Bond Market – Everything You Need To Know About Bonds in the U.S.

Bonds are a useful component of any investment portfolio. They can reduce volatility and add diversity to balance risk across your portfolio. However, the truth is that the bond market is a mystery to a good number of people, including experienced investors. If it sounds like Greek to you as well, don’t worry because you are not alone.

The reality is that though the bond market seems like a tough nut to crack, it is not as complex as it sounds. Read on to find out what the bond market is, how it works and how you too can get in on the action.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

What is the bond market?

In order to understand what the bond market is, let us first demystify bonds. At one time or another, most people have borrowed money. Whether this is a home mortgage or a soft loan to get them to the next paycheck, borrowing is nothing unusual. In fact, it is so common that even the federal government and large organizations borrow from time to time, which they do through the issuance of bonds.

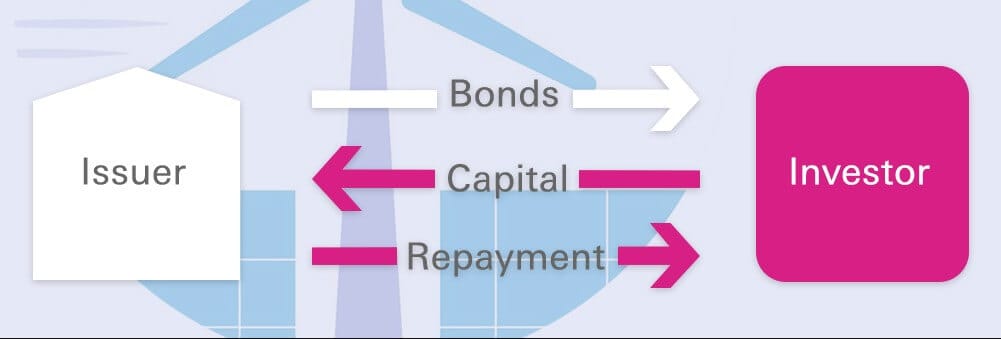

In the simplest terms, bonds are massive loans that large entities take out from multiple parties. From an investor’s perspective, bonds are a form of investment that involves lending money out to a bond issuer. In exchange for this money, the bond issuer pays interests.

Essentially, bonds are debt securities whereby investors are lenders and issuers are borrowers. These securities pay their holders fixed sums known as coupons on a consistent schedule for a fixed duration. Coupons are basically the interests paid to bondholders. When the fixed term elapses, the bond issuer pays back the principal amount.

The bond market is a financial market that revolves around the issuance and purchase of bonds. It is an over-the-counter market as there is no central location or trading floor where trading happens.

Additionally, there is no computer trading system like the Nasdaq Stock Market. Even though computer systems for trading bonds are under development, at present, people still buy and sell bonds using the traditional way.

What are the pros and cons of investing in the bond market?

Pros

- Portfolio diversification

- Low-risk investment option

- Bonds guarantee capital preservation

- Opportunity for fixed income generation in the form of coupon payments at regular intervals

- Municipal bonds allow you to invest in communal projects

Cons

- Credit risk arising from the possibility of an issuer defaulting

- If inflation increases outpacing bond interest rate, investor may lose purchasing power

- Liquidity risk exists when investor needs to sell but cannot find buyer

- Interest rate fluctuations may cause price volatility in bond markets

- Lower returns than other asset classes such as stocks

How does the bond market work?

Typically, bonds are not secured by collateral and issuers sell them in relatively small denominations. The denomination on a bond is referred to as its face value. They range from about $1,000 to $10,000.

Dealers often impose minimums when issuing bonds, mostly in increments of $10,000. The inter-dealer brokers consider bond trades worth less than $100,000 an “odd lot.”

Investors make the decision on how much to pay for specific bonds. One of the considerations they make has to do with the extent to which they expect inflation to affect the value of the fixed payments they receive. When they expect inflation to rise, they pay less for bonds and vice versa. In turn, lower bond prices correspond to higher yields while higher prices result in lower yields. More detailed information about yields will be discussed in the latter part of the article.

Mostly, bonds pay interests at fixed intervals but this depends on the coupon in question. Fixed-coupon bonds divide the coupon into portions and could for instance pay semi-annually. On the other hand, floating-rate coupons, work with specific calculation dates. The issuer calculates the floating rate a short while before the next payment.

There are also zero-coupon bonds, which do not pay any interest at all. Instead, these are issued at a steep discount relative to their face value so as to account for the implied interest.

The lifetime of a bond is known as its maturity and can be classified in three ways:

- Short term – The maturity period is between 1 and 3 years.

- Medium term – The maturity period is between 3 and 10 years.

- Long term – The maturity period is over 10 years.

Long term bonds usually come with higher interest rates in order to compensate for the risk of interest rates rising before bond maturity. This is known as interest-rate risk.

