Credit Karma Tax Review 2020 – Tax Filing for Free

There are a bunch of online tax software platforms that help you in simplifying your tax situation without the need of human advisor.

With the increase in online tax platforms, choosing the right platform appears like a difficult task. This is because these platforms have different tax filing process, software interface along with other features.

To help you with that, we review the Credit Karma Tax platform – which is totally free tax software for individuals and businesses.

What is Credit Karma Tax?

Founded in 2007, Credit Karma initially started providing free credit scores on a weekly basis. After the success of its credit score feature and other products, Credit Karma has launched Credit Karma Tax – which turned into a most popular feature of this online platform. Credit Karma Tax is an online tax preparation software from Credit Karma. They have built the platform to cover all the common circumstances to submit state and federal tax returns for free. The platform is completely free from beginning to the end. They don’t charge any hidden fee or commission.

The users don’t need to have a separate account if they already have a Credit Karma account. Credit Karma Tax gained popularity as it supports several major schedules and IRS forms.

What are the Pros and Cons of Credit Karma?

Credit Karma Pros:

✅Free

✅Supports most IRS and state forms and schedules

✅Clean and simple interface

✅Guidance options

✅Improved mobile access

✅Context-sensitive

✅FAQs and chat help

Credit Karma Cons:

❌ Missing some important forms

❌ Search tool not always accurate

❌ No site navigation tool

How Credit Karma Tax Works?

Credit Karma has created a simple and user-friendly tax preparation and filing platform. Although this is an online tool, it works completely like a human advisor and takes full control of the whole process by asking questions and listening to your answers. They seriously take the accuracy of calculations. This is because misleading figures could result in fines. The user, on the other hand, required to provide the right info to generate accurate figures.

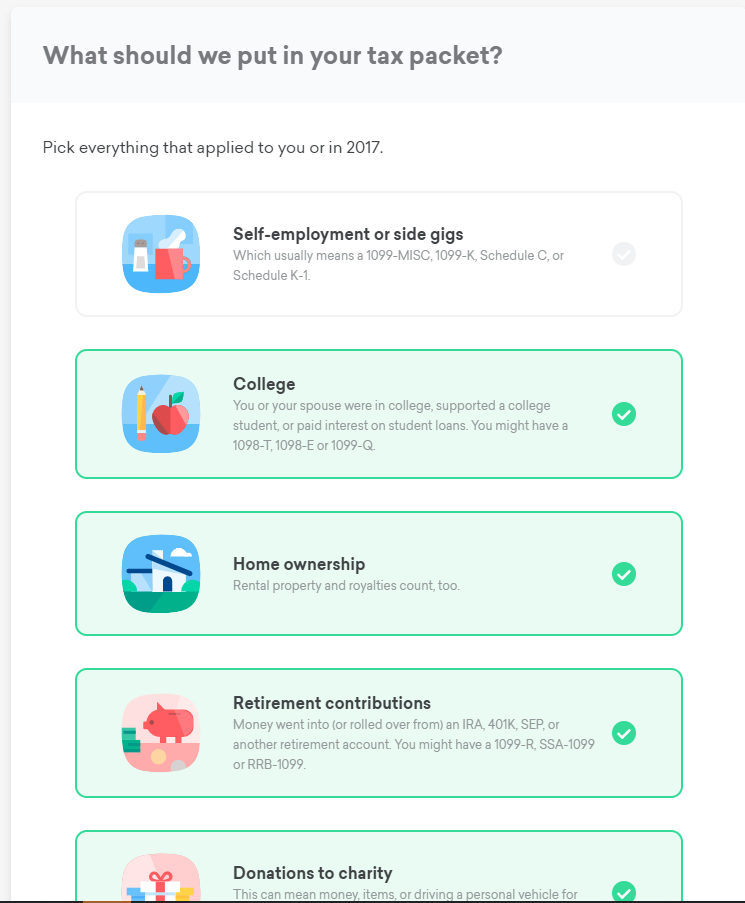

The user can easily select tax-related situations like college, home ownership, and medical expenses from its tax page. The platform is simple to use. This is because the user is only required to answer the questions by entering data and clicking buttons. Credit Karma Tax software works in the background. During the process, if you need help, the user is eligible to contact customers support. Once you are done with entering the data, the software will transfer the data to federal tax and state returns according to your requirement. They will also review all the data to remove error or omissions.

What is the Signup and Tax Preparation Process?

The signup process is simple. The user can easily create an account on Credit Karma. You don’t need to create a new account for Credit Karma Tax. The user should be U.S. citizen with a valid Social Security number. The user needs to put email address and password for signup. Once you added email address and password, the platform will send you a verification link. You need to click on the link to verify your identity. The platform can also send the verification code on your phone for verification purpose.

