Gemini Exchange Review 2022 – Is it Legit?

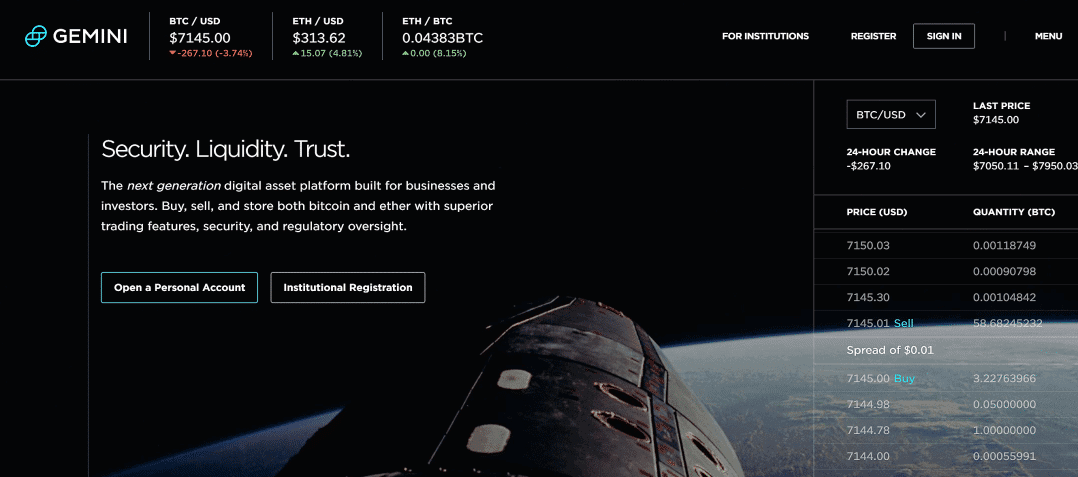

Gemini Trust LLC describes their crypto exchange as a “rules-based marketplace with security at its core.” This, according to the company website, stems from the “institutional-grade crypto storage” and “industry-leading security” measures that the company has put in place.

The exchange is a house of many firsts given that it was one the first crypto exchanges to be fully registered and licensed to operate in the United States. Gemini was also the first crypto exchange to pass the SOC 2 security verification that tests the efficiency and strength of its cybersecurity systems. Moreover, it also was the first crypto exchange to insure their client deposits.

But how reliable and efficient is the Gemini crypto exchange platform? How comprehensive is its trading platform and to whom does it appeal most? We have reviewed the company’s services and here is everything you need to know about Gemini Crypto exchange.

-

-

eToro wallet

Our Rating

- Highly regulated BTC wallet

- #1 cryptocurrency platform

- Accepts Paypal

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Note: Gemini is by far one of the safest crypto exchanges currently available. The exchange has come up with several proprietary cybersecurity technologies, insured its customer deposits, and applied for registration and licensing with one of the world’s financial markets regulator.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Note: Gemini is by far one of the safest crypto exchanges currently available. The exchange has come up with several proprietary cybersecurity technologies, insured its customer deposits, and applied for registration and licensing with one of the world’s financial markets regulator.GEMINI Exchange’s Overview

Going through the number of markets and coins the Gemini exchange has been involved in, you will notice that it has not been as aggressive as its competitors. It is only engaged in limited markets, and will only incorporate a limited number of both crypto and fiat currencies.

Going through the number of markets and coins the Gemini exchange has been involved in, you will notice that it has not been as aggressive as its competitors. It is only engaged in limited markets, and will only incorporate a limited number of both crypto and fiat currencies. Looking at the exchange’s operations, we can’t help but feel like that while in the chase of safety and security, Gemini has neglected important aspects of the crypto trade. Unlike its competitors like Kraken that have comprehensively equipped their exchanges with trading and analytical features, Gemini only hosts the most basic tools and indicators. Here, you wouldn’t find an array of trading tools or technical indicators to help analyze markets. The fact that the buy and sell features are hosted on separate pages further makes the Gemini trading platform unattractive to active traders. These nonetheless make the platform appealing to institutional and high volume investors who value security over trade and analytical tools and indicators.

Currencies accepted here:

On the Gemini exchange, one can only trade in five cryptocurrencies and one fiat currency. These include BTC, ETH, LTC, ZEC, and BCH. For the Fiat currencies, the exchange will only support the USD, despite having outgrown the U.S market reaching out to more international crypto hubs. These can be traded in either crypto-to-crypto or crypto-to-fiat pairs in six different order types. This can be either a market, limit or four other types of limit orders.

