MooMoo Review 2023

Moomoo is a California-based trading platform. The broker offers commission-free trading to US investors and there are no inactivity costs either, which is a major benefit.

The platform has numerous analytical tools, facilitates short selling, and is accessible via a cell phone app as well

We found the account opening process to be fast and stress-free. Read on to find out the ins and outs of this growing trading platform.

Moomoo Review: Advantages and Disadvantages

We’re going to dive into the finer details of this brokerage shortly. First, here’s a quick rundown of the key advantages and disadvantages of Moomoo.

Advantages

- Commission-free stocks for US markets

- Accessible via mobile devices

- Regulated in the US and Singapore

- Registered with FINRA

- Features tools for technical analysis

- Offers stocks from the A-Shares market (China) and Hong Kong

- No account or trade minimums

Disadvantages

- No option to buy cryptocurrencies

- Investors outside of the US need to pay trading fees

What Asset Classes Are Available?

Prior to deciding on a brokerage, it’s important for traders and investors to check what asset classes they will be able to buy and sell.

With this in mind, we’ve listed the tradable assets found at Moomoo below.

ETFs

Moomoo offers access to a range of ETFs to suit most investors. US-based ETFs are commission-free.

The platform also offers the following regional ETFs:

- Global

- North America

- Latin America

- Asia

- China

- Europe

- Middle East

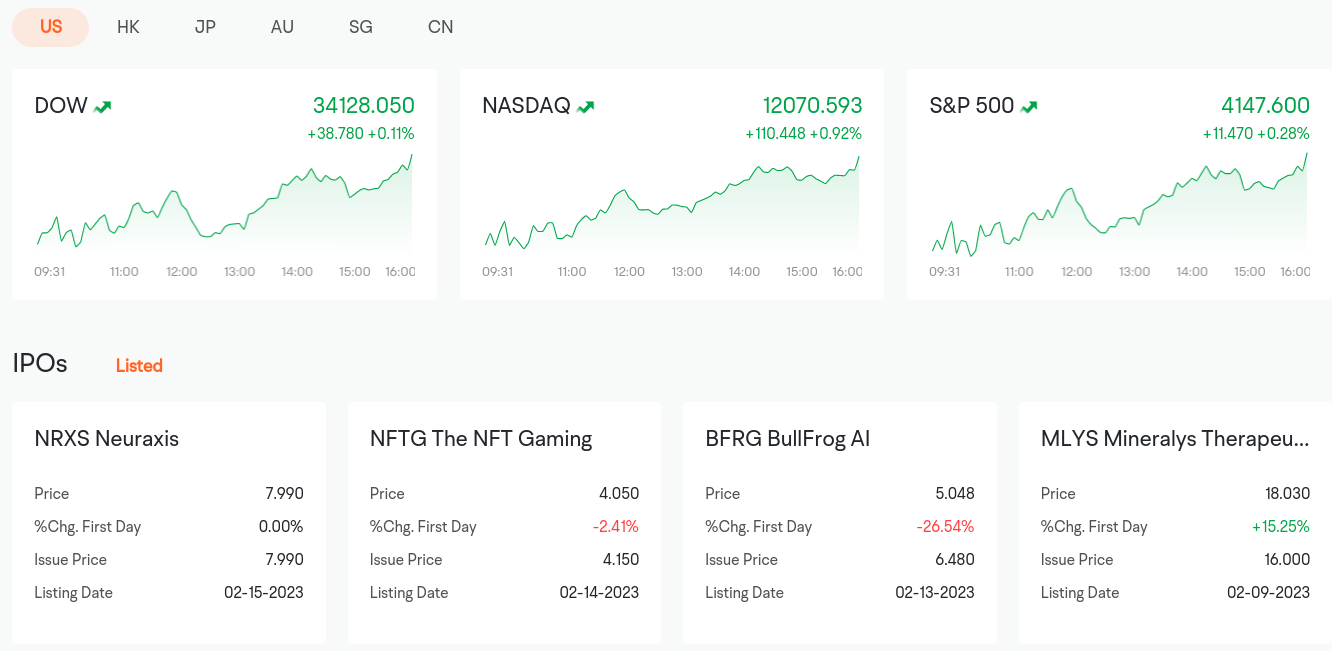

Equity Index ETFs include the S&P 500, NASDAQ Composite, Russel 2000, VIX, DJI Average, and others. This Moomoo review also discovered a range of commodity ETFs covering energy, raw materials, crude oil, gold, and silver.

