How to Buy Aviva Stock For Beginners in 2021

There are numerous regulated brokerages online that allow you to buy and sell Avia shares at the click of a button. You simply need to choose a broker that meets your needs, deposit some funds, and select the number of Aviva stocks that you want to purchase.

In this article, we provide you with a step-by-step guide on how to buy Aviva stock and also review the best two online brokerages where you can buy Aviva stocks.

-

-

How to Buy Aviva Stock in 3 Quick Steps

Want to buy Aviva stock right away? Follow this 3-step guide:

[three-steps id=”196856″]Where to Buy Aviva Stock

Here, we discuss the best two online brokerages that allow for the trade of the Aviva stock:

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

Detailed Provider Review

1. eToro – Best Stock Broker for Worldwide Customers

Our Rating

- Catered to newbie traders

- 0% commission on ETFs and stocks

- Supports heaps of everyday payment methods

- Minimum withdrawal of $50

- High spreads

- MT4/5 not available

75% of investors lose money when trading CFDs2. Plus500 – Trade Aviva Stock CFD on a Feature-rich trading platform

If you're looking to invest in Aviva shares on a short-term basis, we would suggest considering Plus500. The UK-based broker, which is itself listed on the London Stock Exchange, allows you to buy Aviva stocks in the form of CFDs.

CFDs allow you to speculate on the future direction of the price of an asset without actually owning that particular asset. This means that you won't be entitled to Aviva dividends.

It also means that you can 'short sell' Aviva and any other listed stock, which typically involves speculating on the price of Aviva stocks going down.

Plus500 traders get access to attractive leverages of up to 1:30, they don't pay trade commissions to trade stock CFDs, and also benefit from variable but highly competitive spreads. Additionally, the broker doesn't charge any deposit or withdrawal charges, and neither do they have other hidden charges.

To get started at Plus500 you first need to open an account with the online broker and pass their KYC/AML verification process by sending them a copy of your ID/driving license. You can then proceed to deposit a minimum of $100 via Paypal, a debit/credit card, or bank transfer.

Plus500 UK LTD is authorized and regulated by FCA and holds operating licenses from Australia, Cyprus, and Singapore.

Our Rating

- Fast order execution

- Commission free trades with variable spreads

- Wide range of sophisticated technical tools

- Stocks only available via CFDs

- One may consider their currency conversation fees high

80.5% of retail CFD accounts lose money.How to Buy Aviva Stock from eToro

Here is the step by step guide on how t buy Aviva stock CFDs on the all-popular eToro trading platform:

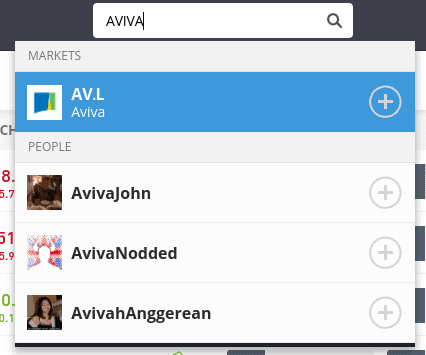

Step 1: Search for Aviva Stock

Login to your eToro account and enter ‘Aviva’ into the search box at the top of the page.

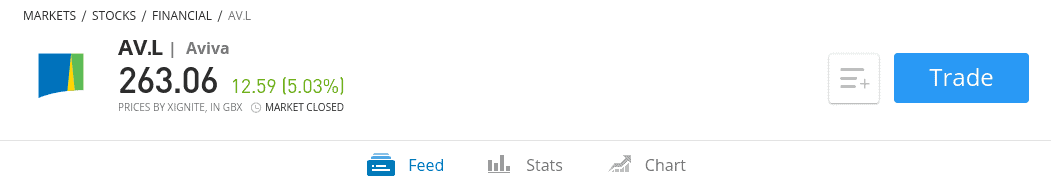

Step 2: Click on ‘Trade’

Click on the ‘Trade’ button to proceed with your purchase. Alternatively, spend some time on the Aviva analysis page to perform some independent research.