Gemini Fees and commissions:

Looking at the Gemini fees and commissions, these three things stand out. One, the exchange is highly transparent and with all their charges and you get to know how much a transaction will cost you before entering into a trade position. We also like the fact that trading fees aren’t static but graduated depending on the number of trades you execute in a month. Lastly, they are relatively affordable compared to most of their competitors.

Trading here, you can expect to pay a maker, taker and auction fees of 0.35%, 0.10%, and 0.20% respectively. Clients with monthly transaction volumes of over $1 million enjoy discounted takers and auction fees of 0.25% and 0.15%. And when your trading volume surpasses $10 million per month, you only get to pay the taker fee of 0.10%. There is a tab on your user account screen indicating your trade volumes and expected charges.

Gemini Account types:

Unlike some crypto exchanges – like coinbase – that maintain different accounts for traders and investors, Gemini has only one live trading account. The exchange claims that this trader account has all the tools needed by a pro or novice trader “to harness the future of money.” But we believe that its limited number of tools and indicators make it inferior in the face of its competitors.

If you are relatively new to cryptocurrency trading or the Gemini exchange, the company also provides you with a practice account – the Sandbox site. This comes off as Gemini’s proprietary version of the Demo account. It has all the trading tools and features of the Gemini live trader account. And just like any other demo account, it is a risk-free environment that is specially designed to help you test and understand the Gemini exchange fully before committing your funds to direct trades.

