Bond ETFs | Invest in a Bond ETF today!

Exchange-Traded Funds (ETFs) are one of the most sought-after asset classes globally. They allow you to invest in an asset, or group of assets, without needing to own the underlying instrument. Instead, you are simply speculating on whether you think the price of the asset will go up or down in the open marketplace. As such, it comes as no surprise to learn that you can now invest in Bond ETFs.

Bond ETFs operate in a different nature to traditional bonds, insofar that you will not be entitled to fixed interest payments. This is because Bond ETF providers will have hundreds, if not thousands of bonds within its portfolio, meaning that coupon payment dates will vary. As a result, most ETFs pay monthly interest on your investment, which can vary depending on the performance of the bond basket.

Fancy finding out what Bond ETFs actually are, how they work, and what you need to do to make an investment today? If so, be sure to read our comprehensive Bond ETFs Guide.

-

-

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

What are Bond ETFs?

Unlike traditional bonds, getting your head around a bond ETF is no easy feat. Traditionally, bonds allow you to loan money to corporations or governments, and in return, you will receive fixed interest payments. You will continue to earn interest until the bond matures, which can be anything from 6-months to 30-years. The yields on traditional bonds never change, so you always know how much you are going to make.

Unlike traditional bonds, getting your head around a bond ETF is no easy feat. Traditionally, bonds allow you to loan money to corporations or governments, and in return, you will receive fixed interest payments. You will continue to earn interest until the bond matures, which can be anything from 6-months to 30-years. The yields on traditional bonds never change, so you always know how much you are going to make.However, Bond ETFs operate completely differently. Firstly, you do not own the bonds, as you are merely speculating on the future value of the asset. Instead, the ETF provider retains full control of the bonds that it purchases. Bond ETFs never have a maturity date either, so the markets function on a 24/7 basis indefinitely. This is because Bond ETF providers will constantly buy new bonds so that the portfolio never matures.

In order to clear the mist, let’s look at a quick example of how a Bond ETF might work in practice.

Example of a Bond ETF Investment

- You invest $5,000 into a Bond ETF

- The Bond ETF consists of both corporate bonds and government bonds with varying maturity dates

- When you invested in the Bond ETF, it had a net asset value (NAV) of $26 per share

- At the end of month 1 and 2, you received interest payments at an annualized interest rate of 2% and 4%, respectively

- You sell your Bond ETF investment during month 3, at a price of $30 per share.

As you can see from the above example, the Bond ETF has a NAV price attached to it, which operates in a similar nature to a share price. The NAV of the Bond ETF will go up and down, depending on how its portfolio of bonds is performing in the open marketplace.

Secondly, you will also notice that your interest payments amounted to two different yields. While month 1 paid 2%, month 2 paid 4%. This is because the Bond ETF can consist of thousands of individual bonds, with the provider adding more along the way. As such, the monthly interest that you receive from the ETF will vary.

Pros and Cons of Investing in a Bond ETF

Pros- Speculate on the future price of bonds without owning the asset

- You can sell the bonds whenever you want

- No requirement to lock your money away

- Gain exposure to bonds that would otherwise be difficult to buy

- ETFs also allow you to go short, so you can speculate on the bonds going down in value

Cons- You won’t own the underlying bond, so you won’t be entitled to interest payments

- Not suitable for those wishing to earn passive income

- Most brokers charge an annual fee to invest in ETFs

Types of Bond ETFs

So now that you have a brief overview of what Bond ETFs actually are, let’s explore the different types of investments that you can make.

Sovereign Bond ETFs

As the name suggests, Sovereign Bond ETFs focus on bonds issued by sovereign nations. In Layman’s Terms, this means that the ETF provider will purchase bonds that are raised by governments. The ETF might focus on a specific government bond, such as US Treasury bonds, or it might niche down even further by tracking a specific instrument, like a 10-year T-Bill. In some cases, the Sovereign Bond ETF might consist of bonds from multiple nations.

For example, the basket might contain government bonds from the US, UK, European Union, and Japan. There are also Sovereign Bond ETFs that target government bonds from emerging markets. This might include the likes of Turkey, Brazil, India, and Thailand. Although emerging government bonds pay a much higher rate of return, the risks higher. As such, some ETFs will add both low-risk and higher-risk Sovereign Bonds with their portfolio.

Note: Sovereign Bond ETFs that focus purely on low-risk economies like the US and the UK give you a much better idea of how much you are likely to make. This is because low-risk bonds are a lot less volatile in comparison to bonds issued by emerging nations.Corporate Bond ETFs

Corporate Bond ETFs contain bonds that are issued by blue-chip companies. Such companies typically trade on major stock markets like the NASDAQ and New York Stock Exchange (NYSE). In a similar nature to government bonds, corporations issue bonds as a means to raise capital. This might be to fund a new project or pay for an upcoming buy-back scheme. Either way, Corporate Bonds usually pay a much higher yield in comparison to Sovereign Bonds. This is because the underlying risks are much greater.

