N26 Review 2021 – Is It Worth Switching Banks to?

What comes to your mind when you hear the word bank?  If you are like most people, you are probably picturing physical buildings filled with people in suits and in some cases, long queues. But something is changing. A new trend is coming up called challenger banks. With this, you can get all the services and you are accustomed to in a mobile or web application. Most of the mobile banks do not have physical branches which means you have to figure things on your own. On the bright side, you can access your accounts anywhere and at any time. They are also regulated in the same manner as regular banks.

If you are like most people, you are probably picturing physical buildings filled with people in suits and in some cases, long queues. But something is changing. A new trend is coming up called challenger banks. With this, you can get all the services and you are accustomed to in a mobile or web application. Most of the mobile banks do not have physical branches which means you have to figure things on your own. On the bright side, you can access your accounts anywhere and at any time. They are also regulated in the same manner as regular banks.

In this N26 review, we look at German’s first fully licensed online-only bank that has also launched in the UK and other countries.

-

-

What is N26?

N26 is a digital mobile bank founded in 2013 by Valentin Staff, who is the current CEO and his longtime friend Maximilian Tayenthal, the current CFO. The aim was to redesign the banking system and make it simpler, faster, cheaper and enhancing it to fit today’s mobile lifestyle. The N26 cost of operations is much lower than regular banks as they do not have branches and IT legacy. Therefore, they are able to pass the cost advantages to their customers. Their basic products are free thanks to that. Unlike other platforms such as Revolut and RobinHood, N26 is a fully licensed bank.

N26 was known as Number 26 until July 2016. Its initial product launch was in 2015. It has since attracted over 2.5 million customers across 24 European markets and it has plans to enter the US market in 2019. The firm has managed to raise over five hundred million USD in three funding rounds, the latest being in January 2019 where it raised $300 million in a round led by Insight Venture Partners. The firm is valued at $2.7 billion overtaking Revolut as Europe’s most valuable mobile bank.

The company launched in the UK last October where it already had over fifty thousand people on their waitlist. N26 is currently offering the basic current accounts and the premium Black and Metal services in the UK market and it will eventually expand to overdrafts and other services. However, there is still a lot of uncertainty in this market due to Brexit.

N26 is like any other bank despite the lack of physical branches and the almost complete lack of human interaction during transactions. You get a real, fully fledged bank account with local account numbers and sort codes and a MasterCard to use anywhere you go.

N26 has partnered with other companies such as TransferWise for international payments that now support transfers to 19 currencies directly from the N26 app. It has also established partnerships with Raisin for savings, Auxmoney for credit and Allianz for insurance. The company faces stiff competition from other similar platforms and the traditional banks.

How N26 Works

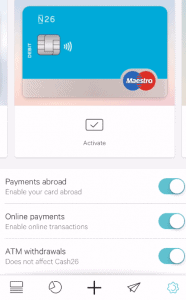

N26 is an online-only bank that allows its users to pay, send, request and receive money. Users can also track their purchases on the app or organize their transaction for easier use. The firm offers free worldwide ATM withdrawals, free international money transfers and insurance on the premium products. The app has security features that enable you to block your card if it is lost, reorder another one or unblock it. You can also disable international withdrawals or set limits. This means you can do everything you would require a traditional bank, directly from N26 web or app.

Every time you make a purchase, you will receive a push notification on your phone. This is a great feature as you will be able to identify unauthorized purchases and lock your card instantly on the app. It also supports contactless payments including Google Pay and Apple Pay. For foreign currency transfers, all transactions are processed at mid-market rates thanks to N26’s partnership with TransferWise.

N26 Pros- You get a real, fully-fledged bank account on your mobile for free

- Free ATM withdrawals worldwide for premium plans

- In-app security features such as blocking/unblocking your card in case it is lost

- Easy to track and manage your transactions

- All transactions, both local and international are completed within one working day

- Transferwise partnership enables seamless transfers into 19 currencies

- Google Pay and Apple Pay support

- Free bank card

- Easy to use mobile app

- N26 Bug Bounty Program ensures the platform stays free of vulnerabilities

N26 Cons- 1.7% fees for foreign currency withdrawals.

- No physical branches where customers can get their issues solved instantly

- No phone support – customer care is only available through chat which can be slow or unavailable

- No overdraft feature in the UK platform

- Not all products are available in some countries.

Getting Started with N26

You can only open an account with N26 if, you are at least 18 years old, your country of residence is supported, hold a supported ID and own a compatible smartphone (on the app). You can only open one account. To start the registration process, click start current account and the registration form will appear. You will fill in your first and last name, date of birth and email.

The second step will require you to fill in your physical address or an address where the card will be delivered to. If you are not the main tenant ensure you fill the C/O with the address owners name. If you have any promotional codes, you can add them in this step.