The majority of bonds have ratings that indicate the credit quality of the issuer in question. Credit quality simply refers to the issuer’s willingness and ability to repay the principal on time. At present, there are 3 main rating agencies namely Fitch, Moody’s and Standard & Poor’s.

AAA is the highest rating while D refers to bond issues that are currently in default. Bonds with a BBB to Baa rating are known as investment grade as they are unlikely to default. Below these, you will find BB and Ba, which are known as junk bonds. These have a relatively high likelihood of default and are subject to higher volatility.

To compensate for the risk of the issuer defaulting or failing to pay on schedule, low-rated bonds have higher interest rates.

As you might have guessed, bonds issued by the US government are among the safest. They have the lowest interest rates as there is no issue relating to creditworthiness. Investors can count on the fact that the government will make payment in full and on time. Based on this, these bonds have a benchmark status. When their yields rise, all others rise, and when they fall, all others fall.

The bond market moves in response to changes in expectations concerning inflation and economic growth. There are instances where long-term yields fall below short-term yields. Normally, it is assumed that inflation rates will remain the same or accelerate.

However, when investors think inflation rates will drop or even deflate, they might buy long-term bonds at lower yields than short term ones. This is because a short-term buyer will have to reinvest in 2 or 3 years while a long-term buyer will not need to reinvest for 30 years or more. In such situations, bond market traders say that the yield curve is inverted.

For instance, in January 2000, the Treasury announced a buyback program for all Treasury securities from investors at market value. The buyback program aimed to pay down the national debt and thus targeted the longest term issues which have the highest interests.

Investors foresaw a shortage of these long term issues, and this drove prices higher. In turn, this made their yields fall below those of short term issues.

The state of the bond market can give an idea about the state of the economy. When yields fall, it is likely that the economy is experiencing a downturn. This is because investors tend to rush to bonds and buy even at low yields to keep their money safe. Consequently, bond issuers are able to sell all the bonds they need while paying low interest rates.

On the secondary market, bond prices go above their face value due to heightened demand, while the interest payment is low, which means lower returns and hence, lower yields.

All in all, the bond market is most attractive when the economy is on the decline. When the economy and stock market are doing well, investors do not show much interest in bonds and as a result, their prices drop. Consequently, they are considered a counter-cyclical investment.

Types of bond markets

The broader bond market falls into a number of smaller bond markets. These are:

- Government and Agency – The US government issues Treasury Bonds, also known as T-Bonds or long bonds. By virtue of their backing by the US government, these are considered a risk-free investment. However, their low risk means that they offer a relatively low interest rate. Treasury Bonds are exempt from local and state taxes but are subject to federal tax.

- Corporate – Corporations also issue bonds from time to time to raise capital. Corporate bonds offer some of the best interest rates in the market. However, the interest is subject to tax both at the federal and state level.

- Municipal – Localities such as municipalities and cities offer municipal bonds to offer public services or finance public projects. These too are tax-exempt but once again, the interest rate is relatively low due to low risk. Municipal bonds fall into two main categories.

- General Obligation – These bonds fund projects that do not yield income such as parks and playgrounds. In order to guarantee the payment of these bonds, the issuer has the mandate to raise funds in whichever possible way. For instance, it can raise taxes or even sell assets to recover the necessary funds.

- Revenue Bonds – These pay back the investor by generating their own revenues. To illustrate, a municipality may issue bonds to construct a highway. To pay back investors, it could use the money it generates from tolls.

How the bond market can help you make money

In the bond market, participants can be part of the primary market by issuing new debt or the secondary market by buying and selling debt securities.

To understand how they make money, consider an illustration. An investor buys a $10,000 bond from the primary market with an interest rate of 3% and a 10-year fixed term. The issuer promises to make a fixed payment once every 6 months during this term. As such, the bond will pay $300 a year in two installments.

Based on this, there are two ways the investor can make money from bonds. The first way is to hold them until their maturity, which is 10 years, and collect interest twice every year.

The second way would be to sell the bonds on the secondary market before their maturity. Despite of being a conservative investment scheme, bonds offer opportunities for active trading. The best time to do so would be at a time when the market value of the bonds has increased. For instance, if the market price at the time of selling is $11,000, the investor will have made a profit of $1,000.

Otherwise, depending on factors such as the general economic state, the interest rate and the issuer, an investor can lose money if they are not careful.

How to invest in the bond market

Since there is no centralized market for trading bonds, getting started might seem rather challenging. But when you get a handle on it, investing in the bond market can be as easy as trading the equity market.

The procedure for buying bonds varies by the type of bond in question. Here is how to buy different types of bonds.

