How to Buy Shares in Australia?

Buying and selling shares of companies is one of the best ways to get your foot into the stock market. By putting your money into the market, you can turn a short-term profit or build wealth over time for your retirement fund.

If you’ve never tried to buy shares before, the process can be confusing. We’re here to make it easier by showing you how to trade and invest in shares.

We’ll explain all the fundamentals of buying shares and help you find shares to buy. Plus, we’ll compare five featured brokers that you can use to buy shares in Australia.

-

- What is Buying Shares in Australia?

- How to Earn from Buying Shares in Australia?

- How to Buy International Shares?

- How to Buy Shares Without a Broker?

- Why Do Companies Buy Back Shares?

- What Regulations are in Place for Buying Shares in Australia?

- What Risks are Involved with Buying Shares in Australia?

-

- What is Buying Shares in Australia?

- How to Earn from Buying Shares in Australia?

- How to Buy International Shares?

- How to Buy Shares Without a Broker?

- Why Do Companies Buy Back Shares?

- What Regulations are in Place for Buying Shares in Australia?

- What Risks are Involved with Buying Shares in Australia?

How to Buy Shares in Australia in 3 Quick Steps:

Want to pick up shares as quickly as possible? You can start buying shares with these three steps:

[three-steps id=”230″]Ways to Buy and Sell Shares

When it comes to buying and selling shares, you have choices. Many long-term investors prefer to buy individual shares and hold them. Alternatively, you can invest in many stocks at once by buying a fund. Short-term traders can turn a profit with fewer restrictions by trading CFDs or options contracts. We’ll dive into more details about these ways to buy shares below.

Step 1: How to Pick a Shares Trading Account in Australia?

No matter which method you want to use to buy shares, you’ll need an account with an Australian ASIC broker that offers share trading. Stock brokers serve as middlemen by connecting share buyers with share sellers.

To help you find the right Australian stock broker to buy shares, let’s compare some of our featured platforms:

1. eToro - Social Share Trading

eToro offers investors and traders access to more than 800 stocks and funds from around the globe. You can trade CFDs or buy shares outright, depending on your investing goals. But, keep in mind that eToro doesn’t offer options trading.

One of the exciting things about eToro is that the platform includes a built-in social network. You can start discussions with other traders and see what companies they’re buying. This is helpful for finding the best Australian shares to buy. Plus, if you find a successful share trader, you can copy their portfolio in just a few clicks.

Our Rating

- Global Shares: More than 800 companies to trade

- Long-term Investing: Buy shares outright

- Social Trading: Start discussions with other traders

- No Options: Only shares and CFDs for trading

62% of investors lose money when trading CFDs.2. Plus500 - Shares and Option CFD Trading

Plus500 offers share and option CFD trading on hundreds of companies around the world. The platform lets you trade share CFDs with up to 20:1 leverage and option CFDs with up to 10:1 leverage. Plus, you can trade popular stock indices from most of the major US, European, and Asian exchanges.

Plus500 doesn’t have any social trading features, but it does include price alerts and beginner-friendly technical charts. These tools can help you monitor share prices so you never miss a buying opportunity.

Our Rating

- Option CFDs: Trade options with up to 10:1 leverage

- Price Alerts: Stay on top of market movements

- Competitive Spreads: Minimize the cost of trading CFDs

- Lacks Social Trading: Cannot see what other traders are doing

76.4% of retail investor accounts lose money when trading.3. AvaTrade - Technical Charting

AvaTrade is one of the best brokers for more advanced share traders. The platform comes with a highly advanced technical charting software with more than 80 built-in indicators. AvaTrade account holders also get access to MetaTrader 5, which enables you to develop custom strategies and take advantage of AI trading.

AvaTrade offers CFDs for dozens of popular shares, with a focus on US companies. It also offers global stock indices and trading for a handful of ETFs. This broker doesn’t support options trading, however, and doesn’t enable you to own shares outright.