The third step is the legal details. N26 will ask you for gender –to help them address you correctly, city of birth, nationality – the country in which you are tax liable. The authorities require the tax information within three months of the account creation. This step is skip-able. The last thing before your account is created is to agree to the terms and conditions, SCHUFA data exchange consent and choose whether you want to receive N26 Bank products updates by email.

The platform will send a confirmation email, click on the link to verify your account. Next is to choose the plans. You will be asked about the purpose of the account, industry that you work in –if you choose for business. Choose between either the N26 Standard, Black or Metal plan. Select your delivery method and card production will start after verification, which is done by photo or video.

The next step is connecting to the app. Download the app from the App Store or Google Play and login into the account you just created. The app will lead you through the process of paring the account. You will be sent a verification code to the number you entered when creating the account. You can change your number later on.

N26 Plans

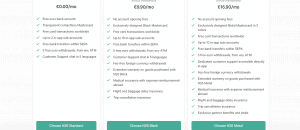

N26 offers its customers five plans, the N26 Standard, N26 Black, N26 Metal, N26 Business and N26 Business Black.

N26 Standard

This a completely free account to set up. You get all bank’s free features and a transparent plastic Mastercard debit to go with it. The card has an EMV chip and is NFC enabled, it can, therefore, be used for contactless payments. There are no account management fees associated with this account as it would be with regular banks. With the standard account, you can make free payments in any currency with the payment processed with the Mastercard exchange rate.

The Standard account also offers free ATM withdrawals in the Eurozone. In Austria, UK and Italy, N26 offers unlimited free withdrawals including Cash26. In France, Netherlands, Spain and the rest of Europe you only get 5 free ATM withdrawals. 3 free withdrawals if you are in Germany, you only get 5 for the first three months or if you are below 26 years or if you receive salary or at least 1000 Euros for at least two months through N26. If you are traveling outside the Eurozone, the ATM withdrawal fee is 1.7%.

Foreign currency transfers are handled via TransferWise which makes it possible to get up to 8 times lower fees in 19 currencies. TransferWise is integrated into the N26 app for a smooth experience. Users in Germany, Netherlands and Austria also get a Maestro card for ATM withdrawals. A 2 euros fee is charged if you use the Maestro for both domestic and international withdrawals.

N26 Black

N26 Black is a premium debit card that gives you additional perks you don’t get with the standard account. The contactless Mastercard comes in an elegant black design as the name suggests. For a fixed 9.90 euro monthly cost, you get comprehensive insurance coverage, free withdrawals n any currency around the world and up to 10 spaces.

The insurance offered includes:- Flight and luggage delay cover – covers your additional expenses up to 400 euros per trip if the flight or luggage delays more than 4 hours (6 hours for luggage) occur.

- Foreign medical expenses – N26 covers your medical expenses in case of acute medical emergencies when you are abroad

- Theft insurance – with the N26 Black, you will be covered in case of a mobile theft or if you are mugged within 4 hours of withdrawing cash from an ATM.

- Extended warranty – extends the warranty of qualifying items bought using the N26 Black up to one year.

The premium account has a minimum membership period of one year and it automatically renews if you fail to cancel your membership 4 weeks before the contract expires.

N26 Metal

The N26 Metal is a premium service. The firm provides the service users with an all-metal stainless steel card in three colors. Charcoal Black, Quartz Rose and Slate Grey. The plan will cost you £14.90 a month in the UK and €16.90 in Germany. The minimum term is 1 year. According to N26, it was the first metal-core card in Europe to support contactless payments.

With the Metal plan, you get all the benefits in all the other plans including the insurance coverage by Allianz. Additional benefits include:

- Travel insurance – reimbursement of medical expenses abroad, flight and luggage delays, travel cancellations after a medical emergency, medical repatriation expenses.

- Purchase protection – reimbursement or repair costs for stolen or damaged goods purchased with the N26 Metal Mastercard.

- Dedicated customer support – you get exclusive access to dedicated customer support representatives directly via the app

- LoungeKey membership

- Exclusive partner offerings such as 10% off for hotel bookings with Hotel.com, one-year We Work membership, 10% discounts for Tannico, Helpling and Zipjet. Other partners include Babbel, Drivy and Lanieri.

You can select the Metal plan when you sign up or upgrade from your account.

N26 Business

This is a dedicated bank account for freelancers and self-employed users. This account is for people who conduct business under their own names rather than companies. It is however not possible to open two accounts on N26 so you cannot run a business and a personal account at the same time.

The main advantage of this account is the 0.1% cashback on all Mastercard purchases which is deposited directly into your account quarterly.N26 Business Black

This is a premium account for freelancers and self-employed users that gives you all the N26 Black benefits plus the 0.1% cashback. If you are an N26 businesses user, you can upgrade to the Business Black by using the in-app ‘upgrade tab’. The plan costs €9.90 a month in Germany, Italy, France and Spain, and £4.90 in the UK.