For example, if the US government was unable to meet its short-term bond coupons, it could simply revert to the Federal Reserve and print more money. However, private companies do not have the same luxury. As such, were they to run into financial difficulties and be unable to meet their bond obligations, your investment could be at risk. Nevertheless, Corporate Bond ETFs will usually consist of hundreds of bonds from multiple industries. This is to mitigate the risks of default.

Note: Although Corporate Bonds are difficult to offload in the secondary marketplace, this isn’t the case with ETFs. This is because ETFs allow you to sell your investment at any given time.Municipal Bond ETFs

Municipal Bond ETFs are also issued by governmental bodies in the US, albeit, this is at a regional level. The debt can be issued by the state itself, or even at a county or city level. Municipal Bond ETFs are much riskier than Treasury Bonds, as they don’t have the safety net of the Federal Reserve. In most cases, Municipal Bonds are issued to pay for local services. Not only are Municipal Bonds difficult to access for the average investor, but they can also be costly to purchase.

As such, ETFs are a great way to access the Municipal Bonds marketplace. Municipal Bonds often pay a very attractive rate of interest, but the risks of default are also high, so you need to weigh up how much risk you are comfortable taking. In the case of ETFs, the provider will hold hundreds, if not thousands of individual Municipal Bonds, from a range of regions in the US.

Broad-Market Bond ETFs

ETF providers that offer Broad-Market Bond ETFs will target all three of the above bond sectors. As such, this covers bonds from corporate, government, and municipal organizations. The specific risk levels will depend on the weighting applied by the ETF provider. For example, a balanced portfolio might consist of 70% in low-risk government bonds, 20% in corporate bonds, and 10% in municipal bonds. In order to diversify as much as possible, ETF bond providers will invest in multiple regions.

How Much Can I Make From Bond ETFs?

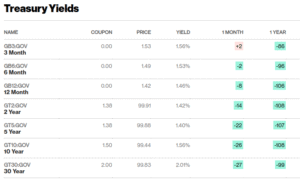

There is no one-size-fits-all answer as to how much you will make from a Bond ETF investment, as there are so many variables to consider. For example, if the ETF invests primarily in US Treasuries, then the risk is going to be super-low. This also means that you will be unlikely to make more than 2% in returns each year.

At the other end of the spectrum, a Bond ETF that invests in corporate bonds from emerging markets is likely to target double-digit gains. However, the risks are going to be much higher, so there’s always a chance that the investment will lose you money.

It is also important to note that you will not know how much a specific Bond ETF is going to make you. The amount of interest that you make will change on a month-by-month basis. For example, while you might get annualized returns of 2%, 7%, and 5% in the first three months, you could equally make a net loss of 12% in month four.

In order to understand why bond ETF yields can fluctuate so widely, check out the explainer below.

Why Bond ETF Yields Fluctuate

Bond ETF yields will go up and down on a daily basis, which is why it is difficult to ascertain how much you are likely to make. Here’s an example of why bond prices change.

Bond Price Goes Down

- To keep things simple, let’s say that you purchase a $100 corporate bond that pays 6% per year.

- This means that bondholders will receive $6 in interest every year until the bond matures.

- However, the Federal Reserve increases its interest rates, which means that corporate borrowing costs become more expensive.

- Next time the corporation issues bonds, it does so at an interest yield of 8% per year.

- This means that anyone that purchases the new bonds will get a higher yield than those holding 6% bonds.

- As such, the value of the original bonds will go down, as those that wish to sell their bonds must do so at a discounted price.

Bond Price Goes Up

- Let’s say that you are holding government bonds at a yield of 4%.

- This means that a $10,000 investment would yield $400 per year in interest.

- With the economy looking like it is about to hit a recession, the government decides to reduce interest rates to boost spending.

- As such, newly issued bonds come with a yield of just 3%.

- This means that those holding the previously issued bonds at a 4% yield will be able to sell their bonds at a premium.

As you can see from the above two examples, bond prices can go up or down in response to macro-economic events. This is why there is often a disparity in the monthly yield that your Bond ETF pays. This is further amplified when you consider that large Bond ETFs often have thousands of individual bonds within their basket.

How do I Invest in Bond ETFs?

Like the sound of what Bond ETFs offer for your long-term investment goals? If so, be sure to follow the step-by-step guidelines that we have listed below.

Step 1: Decide What Type of Bond ETF You Want to Invest in

First and foremost, you need to spend some time thinking about the type of Bond ETF that you wish to invest in. For example, are you more interested in low-risk bonds such as US Treasuries and UK Gilts? Or do you like the thrill of corporate bonds in emerging markets?

The good news is that you can easily diversify by opting for a Broad-Market Bond ETF. Similarly, you can spread your investment funds out across multiple ETF providers. For example, you might distribute 50% to a Sovereign Bond ETF, 25% to a Corporate Bond ETF, and 25% to a Municipal Bond ETF.