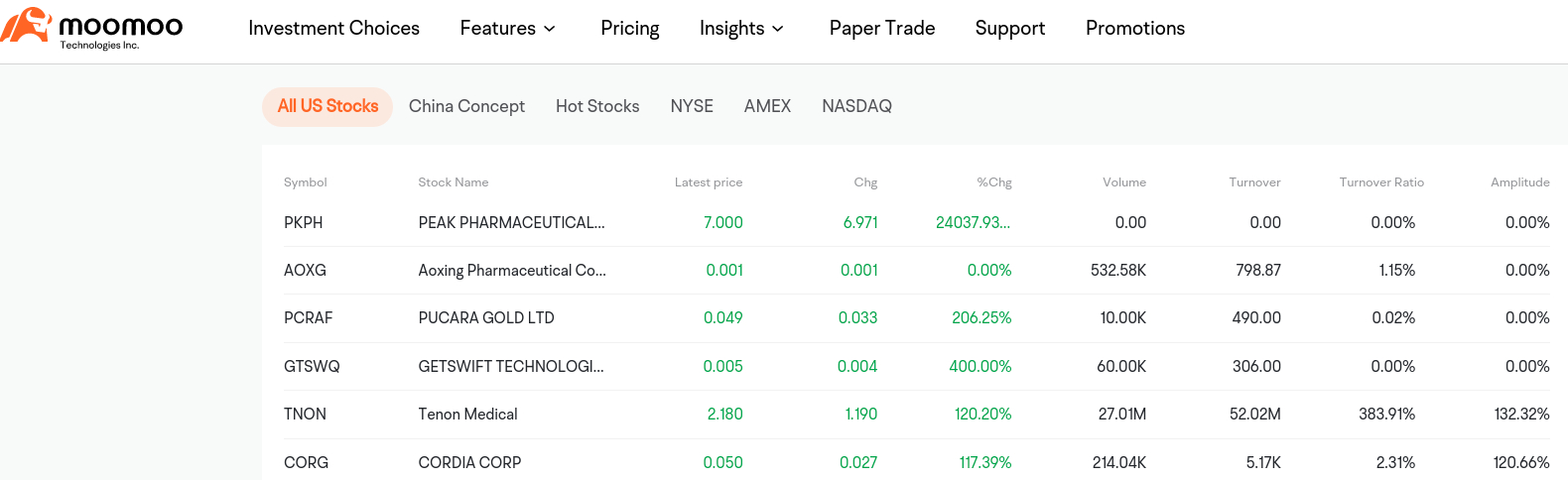

Stocks

Moomoo offers a range of US-listed stocks as well as international ones. For instance, here traders can access Chinese A-Shares, Hong Kong markets, and ADRs.

US stocks from the NASDAQ and NYSE are also available via ETFs and OTCs. This Moomoo review found more than 13,000 different stocks to trade at this brokerage.

Options

A few US and Asian options markets are accessible through Moomoo. Investors who wish to access this marketplace must pay for the contracts in order to purchase stock options.

Buyers of options contracts need to pay costs known as premiums. That said, there is no commission on those in the US when trading via Moomoo.

Futures

Moomoo offers a range of different futures. These are futures from the CME (Chicago Mercantile Exchange Group) equity index futures, in addition to SGX (Singapore Exchange) A50 futures.

