Neteller South Africa – How to Open an Account and Deposit Guide

Neteller is a popular online payment method and one of the biggest money transfer services in the world. It is widely accepted on most online casinos and forex trading sites. It is available in over 200 countries, including South Africa.

In our Neteller review, we are going to show you how to open a Neteller account, deposit money into your Neteller account as well as how to use it on sports betting, online casinos and forex trading platforms.

-

-

Why use Neteller?

The total number of online casinos and forex trading sites is increasing at a rapid rate across South Africa.

Launched in 1999, Neteller is a well-established payment method that processes billions of USD per year. It is popular for its simplicity and fast transaction speed. Also, it is secure and regulated by the Financial Conduct Authority (FCA).

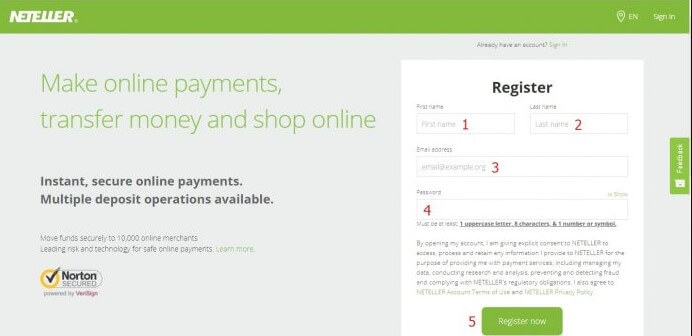

Step 1: Open a Neteller Account

The process of opening a Neteller South Africa account is very simple. Simply go to the official Neteller website and click on the ‘Join for free’ button to access the registration form.

You are only required to submit your name, valid email address and create a password. The password should include 1 uppercase, 8 characters and 1 number or symbol. Click ‘Register now’ to go to the next page that requires you to indicate your preferred base currency and country of residence. Fortunately, South African Rand is among the listed base currencies.

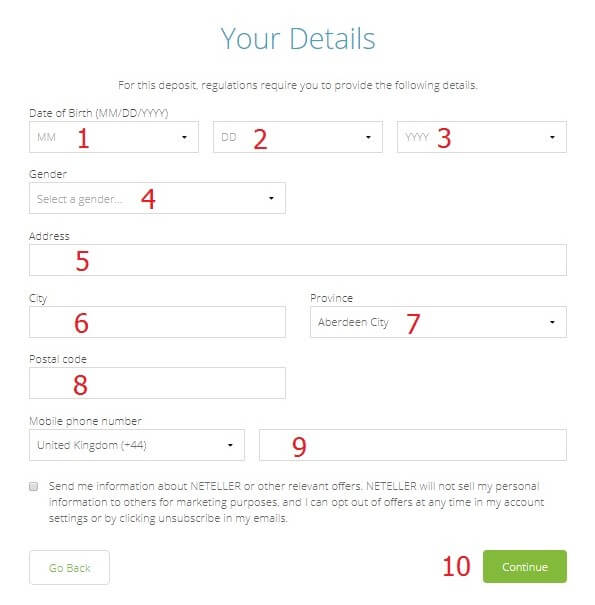

The next step is to provide accurate and truthful detailed personal information to successfully verify your account. On this page, you are required to provide your date of birth, gender, address, postal address and phone number. You will be sent a six-digit authentication code through the phone number you had provided in the previous step.

To safeguard your account, you are required to create a 6-digit secure I.D. that you will use when logging in and when you need to send or withdraw money.

How To Verify Your Identity

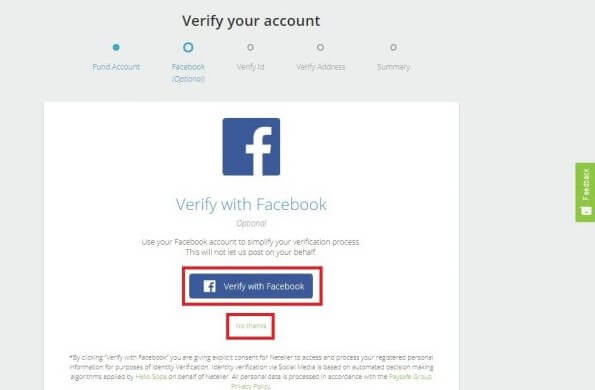

To verify your identity, you will need to submit either your passport, identity card or driver’s license. You can submit scanned copies of your ID that are saved in PNG or JPG formats. You can also verify your Neteller account through your Facebook account. This option is optional so no need to provide information about your Facebook account if you don’t want to.

If you choose not to connect your Facebook account, you will be required to take 2-sided photos with your computer webcam. The image of the documents should be clear such that all the information is readable. Click ‘Continue’ and repeat the same process with the back of your documents.