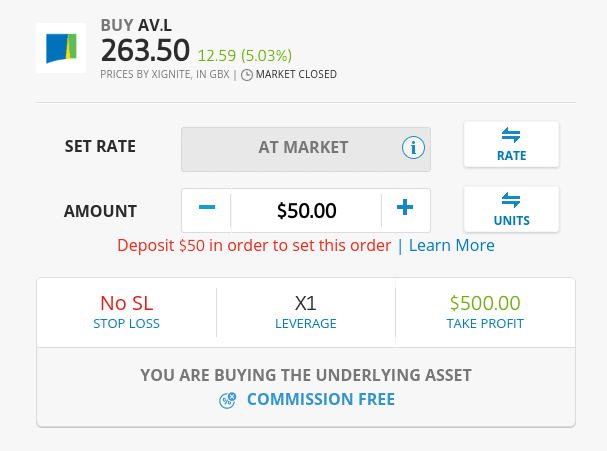

Step 3: Set-Up Order and Buy Aviva Stock

You then have to set up the trade parameters:

These include:

- Amount: Enter the amount of Aviva stocks you wish to buy in dollars and cents. For example, if you only want to invest $25, enter $25 into the ‘amount’ box.

- Set Rate: If you are happy buying Aviva stock at the current market price, leave this as a ‘market order’. If you want to specify the price that you enter the market at, change it to a ‘limit order’.

- Stop Loss: You are advised to set up a stop-loss order. This will close your trade automatically when the price is triggered, meaning you will mitigate your risks if the market goes against you.

- Take Profit: If you want to lock in your gains when a certain price target is met, set up a take-profit order.

Finally, click on ‘Buy’ to complete your Aviva stock order.

Why Invest in Aviva?

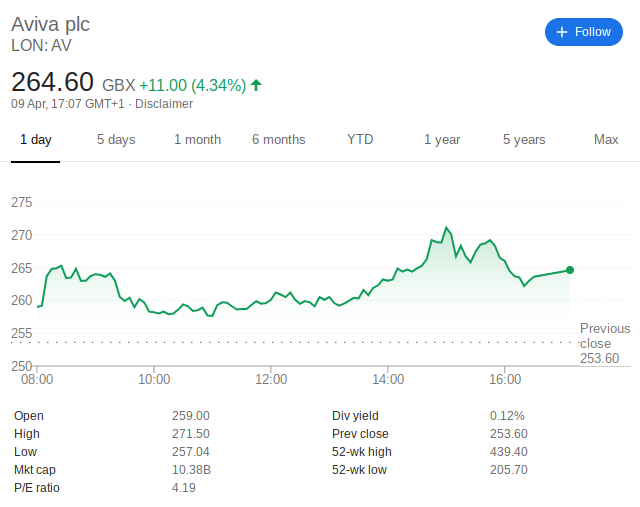

Aviva’s stock price has been super-volatile since its public listing in 1995, so it’s important that you understand both the risks and rewards of making an investment. Below we have listed some of the reasons why you should consider adding the insurance company to your portfolio.

Aviva Continues Cost-Cutting Measures

Although Aviva now has operations in several continents, many of its overseas locations are unprofitable. As a result, management is looking to cut costs wherever possible. At the forefront of this is the Asian marketplace, where Aviva has already rolled out an exit plan.

The company has also sold a number of its unprofitable domestic subsidiaries. And these cost-cutting measures have paid off as, as the insurer currently maintains a Solvency ratio of 194% – which is ahead of its target of 180%.

Recent Financials Were Positive

Aviva’s most recent earnings report in late 2019 noted a 1% increase in operating profits to £1.4 billion. The company put this down to better than expected revenues in its general insurance division. The Q4 2019 earnings report also noted a 3% increase in dividend yield to 9.5p per share. And this makes it interesting for dividend-investors who are looking for a mix of capital gains and regular incomes.

Re-energization Strategy From CEO

CEO Maurice Tulloch, who was appointed in 2019 after 28 years of service at Aviva, has stated that he is keen to implement a “re-energization” strategy. This will centre on reducing the complexities of insurance in the consumer division, as well as placing a strong focus on the end-to-end customer experience. Snd with over three decades of experience at Aviva, Tulloch is arguably the right man to take the company forward.

