What is Binary Options? How to Trade Binary Options in 2021

What if you could trade a stock and know exactly what you will win or lose? Binary options are a lure for new traders because they are simple to use and your potential gain or loss is known in advance.

Do you think the price of gold will be above or below X amount in 10 minutes – Yes or No?

If your bet is correct, you get a fixed pay out. If you are wrong, you lose the cost of the options contract. The outcomes and your risk are clearly defined.

If you bet on the horses or football games, then you are very familiar with this win or lose proposition called gambling. Binary options have been compared to bets on a roulette wheel – Do you expect the ball to land on an even or odd number? – and even Russian roulette.

If you are looking to make easy money, you are not likely to find it in binary options trading. Whether or not binary options are a form of gambling or investing depends on the learning, skill and experience you dedicate to trading them. If you toss a coin – heads the price will rise, tails the price will fall – your chances of winning are 50/50. After trading fees, you will inevitably lose money. This is gambling. Alternatively, like any good trader, you can use fundamental and technical market analysis to decide whether to buy or sell a binary option.

-

-

What Are Binary Options?

Binary options are an all-or-nothing bet on the future price of an underlying asset. The trader receives a fixed payout if the price of an underlying asset (e.g., currency pair, stock) hits a preset level at a preset expiry date. The expiry date may range from a minute to a month, but is generally intraday (minutes to a few hours). Here are two examples of fixed-return high-low binary options:

Market price – In a simple high-low binary option trade, the trader chooses whether the expiry price will be higher or lower than the market price (the strike price). The trader buys a binary option betting the gold price will rise above the current market price of $1,300 in the next five minutes.

Set price level –The trader buys a binary option betting the price of gold will reach 1,310 in two hours. If in two hours the price of gold is above the strike price, the trader receives a payout. If it is below the strike price, the trader loses the cost of the option.

An option is the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined price and date.Bullish

If the expectation is the stock price will rise above the strike price, the trader takes a long position and buys a call option.

Bearish

If the expectation is the stock price will fall below the strike price, the trader takes a short position and buys a put option.

Why Should I Trade Binary Options?

Binary options allow you to easily place money behind your opinion on a market? Do you expect the price of gold to rise above $1,300? Will Netflix stock rise or fall after today’s earnings announcement? Will the unemployment rate report show an increase or decrease?

Let’s take the unemployment report as an example. A falling unemployment number is a bullish signal for the US market that can strengthen the USD against the EUR. If US unemployment falls, traders short the EUR/USD. If unemployment rises, traders typically go long the EUR/USD.

There are many barriers to buying an option on the bet that the EUR/USD will rise based on a higher US unemployment rate.

- Your broker may require a higher account minimum to trade options

- The size of potential losses if the EUR/USD price falls is unknown

- The price could rise but not enough to cover the bid-ask spread after fees

- The orders of large traders with faster executions speeds will be filled first, which could result in price slippage

- The use of leverage will magnify any losses

- In the event of losses, you could receive margin calls

Th binary option, in comparison, has two possible outcomes:

🔺The price rises above the strike price – The unemployment report is negative, the USD price falls and the EUR/USD price rises. You get a payout.

🔻The price falls below the strike price – If the currency pair falls below the strike price before the expiry time, you lose the cost of the option.How the payout is calculated can differ among binary options providers. See the binary options broker and exchange examples below for two popular payout models.

Not all binary options trading platforms are zero-sum games in which the trader has to accept a fixed payout and expiry date. The trader can choose when to exit before the options contract expiry, thereby gaining more control over profits and losses.Pros:

- Simple binary choice – ‘Yes’ or ‘No’

- Risk, potential loss, is predetermined by amount of trade

- Potential reward is predetermined

- Cannot lose more than what you have bet

Cons:

- High risk of loss of capital

- All-or-nothing bet

- A one pip difference from the strike price and the trade is out-of-the-money and pays out 0

- Not legal or available to retail traders in some jurisdictions

How to Start Trading Binary Options at a Broker:

For retail traders to trade investment assets, they need to sign up with a broker who acts as an intermediary between the traders and exchanges. In the US, traders can sign up with the popular Nadex exchange and trade binary options directly with the exchange. As mentioned, the payout models vary across binary options providers. This review of the popular IQ Options broker and Nadex exchange demonstrates two different payout methods.