N26 Bank features

Cash26 -Cash26 enables you to withdraw and deposit cash at more than 11000 retail stores across Germany for free. The app generates a barcode, the cashier scans it and deposits or withdraws the money from your account. Depositing is free for the first €100 every month and 1.5% thereafter. The feature is only available in Germany although this may change in the near future

MoneyBeam – This feature enables you to send money to your smartphone contacts without knowing their bank details. The money is sent instantly if the payee has a N26 account. If the payee is not a N26 user, he will access the money within two working days. If the payee does not retrieve the Moneybeam within 7 days, the money will be re-credited to your account.

Local account number and sort codes – N26 offers real bank accounts with IBANs if you are in Germany and account number and sort codes in the UK. You will, therefore, be able to set up direct debits, receive or make payments the same way you would a traditional bank.

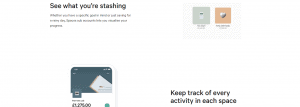

Spaces – These are sub-accounts that allow you to control your spending or set aside some money for a big purchase. You can set savings goals, move money between spaces and get notifications on how close you are on your goals. With the standard account, you get 3 spaces and up to 10 spaces in the premium accounts.

Insurance – The premium plans entitle you to a travel and purchase protection insurance underwritten by Allianz Global Assistance

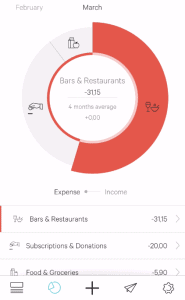

Statistics – The N26 statistics feature enables you to keep track of your daily spending. The information is automatically sorted and put in categories such as ‘ATM, Shopping or Food’. You can also add hashtags to label the transactions.

Google Pay and Apple Pay – N26 supports both Google and Apple pay. You can use your N26 Mastercard at stores, online and apps that accept either modes of payment.

N26 Security

The N26 security features include real-time account push notifications that alert you of all the account activity. Customized security settings that enable you to block payments abroad, online payments or withdrawals. You can also block or unblock your card with a simple tap if it gets lost.

N26 also offers cash rewards to encourage security researchers to inform them about bugs and vulnerabilities before any damage is done.

N26 Bank Fees

An N26 bank account is free (standard accounts) although additional charges may apply depending on your region. ATM withdrawals outside the Eurozone are charged 1.7% of the total. In Germany, France Austria, Italy and Spain, the Black account costs €9.90 in and the Metal plan costs €16.90. In the United Kingdom, the Black plan costs £4.90 while the Metal plan costs £14.90.

Is N26 right for you?

The bank is a perfect fit for people who travel a lot and can be able to use the free ATM withdrawals around the world. Especially the premium services that include insurance and purchase protection. The bank accounts are also designed to be a perfect fit for online transactions.

N26 Review Verdict

The platform operates with a full German banking license which puts it ahead of other challenger banks in terms of deposit protection. For frequent travelers, N26 has an attractive offer that promises to save them lots of money in foreign currency conversions and ATM withdrawals.

The instant push notifications and in-app security features are great measures to prevent fraud. One of the major drawbacks is depositing money into your account, you have to go to a partner shop or supermarket whose attendants may not even have the slightest idea what you are trying to do.

FAQs

How do I find my N26 IBAN or account number?

If you open the account in the UK you will not have an IBAN, but your account number and sort code can be found by going to ‘my account’ in the app or web app. The IBAN number starts with DE followed by the check digits then the bank code and ends with your account number.

Is N26 secure?

N26 uses three layers of security to protect your money. The first is the secure login, then a 4 digit confirmation pin that you can change in the app. The other layer of security is push messages that are sent for every incoming and outgoing payment.

Can I open an account if I live outside the Eurozone?

Yes, if the service is available in your country. You can open an account if you live in Poland, Sweden, Iceland, Liechtenstein, and Denmark.

Can I disable my N26 user visibility?

Yes, you can revoke your visibility as an N26 user by going to ‘my account’, ‘settings’, then ‘personal settings and personal information’. Uncheck the ‘I agree to identifiable for other users as N26 customer’. You will not appear on other people’s contacts as a N26 user.

When will my card arrive?

This depends on the destination. The card is processed and mailed immediately after you are done proving your identity. Deliveries can take up to 10 days. If the delivery fails, N26 will notify you by email.

Can I change my card limits?

Yes, you can define your limits in ‘my account’, select ‘card settings’ in the web app or mobile app. All changes will be applied instantly to all your cards.

What’s the maximum I can spend?

The monthly limit for all card transactions is €20,000. For users in France, there is a €10,000 limit for ATM withdrawals. Daily card limits are €2500 for ATM withdrawals and €5,000 for online payments. You can set your own limits within those limits in the app.

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up