Here are some examples of popular futures we found when compiling this Moomoo review:

- E-mini Nasdaq-100, S&P 500, Dow, and Russell 2000

- Micro E-mini S&P 500 Index Futures (at $5)

- Dow Index Futures

- S&P Index Futures:

- NASDAQ Index Futures

This platform also offers futures on metals via CME on gold and silver. There is also a micro gold contract, which is just 10% the size of the ordinary contract.

Moomoo Fees

Like many online brokers, Moomoo charges fees. To give traders and investors the full picture, we’ve listed all potential fees below.

Margin

For US and Hong Kong equities, Moommoo will charge a margin fee of 6.8%. This is even higher for the A-Shares market, in which case 8.8% will be payable.

Furthermore, to access margin, traders must have a least $2,000 in their account. It’s important to note that this legal requirement applies to all brokerages, not just Moomoo.

Here’s a comparison table showing the difference between US and international fees at Moomoo:

| Asset | Non-US | US Residents |

| Options | $0.65 commission in addition to $0.65 per contract | 0% in addition to $0.65 per contract |

| US ETFs and Stocks | $0.0049 per share with a minimum of $0.99 per order | 0% |

| A-Shares Market | 0.03% or 3CNH. Whichever is higher will be payable | 0.03% or 3 CNH. Whichever is higher will be payable |

| Hong Kong | 0.03% or HK$3 Whichever is higher will be payable | 0.03% or HK$3. Whichever is higher will be payable |

| Short Margin | Changes every day | Changes every day |

| Long Margin for US Shares | 4.8% per annum | 6.8% per annum |

| Long Margin for Hong Kong | 6.8% per annum | 6.8% per annum |

| Long Market for A-Shares | 8.8% per annum | 8.8% per annum |

Commission

US investors won’t need to pay commission fees to trade in domestic markets at Moomoo. They will, however, need to take into account the spread when ETF and stock trading.

- The same can’t be said for international trades, as investors will need to pay 0.03% on non-US stocks

- For ETFs and stocks, non-US residents will pay $0.0049 per share with a minimum order of $0.99

A full fee schedule, which includes commissions, can be found on the Moomoo platform.

Platform

Non-US residents pay a fixed platform fee of $0.005 when stock trading. That said, it’s also possible to choose a tier, which is based on the amount traded per month.

- For instance, non-US residents who trade between 1 and 500 shares will pay $0.0100.

- Those who trade between 10,001 and 50,000 shares per month will pay a fee of $0.0055.

- The lowest is $0.0030, which is reserved for those who trade in high volumes.

- There are 10 tiers in total.

The standard platform fee when options trading is $0.03. Again, there is also a payment structure based on tiers for options.

Between 1 and 50 contracts per month are charged at $0.60 each. The lowest possible contract fee is $0.05. Notably, Hong Kong stocks attract a fee of HK$15 for each order when executed from a US Moomoo account. This is 15CNH for the A-Shares market.

Transaction Fees

We found a range of different transaction fees when compiling this Moomoo review. We’ve added these to a table below so investors know what to expect:

| Method | Deposit | Withdrawal |

| Domestic Wire Transfer | $10 | $20 |

| International Wire Transfer | $10 | $25 |

| ACH | No fee | No fee |

We also discovered a number of other fees at Moomoo. An outgoing stock transfer will be charged $75, for instance. Meanwhile, paper statements and assisted phone trading cost $3 and $10 respectively.

Regulatory Trading Fees

We found numerous regulatory fees when compiling this Moomoo review. Both US and international traders will all pay regulatory fees at this brokerage. US residents will need to pay an SEC fee. The calculation is 0.0000229 * the value of the transaction.

There are also different fees when trading A-Shares and those in Hong Kong. This will include things like handling charges, securities management, stamp duty, dividend tax, and portfolio fees. There is a full list for both US and international residents available on the Moomoo platform.

Moomoo Trading Tools

As with many online trading platforms, our Moomoo review found that the platform offers a range of tools to help traders try to make sense of the markets.