Buy T-Bonds (Government Bonds)

To buy your T-Bonds directly from the US Treasury, here is what you need to do:

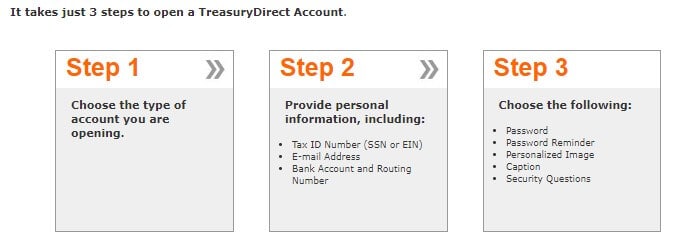

Step 1: Go to TreasuryDirect.gov and open an account

Step 2: Submit a bid

T-Bonds are sold at auction in increments of $100. To submit your bid, log in to your account and click “BuyDirect”

Follow the prompts to select “Treasury Bonds” and specify the purchase amount and other information.

Step 3: Make a payment

Specify your source of funds, which could be a bank account or Certificate of Indebtedness.

Buy Corporate Bonds

To buy corporate bonds from a brokerage firm, here are the steps to follow:

Step 1: Set up an account with a brokerage firm

Compare the different brokers accessible to you and make your pick then create an account. Provide the required personal information and set up account features.

Step 2: Transfer funds into the account

Choose your preferred funding option from the ones available.

Step 3: Make the purchase

Select the corporate bonds you are interested in buying and complete the purchase by submitting your payment.

Buy Municipal Bonds

There are two main ways to buy muni bonds. You can use either the primary market and on the secondary market. However, getting them on the primary market is difficult as it is mainly reserved for high-net-worth investors. It takes place over a duration known as the retail order period, which may last a couple of days.

To buy on the primary market, open an account with the bank bringing the issue to the market. The municipality will make an announcement identifying the authorized bank or group of banks. After this, fund your account and make the purchase.

The second way to buy muni bonds is on the secondary market, which would be through a brokerage firm. Follow the same procedure as when buying corporate bonds.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

Stock market vs. Bond market

When it comes to the relationship between the stock market and bond market, there are a number of general guidelines. Note that the two markets do not always adhere to these guidelines. Rather, investors pick and choose according to prevailing circumstances.

1. When bond prices rise and yields fall, stock prices should rise too because low interest rates are good for both markets.

Low interest rates are known to stimulate economic activity as they allow companies to do more. Additionally, bonds are often considered a viable alternative to stocks. For these two reasons, the lower the yields on bonds, the less appealing they become. As such, low or falling interest rates tend to favor the stock market.

2. A rise in stock prices can cause an increase in inflation. When stock prices rise, bond prices fall and get higher yields.

The reasoning behind this is that the stock market influences consumer confidence and thus helps to drive the economy. When consumers feel confident, they will spend freely and grow the economy.

3. When stock prices plummet unexpectedly, investors tend to move to the bond market causing a rise in bond prices.

Bonds are a lot less volatile than stocks. As a result, when investors’ principal focus is on the preservation of investment, bonds become the ideal getaway. This phenomenon is referred to as “flight to quality.”

What are yields?

Bond yields are the measures of return from bond trading, typically calculated as the annualized return. They vary according to coupon rate, the price paid for the bond and the time remaining to maturity.

There are a number of yield measurements that calculate returns in different situations. These are:

- Yield to Maturity – This is the most common yield measurement. As its name implies, it calculates the return on a bond held to maturity assuming all coupons are reinvested at the same rate. However, since coupons are unlikely to be reinvested at the same rate, the actual returns may vary slightly.

- Current Yield – Current yield is a measurement used to compare the interest income of a bond to the dividend income of a stock. It only considers the income aspect, ignoring potential capital gains or losses.

- Nominal Yield – It refers to the percentage of interest that a bond pays out periodically.

- Yield to Call – A bond that might be called before maturity is known as a callable bond. If such a bond is paid off at a premium, it might mean a slightly higher yield. As such investors calculate the yield to call for a specific date to check whether prepayment is worthwhile.

One of the common mistakes investors make when choosing bonds for investment is reaching for yield. In many cases, this happens when interest rates decline or investors feel like the rates of return are low.

Though you may get an offer with a higher yield, the credit quality of the bond in question might be lower. Always keep in mind that the higher the yield, the higher the risk.

Conclusion

As an investor, you have tons of options with regard to growing your wealth. The bond market might not offer the most lucrative opportunity but it is a great way to diversify as it is one of the lowest-risk investment options.

The fact that there are a variety of bonds to pick from means there is something for everyone. For risk-averse investors, there are relatively low-yield T-Bonds and Muni bonds while for more speculative types, there is a wide range of corporate bonds to choose from.

Now that you understand the intricacies of how the bond market works, you are well placed to add bonds to your portfolio and thrive in the safety they provide.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform