Swell Investing Review 2021 – Positive Impact Investing

For a long time, it seemed like making money and ethical standards were incompatible, maybe because of the many wealthy people who had made their way by taking advantage of others.

Many people have had reservations about investing in companies that may be engaged in activities that compromise their values. What business would a non-smoker have investing in cigarette stocks anyway? Today, most investors – especially millennials – are seeking to invest in companies that hold the same values as they do, or those that mean well for the world.

In this Swell Investing review, we examine a robo-advisor that focuses on creating investments for people who care where their money goes.

-

-

What is Swell?

There are hundreds of robo-advisors today looking to make themselves, and their users money, but only a handful care how the money is actually made. That is why socially responsible investing (SRI) is on demand as more investors seek to align their investment strategies with their values. This is the opportunity that Swell saw and decided to focus on.

Swell was conceptualized by founder and current CEO David Fanger in 2012 after he noted employees’ dissatisfaction with their company’s value on a due diligence visit to another company. A precursor to Swell Investing was later launched in 2015 with financial backing from Pacific Life. This first attempt was not successful as it was not SEC accredited and therefore it had to rely on third-party brokerages. Swell Investing was relaunched in 2017 with further financial backing from Pacific Life.

The platform has its headquarters in Santa Monica, California. It is a registered investment advisor and therefore acts a fiduciary. Swell is a true start-up although it is a subsidiary of Pacific Life, one of the oldest (150 years +) and most established insurance companies in America. The platform seeks to improve the future of the planet and the human race by impact investing.

This way, you don’t have to choose between making money and creating change.

Swell Pros- It is a dedicated socially responsible investing robo-advisor and not a robo-advisor that offers SRI portfolio options. This is great for socially conscious investors who can spread their money across many impact investments

- Low initial investment amount, $50. This is affordable for new and small investors

- All-inclusive fee – the platform does not charge trading commissions or pass expense ratio fees to you even if the accounts are actively managed

- Flexibility – the platform allows you to pick companies and stocks that you would like to invest in unlike some robo-advisors

- Pacific Life backing – because Swell is a subsidiary of Pacific Life, it has more staying power than many of the standalone robo-advisors.

Swell Cons- The 0.75% monthly fee puts the platform on the higher end of robo-advisors. There are other inexpensive options

- Limited investment options. The company SRI only investing limits the companies that you can invest in.

How does Swell Investing Work?

Swell is an investment advisor and therefore it does not hold the account for you. The account is held with Folio Investments, which is registered as a broker-dealer by SEC and is a member of SIPC and FINRA. Swell only acts as your investment advisor. The platform offers investment options in six themes or portfolios grouped by what they do, from healthy living to renewable energy.

To be included in the portfolio, the company must pass through the platform’s strict process to ensure that it is committed to a positive impact, not only in their main areas, but also in their other forms of business. This includes researching how the company makes money. The platform’s process eliminates those in exploitative and destructive industries and chooses the best companies based on their social and environmental issues addresses and revenue alignment. Swell encourages transparency and disclosure.

The companies included must have revenues in alignment with at least one of the seventeen United Nations Sustainability Development Goals designed to help governments and stakeholders worldwide tackle climate change, poverty and inequalities. If a company passes through that process, Swell has to ensure that it can provide high returns for the users who invest on the platform.

Each portfolio on the platform is invested entirely in individual stocks, with each portfolio holding between 40 -60 stocks. Unlike other robo-advisors, the platform does not use ETFs or mutual funds, they also don’t offer other income generating assets or fixed investment options like bonds. To invest, the company offers you seven different portfolios to choose from, six are different areas of SRI while the seventh is like an assortment of the other six.

You can eliminate up to three stocks from any portfolio. You also decide how you will allocate each investment.

When you invest with Swell, you have ownership of the actual shares you invest in. This means you are able to attend corporate meetings and vote on shareholder resolutions as a direct shareholder.

