex, commodities or crypto

There is no guarantee you will make money with this provider.Why Invest in Aramco?

If you’re still sitting on the fence as to whether or not you should buy Aramco stock, below we list some of the reasons why analysts are bullish on the firm.

Gain direct exposure to the global oil and gas space

Make no mistake about it – when it comes to the global supply of oil and gas, it really doesn’t get much bigger than Aramco. The Saudi-led organization is not only one of the largest suppliers of black gold, but it is also one of the most profitable companies in the world. In other words, by buying Aramco stocks you will be getting direct exposure to the oil and gas space without you needing to worry about costly CFDs.

Saudi Arabia dominates the crude oil industry

Aramco is somewhat different from other major public companies, insofar that the vast majority of the firm is controlled by the Saudi state. This is highly fundamental in the context of crude oil, as many would argue that Saudi Arabia dictates global prices via OPEC.

It does so by directly managing how much oil is produced and distributed. That is to say, if Saudi-led OPEC wishes to fend off competition it will simply increase production to bring prices down. If it wishes to increase global prices, it will do the opposite.

About Aramco Stock

Company and Stock history

Saudi Aramco is the largest oil and gas supplier in the world. As the name suggests, the company is based in Saudi Arabia and is controlled mostly by the state. It is believed that the organization has close to 270 billion barrels of oil in reserve. To put these figures into nominal terms, Saudi Aramco made a whopping $88 billion in 2019, making it the most profitable company in the world.

This is significantly higher than its nearest PLC-competitor, Royal Dutch Shell, which made $16.5 billion during the same period. Although Aramco is controlled by the Saudi regime, it made the surprising decision last year to go public. With that said, just 1.5% of the company has been floating, which is much lower than the 5% originally planned.

Nevertheless, its respective IPO raised $25.6 billion, making it the largest of its kind. In fact, this valued the company at a whopping $1.7 trillion, making it the largest firm in the world. It is important to note that it is somewhat unusual for a company to float just 1.5% of its shares.

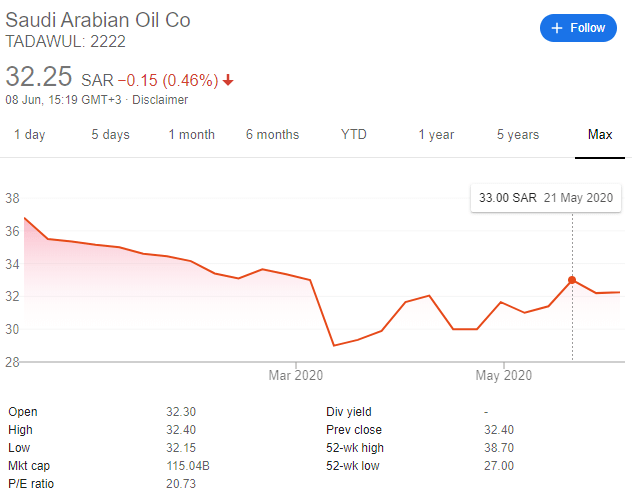

For example, major US companies like Facebook, Apple, Amazon, and many more average 80-90% of share circulation. However, Aramco is no ‘normal’ stock, as it is controlled by the Saudi state. A further point of consideration is that Aramco is priced in Saudi Riyal, not least because it is publicly-listed on the Tadawu. However, this isn’t an issue per-say, as you will likely be using a broker that denominates everything in US dollars anyway.

How to Buy Aramco Stock on eToro

Here is a step by step guide on how to buy Aramco stocks on our pick for the number one best stock trading platform, eToro. If you choose to use other online stockbrokers, the process is generally quite similar.

Note: Make sure you have an account with eToro before moving on to step 1. You will also need to ensure your account is funded, with eToro requiring a minimum deposit of $200.Step 1: Search for Aramco Stock

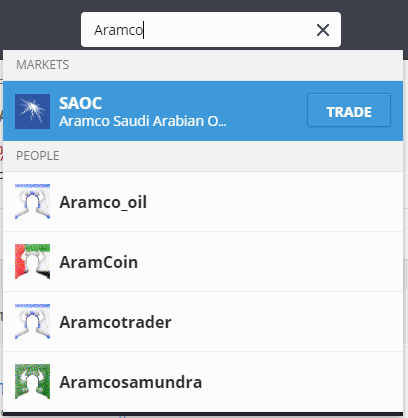

As eToro hosts over 800 stocks, it is easier to get the ball rolling by entering ‘Aramco’ into search box at the top of the page.

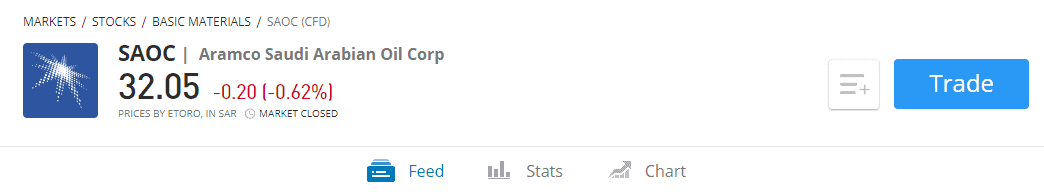

Step 2: Click on ‘Trade’

To go straight to the Aramco trading page click on the blue ‘Trade’ button.

Step 3: Set-Up Order and Buy Aramco Stock

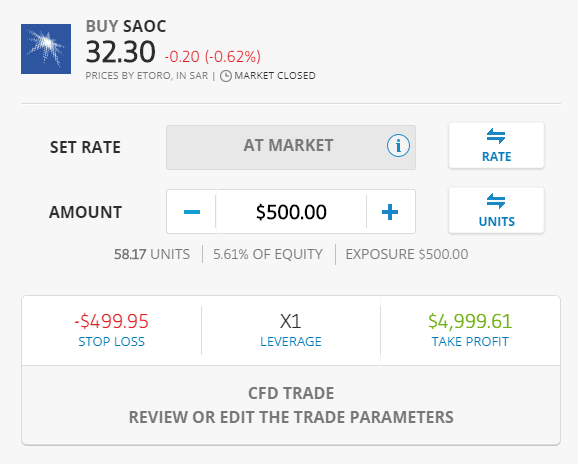

You will now be required to set up an order. This is by choosing whether you want to buy stock or make a CFD trade, how many shares you wish to buy, and what stop-loss/take-profit orders you will to install.

Here’s a brief overview of the metrics you will need to enter.

- Amount: Enter the amount of money that you wish to invest in Aramco. This is the total investment amount in USD and not the number of Aramco stocks you wish to buy.

- Set Rate: If you want to take the next available market price, leave the set rate as it is. Alternatively, you can change this to a limit order if you want to specify an entry price.

- Stop Loss: If you want to mitigate your losses, it is advisable to set up a stop-loss order.

- Take Profit: This allows you to automatically close your position when a profit target is triggered.

Finally, click on ‘Open Trade’ to complete your Aramco stock order.

Should I Buy Aramco Stock?

Aramco is an interesting addition to the global stock markets. The most important takeaway is that it is unlike any other oil and gas firm active in the space. Crucially, Aramco – and Saudi Arabia as a state – is nowhere near as susceptible to a fall in global prices as other major producers.

In fact, the firm is often directly involved in the push-down of prices, which it does when it wishes to fend off competition from the likes of Iran or the US with its vast shale oil supplied. The reason for this is that Saudi Arabia has a per-barrel breakeven point that is significantly lower than other nation-states.

This because evident during the coronavirus pandemic, insofar that Aramco stocks stayed somewhat stagnant while the rest of the industry suffered greatly. All in all, Aramco could be a worthwhile addition to your wider stock portfolio, especially if you are looking to gain exposure to the global oil and gas space in a cost-effective manner.

If you do want to buy Aramco stock today, we recommend signing to our recommended stockbroker, eToro. With the option to buy stocks or trade CFDs, 0% commission and innovative copy trading tools, this broker ticks every box. Simply click the link below to get started with eToro today.

eToro: Market Leading Social Trading Broker

Our Rating

- Buy stocks or trade stock CFDs

- 0% commission

- Social and copy trading tools

- Strictly regulated

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

What does Aramco do?

Aramco is the largest oil and gas company in the world. 98.5% of the organization is owned and controlled by the Saudi Arabian state.

How much did Aramco raise in its IPO?

The Saudi Aramco fund-raising campaign was the largest IPO of all time. With just 1.5% of the company up for grabs, the IPO raised just over $25.6 billion. This valued the company at a whopping $1.7 trillion.

Which stock market are Aramco stocks listed on?

Aramco is listed on the Tadawu – which is the Saudi Arabia Stock Exchange. As a result, its shares are priced in Saudi Riyal. The good news is that it is still possible to buy shares at the click of a button with brokers like eToro and IG.

Does Aramco pay dividends?

Yes, Aramco does pay dividends. In Q4 2019 it distributed $13.4 billion and in Q1 2020 this increased to $18.75 billion. Take note, these figures are based on the entire structure of the company and not just shareholders.

Should I buy Aramco stock or wait?

As access to Aramco stock is limited by its Tadawul listing, currently foreign investors can not buy Aramco stock. Instead, you have to trade CFDs or invest in Saudi ETFs.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up