How to Trade Binary Options in the US:

Why Choose Nadex? Binary Options Trading Trading Screen Basic Binary Options Trading On Nadex

Advanced Binary Options Trading On Nadex

Fees: $1 per contract

Min Deposit: $250

Nadex is a popular binary options and spread exchange in the United States regulated by the Commodities Futures Trading Commission (CFTC). Binary options can be traded on stock indices, forex, commodities, and economic events. Choose an expiry from 5 minutes to 2 hours (intraday), or daily or weekly periods. Nadex provides the option to close binary trades before expiry. Test drive the platform with the free demo account.

- Low fee of $1 per contract on large choice of underlying assets

- An exchange, not a broker, is the trade counterparty

- Call spread and touch bracket options

- Exit trade before expiry

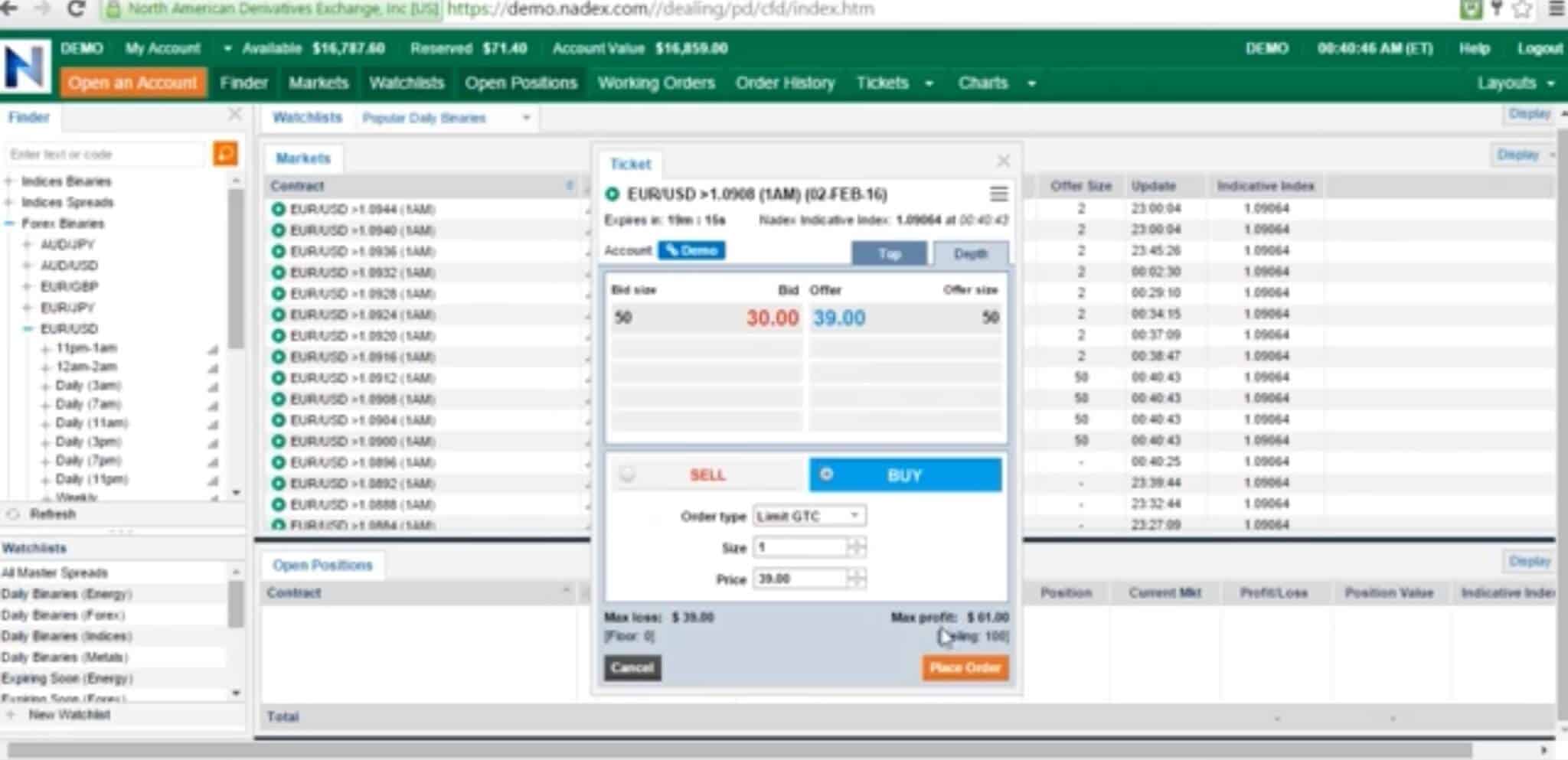

The trading screen looks like a typical online trading interface. The major difference is instead of complex price charts and indicators, you are given a choice of options contracts to buy.