About Aviva Stock

Company and Stock history

Aviva is a UK-based insurance firm with operations in more than 16 countries. Led by CEO Maurice Tulloch, the company claims to have more than 33 million customers drawn from all over the world. It covers multiple insurance-based sectors, including but not limited to health insurance, car insurance, life insurance, and pet insurance. Aviva is also home to a global pensions division.

The company is publicly listed on the London Stock Exchange with a Q2 2021 market capitalization of £10.3 billion. Aviva shareholders have enjoyed both good and bad times since its 1995 IPO. For example, stocks were originally priced at 500p per share, rising to 1,236p per share just three years later. This represents an increase of just under 150%.

However, its share has been on a downward spiral. In April 2020, Aviva stocks were going for 246p per share – translating to over 78% decrease in value from its 1998 peak price of 1,236p. Even more of a concern is the fact that Aviva stocks are worth less than the company’s listing price of 500p.

Should I Buy Aviva Stock?

It’s difficult to put a strong case forward for Aviva. Much of this centres on the company’s abysmal performance as a PLC pretty much since it went public. While the firm did enjoy three years of success on the London Stock Exchange with a post-IPO jump of 147%, its shares have been on a downward spiral ever since.

As such, it is now cheaper to buy Aviva stocks than it was back in 1998. Could this point towards the possibility that Aviva’s IPO was heavily overpriced? Potentially. And even if this isn’t the case, there is still a lot of upside on Aviva’s current share price.

With the guidance of new CEO Maurice Tulloch, Aviva is finally looking to exit non-profitable overseas markets. Its most recent earnings report was also promising, with a 1% increase in operating profits, as well as a 3% rise in dividends. Ultimately, you need to perform some independent research prior to investing in Aviva stocks.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Glossary of Stocks Terms

StockA stock is a representation of a company’s equity. When a company wants to raise capital, it issues stocks to the public. It is the aggregation of the total stocks owned by one individual that inform their shareholding of the company.

SharesA share is an indivisible unit of capital that expresses the ownership relationship between a shareholder and a particular company, mutual fund, REITs or limited partnership. A share indicates a portion of ownership (claim) that one has on a company or fund.

DividendDividend refers to the portion of the company’s profits that is distributed to its stockholders. It can be on a quarterly or annual basis.

Bull marketA bull market is an economic condition where the stock markets are in an extended period of consistent increase in stock prices.

Bear MarketA stock market is said to be bearish if it is involved in extended periods of continuous price decrease of the stock prices.

Stock ExchangeA stock exchange is an institution or a platform where shares and stocks and a host of other money market instruments are traded.

Return On Investment (ROI)The return on investment is the profit you make from trading in or investing in shares and stocks of a particular company. It often comes from selling the investment at a higher price than was originally bought or benefiting from dividends and other profit-sharing schemes as a result of owning and holding onto a particular investment.

BrokerA broker may be a person or entity that engages in the buying and selling of different types of investments on behalf of other individuals or entities at a fee (or commission).

Day TradingDay Trading is the practice of buying a money market investment product and selling it as soon it reports price increase or loss, within the same day. Traders engaged in day trading are referred to as “day traders” or “active traders”

ArbitrageArbitrage is the act of buying and selling security at different stock exchanges or markets with varying prices. If, for instance, stock ABC sells at $11 on one exchange and $11.75 on the other, arbitraging involves buying from at the low price exchange and profiting by selling it at the higher-priced exchange.

IndexA stock index is a statistical measure of the change in the stock and securities market. It comprises a hypothetical portfolio of different companies whose change in prices is calculated to determine market performance.

Initial Public Offering (IPO)The Initial Public Offering refers to the sale of company stock to the public for the first time. It is the act of taking a company public and is highly regulated by such financial regulators like the SEC in the USA and FCA in the UK.

OptionsOptions are derivative financial instruments whose price is based on the value of their underlying tradable security like shares and stocks. They are contracts that give the holder an option to buy or sell the underlying asset at a later date. Unlike futures, an options contract holder has the choice to buy/sell or not.