Our Rating

- Advanced Charting: Available on desktop and mobile

- MetaTrader 5: Build strategies and apply trading bots

- US Shares: Trade CFDs for top US companies

- Limited Selection: Relatively few global shares to choose from

5. IG - Global Share Trading

IG has an absolutely massive reach when it comes to share trading. This broker allows you to buy shares outright for more than 11,000 companies, including most major Australian shares. If you want to trade CFDs, you can access more than 13,000 companies from exchanges all over the world. IG also offers options, ETF, and index trading.

However, bear in mind that trading shares outright with this platform will cost you. Buying Australian shares costs 8 AUD per trade, while most other shares cost 10 AUD per trade. Thankfully, CFD trades are commission-free with IG.

Our Rating

- Global Shares: Trade shares for more than 13,000 companies

- Options Trading: Buy and sell options contracts for thousands of shares

- CFD Trading: Buy shares outright or trade CFDs

- Trade Commissions: Buying shares outright can be expensive

Step 2: Learn How the Shares Market Works in Australia

Before you start buying shares, it’s important to have a strong understanding of how the Australian share market functions. This will allow you to trade more profitably and help protect you from risk.

What is Buying Shares in Australia?

Stock trading in Australia involves buying and selling shares of companies. When you buy shares outright, you actually own a small percentage of the company you purchased. That won’t entitle you to sit in on board meetings. But, it will enable you to listen in on shareholder meetings and to collect any dividends the company issues as passive income.

How to Earn from Buying Shares in Australia?

The main way that traders and investors earn money from buying shares is to buy low and sell high. The price of a share increases when demand increases, which usually happens when the underlying company is doing well. Any appreciation in the share price is realized when you sell your shares to another trader.

You can also make money from shares by collecting dividends. These are quarterly or annual payouts that some companies make to shareholders. Typically, they are small, only around 1% of the share price, but they can be a form of passive income for long-term investors. Most active traders aren’t concerned with dividends, and in fact, you aren’t eligible for dividends when you buy CFDs or options.

How to Buy International Shares?

You’re not just limited to finding the best Australian shares to buy. Most brokers let you trade shares for companies from around the globe.

The process for buying international shares through your broker is the same as for buying shares of Australian companies. However, you will need to keep in mind that trading hours are different for different exchanges, so it may take several hours for your buy or sell order to be filled. In addition, some share brokers charge higher spreads or commissions when trading international shares.

How to Buy Shares Without a Broker?

Using an Australian share broker is usually the easiest way to buy shares. But, there are some cases in which you can buy shares directly.

The first is an initial public offering, or IPO. When a company makes its IPO, it may enable individuals to purchase shares. Make sure to read the company’s prospectus, as it hasn’t been thoroughly vetted by investors up to this point.

Another way to buy shares directly is through equity crowdfunding. This is a method that many small- and medium-sized Australian companies use to offer shares directly to the public. Keep in mind that you can invest a maximum of 10,000 AUD per year in crowdfunded shares.

Finally, if you work at a public company that has issued shares, you may be eligible for an employee share scheme. In this case, you may be given or may be able to purchase shares directly from your employer.

Why Do Companies Buy Back Shares?

Some companies buy back shares as an alternative to issuing dividends to shareholders. Buying back shares pushes up the price of the stock since it reduces the number of shares available for trading. That’s a good thing for any current shareholders.

In addition, from the company’s perspective, the shares it buys back can be recycled. If the company needs to raise capital in the future to develop a new product or buy out a competitor, it can re-issue the shares it bought back, potentially at a higher price than it paid for them.

What Regulations are in Place for Buying Shares in Australia?

Share brokers in Australia are regulated by ASIC, the Australian Securities and Investments Commission. The most important regulation you need to know about when you go to buy shares in Australia is that the first time you purchase shares of a company, you must invest at least 500 AUD. If you already own shares of that company, there is no investment minimum.

This rule only applies to Australian companies traded on the ASX exchange. It also doesn’t apply if you’re CFD trading or options trading as opposed to buying shares outright.

What Risks are Involved with Buying Shares in Australia?

With the opportunity for profit from share trading comes the risk of taking a financial loss. There’s always a chance that the price of a company’s shares drops after you buy. In that case, you can either hold the shares until the price rises again or sell the shares for a negative return.