Getting Started with Swell

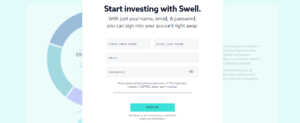

To open an account with Swell Investing, you must be a US citizen or permanent resident, be at least 18 and have a valid social security number. In the first step, you will be required to fill in your legal name, provide an email and set a password for your account. The password should be more than 10 characters to be accepted.

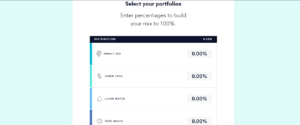

After you create an account, you will be required to ‘choose your mix’. A mix is a customized combination of Swell portfolios. You can choose one of the recommended ‘mix’ or you can choose to create your own by assigning percentages to the options provided. However, the total must not exceed a hundred and you cannot assign less than 15% to each portfolio. It is therefore not possible to include all seven options.

You will also be required to provide your address and contact details. You will be asked about your net worth, employee status and residency status as required by the SEC. The next step is choosing the type of account you are opening. Legal formalities will follow to open a brokerage account with the custodian, Folio Institutional. You will also be required to sign an account agreement before verifying your identity with a social security number.

Types of accounts offered by Swell

You can open four different accounts depending on what your goals are. They include:

- Flexible Swell – these are a brokerage account that you can invest without any tax benefits. You can deposit or withdraw funds into this account at any time. There is also no limit on how much money you can deposit at any time.

- Roth IRAs – this is a plan that allows you to invest with already taxed funds. Therefore, if you wait until you are 59 ½ years old, you will not pay any taxes on the funds but for any spending before that, you will be taxed. You can put up to $5,500 per year in this account if you are below 50 years old and $6500 thereafter.

- Traditional IRAs – if you are eligible for this account, you can invest in pre-tax funds and pay the taxes when you withdraw after reaching 59 ½ years. You can deposit up to $5500 per year if you are below 50 and up to $6500 per year thereafter. Money in these accounts is locked up until retirement although it can be shifted to other long-term investments.

- SEP IRAs – if you have income from self-employment, you can open a Simplified Employee Pension IRA with Swell. They have the same properties as traditional IRAs apart from the higher contributions allowed. You can contribute up to 25% of your salary, or up to $55000 per year pre-tax. Withdrawals will be taxed like the traditional IRAs at 59½ years.

What Features does Swell Offer?

Impact Investing – this is Swell’s most distinctive feature. The goal of the portfolios on the platform is to invest in companies that provide a solid investment return and make an impact in their field. The companies you invest in on Swell are either involves in zero waste, renewable energy, clean water, disease eradication, green tech and healthy living. While there are a number of robo-advisors offering the SRI services, investors may choose Swell despite the high fees as it only focuses on that. Swell searches for high growth companies that are addressing global challenges and adds the best in the portfolios.

Automatic deposits – Swell allows automatic deposits to help investors boost their accounts regularly. This is to encourage investors who may not be able to save large sums to invest later. Since there are no fees charged, investors can set up small but frequent deposits to grow their accounts and build a strong portfolio.

Tax optimization – Swell rebalances your accounts quarterly, they implement tax intelligent lot ordering designed to offset capital losses with capital gains and minimize tax liability. This means shares with the largest losers will be sold first and the largest winners will be sold last to minimize the taxes that you will pay on your gains. However, this is not the same as tax loss harvesting used by other platforms.

Automatic Dividend reinvesting – Swell allows you to automatically put back the cash you receive you receive from companies that you have invested in into your portfolio. The platform will reinvest your dividends when they reach $1. This allows your portfolio to grow over time without any additional actions from you.

Automatic rebalancing – swell rebalances your portfolio quarterly. Swell removes underperforming investments and focuses on those with sizeable impacts. Accounts are rebalanced to meet the risk-adjusted allocation models set by the research and portfolio management teams.

Human portfolio management team – unlike most robo-advisors, Swell uses a portfolio management team to manage your account. However, you cannot use the experts for other financial needs other than ones related to your accounts. Most robo-advisors only use algorithms with less human expert input. Some use algorithms only.