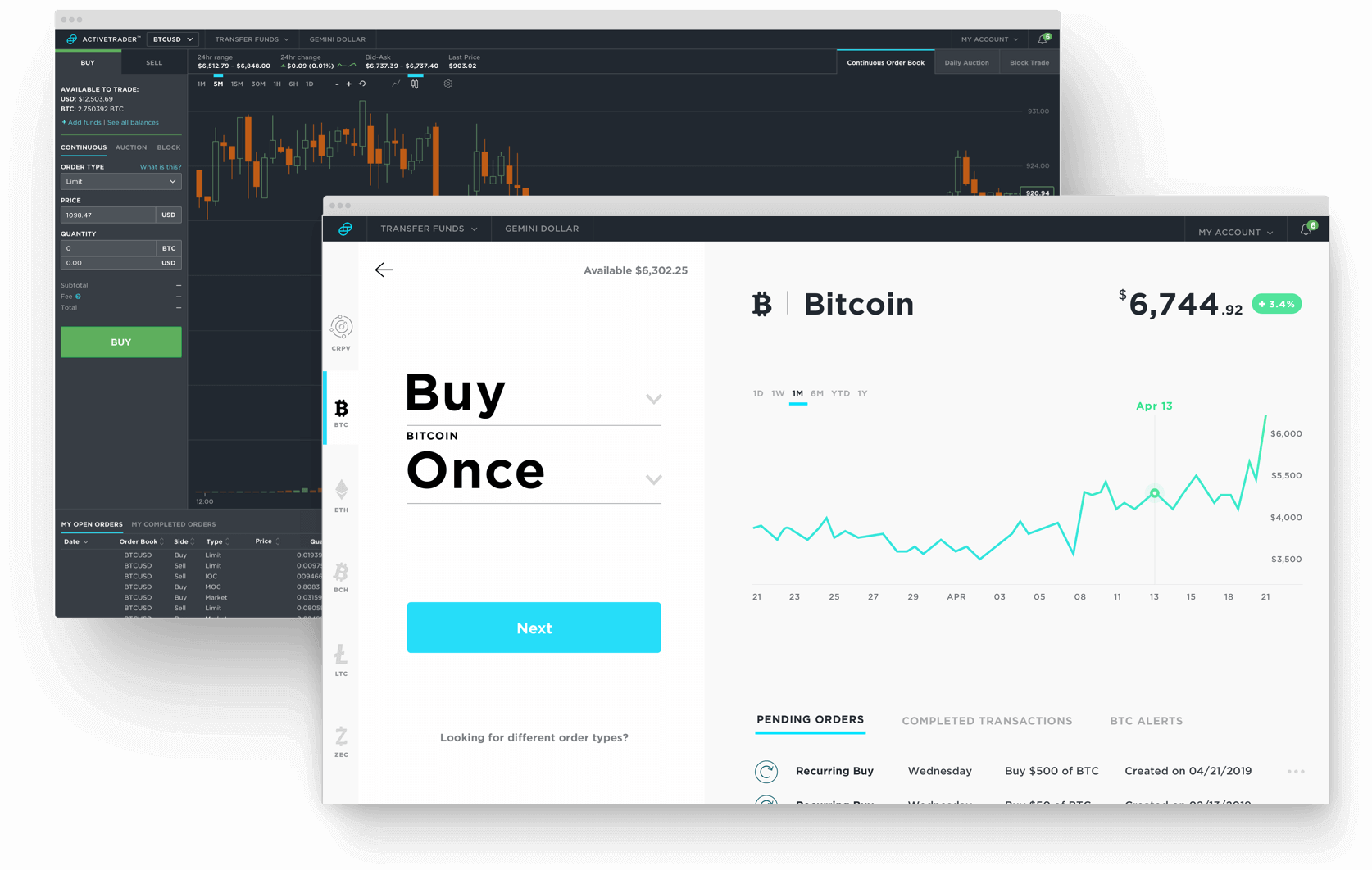

Gemini Trading Platforms:

Gemini exchange has also come up with a proprietary trading platform that is accessible as a web trader and a mobile phone app. And one of the most interesting features – an industry first – about the platform is its support for automated recurring buys. According to the exchange, you can schedule a “recurring purchase” for any crypto coin “across any Gemini order book.” This was designed for the investors looking to build their long-term crypto portfolio.

The Gemini app is highly secure and boasts of a three-layered security system with the Face ID as one of its authentication features. We also find it rather simplistic and easy to use, especially considering the limited number of tools available here.

Deposit and Withdrawal methods and costs:

Deposits into Gemini account are free. And you can make your deposit either in fiat currency via a bank wire transfer or any of the other supported cryptocurrencies. Note, however, that the exchange will not foot the requisite blockchain and bank fees charged at the source. It is also important to note that the exchange imposes limits on how much you deposit into the account per day. If you are an individual investor, your bank transfers in are capped at $500 per day or $15,000 per month. Institutional investors also have their daily bank transfers in capped at $10,000 per day and $300,000 per month.

How much you pay for withdrawals largely depends on your preferred withdrawal methods. Bank transfers and wire transfers are however free. And so are the first ten cryptocurrency withdrawals. The rest are charged a minimal 0.001 BTC per withdrawal.

There also are limits to how much you can transfer to a bank on a daily basis for both individual and institutional account holders. This currently stands at $100,000 for both types of clients while the minimum withdrawal limit is set at $100.

Security:

Gemini takes great pride in the security of their systems and currently ranks as one of the most secure and best Bitcoin exchanges currently available. And this starts at the client registration stage where the exchange won’t accept deposits from an unverified client account. In this case, you need to furnish the exchange company with a photo of your government-issued identity documents as well as a proof of address.

On the company’s part, it has prioritized security by coming up with several industry-first security measures aimed at protecting the client data and digital assets. For the best part, this involves coming up with highly advanced proprietary security measures. Gemini exchange has also resulted to the traditional asset protection measures employed by most banks and financial institutions – insurance. And this gives their clients confidence that should the exchange suffer a breach that compromises their digital assets, they will be compensated accordingly.

Countries Gemini Operates in

Gemini was founded in the United States where it also maintains its headquarters and the largest client base. It has nonetheless, spread to other world financial hubs like Singapore, South Korea, Canada, Japan, and the United Kingdom.

Customer support:

According to Gemini, their customer support team is available 24/7. But several factors point to potential weaknesses in the company’s customer service team. You, for instance, can only contact the support team by raising a ticket on their different social media handles. They do not have a live chat feature on the website.

The exchange also doesn’t maintain a contact center where you can call the customer support team directly. And with an average response time of between 1 and 2 hours, it makes it highly inconveniencing to clients with urgent issues.

What we like and don’t like about Gemini

What we like about Gemini:

- Gemini’s trust:

Looking at some of the most innovative technologies and drastic steps taken by Gemini, one can tell that they are all aimed at improving trust in the face of the global crypto community. From advanced security systems to protect the digital assets to seeking regulation and even insuring customer deposits. These are aimed at boosting the customer’s confidence in the brand.