Finally, use your computer’s webcam to take a picture of yourself holding a note that Neteller asks you to. In most cases, it involves the word Neteller plus the day, month and year and your face must be seen clearly. Press the ‘Confirm’ button to complete the process.

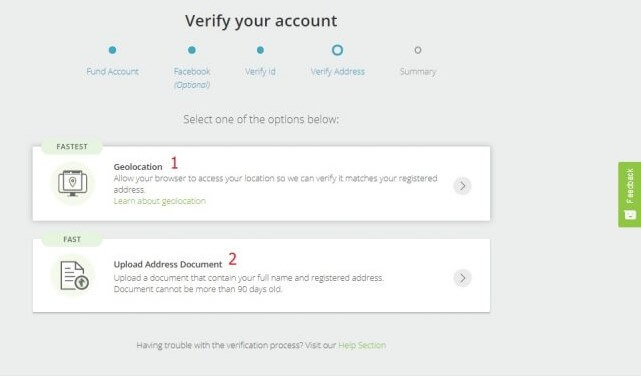

How To Verify Your Location

The last step of the verification process is to verify your address. There are two ways you can do that; you can choose either geo-location or upload address document option.

With geo-location, you only need to turn on the location of your browser so that Neteller can check your location on the Google map. This method is automatic and extremely fast, but you must be using your computer near the location you registered your account.

With the other method, you will need to take photos of documents that contain your full name and address. Such documents can include your utility bills, bank statement, tuition receipts, etc. that are not more than 90 days old.

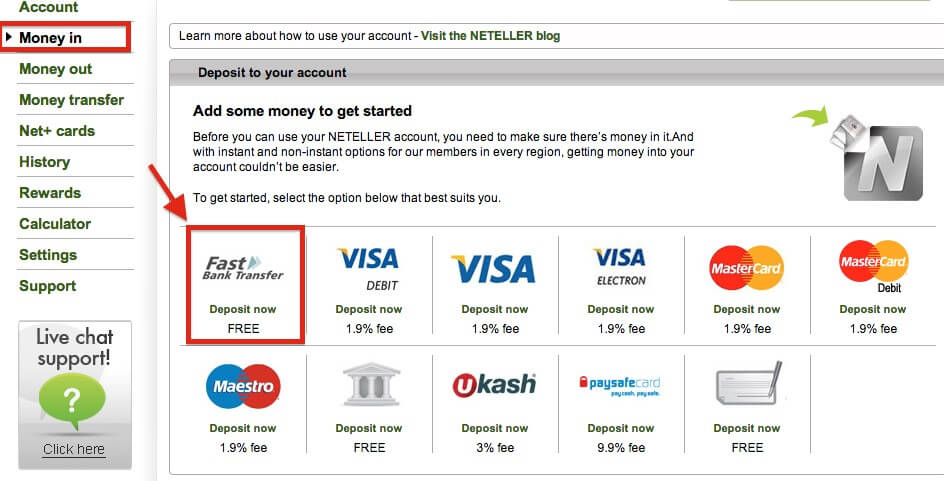

Step 2: Fund Your Neteller Account

You will be asked to submit a minimum of R900 ($5) to verify your account. There is a fixed transfer fee of 2.5% for all types of cards and wallets. So, you will have to pay an additional R2 ($0.13) to cover the cost.

On the account interface, click the ‘Money in’ button. Select your preferred card type to deposit on Neteller. It supports Mastercard credit, Maestro, MasterCard debit, Visa debit, Visa credit and Visa electron. Add the payment information that includes the amount you want to deposit, the card’s expiry month and year as well as the security numbers.

Verify the deposit information and click on the ‘Continue’ button to complete the process.

Step 3: Select Your Neteller Casino or Forex Broker

We are going to show you how to use Neteller for online casinos and online forex trading. Although you can use Neteller for all kinds of things, this is the most popular provider.

1. Mansion Casino - Has Generous Welcome Bonuses and Offers

Mansion Casino is an online casino that has been in operation since 2004. With a wide selection of casino games, outstanding software performance and user-friendly platform, it has become a popular online casino across South Africa.

Depositing and withdrawing funds from your casino account is hassle-free. Mansion Casino has made the process as effortless as possible by supporting a wide range of payment methods, including Neteller. It supports numerous base currencies, including the South African Rand. Note that once you have chosen the base currency when making your first deposit, you are not allowed the change it later. The Neteller option is mostly preferred because it is instant, safe and secure. The minimum deposit through this method is R270 ($15), and the maximum amount is R18,000 ($10,000). On the downside, it charges higher transaction costs than other options.

Mansion Casino is regulated and licensed by the U.K. Gambling Commission and the Gibraltar Gaming Commission. These are reputable agencies that have set high standards and oversee many casinos around the world. In addition, all payments are carried out through secure and high-level 128-bit encryption.