Step 2: Choose an ETF Bond Broker

Once you have ascertained the type of Bond ETF that you wish to invest in, you will then need to choose a broker. There are literally hundreds of brokers that list Bond ETFs in the online space, so knowing which platform to sign up with can be challenging. As such, it might be worth considering some of the following metrics.

- Is the broker regulated?

- What fees does the broker charge?

- What types of Bond ETFs does the broker offer?

- Am I eligible to open an account with the broker?

- What payment methods does the broker support?

- Are there any minimum deposit and withdrawal amounts?

Once you’ve gone through the above checklist and chosen a broker, you are then ready to open an account.

Step 3: Open a Brokerage Account

As you will only be using a regulated bond broker, you will need to provide some personal information when opening an account. This will include your first and last name, home address, nationality, date of birth, and contact details.

You will then need to verify your identity. This will likely require you to upload a copy of your government-issued ID. Most brokers will accept a passport or driver’s license, and they can usually verify the document automatically.

Step 4: Deposit Funds

Once your brokerage account has been verified, you will then need to deposit some funds. Most brokers will offer a range of payment methods, such as a debit/credit card, e-wallet, and bank transfer. Make sure you keep an eye on any deposit fees that the broker might charge. You also need to check whether or not a minimum deposit amount is required.

Step 5: Invest in a Bond ETF

Now that your brokerage account is funded, you can proceed to invest in a Bond ETF. You’ll hopefully have access to hundreds of different ETFs, so choose wisely. In fact, you are best advised to diversify as much as possible. You will need to enter the amount that you wish to invest in the Bond ETF, and then confirm the order.

Step 6: Evaluate Bond ETF Price and Monthly Yield

Once you complete the investment process, you will then need to keep an eye on how the Bond ETF is performing. The NAV of your investment indicates how much the portfolio is worth – based on current market prices. As the NAV goes up, as will the value of your investment.

You will likely receive interest payments on a fixed date of each month, with the specific amount depending on the value of the bonds within the basket. You can sell your Bond ETF investment at any given time, albeit, this usually needs to be done during market hours.

Conclusion

In summary, we hope that by reading this guide from start to finish, you now have a firm grasp of how Bond ETFs work. Bond ETFs gives you much more freedom in comparison to traditional bonds. For example, you can offload your investment whenever you see fit, as opposed to having to wait for individual bonds to mature. You can also diversify easily with Bond ETFs, as most baskets will consist of thousands of individual bonds.

Most importantly, Bond ETFs give you access to bond markets that would otherwise be difficult to reach. With that said, Bond ETFs still come with their flaws. At the forefront of this is an inability to know how much yield you are going to make on your investment. As such, they might not be suitable for those of you that seek fixed passive income.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

Glossary of Bonds Terms

BondA bond is when companies or goverments need to generate funds and when you invest you will receive you lump sump back with interest at the end of your agreement.

Treasury BondBonds issued by the United States Department of the Treasury to finance government spending.

Treasury NoteA Treasury Note are bonds issued by the United States Department of the Treasury and last up to 10 years.

Treasury SecurityTreasury securities are the bonds issued to investors by the U.S. government

Municipal BondsA Municipal Bond is usually issued by local Governments to finance public projects such as roads, schools, and airports. You will recieve you lump sum and interest back at the end of the term.

Corporate BondsA Corporate Bond is issued by businesses to raise funds for expansions or projects. You will recieve you lump sum and interest back at the end of the term.

Premium BondsA Bond that has no interest rate but your investments are entered into prize draws to win £25 to £1mil.

Savings BondUsually offered by Banks and Building Societies, Saving Bonds will last for a fixed term and earn interest. You are not able to access the money during the fixed term.

Fixed Rate BondsA Fixed Bond will start and end with same Interest Rate.

FAQs

How do I make money with Bond ETFs?

Bond ETFs make money on two key fronts. Firstly, any coupon payments that the provider receives will be forwarded on to you at the end of each month. Secondly, if the overall value of the provider’s basket of bonds goes up, as will the value of your investment.

Are Bond ETFs risky?

As is the case with all investment products, there will always be an element of risk when investing in Bond ETFs. The specific risk level will ultimately depend on the types of bonds that the ETF provider has purchased.

What is the minimum amount I can invest in Bond ETFs?

This depends on the Bond ETF provider that you decide to use. Most will have a minimum deposit amount, which typically averages $100.

What is the safest Bond ETF to invest in?

The safest Bond ETFs on the market are Sovereign Bonds issued by governments. More specifically, these are bonds issued by governments from strong economies. This would include ETFs that contain US Treasuries and UK Gilts.

Do Bond ETFs have a maturity date?

No, Bond ETFs never have a maturity date, so you can effectively invest in one on an indefinite basis. With that said, the individual bonds within the ETF will each have a maturity date. This is why fund managers constantly top a Bond ETF up with new investments.

Are Bond ETF yields fixed?

Unlike traditional bonds, which always come with a fixed interest rate, the value of Bond ETFs will fluctuate on a daily basis. This means that the size of your monthly yield will always change.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up