Stash Invest App Review 2020 – Investments Starting at $5

Every first-time investor is faced by two major problems, either they

In this Stash review, we look at an app that aims to make investing as easy and fun as possible. Does it really make investing approachable? Read on to know more about its features and how it works.

-

-

What is Stash App?

Stash is an app from Stash Investments that is mainly directed to beginning investors who want to invest small amounts or those who do not really understand how investment works and the terminologies. The company launched Stash in 2015 and is headquartered in New York.

According to Stash co-founder and CEO Brandon Krieg, the company’s mission is to simplify investing and avail financial opportunities to the larger population that has been left out on investing for long. According to CNN, only 54% of Americans were investing in the stock market in 2017. Stash founders knew that the greatest challenge is to get people to start investing, their idea is to enable investing from as low as $5 and using the investment themes to simplify it.

What better way to attract a bigger and younger audience than providing easy to use smartphone applications? The Stash app can be downloaded from iTunes and Google Play for Android users. The app offers access to their news and education platform, Stash Learn, where investors can find guides about saving and investing and also keep up with financial news.

Stash App Pros- Educational and news platform to help new and experienced investors stay updated. This helps you invest with confidence.

- Fractional shares are available

- Low minimum amount required to invest, starting at $5

- There is no minimum deposit required to open an account

- The app is easy to use, it also has features that enable you see how your investments may go over time

- Stash enables you to invest in your passions by choosing investments that are in line with what you care about. For example, if you want to invest in companies that focus on the environment, it is easy to find them.

- Free retirement accounts for users under 25

Stash App Cons- The platform fee is high on small accounts. $1 or 0.25% fee may not seem much but on a $100 investment, that is 12% a year.

- The application does not manage your portfolio. As your portfolio grows, you may have to move to a robo-advisor

- Limited ETF offerings

- Delayed trading executions – this may not be a problem for long-term investors, but for people who would like to actively trade, it is an issue. By the time the trade is made, many changes could have happened.

How Stash App works

Stash Invest is an automated application that allows you to make investments for as little as $5. However, unlike other apps on the same level, it does not automatically make investments for you. It only makes recommendations and leaves the rest up to you. The platform offers personal investment accounts, retirement and custodial accounts that allow you to buy bonds, stocks and funds all under one app.

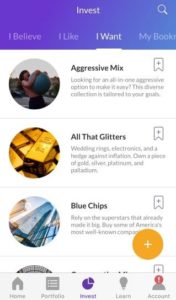

The app allows you to choose from 40+ exchange-traded funds based on how you fill the risk assessment questionnaire when signing up. This risk level may or may not be changed when you revise your suitability questions later in the app. Your risk level is labeled as conservative, moderate or aggressive and is determined by your investment goals, investment time horizon and age.

Just like in other robo-advisors, every risk level has its own recommended investments. Stash organizes your investments using headers such as ‘I like’ ‘I want’ or ‘I believe’ and by clicking on them, you can find the underlying security, companies whose stock make it up, yield, expense ratio among other details.

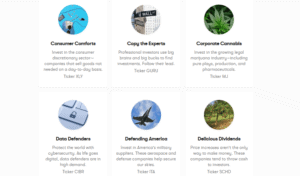

The company also tries to simplify its offerings by giving them interesting names rather than symbols used by other apps. You can select customized portfolios based on what your interests are, from political, environmental or financial. The investment themes have interesting names such as ‘delicious dividends’, ‘Do the Right Thing’, ‘Data Defenders’, ‘Defending America’ ‘Doctor, Doctor!’ among others.

This is to help you invest in companies whose ideologies you support, or voting with your money in other words. This way, you have an actual idea of what you are investing in. These themes make investment relatable and simple. All you have to do is ‘add to portfolio’. However, what you like or believe in may not be the best investment.

Stash app Subscription Plans

Stash App has recently removed their BPS (basis points) pricing structure, and launched three subscription plan options with flat, monthly fees (regardless of account balance). See below for the details.

-

STASH Beginner ($1/mo.) helps customers learn the basics of saving and investing with a personal brokerage account and access to banking services, including Stock-Back™ rewards.

-

STASH Growth ($3/mo.) helps customers build the foundation of a healthy financial life with a personal brokerage account, retirement account and access to banking services, including Stock-Back™ rewards.

-

STASH+ ($9/mo.) helps customers maximize the value of every dollar they make with a personal brokerage account, retirement account, two custodial investment accounts for minors, a metal STASH Debit Card with 2x Stock-Back™ rewards, and a monthly market insight report.

Getting Started with Stash app

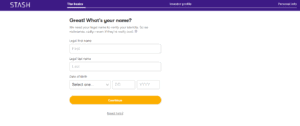

The signup process is simple, first, you have to download the app from iTunes for Apple users or Google Play for Android or you can sign up using the desktop platform. Enter your email address, set a password, and ‘start your Stash’. The platform will then require you to fill in your name, date of birth, and select the type of investor you think you are.