New users are eligible to have Mansion Casino’s massive welcome bonus, which can be up to R90,000 ($5,000). It will be credited in your account immediately after making your first deposit. On top of that, the company offers numerous promotional offers. For instance, the red and black promotions enable you to potentially double your money every Wednesday. Also, there is a R900 ($50) refer-a-friend bonus.

Mansion Casino features a wide selection of games for you to choose from. It is powered by Playtech engine that offers popular licensed slot games such as D.C. comic series like the Green Lantern and Man of Steel as well as MGM movie games like Pink Panther and King Kong. If you don’t want to install the software, you can play instant games directly on your browser. However, the number of instant play games available on your browser is a little less than on the software version.

Our Rating

- Numerous roulette games

- Supports South African Rand

- Offers instant games

- Withdrawal limits

Step 4: Fund your Casino and Forex Trading Accounts

Mansion Casino

Neteller is an effective and convenient way to deposit funds into your Mansion Casino account.

Click on the Deposit tab, select Neteller as your preferred method then indicate the amount you want to deposit. The funds will be deposited into your account immediately.

Step 5: How to Withdraw Your Funds to Neteller

Mansion Casino

To withdraw your winnings from Mansion Casino, click the Withdrawal tab, choose Neteller as your preferred method then stipulate the amount you want to withdraw. The money will then be deposited into your Neteller account immediately.

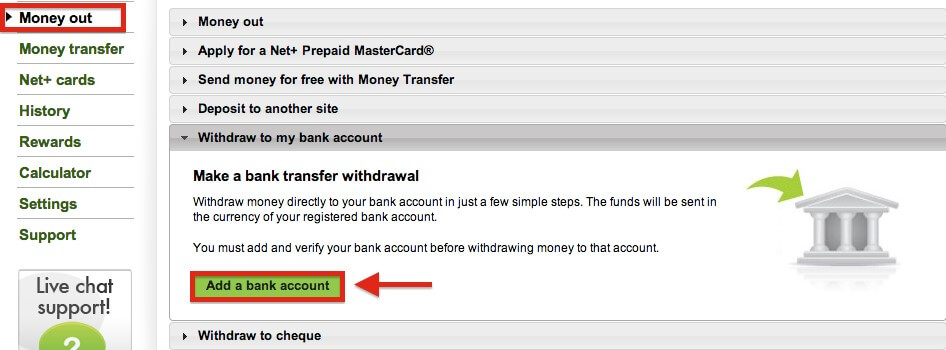

Step 6: How to Withdraw From Neteller to Your Bank

To transfer funds from your Neteller wallet to your bank account, click on the ‘Money out’ button section. Select the ‘Bank withdrawal’ section, then click on the ‘Add a bank account’ button and enter your bank details. Make sure to double-check the bank details you’ve entered.

Once you’ve linked your bank account, enter the amount you want to withdraw, verify again the details then click on the ‘Confirm’ button to complete the process.

Neteller Fees And Other Expenses

Making deposits on Mansion Casino using Neteller is free. However, you will be charged for topping your Neteller South Africa account. The exact percentage you’ll pay will depend on the value of the transaction.

If you choose to fund your Mansion Casino account through MasterCard, you will be charged between 2.25% and 4.95% and the amount you will have to pay will also depend on the bank you are using. If you choose to top up using Skrill or Trustly, you will be charged 3% and 1.95% respectively. Withdrawal charges also depend on the payment method you choose. For example, if you use bank transfer to withdraw your earnings, there is a fixed fee of 7.50%.

For sending money using Neteller, the regular fee is 1.45% and minimum R9 ($0.50) will be charged.

For withdrawing money on Neteller, the transaction amount is R180 ($10). Withdrawals usually take three to five business days to be completed. However, if ever your Neteller account and bank account are in different currencies, an additional 3.99% will be charged for the foreign exchange fee.

What If Neteller Blocks My Deposit?

If Neteller blocks your deposits, you should immediately contact the customer support team.

Below are the reasons why your credit/debit card deposit might be declined on Neteller.

- You have reached the card’s limit. You should verify your card to increase your deposit limits.

- You have entered your card details incorrectly. Always double-check your name’s spelling, card number, etc. to avoid this mistake.

- Personal information on the card does not match the information on your Neteller account. To solve this, ensure you type your name correctly.

- As an additional security measure, Neteller has included Verified by Visa step in the transaction process. Make sure you have enabled your pop-up windows and entered the correct code.

- Neteller allows you to use a credit/debit card on one Neteller account only. If you had a previous account in a different currency or closed for a specific reason, contact the support through the available channels.

- The card issuer has declined the transaction for security reasons. Contact your bank to get more information.

How Does Neteller Compare to Skrill and PayPal in South Africa?

Neteller vs. Skrill in South Africa

Security

Both Neteller and Skrill are secure, reliable and easy to use payment methods that are widely accepted by online casinos and trading sites.