In this example, the EUR/USD currency pair is trading at 1.250. We choose to buy 5 contacts of the 15-minute contract at USD18 for a total cost of USD90. The option price of less than USD100 indicates traders see a low probability, an 18 percent chance, of the EUR/USD price rising in the next 15 minutes. Your chance of losing is about 82 percent.

Nadex binary options have a fixed payoff between $0 and $100, so your profit and loss potential is known in advance.

You have two exit options.

1. Let the contract expire. If it expires above the strike price, you gain $100 per contract. If it expires below the contract price, you get paid 0 and lose the cost of the options ($90).

Your maximum gain is USD 410 ($500 ($100 x 5 contracts) – $90).

Your maximum loss is the cost of the options USD 90.2. Sell before the expiration at a price at or less than $100.

The price rises to $50 and then starts to fall. You decide to sell at $40 to lock in profits and avoid losses.Your maximum gain is USD 110 ($200 ($40 x 5 contracts) – $90).

The Touch Bracket is a new instrument that caps potential profit and losses within a defined price range. Bulls would buy and win if the top bracket is hit while bears would sell and win if the bottom bracket was hit. The contract settles by price if a bracket is hit, or time upon its expiry. Any realized profit or loss will be determined by the difference between the level at which the contract was bought or sold and the expiration value of the contract.

How to Trade Binary Options (non-USA option)

Why Choose IQ Option?Basic Binary Options Trading With IQ Option

Advanced Binary Options Trading With IQ Option

Fees: $0

Min Deposit: $10, Min. Trade: $1

IQ Options is a Cyprus-regulated binary options platform. Many binary options traders have started off with its intuitive, easy-to-use interface. Trade forex and cryptocurrencies, as well as CFDs on close to 200 stocks, ETFs, and indices – with 5x leverage. Take control of your binary options trades with limit, stop-loss, and trailing stop orders. Start with the basics of binary options trading. Fundamental and technical analysis training can take you to the next level. Dozens of videos are available in the education center. Over 100 technical indicators and widgets are available to deepen your trading strategies. Get accustomed to the platform using the free demo account. IQ Option is not available to retail clients in Europe, where only Professional clients can trade binary and digital options.

- No to low fees

- Forex, cryptocurrencies, CFDs (on stocks, indices and more), and ETFs

- User-friendly interface

IQ Options has one of the most user-friendly trading interfaces. Market information is provided including trader sentiment, and event and economic calendars. Parameters are easy to set as follows:

- The price direction – higher (call option) or lower (put option)

- The strike price (at which you will exit the trade)

- The amount you are trading

- The expiration time of the option

The payout percentage is preset by the system based on the spread, transaction costs, time of the day, and expiration time. The maximum payout percentage is about 90% to 95%.

Many of the favorite tools of the advanced trader are offered by IQ Option. Set stop losses and trailing stops. Choose from over 100 technical indicators. In this example, a basic moving average indicator is applied. Set your own parameters by choosing the moving average period and type – short-term moving average (SMA), weighted moving average (WMA), exponential moving average (EMA), and so on. IQ Option provides the option to close the trade before expiry.

When an option settles above the strike price, it is in the money. When an option settles below the strike price, it is out of the money. In the latter case, the trader will let the option expire and lose the contract cost.

What to Look for in a Binary Options Broker?

Binary options are deceptively simple. A trading platform with education on how to use technical indicators and trading strategies can help you develop binary options trading skill. Without skill, you are rolling the dice. Other broker features to compare include:

Regulated – Many binary options brokers have been shut down for fraudulent activity. Go with a broker that is regulated and trusted in your market.

Trade exit before expiry – The ability to lock in profits or minimize losses by closing a trade before expiry can significantly improve your trading performance.