Swell Investing Portfolios

These are the seven portfolios offered by Swell:

- Green Tech – this portfolio includes companies that are focused on energy efficiency and reducing the negative effects of energy usage such as CO2 emissions. In this portfolio, you will find electric vehicles manufacturers, lithium mining and energy efficient solutions. There are 58 companies in this portfolio including Tesla, Nvidia, Aptiv PLC among others.

- Renewable energy – this portfolio invests in companies producing solar panels, wind turbines, and lithium batteries. The portfolio encourages investors to get behind companies harnessing renewable resources to produce energy. Currently, the portfolio holds 55 companies including Eaton, Hexcel Corp among others

- Zero waste – this is a portfolio dedicated to providing waste management, recycling, repurposing and waste treatment companies. Currently, the portfolio has 36 holdings, most of them not household names, including Tetra Tech, Cummins Inc. and Dover Corp.

- Disease eradication – this portfolio holds biotech and pharmaceutical companies doing research and developing new approaches to combat health challenges. The portfolio has 56 companies including Biogen, BioMarin and Celgene.

- Clean water – this portfolio includes companies working towards meeting the global demand for clean water, companies dealing with water filters, water pipe repairs and water treatment facilities. The portfolio has 49 companies including Aqua America, Idex, and Ecolab.

- Healthy living – this portfolio invests in companies focused on food, fitness and new technologies that enable people to live longer and healthier lives. The portfolio has 53 companies including Unilever PLC, VF Corp, Insulet Corp among others.

- Impact 400 – This is a general portfolio best for investors looking for a single investment option that will spread their money across many firms, sectors and impact themes. Currently, the portfolio has 390 companies including Apple, PayPal Holdings and National Grid PLC.

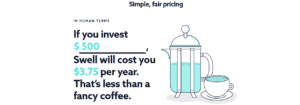

Swell Investing Fees

Swell, like most robo-advisors, uses a simple flat pricing model. They charge a 0.75% annual fee, no expense ratios, no price tiers and no trading fees. However, this is expensive than the average robo-advisor that charges 0.25%-0.50%.

Is Swell Investing for you?

Swell is designed for people who would like to invest in companies that reflect their morals, personal values or even goals. Therefore, if you are a socially conscious person and would like a hands-off investing experience, you should consider Swell. The platform is also great for millennials who would like to earn profits with a purpose.

Swell Investing Review: Verdict

Swell Investing is a great platform for any investor, beginner or an experienced investor. The low account minimum makes it available for beginners and investors with small account balances.

If you are a huge believer in socially responsible and impact investing, Swell is worth checking out, even if the fees may be higher than other robo-advisors, it may be worth it paying extra to invest in what you believe in. However, the platform is hard to recommend to someone who is not truly driven by socially responsible investing.

FAQs

How long does it take for my account to open an account and be fully invested?

It can take between 4-8 business days for your account to be activated and fully invested depending on the day of the week you open it.

Does Swell check my credit when I signup?

No, the platform does not check your credit or pull any information that could affect your credit score.

What is Folio Investments?

Folio investments is a registered broker-dealer with SEC and a member of FINRA and SIPC. Since Swell is a registered investments advisor, it chose Folio, an independent third party to act as a custodian to safeguard your assets and execute transactions based on Swell’s instructions. All Swell does is manage your money.

How is Swell regulated?

Swell is a registered investment advisor with the Securities and Exchange Commission (SEC).

Is Swell a fiduciary?

Yes, therefore it is legally required to act in the best interests of the clients. It cannot engage in any activity that conflicts with a client’s interest without their consent

Can you open a joint account on Swell?

Currently, the platform does not offer joint accounts. They do promise that they might in the future.

Can I open multiple accounts?

Yes, the platform allows you to open multiple accounts by logging into your account, select ‘add account’ from the ‘accounts’ dropdown from the navigation bar.

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up