Once you are done with verification, you are eligible to add your tax information. The platform starts preparing your tax returns with simple questions. Below are the questions that the platform will ask:

- Where do you live?

- Do you live in two states?

- What is marital status?

- Do you own or rent a home?

After providing basic information, the platform will start asking complex questions that are directly related to your tax returns. Credit Karma Tax will show a new page with new questions. Below is the list of those questions:

- Do you work in one state and live in other?

- What you did in last year (employed and receiving W-2s, a student or self-employed)

- Any income from investments

- Rental property

- Bank account interest.

After asking questions about the inflow of money, the platform will show new questioner where you have to give details about the outflow of money. The questions are related to personal expenses, Medical related expenses and Government.

Once you are done with this basic information, the platform will review your data. They will immediately let you know whether you use this platform for tax filing or not. If they accepted your data, they will ask you to provide more information and start filing tax returns.

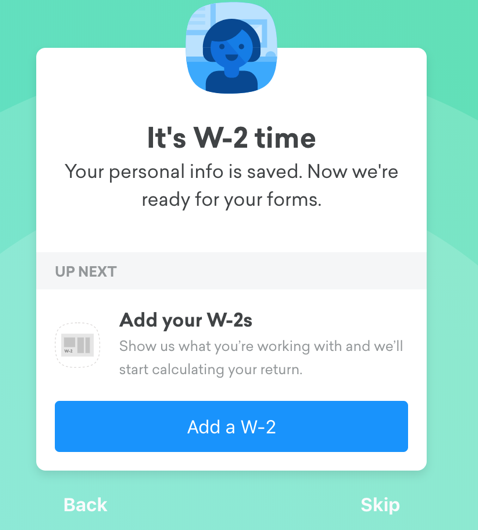

Once you click on the next button, the platform will take you to a new page – where you will see five different tabs. These tabs include Info, W-2, Life Events, State and Review. The user is required to fill the data in these tabs one by one. Starting the return is straightforward, with simple graphical buttons and a card-style interface.

Under the Basic Info tab, the user is required to sync up tax info to Credit Karma account. This step allows the platform to link tax product with the rest of its offerings. The basic information tab also includes the following questions:

- Address

- Phone

- Date of birth

- Social security number

- Filing status and dependents,

- Profession.

Form W-2 includes federal, state, social security, and other tax information.

Once you are done with W-2, you need to move to the next tab. In the Life Events tab, the user is required to enter information about donations, retirement, and investments. They have created several sub-questions for retirement, donation, self-employment, investment and so on. The user is required to add all the information. After providing all the information related to life events, the user is required to tell about his state. The user can review all the information by clicking on the review tab. You should cross check all the information to avoid errors.

What Tax Situation Credit Karma Tax Doesn’t Support?

It’s true that Credit Karma Tax is free. It allows the filing of both federal and state returns. The user can also find all schedules and deductions. However, the platform does not support certain situations. Below are the forms and tax situations that are not supported on this platform:

❌ Earned Income Credit with Non-Dependents

❌ Clergy member tax filings (e.g., ministers or pastors)

❌ Schedule J, Income Averaging for Farmers and Fishermen

❌ Schedule K-1 – Estate and Trust income

❌ Form 1040NR – Nonresident alien federal tax return

❌ Form 1116 – Foreign Tax Credit

❌ Form 2555 – Foreign Earned Income

❌ Form 2210 – Underpayment of Estimated Tax by Individuals, Estates, and Trusts

❌ Form 8332 – Release of Claim to Exemption for Child by Custodial Parent

❌ Form 8615 – Tax for Certain Children Who Have Unearned Income

❌ Form 8864 – Biodiesel and Renewable Diesel Fuels Credit

❌ Form 8885 – Health Coverage Tax Credit

❌ You want to claim the Health Coverage Tax Credit.

❌ Form 8903 – Domestic Production Activities Deduction

❌ Form 8915A – Qualified 2016 Disaster Retirement Plan Distributions and Repayments

❌ Form 8915B – Qualified 2017 Disaster Retirement Plan Distributions and Repayments.

What Forms and Tax Situation Credit Karma Supports?

