Prosper Review 2021 : Is it a Good Investment?

Peer to peer lending is still a new concept for most people who have only known banks and other conventional financial institutions, despite its popularity.

In this Prosper review, we look at one of the top p2p platforms and the first to use the peer-to-peer lending model in the US.

-

-

What is Prosper?

Prosper became the first peer-to-peer platform in the US after it was launched in 2005. By 2019, the company claims to have facilitated over $15 billion borrowed by over 900,000 people. As the case with all peer-to-peer lenders, Prosper aims at enabling borrowers access loans conveniently and at better rates while allowing investors to get more returns.

Prosper Funding LLC is a subsidiary of Prosper Marketplace Inc. It is headquartered in San Francisco, California. The platform mainly deals with unsecured personal loans originated on the platform. The loans can be used for any purpose including home improvements and debt consolidation.Prosper ProsFor borrowers

- You can borrow up to $40,000 unsecured personal loan

- No early payoff penalties

- Low fees and interests compared to other competing platforms

- Checking rates on their platform does not affect your credit score

- Loans are available for borrowers who may not qualify for bank loans

- Quick approval and turnaround time

For investors

- You can invest with as low as $25 per note

- It is open for investors who are not accredited

- Automated investing tool for a more hands-free experience

- The platform provides more details on the borrower including credit score, annual earnings and credit history

Prosper ConsFor borrowers

- The platform charges origination fee before you receive the funds

- You are limited to a 3 or a 5-year loan term

- Late fees of $15 or 5% if you are late on your repayment

- Check processing fees

- Interest rates depend on your credit scores, it is possible to get an offer with high interests

- Loan amounts are limited to $40,000

For investors

- Loans are not secured, hence riskier

- The platform is not available for investment in all states and other restrictions.

How Prosper works

Like other peer-to-peer lenders, Prosper works by connecting borrowers who are in need of money to investors who want to invest and earn above-market returns. Prosper only deals with unsecured personal loans currently.

Borrowers can apply for as low as $2,000 to a maximum of $40,000 with a fixed rate and term. Prosper evaluates the creditworthiness of the borrower and rates the loan on a risk scale between the lowest risk (AA) and high risk (HR). Investors use that information to decide if they will fund your loan or not.Prosper offers the loans on its platform as notes, shares of a loan for investment. The minimum you can invest in a note is $25, which is great for diversification. In addition, an investment can be any amount above the minimum and does not have to be in multiples of 25.

Prosper earns by charging a non-refundable origination fee also known as a prepaid finance charge. The origination fee is between 2.4% and 5%. It is taken out before you receive the money, therefore, if you need an exact amount you should borrow more to cover it. The platform also charges a 1% annual servicing fees to investors.

What types of loans are offered by Prosper?

Debt Consolidation – you can take out a loan on Prosper to pay off other debts such as credit card debt, potentially with better rates and terms

Home improvement – you can use funds for a variety of home improvement projects including repairs, furniture or remodeling

Auto and vehicle loans – purchase or refinancing

Small business loans – especially for struggling start-ups that can’t qualify for a loan elsewhere. Owners can use a Prosper personal loan to cover their costs.

Military loans

Short term and bridge loans

Special occasion loans – such as weddings, birthdays, vacation

Home Equity Lines of Credit (HELOCs) are expected on the platform later this yearSteps to getting your first loan on Prosper

- Checking your rate – this is to check if you qualify for the loan. Use the ‘Check Your Rate’ button on the platform. It will require you to enter the loan amount you would like to borrow, purpose and personal details including name, address and your income. Prosper will then do a soft inquiry on your credit history and decide if you qualify. The platform claims that checking your rate will not affect your credit score.

- Make a loan request – you will be required to set up a profile and loan request to move forward. This step is free and there is no obligation unless your loan gets funded.

- Lenders bid on your loan – your loan is listed on the platform’s auction-like environment. Lenders compete to get the best loans, if your loan is attractive and you have good credit, your loan will be funded quickly. This can help borrowers by lowering their interest rate.

- Verification and Funding – if your request is funded by the time the listing is closed, Prosper gets in touch with you to re-verify your identity. You will be required to provide documents and once the process is complete, the funds will be transferred to you.

How Prosper Grades loans

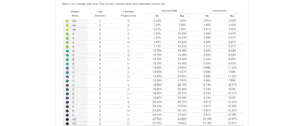

Every loan on Prosper is assigned a rating through their proprietary rating system which is expressed as a letter grade. The grade indicates the risk associated with that particular listing. It corresponds to an estimated average annualized loss rate range. The risk scale ranges from AA (least risk loan) to HR (High-Risk loan).

AA interest rate range from 5.32% – 7.36% (lowest risk)

A 7.49% – 10.43%

B 10.76% – 13.46%

C 13.99% – 17.97%

D 18.80% – 22.48%

E 23.44% – 27.04%

HR 27.75% – 31.90% (highest risk)Do I qualify for a Prosper Loan?

Prosper does not reveal all the details about its approval process, but to be eligible for a loan on the platform, you must:

- Have a credit score of at least 640, the average credit score of the borrowers on the platform is 717

- Have a steady employment or source of income

- Have a low debt to income ratio (below 50%)

- Have no bankruptcies filed in the last 12 months

- Have fewer than five credit bureau inquiries within the last 6 months

- Minimum of 3 open trades reported on their credit report

The standards are more lenient for people who have successfully paid off their first Prosper loan.

Investing in Prosper

Prosper offers investors the opportunity to buy shares of loans on the platform (notes). If the borrower repays the loan, the investors earn interest after the platform deducts its fees. Prosper offers investors a chance to diversify their portfolio more by setting a minimum investment amount of $25 compared to other competing platforms. Investors who choose to invest through Prosper risk their principle and interests since their funds are not FDIC insured.

How to start investing in Prosper

The first step towards investing on the platform is setting up an account. The first page requires you to enter your zip code so you can access the actual registration form. You will be required to choose the account type you would like to open. Right now, the platform offers three types of accounts, the general investment account, Individual retirement account (IRA) and the institutional investor's account.

The next step will require you to provide personal information including phone number, physical address. You will also be required to provide your financial information and identification details including social security number and date of birth. The information is also used for tax reporting purposes.Choosing investments on Prosper

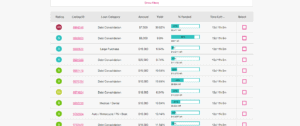

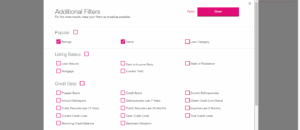

The platform allows you to choose loans manually or using the auto invest tool. There are no registration requirements to view the available listings but you must log in to take action on them. The available filters include loan term, rates and amount.

You can also set search criteria using the quick invest tool. It will compile a number of loans that meet the set criteria and it will invest in the notes with the funds that you have committed to your order.

There is also an option to place investments through Prosper API tools. These investor APIs can be used to locate quickly, bid on, filter or search for loans to build a portfolio that matches your parameters.Automated investing

The platform provides an auto invest tool that automatically invests the funds available into loans that match the investor’s set parameters. Investors can also set a cash reserve, this way, the auto invest tool will only invest using cash in excess of the reserve.

You can stop, pause, adjust or restart your auto invest at any time, however, you cannot cancel an investment that has already been placed by auto invest. It is also possible to use both manual and auto invest and manual investing at the same time

Risks associated with investing in Prosper

Before becoming an investor on the platform, it is important to note that Prosper does not guarantee the repayment of notes that you invest in. Prosper will only make payments if the borrower repays their loan. Here are other risks involved:

- Borrower defaults – All financial lenders face the risk of borrowers not being able to repay their loans. For Prosper, this risk is even worse because the loans are not secured, so little can be done if the borrower does not pay. The average annual default rates on the platform are 3% -4% across all grades, with the higher risk grades carrying a higher default rate.

- Liquidity risk – the platform provides a secondary market but this does not mean that it is liquid. There is no guarantee that you will be able to sell your loan, also, the platform does not allow trading of late loans, further limiting investor liquidity

- Interest rate risk – the platform does not penalize borrowers for early payment of their loans. This can affect the interest rates of the investor in the long run.

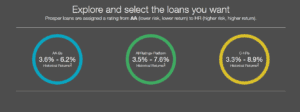

How much can I earn on Prosper?

There is no sure way of determining how much money you can on the platform. What you earn depends on the risk you are willing to take, the amount you have invested, how well you diversify your investment and the default rate.

The platform advertises an average rate of 7.41% return per year. The platform also shows historical returns of 5.3% average for all loans. The historical returns for the lowest risk grades (AA - B) are 3.6%-6.2% for higher risk grades (C - HR) are 3.3% to 8.9% and 3.5% -7.6% for all ratings on the platform.Who is eligible to be an investor?

To be eligible for a loan on the platform, you must:

- Be a citizen or a permanent resident of the US

- Be above 18 years of age and have a valid social security number

- Have a checking or savings bank account

- For residents of New Hampshire, Maine, Idaho, Washington, Virginia, and Oregon, you must have an annual gross income and a net worth of at least $70,000 excluding home and home furnishings and automobile. Or, have a net worth of at least $250,000. In addition, you must not purchase notes in excess of 10% of your net worth

- For California residents, you must not purchase notes in excess of 10% of your net worth, must have at least $85,000 gross income in the last tax year and expecting the same $85,000 + gross income this current tax year and net worth of the same amount, or, a net worth in excess of $200,000.

Prosper Review: Verdict

Prosper was the first peer-to-peer lending platform in the US and is arguably one of the top sites in the field. If you can get a loan at lower rates than your credit card conveniently, you might be able to save a lot of money on the platform, especially if you have good credit to qualify for single-digit rates.

For investors, the platform provides an opportunity to earn passive income at higher rates, that is, if you are willing to take the risks.

FAQs

Can I convert my current Prosper account to an IRA account?

No, you have to liquidate the current account then open an IRA account because taxable funds cannot be moved or converted into a tax-deferred IRA account on the platform.

What is the minimum investment amount for IRA accounts on Prosper?

In the first year, a minimum investment of $5,000 is required and a similar investment added in the second year.

What type of fees are charged on loans?

The platform charges an Origination fee of 2.4% - 5% depending on your Prosper rating, A check processing fee of 5% or $5, whichever is lesser. You will also be charged $15 or 5% of the unpaid payment if you are late on a payment and $15 for each returned or failed payment.

What is Autopay?

Autopay is a service that automatically schedules and deducts your monthly payments from your bank account. This way, you will never be late on your monthly payments.

Can I change my payment due date?

Yes, you can, but you have to call and discuss it with them.

Can I extend my loan term?

No, currently there is no such option.

Peer 2 Peer - A-Z Directory

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up