Unfortunately, it’s impossible to predict the future and avoid bad trades entirely. Sometimes, unforeseen events like natural disasters can cause share prices to fall. If a company goes bankrupt, it’s also possible that you could lose your entire investment. Shareholders are typically last in line to get paid when a company runs out of money.

The bottom line is that you should never invest more than you’re willing to lose when buying shares.

Step 3: What Factors Should You Consider When Buying Shares

The trickiest part of buying shares is figuring out which shares to buy. There are thousands of companies, after all. Here, we’ll explore some of the most important factors you need to consider when picking shares.

Historic Financial Performance

While past performance can’t guarantee future performance, where a company has been is the best indicator of where it’s headed. When determining what shares to buy, look closely at a company’s financial history.

Strong companies typically see consistent, increasing profits. There are many promising companies that haven’t yet turned a profit, such as Peloton, that could also be worth a look. But, you’ll need to carefully evaluate whether these companies can truly breakout in the future.

Dividend Payout

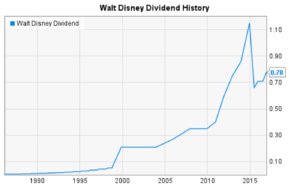

Dividends payouts to shareholders can be very attractive. These payouts represent a return on investment that you can rely on even if the share price goes down rather than up. Many established companies, including high-growth companies like Costco and Disney, pay out dividends.

When considering dividends, make sure the payouts have been steady or increasing over time. Also, check to see whether competing companies offer dividends and how the size of the payouts relative to the share price compares.

Professional Share Forecasts

Analysts at large banks and investment firms frequently issue predictions about the future price of a company’s shares. Check these predictions; they’re not always right, but they’re often close. Professional share forecasts can provide a reality check on your own evaluation of what a share will be worth in the future.

Economic Factors

The trajectory of a market sector or the economy as a whole can play a big role in boosting or dragging down a company’s shares. Take a wide view of the economy to look for market trends and signs that could point to where the overall stock market is headed. Keep in mind that while the share market is more global than ever before, every country has its own specific economic conditions.

Step 4: Alternative Ways to Buy and Sell Shares

There are several different ways to buy and sell shares of companies, including through funds, CFDs, and options. Ultimately, which method is best for you comes down to your investing goals and risk tolerance. Many investors use a combination of all of these asset types to buy and sell shares.

Invest in Shares through ETFs and Index Funds

Investing in ETFs (exchange-traded funds) and index funds is a low-stress and low-complexity way to build a share portfolio. ETF and index fund investing is generally preferred by long-term investors.

When you invest in a fund, you’re essentially buying a basket of companies rather than just one. This reduces your financial risk if any one company sinks, but it also limits your gain if one company takes off.

Trade Shares using CFDs

CFD trading involves buying and selling contracts rather than shares of a company directly. The price of a CFD contract typically mirrors the price of the underlying shares, so you get just as much financial exposure to changes in the share price. But, CFDs are typically less costly to trade than shares and enable you to trade with leverage.

In general, CFD brokers are built for day trading shares. However, you can also hold share CFD contracts for the long term.

Trade Shares with Options

Options trading is another way to buy and sell shares. With options, you buy a contract that enables you to buy shares at a set price up until a specified expiration date.

Options trading is extremely flexible since you can buy multiple contracts with different expiration dates. In addition, you can make a lot of profit with options trading since every position is leveraged. But, options are relatively risky and trading them requires a strong understanding of how these contracts work.

Step 5: Open an Account to Buy Shares

At this point, you’re ready to buy shares. We’ll walk you through the process using eToro to show you how it’s done. If you chose another of our feature brokers, the process is largely similar.

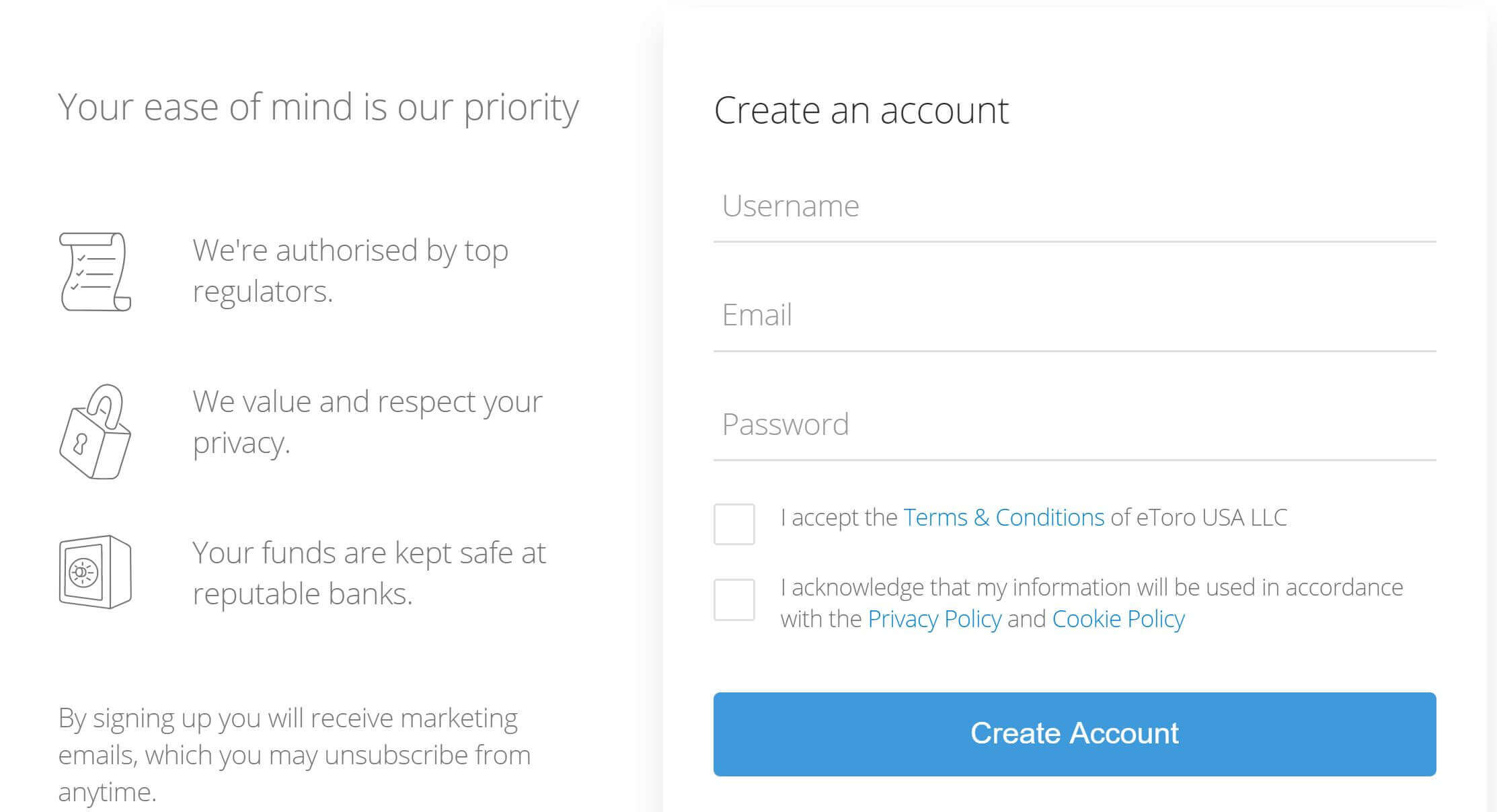

Create an Account and Verify Your Identity

To get started, you need to create a trading account. Click the ‘Join Now’ button on eToro’s homepage and enter your account information.

To verify your identity, upload a copy of your driver’s license or the photo page of your passport. You will also need to upload a copy of a credit card statement, bank statement, or tax document to verify your address.

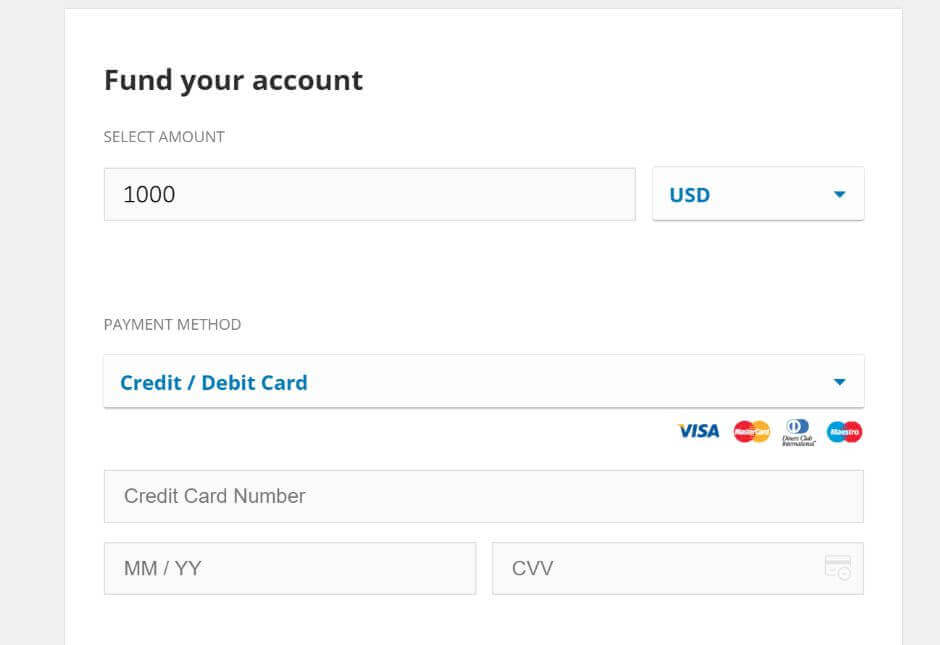

Deposit Funds

You need to add funds to your trading account before you can buy stocks. Navigate to your account page and click ‘Fund Your Account’. You can add funds by debit or credit card, PayPal, bank transfer, or e-wallet.

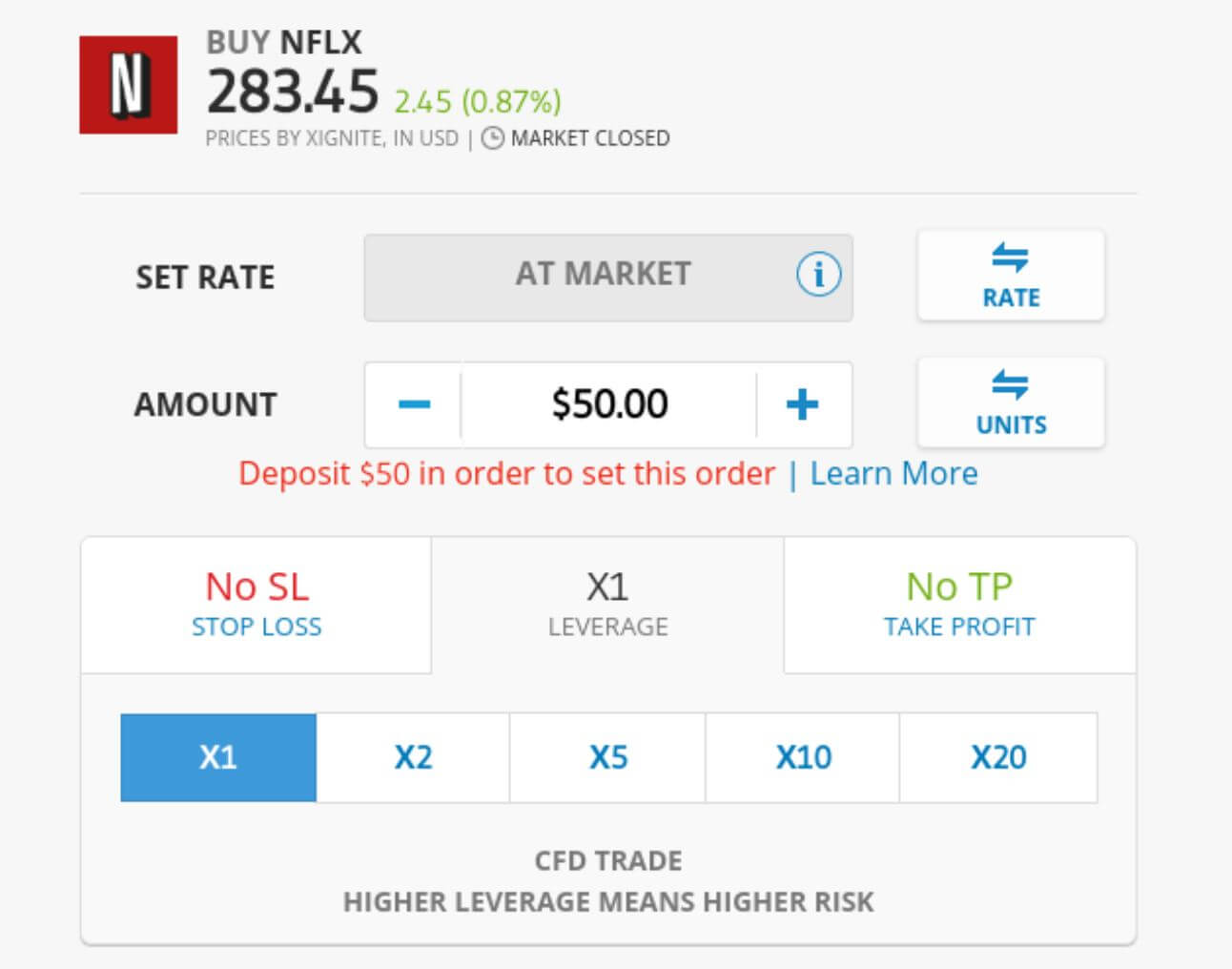

Buy Shares

To buy shares, enter the name of the company you want to purchase in the search bar at the top of the eToro dashboard. When it appears in the drop-down menu, click on it and then click ‘Trade’ on the next page. This will take you to the order form.

Here, you can specify how many shares you want to purchase. If you’re buying CFDs, you can also decide whether you want to use leverage. It’s a good idea to specify a stop-loss here, as that will tell your broker to automatically sell your shares if your trade loses too much money.

When you’re ready, click ‘Trade’ to buy your shares.

Pros and Cons of Buying Shares

Pros

- Shares—Trade or invest and collect dividends

- ETFs & Indices—Invest in a diversified portfolio with a single purchase

- CFDs—Trade shares with leverage and bet the share price will drop

- Options—Highly flexible trading strategies with built-in leverage

Cons

- Shares—No leverage and some shares have low liquidity

- ETFs & Indices—Your profit can be reduced by a few poor performers

- CFDs—Complex derivatives that can be risky if you trade with leverage

- Options—Become worthless if they expire out of the money

Conclusion

Learning how to buy shares is an important step in making money through trading and investing. Depending on your goals, you can buy shares outright, trade CFDs or options, or invest in ETFs and indices.

Ready to buy your first shares? Create an account at one of our featured brokers to get started today.

eToro - Invest in shares with 0% commission

Our Rating

- Trade Stocks, Forex, Crypto and more

- Only $50 Minimum Deposit

- Fully Regulated

- Easy to Use Trading Platform

FAQs

What is the minimum amount I need to start trading shares?

If you are buying shares of Australian companies trading on the ASX exchange, the minimum trade value is 500 AUD unless you already own shares of the company you want to buy. Most international exchanges do not have any purchase minimums.

Do shares expire?

No, when you buy shares they do not expire. You can hold them for as long as you want in your brokerage account before selling them. CFD contracts have an expiration date at the end of the month, but your broker will automatically roll your contract over into one for the next month. Options contracts do expire, and they become worthless if they expire before you sell or exercise them.

Are dividend payments guaranteed?

Most companies that pay dividends work hard to ensure the payments are consistent. However, dividends are never guaranteed. A company can suspend or decrease its dividends at any time.

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up