How to Cash in Savings Bonds

When you got given savings bonds as gifts when you were in elementary school, you might have thought that they were the worst gifts ever. Given the time they take to mature, you thought you would never see the day when you would get to redeem them.

Now that the time has finally come, you might appreciate them a lot more, but at the same time, you might also be riddled with questions about how it all works out.

Read on to find out everything you need to know about savings bonds and how to finally redeem your long-awaited prize money.

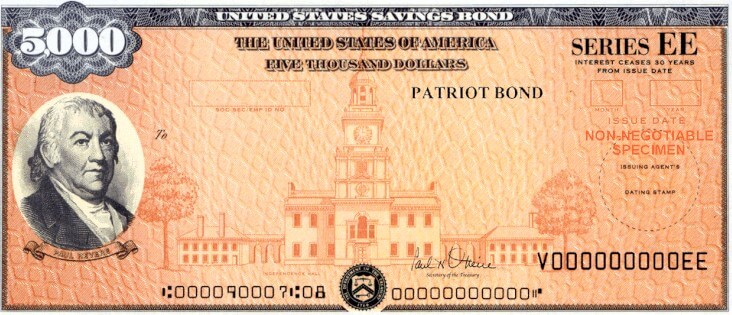

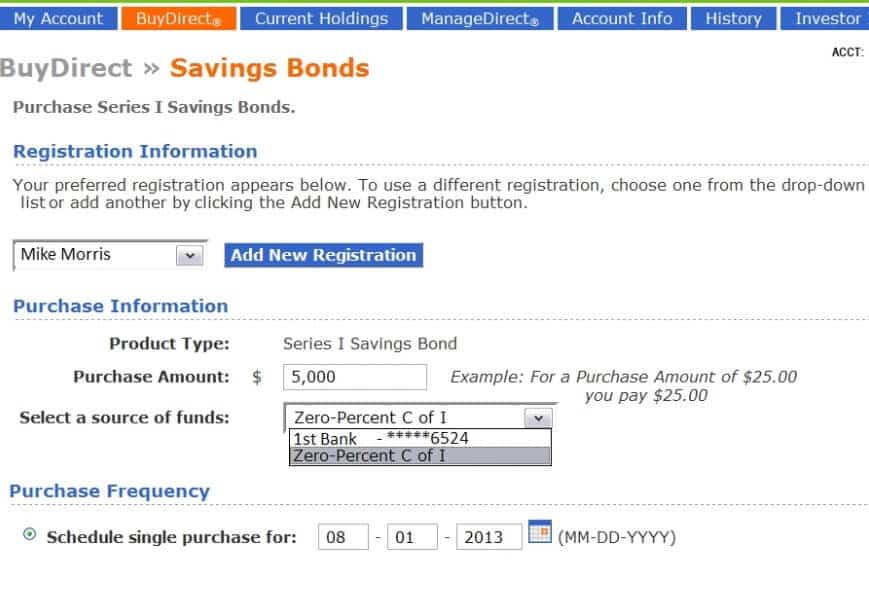

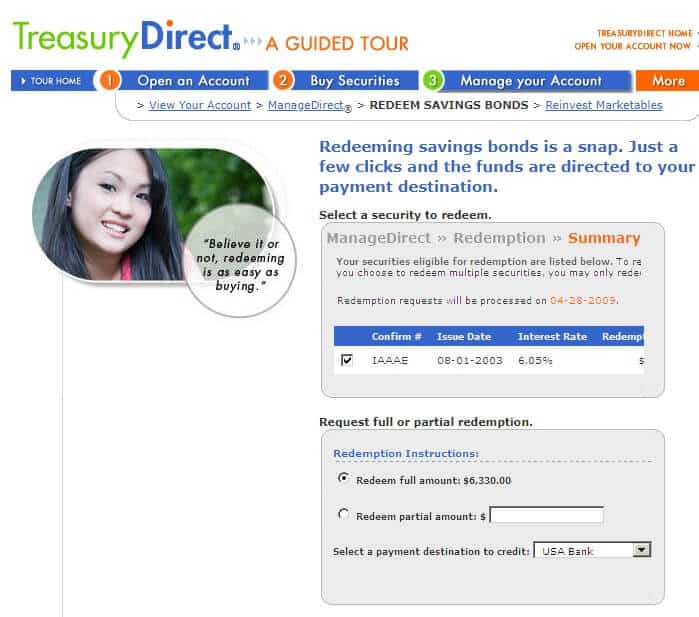

Featured Bonds Broker 2020 Savings bonds are debt security that the US Department of Treasury issues on behalf of the government to help cover borrowing needs. Uncle Sam issues them in the form of savings certificates in small amounts to individual investors. In the past, they would range in value, from $50 all the way to $10,000, with the denominations printed on the face. But with the advent of the digital era, you can now purchase them in penny increments online from as low as $25 and a maximum of $10,000. Savings bonds first came into existence in 1941 during World War II, issued to assist in paying for the massive expenditure that the government would incur. This was after President Franklin Roosevelt signed legislation in 1935 allowing for their issuance. At the time, they were known as Defensive Bonds, changing later to War Savings Bonds following the Pearl Harbor attack. Following the end of the war, the Treasury still encouraged people to buy them. Since then, they have been used to raise funds for capital projects and generally manage economy-related operations. When you buy savings bonds, you are essentially lending the government money. In return, the government pays you back with interest. Given that the government is highly unlikely to default, these are among the most secure investments. Pros Cons Over the years, the types of savings bonds that you can buy have changed. For instance, though there used to be a series HH, the government discontinued it in 2004. At present, there are two main types of savings bonds. These are Series EE and Series I. Often called the Patriot Bond, the Series EE bonds came into existence in 1980 as a replacement for Series E. They earn a fixed monthly interest rate for a maximum of 30 years. You have a guarantee that this type of bond will at least double its value within the first 20 years of the investment period. The applicable interest rate is determined at the time of issuance, based on a percentage of long-term rates. Starting May 2005, this series of bonds get a semi-annual fixed coupon rate announced on May 1 and November 1. The interest on Series EE bonds is exempt from local and state taxes but subject to Federal taxes. However, the tax only applies in the year of redemption or maturation. As the more recent option of the two, the Series I bond came into existence in 1998. The main difference between the two has to do with the interest rate. On the latter, investors get a combination of a fixed interest rate as well as a variable inflation rate. As such, in addition to giving its holders returns, it also protects their purchasing power. The inflation rate is adjusted annually in May and November on the basis of changes in the consumer price index for urban consumers. On the other hand, the Secretary of the Treasury announces the fixed interest rate every 6 months on the first business day in May and November. This variable interest aspect makes it difficult to predict the value of Series I bonds over a long period. A majority of these bonds are electronically issued. However, you may also buy paper certificates using income tax refunds. The minimum investment amount, in this case, will be $50. Note: If you sell these bonds and use the proceeds to fund higher education, the interest will be free from federal income taxation. During any calendar year, you can purchase bonds worth a maximum of $10,000 and must hold them for at least 12 months. Though they accumulate interest for up to 30 years, redeeming them in less than 5 years will mean forfeiting your interest payment for 3 months prior to redemption. Once the maturity period of your savings bonds elapses, their value is frozen. Therefore, at that point, there would be no reason to hold on to them, other than nostalgia. Rather, you can cash them in so as to put the investment money into a more productive endeavor. At any time, you can view the growth of your bonds by logging in to Treasury Direct if they are electronic. If they are in the form of paper certificates, use the online savings bond calculator from the US Treasury. As mentioned, savings bonds are among the safest investment options out there, but the tradeoff for their safety is a relatively low return rate. In exchange for your investment, the Treasury pays back interest at a rate determined by the type of bonds that you hold and the current rate applicable. To illustrate, Series EE bonds that were issued between November 1, 2014 and April 30, 2015 attract interest at an annual rate of 0.1%. While that may sound incredibly low, holding on to the bonds for 20 years will mean getting double your initial investment. That would be equivalent to a compounded return rate of approximately 3.5% annually. Unlike Series EE bonds, Series I bonds offer no guarantee of doubling your investment. However, they make a better investment during periods of high inflation. In addition to offering a direct hedge against inflation, you do not have to hold them to maturity for the best returns. A few short years back, buying savings bonds meant a trip to the bank or credit union. But starting 2012, the process is now digital. It is only on the US Treasury Department’s website, TreasuryDirect.gov, where you can make the purchase. Here is how to make your first investment: Now that your account is up and running, you may go ahead and make a purchase. Within two weeks, you will receive an access card via US mail. This card will be a requirement for completing transactions on the site. It is also possible to buy bonds with your tax refunds, which is the only way to get your bonds in paper form. You can make this purchase in increments of $50, with $5,000 being the highest amount you can get in bonds at once. To make this purchase, you will need to download form 8888 from TreasuryDirect. In order to buy US savings bonds, you need to be an official resident of the US, a US citizen (including those residing abroad), a US citizen minor or an employee of the US government (regardless of location and citizenship status). Minors do not have to use a trust as an intermediary to own bonds, but they have to use a custodial account linked to a guardian’s or parent’s account since they cannot buy directly from the Treasury. If you wish to buy multiple times in the course of a year, you may want to set up a recurrent purchase schedule. Alternatively, you could sign up for the Payroll Savings Plan which makes automated payroll deductions to buy bonds for you. The place where you redeem your savings bonds depends on the form they are in. If your bonds are in paper form, you can typically cash them in at a credit union or bank. Here’s how to cash in your savings bonds: Keeping in mind that you can only redeem savings bonds 12 months after purchase, you may want to be sure that you qualify. At the same time, you can only redeem bonds if you are the owner, entitled individual or co-owner. An entitled individual includes legal guardians and persons with Power of Attorney. Ever since the Treasury’s move to a virtual system, redeeming bonds has become quite simple. In the past, you would have had to visit a bank or credit union. Presently, you can do it from the comfort of home as the entire process is digital. Visit TreasuryDirect.gov and log in to your account. Go to the “Current Holdings” page and click the “Redeem” button. Specify whether it is a partial or full redemption and then indicate the payment destination. The funds will be transferred to the specified bank account. Alternatively, you can request for the payment via check, in which case, you will get it via US mail. You will likely receive the cash in your account within 2 business days if you request for a direct cash transfer. There are two ways to redeem your bonds manually, at a bank or credit union or via mail. However, if you are not a member of the institution in question, it would be best to check in advance whether they will cash your bond. If local banks do not accept to carry out the transaction, try out the Federal Reserve Bank. Carry the relevant identification documents such as your social security card or driver’s license. Note that the name on the identification, the name on the bond and the name on your bank account need to match and you need to have had the account for at least 6 months. If you do not have an account at the bank in question, you’ll need to provide a photo ID and signature. Sign the section labeled “Request for Payment” on your bond. They will write your account number and type of identification on the back of the bond. If necessary, fill out the Durable Power of Attorney form. This applies if the owner of the bond is home-bound or in hospital. It authorizes the person holding the form to cash in, but in order for it to work, it has to be notarized. If you are cashing in for a minor, provide proper identification to show that you are the parent or guardian. To redeem via mail, download the FS Form 1522 from the official Treasury website. Next, get your signature certified and then mail the form to the address indicated on the form. Even after Treasury made the switch from paper to digital savings bonds, many still hold their bonds in paper form. On TreasuryDirect, there is a provision to convert bond certificates into electronic form. That makes it much easier to file, store and track your savings bonds and also simplifies the redemption process. Furthermore, by converting your paper bonds to digital form, you will be in a position to see their current value as well as the applicable rate. For those with paper bonds, however, you have to use an online calculator, which is an unnecessarily arduous process. To make the conversion: The best time to redeem your savings bonds is right after they add interest. A majority of the bonds purchased after May 1997 add interest every 6 months. Most of the ones purchased before then add interest every month. Take care not to lose money by cashing in just before the date when interest is added. If it applies in your case, you might also want to cash in your bonds when paying for higher education. As highlighted earlier, the Education Tax Exclusion program allows you to render this income tax-free. As mentioned above, savings bonds are only taxed at a Federal level. Consequently, the interest you earn on your bonds is subject to taxes. When it comes to paying the taxes due, you may choose to make yearly payments on the interest earned. Alternatively, you may choose to defer the payment until you redeem or until the bonds mature. Deferring the payment until bond maturity means you will have to pay 30 years’ worth of taxes on the interest. Notably, when you select this option, all your bonds will be subject to the same treatment. You cannot defer payments on some and pay annually on others. With regards to ownership, the person who purchases bonds as the sole owner is responsible for paying the taxes thereof. If the owner in question is a minor, the parent or guardian could report the interest and pay taxes on their own returns. As at the beginning of 2019, the US government reported that there was at least $25 billion lying dormant in matured yet unredeemed savings bonds. If you are among the owners of these old savings bonds, the above information is all you need to get your hands on the cash. Cashing in your savings bonds can be a lifesaver when you need fast access to cash. In case you do not need the money immediately, think about reinvesting it instead of letting it collect cobwebs in the Treasury. Featured Bonds Broker 2020 Yes, you could use the serial numbers of your bonds to find out if someone has already cashed them in. If not, you can try replacing them. To claim them as your own, you will need documentary proof such as pay stubs showing deductions for bonds. Mature bonds do not continue to pay interest. Therefore, if you choose not to cash in, you are basically lending the government your cash interest-free. No, there are no charges for cashing in. To start with, check the series name. If it is a Series E or HH bond, it is mature. If it is a series EE or I, it will mature 30 years after the issue date. Find the issue date on the top right corner under the series name. One way is to use it for a qualifying education expense. Another option is to put it in your retirement savings account. Though you will still pay the interest due on the bonds, the tax deduction from contributing to a tax-deferred retirement account will offset the taxes paid. Nica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates. WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site. Copyright © 2026 | Learnbonds.com

What are Savings Bonds?

What are the pros and cons of buying savings bonds?

Types of savings bonds

Series EE

Series I

How Savings Bonds make Money

How to invest in savings bonds

Step 1: Open an account on TreasuryDirect

Step 2: Fund the purchase

Step 3: Buy savings bonds

How to cash in Savings Bonds

Step 1: Confirm eligibility for redemption

Step 2: Redeem your bonds

Cashing in Online

Cashing in Manually

How to change paper bonds to electronic

When should I cash in Savings Bonds?

How are Savings Bonds taxed?

Conclusion

FAQs

Can I cash in on savings bonds that I have lost?

What if my bonds have reached maturity and I do not want to cash them in just yet?

Are there charges for cashing in my savings bonds?

How can I tell the maturity date of my paper savings bonds?

How can I avoid paying taxes on the proceeds of my savings bonds?

See Our Full Range Of Bonds Resources – Bonds A-Z

Nica

Nica