Stop-loss orders – Stop-loss and trailing stop orders minimize your losses by stopping out trades at preset price levels.

Technical indicators – Conducting fundamental and technical analysis is the difference between rolling the dice and trading based on skill. Start off with the basics like moving averages, and support and resistance lines to improve your price forecasting skills.

Demo account – Practicing how to trade these exotic options before putting real money at risk is highly advised.

Binary options are called naked options for good reason. Because the writers of these options do not own the underlying asset, they face high price risk exposure. Traders, however, do not have to be completely naked. By using risk management tools, you can gain more control over your potential gains and losses when trading binary options.

FAQs

How much do I need to start trading binary options?

The account minimum varies among brokers. In the US, traders can trade binary options on the Nadex exchange with a $250 account balance. In Europe, traders must be designated as professional traders to trade binary options with a broker. This involves meeting two of three requirements: an investment account balance of more than EUR 500,000, an average of 10 transactions per quarter over four quarters, one year professional experience in the financial sector.

How much can I make as a binary options trader?

Your earnings potential as a binary options trader depends on your experience, skills and expertise. Prudent traders control their potential gains and losses by using the 1 percent risk rule: Never trade more than 1 percent of the value of your portfolio on one trade. If you choose to borrow on margin to increase your buying power, your potential gains and losses will be magnified by the leverage amount.

Do I need a margin account to trade binary options?

Unlike many derivatives such as CFDs, futures and options, binary options are generally not traded using borrowed money, also known as margin borrowing. A leverage of 20:1, for example, would involve borrowing 20 times the amount of cash and securities in your investment account. An account with a value of 5 euros would be able to trade using 100 euros.

Do I need to use stop-loss orders to trade binary options?

Binary options brokers are adding traditional risk management tools such as stop-loss and limit orders, though not all will provide these order types. Stop orders are a popular way of limiting downside risk while trading. The two most popular are:

Stop-loss order – Stops out the trade when the price falls to the predetermined stop price.

Trailing stop – Follows the price within a range (e.g. 10 pips). The trade is closed if the stock price passes through the trailing stop level, thereby limiting downside risk.

I want to day trade binary options but the broker is not licensed in my country.

Because binary options have a high risk of loss, they are banned in many countries. In Europe, professional traders may trade them but they are off limits to retail traders. Anyone anywhere in the world can download a binary options broker app and start trading. If the broker is unregulated and goes out of business, your losses will not be covered by investment account insurance. Offshore brokers are prohibited from marketing to US residents. Also be aware that many binary option dealers have been shut down owing to fraudulent activities.

Can I trade binary options in Europe?

Under the new ESMA rules enacted in July 2018, retail traders can no longer trade binary or digital options. Retail traders can trade CFDs with up to x30 leverage. Traders with Professional trader designation can trade binary and digital options with up to x500 leverage, and their accounts benefit from negative balance protection. Refer to ESMA or your broker’s qualifications to upgrade to a professional account.

What is the difference between a binary options exchange (e.g., Nadex) and a broker (e.g., IQ Option)?

An exchange matches buyers and sellers of a security but does not take a position in the security. A broker acts as your counterparty and therefore takes a position in the security. That means your loss is their profit. The exchange makes money from commissions. Because the broker also makes money from the spreads, the trader faces the risk of price manipulation. Brokers have a fiduciary responsibility to provide clients with best execution pricing.

What is the difference between a binary option and digital option?

Both binary and digital options are priced based on whether the settlement price is higher or lower than the strike price. The return on a binary option is a fixed percent of the amount invested and based on the spread, volatility, time of day, cost and other factors. The return on a digital option varies and is based on how far the price moves from the strike price. On a buy order, for example, as the price moves higher than the strike price, your potential profit increases. As the price moves lower than the strike price, the potential loss increases.

Am I missing anything?

In This Guide-

Maggie Smith

Maggie Smith

Maggie is an investment expert with 10 years experience in dividend stocks and income investing. She has a PhD in Financial Markets and Investment Strategies and has contributed to a number of financial portals, writing stock market analysis pieces and reports on technology stocks and IPOs.View all posts by Maggie Smith

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Fees: $1 per contract

Fees: $1 per contract

Fees: $0

Fees: $0