- Straightforward registration process:

Gemini also has one of the most straightforward registration processes we have come across in the crypto industry. You might find the barrage of information and identity documents required to activate an account here frustrating. But the elaborate and clearly layered nature of the process makes it as seamless as possible. You are not only aware of all that is required for the registration before the process begins but you can also check its progress.

- Platform’s ease of use:

Two primary factors make Gemini’s trade platform one of the easiest to use; the fact that there are only a few technical tools and indicators and that you only have to deal with 6 currencies and 12 trading pairs. Unlike most exchanges with sophisticated dashboards, you don’t need days of trial and error or expert help to get around the bitcoin system. But they still provide the sandbox to make familiarizing with the platform easier.

- Multiple trade types:

Gemini features three prominent types of trade. The immediate market orders, five different types of limits orders, and the innovative auction orders. We are particularly drawn to their host of limit orders that give their clients the ability to determine the price at which they want to buy and sell different crypto assets.

What Paxful need to improve on:

- Additional mobile transaction charges:

Interestingly, Gemini imposes ‘convenience’ fees on all transactions executed through their mobile trading platform. The fee is on a graduated scale based on the value of the transaction. There is no reasonable explanation for the fee that only has a negative impact on the uptake of the app as most traders prefer standard charges on the web trader.

- More tools and indicators:

While fewer technical indicator and analysis tools help you master your way around the system easily, they serve as a deterrent to traders. Most crypto traders want to operate in an environment that helps them analyze and come up with industry forecasts.

- More deposit and withdrawal options:

Currently, there are only three ways in which you can deposit and withdraw funds in and out of your Gemini crypto account. It has to be the bank transfer, wire transfer, or crypto coin withdrawal. It would be interesting to see the exchange company and incorporate more and faster payment processing services like online cash wallets and cards.

- Coins selection:

Most traders will also shy away from any exchange that only presents them with five tradeable assets. The fact that clients outside the U.S need to first convert their currencies to USD before making a deposit and incur further conversion costs after withdrawal makes the platform unattractive.

Conclusion

The Gemini platform is, without a doubt one of the most secure and highly regulated crypto trading havens. The security measures that Gemini puts in place ensure that your digital assets are out of reach of cybercriminals and third party intruders. It also presents you with an easy to use trading platform and will also not charge for the deposits and withdrawals. But with the security notwithstanding, there also are areas that need improvement. The exchange, for instance, needs to work on incorporating more coins, trading tools and payment processing methods on the exchange. It is up to you to determine what matters to you most, the safety of your digital assets or the convenience of trades.

FAQs

What do I need to register for an account with Gemini?

Gemini does not have a minimum initial deposit or account operating balance. But you must pass their rather strict registration process that involves all the different know your customer and anti-money laundering vetting stages. In this case, you will need a photo of your identity card as well as proof of physical address.

How long does it take to deposit or withdraw on Gemini?

Gemini accepts both crypto and fiat deposits and withdrawals. And while crypto transactions are almost immediate bank transfers in and out of your Gemini account will take between 3 and 5 days.

Does Gemini provide clients with a free wallet?

Yes, Gemini recently introduced the Segregated Witness (SegWit) Bitcoin wallet.How safe is the Gemini crypto exchange?

Gemini was the first to pass the SOC 2 security verification. It has also developed some highly advanced sophisticated security systems meant to keep away cybercriminals and hackers. The exchange is also one of the few crypto exchanges that insure its client’s deposits.How many trading pairs can I trade on Gemini?

Currently, Gemini supports five cryptocurrencies and one fiat currency. This means that you can only trade 12 crypto and fiat pairs.Can I trade anonymously on Gemini?

No, with the strict adherence to KYC and AML policies required before activating your trader account comes the loss of identity. Simply put, Gemini does not accept deposits from unverified accounts, and the only way to verify a trader account here is by sharing as much personal details as possible.

Edith Muthoni

Edith Muthoni

View all posts by Edith MuthoniEdith is an investment writer, trader, and personal finance coach specializing in investments advice around the fintech niche. Her fields of expertise include stocks, commodities, forex, indices, bonds, and cryptocurrency investments. She holds a Masters degree in Economics with years of experience as a banker-cum-investment analyst. She is currently the chief editor, learnbonds.com where she specializes in spotting investment opportunities in the emerging financial technology scene and coming up with practical strategies for their exploitation. She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up