Here are some of the most notable trading tools at Moomoo.

Market News and Insight

Moomoo offers news feeds from well-known financial media channels including CNBC and Dow Jones Newswires, in addition to its exclusive market analyses. Additionally, feeds can be altered according to positions.

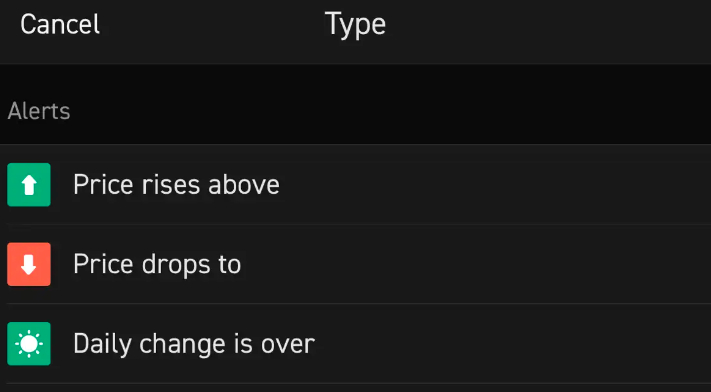

Stock Alerts

To save tracking individual assets, Moomoo also offers stock alerts. Traders can choose their preferred frequency. This allows the trader to set a price and the alert can be customized to include how many reminders they receive, how often (hourly, daily, and so on), and more.

The trader can then choose a range of other alert options to keep them abreast with the latest price movements of their chosen asset.

Level 2 Market Data

Users of Moomoo with approved brokerage accounts are entitled to free level 2 data.

Investors can learn important information about buy/sell price ranges of quotes filed and much more via this feature.

This information is an essential part of many trading methods. In essence, level 2 market data gives stock traders knowledge about the supply and demand of the asset they have selected.

Customizable Market Alerts

Moomoo offers personalized and thorough alerts for other assets too. This ensures that traders don’t miss any crucial opportunities.

- Traders can configure their own price, bid/ask, and event alerts

- These alerts are provided via in-app and mobile notifications

- Traders can study the market from any location at any time

The AI Monitor used by the Moomoo platform makes it simple to locate assets that are moving amid thousands of data points. The software also gauges market emotion by charting long/short distribution and price volatility

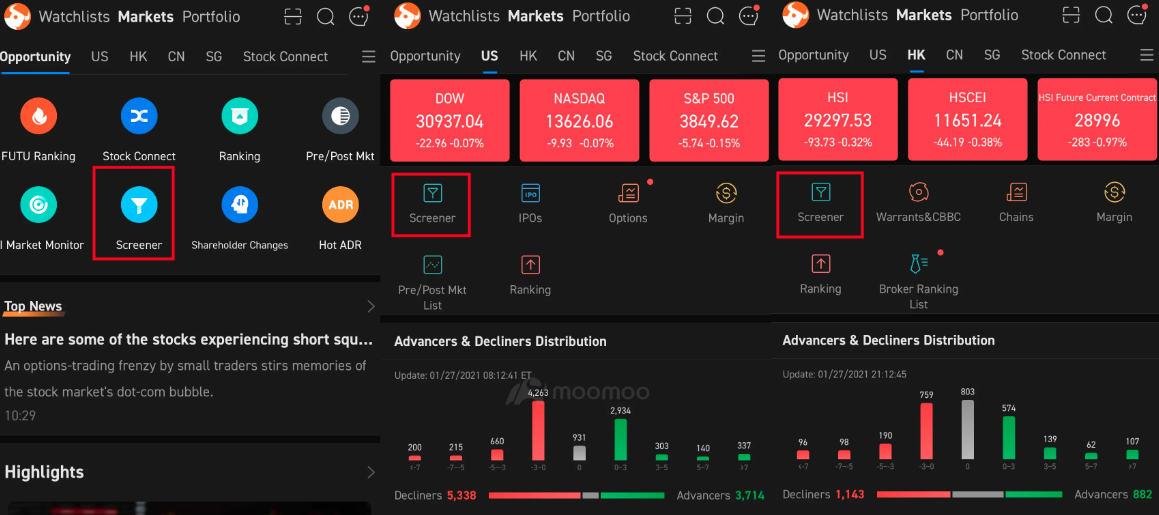

Stock Screener

Moomoo offers stock screeners. For those unaware, this filters equities that match the investor’s requirements. The Moomoo Screener allows stock screening covering range, quotes, financial, and technical.

