Best Forex Trading Demo Accounts in South Africa

Forex trading is getting more and more popular with South African retail clients, with loads of platforms now active in the market. However, as most newbie investors lose money when trading forex, it’s a wise idea to start off with a forex trading demo account.

Demo accounts also allow you to try out brokers without risking money, so they’re a great option to have. Then, when you begin to get more comfortable, you can make the transition to a real money forex account.

In this guide, we review the best South Africa forex trading demo accounts of 2026. We also discuss some of the things that you need to look out for prior to getting started, such as account sizes, time limits, and trading tools, and provide a step-by-step walkthrough of how you can get started today.

-

-

Our Recommended Forex Trading Demo Account for 2026

Don’t have time to read our guide all of the way through? Below you will find our pick for the best forex trading demo account in South Africa!

The Best Forex Trading Demo Accounts in South Africa

There are many forex brokers in South Africa offering demo accounts that you can use to try out forex trading for free. With so many platforms to choose from, knowing which demo account is best for you isn’t always easy.

To help you out, we’ve reviewed the five best forex trading demo accounts for South Africans in 2026. Check them out below!

1. Plus500 - Never Run Out of Demo Accounts Funds

Plus500 is an online CFD provider that offers a highly in-depth forex department. Not only can you trade heaps of majors and minors, but you can also trade optics pairs like USD/ZAR. This is ideal if you are planning to place buy and sell orders on the South African rand. The broker does not charge any trading commissions, which is great, and spreads are super competitive.

The demo account itself can be opened in minutes, and you will have access to live trading conditions without risking any money. One of the best things about Plus500 is the demo account balance is automatically replenished when it falls below $200 (or an equivalent amount), so you'll never run out of paper money! Plus500 has its own web-trading platform, so you won't need to download anything to your device. Instead, you simply need to log in to your demo account and you can start trading straight away.

You will get to test out key market orders like stop-loss, take-profit, and limit orders. You will also get to perform technical analysis from without your demo account. Plus500 also offers a mobile forex trading app so that you can access your demo account on the move.

If you decide to take the plunge by upgrading to a real-money account, you will need to deposit at least £100 (about 2,000 rands). The broker supports several South African payment methods, which includes a debit/credit card, bank account, and Paypal. Finally, Plus500 is regulated by the FCA, ASIC, CySEC, and MAS.

Our Rating

- Regulated by the FCA and ASIC

- 0% trading commissions

- Mobile forex trading app available

- No educational material

80.5% of retail investor accounts lose money when trading CFDs with this provider.2. FinmaxFX - Forex Broker With MT5 and Unlimited Demo

FinmaxFX is an online forex broker that is popular with South Africans that require higher leverage limits. This stands at 1:200 when you trade major pairs, and up to 1:100 on minors. Such high leverage levers are only suitable for those of you that have some experience of forex trading, so do tread with caution.

The good news is that you can test your forex trading strategies out via the FinmaxFX demo account, which is unlimited. In order to do this, you will need to quickly open an account and then download the MetaTrader 5 (MT5) software to your device. After that, you can buy, sell, and trade currencies at the click of a button with paper funds.

If you don't want to download the MT5 software, you can also access it via the FinmaxFX website. However, for the best forex trading experience, it's best to use the software. After all, this will also allow you to test out your forex EAs without risking any money.

In terms of upgrading to a real money account, FinmaxFX requires a minimum deposit of $250 (about 4,300 rands). The forex broker supports debit/credit cards and bank accounts. You can also get money into and out of the broker with an e-wallet or Bitcoin. Regulation-wise, FinmaxFX is licensed by the VFSC (Vanuatu) and the IFMRRC.

Our Rating

- Leverage of 1:200 on major forex pairs

- Educational materials

- Bonus available to new customers

- Doesn't hold a tier-one license

There is no guarantee you will make money with this provider3. AvaTrade - Huge Demo Account With MT4 & MT5

If you're planning to forge a long-term career in the online forex trading space, it might be worth opening a demo account with AvaTrade. This is because the platform is hugely popular with South Africans, as it offers some of the most competitive trading fees in the space.