Call optionsThis is an options contract that gives the holder an option to buy the underlying asset before the expiry date.

Sell optionsThis option gives its holder the choice of selling the underlying asset before its expiry date

Mutual FundsA mutual fund refers to a company that pools funds from different investors and invests these funds in stocks, bonds, and other financial market securities. They then distribute the capital gains from these invests to their members.

Over-the-CounterThe process through which stocks for companies that are not listed with accredited stock exchanges like the NYSE are traded. It is a broker-dealer network for unlisted stocks for companies that do not meet listing requirements set by the organized exchanges.

OverboughtA stock is said to be overbought if it is traded excessively over a short period of time and at unjustifiably high prices.

OversoldA stock is said to be oversold if it is consistently traded below its true value.

Ask PriceAlso referred to as the offer or asking price, this refers to the lowest price that the seller will take for a stock.

Bid PriceBid price refers to the maximum price that a buyer is willing to pay for a stock.

VolumeIn the stock trading context, Volume refers to the number of shares that change hands within a given period of time, be it a day, month or annually. It is trading/investment indicator where rising trade volumes point to a healthy stock while dwindling volumes are indicators of investor pessimism towards a stock.

VolatilityRefers to the statistical measure of the change in price of a stock over a given period of time. It is a measure of the rate and the time it takes for a stock price to move from high to low and how long it remains within a certain price range. The higher the volatility, the higher the risk.

52-Week HighThis refers to the highest closing price recorded by a given stock in the last 52 weeks.

52-Week LowThis refers to the lowest closing price that a particular stock recorded in the last 52 weeks.

Bid-Ask SpreadThe bid-ask spread refers to the difference between the lowest price that a seller is willing to take for their stock and the highest price that a buyer is willing pay for the stock. It is the difference between the quoted ask and bid prices.

Market OrderA market order is an instruction by an investor to the broker or brokerage platform asking them to buy/sell a stock or any other security at the best price available at that moment. It is often issued when an investor wishes to enter or exit the market quickly and at the prevailing rates.

Limit OrderA limit order is an order that triggers a sale or buy when a predetermined or better price is met. For a buy limit order, the buy order is executed once the set limit price or a better price is triggered. The sell limit order on the hand triggers the sale of stocks if the limit price or better price is hit.

Stop OrderAlso referred to as a stop loss order, it is an order that triggers a buy or sell action once a predetermined price level is hit. It is designed to help you minimize possible loss on a given trade should the markets move against your bet.

Take ProfitTake profit is a type of limit order dictating the price level at which the broker or brokerage platform is to close a trade for profit.

Capital GainsCapital gain refers to the value rise of a tradable financial instrument that makes its selling price higher than the buying price. It can also be referred to as the profit realized from liquidating a capital investment like stocks.

ETFsAn ETF is a collection of many tradable instruments like bonds, stocks, and commodities. These are listed on the exchanges and traded like ordinary stocks.

Debt-to-Equity RatioThe debt-to-equity (D/E) ratio is a financial ration tool used to measure the financial health of a company by gauging value of its equity in relation to debt. It is achieved by dividing the company’s total liabilities in relation to its shareholder’s equity.

Dividend InvestingThis is an investment strategy where the investor only buy shares that have consistently paid out high dividends in the past or others with the fastest dividend rates. Dividend investing strategy advocates are more interested in how much a shares pays in dividends than its price fluctuations.

Growth StocksGrowth stocks refers to the stocks of companies that are expected to grow at a faster rate than the industry average and report consistent and sustainable cashflows. The company sales and revenues are also expected to increase at a faster than that of an average company in the same industry.

Penny StocksThese are also referred to as micro-cap or nano-cap stocks and refers to the stocks of relatively small companies valued less than $5 and only trade via the Over-The-Counter markets.

Blue ChipA blue chip refers to a nationally recognized and financially sound company with a long and stable record of consistent growth. It is company whose financial might and nature of operation make it well suited to face turmoil and remain profitable in the uncertain economic conditions..