The two companies are regulated by the Financial Conduct Authority (FCA), a leading financial regulator. Also, they have employed various precaution measures for additional security.

With Neteller, you will choose between the Secure ID and 2-factor authentication. The Secure ID involves a 6-digit code that you will need to input each time access your account or transact. As for Skrill account holders, there is the standard dual authentication.

Ease of Use

Both Neteller and Skrill have user-friendly platforms that contain all important information about them such as offers and rewards and fees breakdown.

In addition, the two companies support a wide range of deposit and withdrawal options such as credit/debit cards, prepaid cards, e-cheques and more.

Customer Support

Neteller’s customer support is more reliable than Skrill’s.

The ‘Support’ option is displayed on the Skrill homepage and it gives access to the FAQs section and the opportunity to contact the support through email and phone.

On the other hand, Skrill also has an extensive FAQs section and option to call or email the support. The downside is that its support takes longer to respond.

Physical Card Availability

These two e-wallets offer cards issued by MasterCard, which significantly increases the users’ accessibility to their funds.

The Net+ Prepaid Mastercard gives you greater freedom of using the funds stored in your Neteller account. To get the card, you only need to pay a one-off fee of R180 ($10) and wait for 2 to 10 days.

The Skrill MasterCard card is issued free of charge and can be delivered between 5 and 10 days. Other services such as payment process, online bank statement and PIN renewal are also free.

Neteller vs PayPal in South Africa

Security

Neteller uses the latest technology to offer a fast and secure way to transfer and store funds. The security of your personal data is the company’s top priority, and it employs all the available protective measures. All sensitive information is transmitted through high-level and military-grade 125-bit encryption and stored in highly secured data centers. Other measures include Secure ID and an optional 2-factor authentication.

PayPal’s website is also highly encrypted and secure. Every transaction is monitored to prevent fraud, identity theft and email phishing attempts. It also features a 2-factor authentication wherein you will receive a code every time you attempt to login to your account.

Ease of Use

Both Neteller and Paypal platforms are incredibly easy to use.

On the left side of Neteller’s main page, there is a navigation bar that shows all the main sections of the platform such as your account, money in, money out, money transfer, history, rewards, calculator, settings and support.

The PayPal platform is also very easy to navigate with the summary section as the default home page. The buttons to access the other parts of the platform are placed at the top.

Customer Support

Both Neteller and PayPal have reliable customer support.

The support section that is placed on Neteller’s homepage gives access to various support options such as the FAQs section, popular topics and the option to call and email the support.

PayPal provides numerous ways you can seek help. There is a community section with discussions of the latest topics as well as resolution center to solve transaction issues. Also, you can get in touch with the support through phone, email or social media.

Conclusion

Based on our Neteller review, it is clear that Neteller is one of the most popular online payment methods in South Africa due to the fact it is widely accepted on most online casinos and forex trading platforms.

It has employed stringent measures to safeguard your funds and personal information. The only issue with Neteller is that withdrawals can sometimes take longer to reflect in your bank account.

Our Recommended Neteller South Africa Casino

Our Rating

- R90,000 Casino Welcome Bonus

- Huge Progressive Jackpots

- The Most Extensive Collection of Slot Games

- Supports South African Rand

FAQs

How long does the verification process take when opening a Neteller account?

You should expect to get a response within 24 to 48 hours. You will be required to submit a copy of your valid passport, driver’s license or government-issued I.D. for proof of identity and utility bills or bank statement for proof of address. You will also be required to take a selfie with a unique code provided by Neteller.

How can I withdraw funds from Neteller in South Africa?

There are several ways you can withdraw funds from your Neteller account. You can use a prepaid Mastercard or make a local bank withdrawal, mobile wallet withdrawal, etc. Neteller also offers withdrawals through cheques and bank drafts, though it can take up to 21 days.

How does the Neteller mobile application work?

You can download the official Neteller app on Google Play Store and Apple App Store. The app will enable you to send money, buy and sell cryptocurrencies and withdraw to a bank account. On the downside, you cannot verify your account through the app so you need to go to the web-based version.

Can I send money from one Neteller to another?

It is possible to send funds to other Neteller members around the world instantly. On the ‘Money Transfer’ section on your account, select ‘Send money to email or Neteller account.’ Enter the email of the recipient, the amount you would like to send, select the currency and click ‘Continue.’ A page with the details of the transaction will appear for you to confirm. Click ‘Continue’ and enter the 6-digit verification code or your secure I.D. to complete the process.

What is Neteller’s secure I.D.?

Secure ID is an additional surety measure by Neteller to increase the security level of your account. It involves a code that you use during logging in and completing a transaction. It must be 6 digits and not contain 6 repeating numbers.

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

Latest News

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up