Investors can arrange them in many unique combinations. Although this is a handy trading tool, to make a good investment, keep in mind that research is equally essential.

Technical Indicators and Charts

Moomoo offers 38 different drawing tools and a range of custom indicators with more than 190 pre-set functions to choose from.

Additionally, our Moomoo review discovered over 63 signs for conducting in-depth technical analysis. Investors can monitor six different stocks simultaneously at Moomoo.

Supported Payment Types at Moomoo

The supported payment types at Moomoo are limited compared with some other platforms. Traders and investors are only able to fund their accounts with bank wire transfers or ACH.

Bank wire transfer deposits can take up to three business days to clear and this will delay the trader’s ability to place any orders.

The alternative is to opt for ACH – which allows the trader to get started right away.

Moomoo Deposit Requirements

There is no minimum deposit requirement at Moomoo. Although, notably, fractional investing is not an option here. As such, investors will need to ensure they deposit enough money to buy whichever asset they are interested in.

Promotional Offers at Moomoo

At the time of writing, Moomoo is offering up to 15 free stocks worth between $3 and $2,000 for opening an account at the brokerage.

Those who open an account, but don’t fund it, will get one free stock, level 2 data, low margin rates, and 0% commission (US residents only).

Open an account and make a deposit of $100 to receive the above-mentioned benefits, along with five stocks. Those who sign up and fund their account with $1,000 or more will receive 15 free stocks from Moomoo. Investors have 60 days to unlock the free stocks they are given.