Credit Karma Tax supports all the common tax situations and forms. You need to visit the website to review the list of forms and tax situations that are accepted on this platform. Below is the list of a few situations that are supported on this platform:

- W-2 Wages and Tax Statement

- W-2G Certain Gambling Winnings

- 1040 U.S. Individual Income Tax Return

- 1040-V Payment Voucher

- 1040X Amended U.S. Individual Income Tax Return

- 1095-A Health Insurance Marketplace Statement

- 1095-B Health Coverage

- 1095-C Employer-Provided Health Insurance Offer and Coverage

- 1098 Mortgage Interest Statement

- 1098-C Contributions of Motor Vehicles, Boats and Airplanes

- 1098-E Student Loan Interest Statement

- 1098-T Tuition Statement

- 1099-DIV Dividends and Distributions

- 1099-G Certain Government Payments

- 1099-INT Interest Income

- 1099-OID Original Issue Discount

- 1099-R Distributions From Pensions, Annuities, Retirement, etc.

- 1099-A Acquisition or Abandonment of Secured Property

- 1099-B Proceeds from Broker Transactions

- 1099-C Cancellation of Debt

- 1099-K Payment Card and Third Party Network Transactions

- 1099-MISC Miscellaneous Income

- 1099-Q Payments From Qualified Education Programs

What is Credit Karma Tax Refund?

Credit Karma offers a tax refund. They offer tax refund in the form of a gift card if you receive a larger federal tax refund amount or owe less in federal taxes using the same Tax Return Information. The platform permits users to contact the support team to discuss details if you are facing issues. The support team will also help in filing an amended tax return using Credit Karma Tax.

What is the Maximum Refund Guarantee?

In the case, the platform fails in solving your issue and the user decides to contact other tax services for filing an amended return, the user can submit a Maximum Refund Guarantee claim. You must fulfill the following requirements to avail maximum refund guarantee.

- The user must have filed a federal income tax return.

- The user must have filed an amended 2018 federal income tax return.

- The user amended 2018 federal income tax return must have been accepted by the IRS.

- The user submits complete Maximum Refund Guarantee claim to Credit Karma Tax.

The platform will review documents before giving acceptance. The user can expect to receive an email regarding acceptance or denial.

Is Credit Karma Tax Safe?

Yes, Credit Karma Tax is safe. The platform has an extensive history in financial services and Tax filing. The user’s reviews on the independent website are also strong. Besides all this, they use the highest level of security to protect customer accounts. Below are the security features they use for clients:

- The platform uses 128-bit or higher encryption for the protection of data during the transmission of their site.

- Credit Karma Tax is an Authorized IRS e-file Provider.

- The platform also maintains electronic, physical and procedural safeguards of taxpayer information.

- The platform use phone number and text SMS for verification.

- Two-Factor Authentication.

How Credit Karma Make Money?

Credit Karma does not charge any fee to users. Everything is free on this platform. They earn money from partners who advertise products on their website. Below are the various types of offers available on this platform:

- Best Credit Cards

- Credit Cards for Bad Credit

- Credit Cards for Good Credit

- Balance Transfer Credit Cards

- Low-Interest Credit Cards

- Rewards Credit Cards

- Cash Back Credit Cards

- Secured Credit Cards

- Personal Loans

- Auto Insurance

When the user buys the products through Credit Karma, they are entitled to receive a commission on that purchase.

What Countries are Accepted on Credit Karma Tax?

Credit Karma Tax only accepts clients from the United States. The person must have a valid social security number and other permanent residential details. Credit Karma Tax supports e-filing for the following states:

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maine

- Mississippi

- Missouri

- Montana

- Nebraska

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Utah

What is Credit Karma Tax Audit Service?

Credit Karma provides service and support in case of an audit. This service is also free. They use service of Protection Plus in the case of an audit. Protection Plus works with its clients during the audit. They will review your documents and other data to help you handle your audit.

Is Credit Karma Tax Customer Support Good?

Credit Karma Tax is popular for offering robust customer support service. They have set up broad frequently asked question segment. They answered questions related to account setup and taxation along with other general information. The user can also contact the support team via the website. The user is eligible to submit a question directly to support team. They generally respond to queries within three business days.

Credit Karma Review 2019 – Verdict

Credit Karma Tax is one of the popular online platforms for individuals and small business. The platform is free for all users. They support various types of tax circumstances and forms. They have created a simple platform for tax preparation and filing. They have set up extensive questioner – where the user has to provide data and information. They provide recommendations during the preparation of tax returns. Credit Karma Tax team also review each filing to remove errors. The availability of tax refund, strong customer support, and free tax audit service adds to the user’s confidence.

FAQs

Does Credit Karma Tax support joint filing?

Can the self-employed or small business owner use this platform?

When the user can start taxes on Credit Karma Tax?

Can the user add data through mobile phone?

Can the user file tax returns after the end of tax season?

How soon the user will get a federal refund?