For example, forex trading is commission-free at AvaTrade, and spreads are very tight. For example, major currency pairs start at 0.9 pips. You will also have access to leverage facilities - which is capped at 1:30 for retail clients. Once you open an account, with you have several options when it comes to selected a forex demo trading platform.

The AvaTrade demo account comes with $100,000 in paper money, though this runs out after 21 days. If you want to use the demo account for longer, you can contact customer service to ask if they can extend it.

Not only does this include MT4 and MT4, but you can also trade via the AvaTrade web-platform. AvaTrade is also heavily regulated, which includes a license with South Africa's FSB. Regulatory bodies in Canada, Japan, Ireland, and the BVI also oversee the broker.

Our Rating

- Spreads from just 0.9 pips

- Multiple licenses

- Both MT4 and MT5 supported

- Sparse educational resources

There is no guarantee you will make money with this provider4. IG - Forex Demo Account with Educational App

IG is a trusted UK-based broker that hosts everything from stocks and shares, CFDs, spread betting, and forex. In fact, the platform offers more than 90 currency pairs, which is great if you are looking to gain exposure to several marketplaces. This also includes a rand-denominated pair against the US dollar.

The broker does not charge any trading commissions on forex, and you can get your spreads down to just 0.6 pips on major pairs. Minors and exotics are slightly wider, but still competitive nonetheless.

If you're looking to learn more about trading, you can download the IG Academy app which comes packed with helpful educational resources.

IG supports MT4 and its own proprietary platform, both of which you can access via your desktop and mobile device. Once you make the upgrade wot a real brokerage account, IG requires a minimum deposit of £250, which is about 5,300 rands. Finally, IG is heavily regulated - and it has been facilitating trading services since 1974.

- Spreads from 0.6 pips

- Supports MT4 trading platform

- Excellent research department

- 1% fee when using Visa and 0.5% via MasterCard

There is no guarantee you will make money with this provider.Step 2: What to Look for in a Forex Trading Demo Account?

So now that we have discussed some of the best forex trading demo accounts in South Africa, we are now going to explore some of the things that you need to look out for prior to signing up.

So now that we have discussed some of the best forex trading demo accounts in South Africa, we are now going to explore some of the things that you need to look out for prior to signing up.After all, one would assume that you are looking to use a forex trading demo account as a pre-cursor to real-money trading. As such, you should choose a demo account with a broker that provides top quality trading services for when you try out the real thing!

Account Size

First and foremost, it is worth exploring how much paper money the forex trading demo account will provide you with.

You don’t want to blow your demo account balance on day one, so it’s best to stick with a provider that offers a comprehensive amount. Some brokers even automatically replenish your forex demo account balance if it reaches zero.

Time Limits

Many newbie traders are unaware that demo account facilities typically come with a time limit. That is to say, after a set period of time you will no longer be able to use it. This will vary from broker-to-broker and averages 30 days.

Some brokers are known to be somewhat strict with this, meaning that you might get just 7 days to test the demo trading platform out. In our view, this isn’t enough time to get used to the ins and outs of how forex trading works, so be sure to check what time limits are in place!

Regulation

Whether you’re using a forex trading demo account or using real money, it’s always vital to with brokers that are licensed and regulated in order to ensure the safety of your funds and personal details. All the brokers we recommended are regulated by leading authorities such as the FCA (UK) and ASIC (Australia), so you know you’re in safe hands.

Social Trading

If you have virtually no knowledge or experience of trading currencies online, it’s worth taking a step back and understanding that most traders lose money. As a result, it might be a good idea to choose a platform that offers a social trading feature.

If you have virtually no knowledge or experience of trading currencies online, it’s worth taking a step back and understanding that most traders lose money. As a result, it might be a good idea to choose a platform that offers a social trading feature.In a nutshell, this allows you to communicate with seasoned traders that are using the same platform. They might share forex trading ideas, and you can then comment with how you think the markets go.In doing so, you’ll benefit from a social trading experience that at the same time will help you build up your knowledge.

Trading Tools

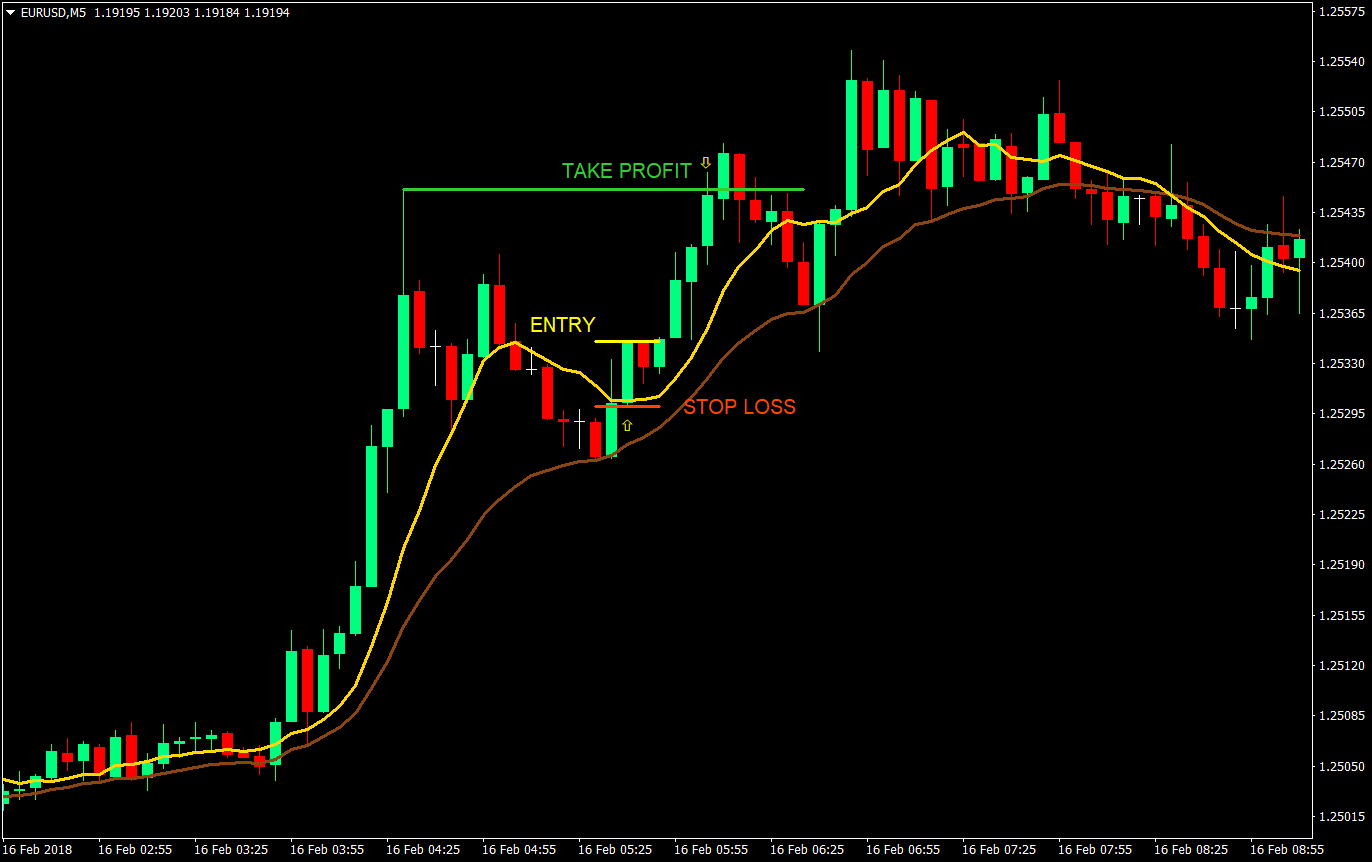

One of the most important metrics that you need to look out for is whether or not the forex demo account comes with sufficient trading tools. After all, you will need to make full use of technical indicators and fundamental research tools if you plan to succeed in the online forex space.

If you don’t, you are simply ‘guessing’ which way you think the markets will go. So, a good starting point is to look at what technical indicator are available at your chosen demo account facility. Advanced charting reading tools, drawing tools, and a fully customizable trading screen are also useful.

News Feeds & Insights

Leading on from the above section, it’s also important to choose a forex trading demo account that offers news feeds. This will be relevant news developments that could potentially impact the value of a currency, our a pair of currencies.

Moreover, market insights is also a useful feature to have at your disposal, as this will allow you to extract the thought-processes of an experienced forex trader.

Some brokers also offer forex bonuses and no deposit forex bonuses. Like a demo account, these can be useful if you want to try out a broker without risking your own money.Step 3: Forex Trading Strategies to Try on Your Demo Account

While we briefly made reference to technical and fundamental analysis, it is equally as important that you find a trading strategy that meets your needs. Once again, most newbie traders enter the forex arena without a clear ‘plan’, which is is why they end up losing money.

As such, be sure to review the following forex trading strategies that you can test out at your chosen demo account facility.

Swing

Swing trading is somewhat of a broad term, as it is used to describe the length of time that a forex trader typically keeps a position open. It is generally accepted that this is anywhere from 1 day to 2 months. For example, the swing trader might see an opportunity on USD/ZAR, where they think that the price of pair will go on an upward trajectory for a number of days or weeks.

The swing trader is happy to keep the position open for as long as they think the trend will continue. As a result, the main focus of a swing trader is to ‘follow the trend’. In doing so, profit margin targets are typically much higher than that of day traders.

Day Trading

Day trading is arguably the complete opposite of swing trading. This is because – and as the name suggests – day traders will rarely keep a position open for more than a day. Instead, forex positions are opened and closed in minutes or hours.

This does mean that profit margins are significantly lower than those chased by swing traders. But, day traders will often place dozens of orders each and every day, so these small gains start to build up. Crucially, there is no harm in combining day and swing trading strategies – as each opportunity is independent of one another!

Scalping

Scalping is the process of entering buy and sell positions within a tight trading range. For example, let’s suppose that USD/ZAR has been trading between 17.25 and 18.25 for several days. A scalping trading will recognize this, and look to capitalize by placing orders at the end of each range.

For example, they will have a sell order placed just below 18.25, and a buy order just above 17.25. In doing so, the scalping trader will make money for as long as the price of USD/ZAR bounces up and down within the range. This particular strategy is reasonably low-risk, as a seasoned trader will know to cover both outcomes of an eventual ‘breakout’.

Step 4: Open a Forex Trading Demo Account

If you have managed to make it through our comprehensive guide up to this point, you are now ready to place your first-ever forex trade through a demo account.

In order to do this, you will need to open an account with your chosen broker and then place a buy/sell order.

Pros and Cons of Forex Trading With a Demo Account

Pros

- Learn the ins and outs of how the forex trading space works

- No need to risk any money

- The best forex demo account providers give you access to live market conditions

- Test out various forex trading strategies risk-free

- Learn everything from market orders, to leverage, to short-selling

- Dozens of forex pairs to trade

- Get to grips with a forex broker before opening a real-money account

Cons

- Demo accounts do not prepare you for the emotional effects of trading

- Most demo accounts come with a time limit

- Can be difficult to maintain realistic trading habits

Conclusion

Forex trading demo accounts allow you to learn the ins and outs of how trading works without risking a single rand. Instead, your demo account will be loaded with paper money, which you can then use as and when you see fit. This is great for getting to grips with market orders, leverage, and other key trading tools, and it’s also ideal for trying out new brokers. You will also have the opportunity to test out trading strategies in a risk-free environment.

FAQs

What is a forex trading demo account?

As the name suggests, a forex trading demo account allows you to trade currencies in live market conditions without risking any money. Instead, you will be placing buy and sell orders with ‘paper funds’.

How do I open a forex trading demo account?

You will first need to find a suitable broker that offers demo accounts. Then, you will need to register an account with the broker. You will then be able to use the demo trading facility until the time limit expires!

How do I use a forex trading demo account?

Demo account facilities typically mirror that of the broker’s real brokerage platform. As such, you will need to place buy and sell positions on your chosen currency pair.

What happens if my forex trading demo account runs out of money?

In most cases, you will not be able to use the demo account facility anymore if you run out of funds. However, some forex brokers allow you to reset the demo balance, so be sure to check this with your chosen broker.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

More Best South Africa Forex Brokers for 2026 GuidesView all

Latest News

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up