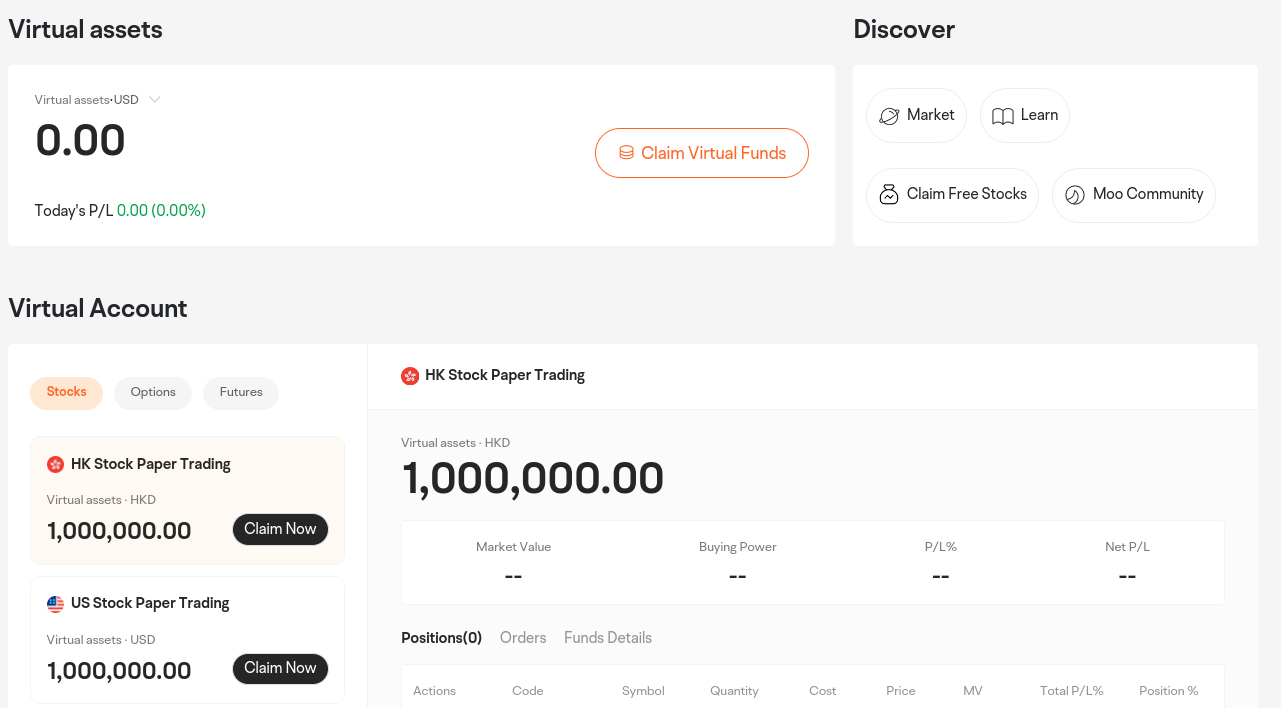

Moomoo Demo Account

There is also a paper trading account available at Moomoo. This allows traders to access $1 million in virtual money to hone their skills.

Moomoo also offers a virtual stock simulator. This enables traders to take their strategies for a test drive in an environment that mimics real market conditions.

Customer Support Options

Customer service options include a hotline, an email address, and a 24/7 live chat box that’s available on the Moomoo app. The fastest response time is provided through the live chat option.

Moomoo Broker Licensing

Moomoo is owned by Futu Holdings Ltd., a firm listed on the NASDAQ. Moomoo Financial Inc. is registered with FINRA (Financial Industry Regulatory Authority).

The app is also a member of the SIPC (Securities Investor Protection Corporation) and holds a license with the SEC (U.S. Securities and Exchange Commission).

Who Can Trade At Moomoo?

Moomoo can be accessed by traders of all skill levels. The platform will be helpful to experienced traders who want a wide variety of trading tools. Moomoo should also be suitable for newbies who want to learn more about trading and access a virtual paper account.

Traders and investors are accepted from the US, Taiwan, Malaysia, Macao Special Administrative Region, Japan, Singapore, and Hong Kong. Additionally, Moomoo announced its formal launch in Australia in early 2022.

Moomoo Sign-up Guide

This Moomoo review has so far covered the ins and outs of this popular brokerage. We’ve covered tradable assets, tools, licensing, promotional offers, and more.

Those who like the sound of Moomoo can follow this five-step guide to sign up and start trading today.

Step 1 – Register With Moomoo

The first step is to register an account with the Moomoo trading platform. This is a simple case of entering an email address, and also a strong password.

Alternatively, it’s possible to register via social media.

Step 2 – Open an Account

Once registered, investors can open a brokerage account with Moomoo. When prompted, enter a full name, address, and date of birth. Investors will need to have some ID handy at this stage for regulatory purposes.

Upload the ID when prompted by the broker. Moomoo will allow traders and investors in the US to open an account using their social security number.