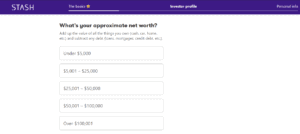

To assess your acceptable risk level, the platform will require your employment status, how much you make in a year, net worth, how you file your taxes as (status), how much you think you will make the current year and investment horizon. Other details include relationship status, if you have children under the age of 18, if you own a home and your investing experience.

The platform will ask for your address, social security number, and phone number to verify your identity and you will be ready to view the apps plans. To open an account, you must be a citizen or a permanent resident in the US, have a serial security number, be above the age of 18 and have a checking account

Stash App Features

Stash Retire – this is a retirement account option for investors. It offers Roth and the traditional IRAs with the same investments in the regular Stash. However, this is more expensive than the regular individual account. Up to $10,000, the platform costs $2 per month and 0.25% thereafter. Currently, there is no option to roll over old IRA into Stash retire.

Stash Banking – this is a new feature on the platform, Stash Invest partnered with Green Dot Bank to start this service. Stash banking offers a debit account available on the app’s home feed. It has no overdraft or monthly fees. It also offers stock back option every time a customer spends money. Using the ASAP Direct Deposit, users can get their pay up to two days earlier in addition to access to a large ATM network nationwide.

Banking users can also use features such as Round-Ups where savings grow and when they reach the minimum $5 they are transferred to Stash personal account and invested. You can also get cash back on everyday purchases, connect up to three debit or credit cards and can invest your cash backs in stock.

Diversify Me – This feature simplifies your portfolio building by helping you create a well-balanced portfolio.

Custodial accounts – these are Stash accounts that you can open for a child or a grandchild who is under 18 and maintain it on his or her behalf until the minor reaches the legal age, which is either 18 or 21 depending on the custodians state. The first transaction on the custodial account is made according to your risk level, you are free to invest in other investments thereafter.

Auto Stash – set of tools that allows you to save and invest automatically. The tools include round-ups, smart stash, and set schedule. Set schedule allows you to set money aside for your investing accounts automatically. Smart stash, on the other hand, analyses your spending and earning pattern and helps you save when you can afford it.

Stash Learn – this is where the platform stores all the information, guides, news and material to provide financial education to investors. Especially teach new investors the basics.

Stash Coach – this is a program that helps you shape your portfolio the best way you can.

What are the Stash Invest App Fees?

Stash App services cost $1 a month for accounts with balances below $5000 and $2 per month for IRA accounts with balances less than $5000. After $5000, the fees switch to percentages. Stash charges 0.25% for both general investment accounts and IRAs above $5000. Since the platform’s main target is new investors, most people are likely to be in the $1 per month range.

The fees may seem inexpensive but it is not. At $1 per month, an investor whose account holds $100 will pay 12% of his account balance in one year. If your account holds $500, that will be 2.4% per year gone in fees. The retirement accounts get it worse. Compared to other platforms, the fees are quite high. Note that the account does not charge any fees for IRA account holders below the age of 25.

The fees are not terrible but you can find better.

What Stash App does best?

- Design – the app is well designed with an easy and intuitive display. All the information is well put and makes sense. The signup process is perfect that despite requiring a lot of information, it does not stress you out.

- Investment guidance – after just a few questions to determine your risk tolerance, the platform suggests ETFs that make sense to your current financial situation.

- It helps you invest in what you believe in - using theme driven ETFs that help you invest in what you care about including clean energy among others

Stash Invest App: Verdict

The platform removes two of the greatest investing barriers, lack of knowledge and high minimum deposits or investment requirements. Therefore, Stash Invest is great for beginners who want to learn how to invest. It provides a lot of learning resources that may help you avoid costly mistakes and save money in the long run. For younger investors below 25, the no-fee retirement accounts may be a nice place to get started on and later branch out to other platforms.

You may find cheaper options but for those looking to learn, $1 a month may not be that big an issue.

FAQs

Are my earnings from Stash taxed?

Yes, investments you make with the platform are taxed as any other investment. Any profit is considered as income.

When can I withdraw my money from a Stash account?

You can withdraw any amount that shows as ‘withdrawable’ in your cash balance. The other money may not be withdrawable if you haven’t sold your shares yet, if money is being held from a sell or it was just recently deposited.

Are there early withdrawal fees?

No, the platform does not charge for withdrawals or deposits.

Is my information safe on Stash?

Stash does not store your bank credentials. It uses Quovo and Plaid to authenticate your account before any transfers are made. All information between the three services are encrypted over a 256-bit SSL.

Is my money protected if Stash goes out of business?

All Stash accounts are held by Apex Clearing, which is registered as a broker-dealer by FINRA. Your accounts are protected up to $500,000 including $250,000 in cash through the SIPC. Un-invested funds are also insured up to $250,000 by FDIC insurance.

What are round-ups?

This is spare change from your purchases rounded up to the nearest dollar. When it reaches $5, the round ups in your linked account are transferred to your investment account for investment.

Cryptocurrency - A-Z Directory

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up