Short SellingShort selling is a trade/investment strategy where the investor is banking on the decline of the shares of a particular company. They therefore borrows these shares, sells them at the current market price and buys them back after they lose value, effectively profiting from the price difference.

YieldYield refers to the profit/earnings generated from investing in a particular stock or market instrument over a given period of time and is expressed a percentage of the stock’s market value, face value or as percentage of invested amounts.

Capital StockCapital stock, also referred to outstanding shares, refers to all the regular shares issued by a company and held by all its shareholders including the restricted/locked-in shares held by company insiders, executives, and institutional investors. The number of capital stock is used in calculating key metrics including cash-flow per-share and earnings per share.

Earnings Per Share (EPS)EPS refers to the monetary value, the profit or earnings attributable to each outstanding shares held by a company. It is a financial ratio that is arrived at by dividing the company’s profit by its outstanding shares of the common stock.

Price Earning Ratio (PER)Also referred to as Price-to-earnings ratio, PER is a financial metrics tools used to check if a company’s shares are over/undervalued by dividing the shares current market price with its earnings-per-share.

FloatA company’s flat refers to the number of regular shares issued to investors that are available for trading. The float shares figure is arrived at by subtracting the locked-in shares held by company insiders and executives from its capital stock.

Gap-up StocksGap up stocks refer to company stocks that open the day trading at relatively higher prices than their previous day’s closing price. This is often attributed to the after-market trading activity.

Gap-Down StocksGap down stocks refers to company stocks that open the day trading at relatively lower prices that the previous day’s closing price. For instance if a company stock closes the day trading at $50 but opens the following day trading at $45, it is said to have a 5-point gap down.

Stock BuybackStock buyback, also referred to as share repurchase, occurs when a publicly listed corporation uses a part of its revenues to buy back its shares from the marketplace. The move effectively reduces the number of company shares in circulation, which translates to an increased share price.

HOLDHOLD is a financial recommendation issued by a qualified financial institutions or financial analyst advising investors/traders not to buy or sell a particular stock. It is a no-action situation where long position traders are advised not to sell and others investors advised not to buy into the stock.

Resistance LevelsThis refers to the upper-most price level that a particular stock or any other security reaches but doesn’t exceed due to dwindling number of buyers and an increasing number of sellers.

MacroeconomicIs a branch of economics that’s concerned with the study of how the economy and different large-scale markets are structured, how they behave, and how they perform.

RSIRelative Strength Index is a technical momentum indicator used in market analysis to determine if a stock is overbought or oversold by measuring the magnitude of a recent bullish or bearish price run. It has a scale of 0-100 where RSI readings of 70+ indicate a stock is overbought while an RSI reading below 30 is an indicator of an oversold security.

Moving AverageMoving Averages is a statistical calculation that is specially designed to identify the arithmetic mean of a given number of data sets or range of prices calculated over a given period of time. Each of these data set or price range is created by the average/mean price for that subset. For instance, a single data point on a moving averages scale may represent the average stock price for a day or trading session.

Bollinger BandsBollinger Bands are a technical indicator tool characterized by two statistical carts that run alongside each other indicating the changes in prices and volatility of a financial instrument like stock or commodity over a given period of time.

Fibonacci RetracementsFibonacci retracements refer to two horizontal lines that use the Fibonacci numbers to measure the percentage of price retracement in a bid to indicate where the resistance and support are most likely to occur.

FAQ

What is Aviva all-time high stock price?

Aviva last hit a new all-time stock price in 1998, where its share were priced at 1,236p.

Who is the current CEO of Aviva?

After 28 years working his way up through the ranks, Maurice Tulloch was made CEO of Aviva in 2019.

Does Aviva pay dividends?

Yes, Aviva has a long-standing track record of paying dividends.

Do I need to buy whole Aviva shares?

No, the stock brokers that we have listed on this page allow you to buy fractional shares in Aviva.

What stock exchange are Aviva stocks listed on?

Aviva is listed on the London Stock Exchange.

When did Aviva go public

Aviva went public in 1995 with a IPO listing price of 500p.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up