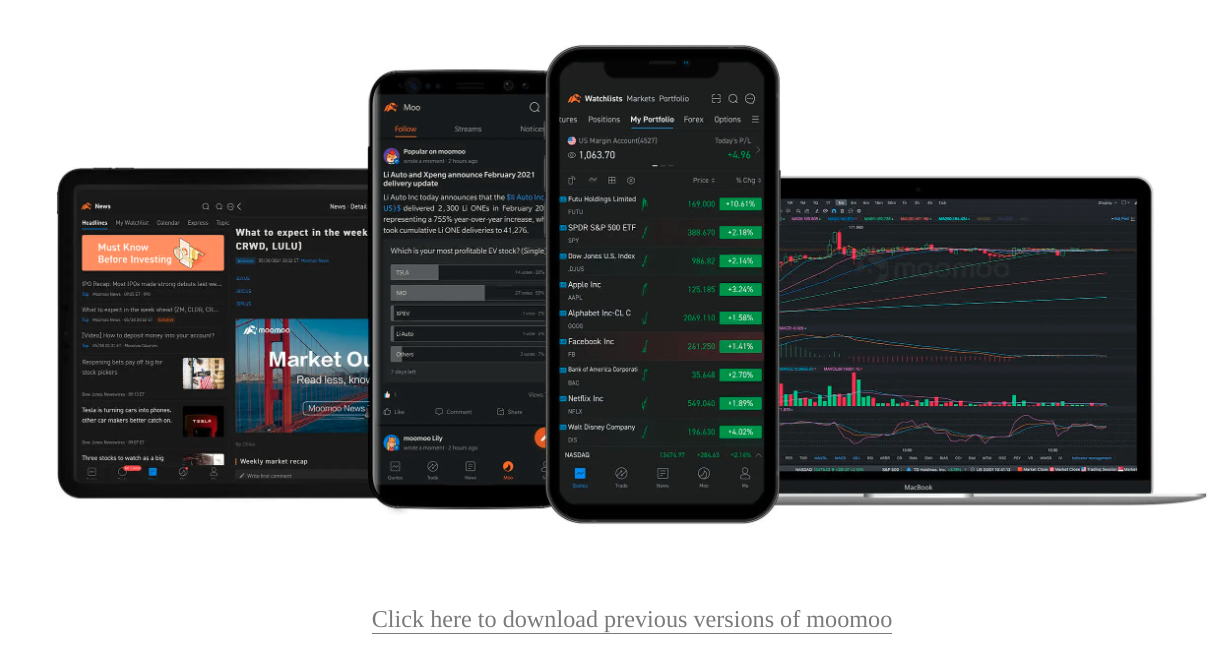

Step 3 – Install then Moomoo App

To start trading at Moomoo, download the app.

Do note that the Moomoo trading platform is supported by Windows, Mac, Apple, Android, and others. Investors could also opt to download the app by pointing their camera at the QR code for added convenience.

Step 4 – Make a Deposit

As we touched on earlier in this review, there is no minimum deposit in place at Moomoo. As such, investors will need to consider how much their chosen asset is when funding their account.

Deposit options are limited and include bank wire transfers and ACH. The latter is the fastest option.

Step 5 – Locate the Asset and Place an Order

At this point, the trader should have a fully funded brokerage account. As such, they can now choose an asset class, and search for the specific one they wish to trade.

Click ‘Trade’ once found and then enter the amount to allocate to the asset. In many cases, there will be a variety of order types to choose from, such as stop-loss and take-profit.

Moomoo: The Verdict

That concludes our thorough review of the online trading platform Moomoo. The brokerage allows US citizens to trade stocks, options, and ETFs without paying any commission.

Advanced analytical tools are available on Moomoo’s user-friendly mobile platform. This means that traders can buy and sell assets in addition to conducting much-needed research while on the move.

FAQs

Is Moomoo good?

This review found Moomoo to be a good commission-free broker for US traders. Although there aren’t assets such as cryptocurrencies, there are plenty of stocks from the US and Asia This is in addition to ETFs, options, and futures. The platform is offering 15 free stocks when you sign up for an account today.

Does Moomoo have a regulatory license?

Yes. Moomoo holds a regulatory license from the SEC in the US. The platform is also a member of SIPC and FINRA, in addition to being regulated in Singapore.

Can US residents use Moomoo?

Yes. US residents can use Moomoo to trade stocks, ETFs, options, and futures. US residents have an advantage over international traders as they can access most assets on a commission-free basis.

Moomoo is a financial information and trading app offered by Moomoo Techonologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate of them. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided by the influencer are their own and not necessarily the views of MFI, MTI or moomoo. They do not endorse any trading strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation to engage in any investment or financial strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should always be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes.