Best Forex Trading App in South Africa – Top Apps for 2026

Forex trading apps are ideal for placing last-minute orders at the click of a button. They also ensure that you are able to exit a position when the markets are moving against you, no matter where you are. Mobile forex apps are offered by many online forex brokers, so you’ll need to do some homework to find the forex trading app that best meets your needs.

In this guide, we review the best forex trading apps in South Africa. We also explain some of the things that you need to take into account before choosing a trading app, and show you step-by-step what you need to do to get one installed today.

-

-

Our Recommended Forex Trading App for South Africa Traders

Don’t have time to read our guide all of the way through? Below you will find our recommended South Africa forex trading app for 2026.

How to Pick a Forex Trading App in South Africa?

In order to begin forex trading on your mobile phone, you will need to join a South Africa forex broker. This is because trading applications are offered by fully-fledged online brokerage sites that offer an app on top of their main desktop suite. As such, you need to look at a range of factors before choosing a mobile forex trading platform.

With so many forex trading apps for iOS and Android devices to choose from, below we have reviewed some of the most popular options currently in the market.

1. Plus500 - Low Cost Forex Trading App

Plus500 is a popular forex trading app that is available to download free of charge onto Android and iOS devices. You can still trade via your mobile phone if you have an alternative operating system. But, you will need to do this through your standard mobile web browser. The platform itself is regulated by the FCA, ASIC, CySEC, and MAS, and its parent company is listed on the London Stock Exchange.

As a CFD specialist, Plus500 is home to thousands of tradable instruments. This includes dozens of currency pairs. On top of majors and minors, you will have the capacity to trade exotics currencies such as the South African rand. If you are tempted to diversify into other asset classes, Plus500 also hosts stocks, indices, commodities, and cryptocurrencies, all in the form of CFDs.

There are no trading commissions charged by this broker, other than the spread. You will also have access to leverage facilities at Plus500. This stands at a maximum of 1:500, albeit, you might get less depending on your prior trading experience. You will also get less if you plan to trade less liquid currency pairs. The forex trading app is jam-packed with features and tools, such as the ability to place orders, perform transactions, and check your portfolio.

In terms of getting started, it takes just minutes to open an account. You can do this via the forex trading app or main desktop site, and you will need to meet a £100 account minimum (about 2,100 rands). Supported payment options include a debit/credit card, bank account, or Paypal. Plus500 does not charge any fees to withdraw money out, which is an added bonus.

Our Rating

- Regulated by the FCA and ASIC

- 0% trading commissions

- Mobile forex trading app available

- No educational material

80.5% of retail investor accounts lose money when trading CFDs with this provider.2. FinmaxFX - High Leverage Forex Trading App With MT5

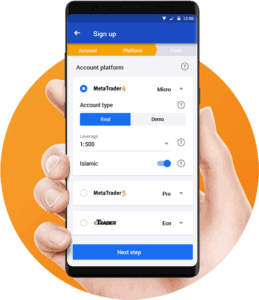

FinmaxFX is a relatively new entrant to the forex trading app space. Launched in 2019, the offshore broker is regulated by the VFSC (Vanuatu) and the IFMRRC. The platform hosts a full selection of forex pairs across the majors, minors, and exotics. You will have access to high leverage limits, which stands at 1:200 when trading major forex pairs. This means that a 2,000 rand deposit would permit a maximum trade size of 400,000 rands.

You will get 1:100 when trading less liquid pairs, but this is still substantial nonetheless. FinmaxFX is also popular with South Africans because of its integration with MT5. If you haven't used the provider previously, MT5 is a third-party software platform that allows you to fully customize your trading screen. It also comes packed with advanced market orders, chart reading tools, and technical indicators.

Furthermore, trading via MT5 at FinmaxFX gives you the capacity to install a forex EA (Expert Advisor). You can also set up a demo account with the broker, which is great for testing out new strategies. In terms of the fundamentals, FinmaxFX offers several account types. The most basic account comes with a minimum deposit of $250. All account types come with a forex bonus, with the size of the promotion depending on your choice of account.

You will get to choose from a wide variety of payment options, which includes debit/credit cards, a bank wire, e-wallet, and even Bitcoin. FinmaxFX will sometimes charge a withdrawal fee, albeit, this depends on the type of account you have. When it comes to trading fees, FinmaxFX is somewhat expensive in the spread department. You can get this down to a minimum of 1 pip when trading majors, but this is only for upper-end account types.

Our Rating

- Leverage of 1:200 on major forex pairs

- Educational materials

- Bonus available to new customers

- Doesn't hold a tier-one license

There is no guarantee you will make money with this provider3. AvaTrade - Global Forex Trading App With MT4 & MT5

AvaTrade is a well-established forex trading app that is popular with both newbie investors and seasoned traders. This is because the broker gives you several options in the trading department. For example, if you have some experienced under your belt and want access to more advanced tools, then you might be suited for MT4 or MT5. At the other end of the spectrum, AvaTrade also offers its own proprietary trading platform.

This is potentially more suited to those of you that want a cleaner, and somewhat more user-friendly trading suite. Either way, you will still have access to lots of trading tools and market orders, all of which can be executed via the AvaTrade mobile trading app. The application itself is available to download on Android or iOS devices. Once again, if you fall outside of the main two operating systems, you can trade via your mobile web browser.

AvaTrade is also popular with South Africans because of its super-competitive fee structure. Not only can you buy, sell, and trade forex pairs without paying any commission, but spreads are low. In fact, major pairs like EUR/USD can be traded at a spread of just 0.9 pips during standard market hours. You can also deposit funds without being charge, with support payment methods including a debit/credit card or bank account.

As a global forex trading app that is available in over 100+ countries, AvaTrade is regulated on multiple fronts. On top of holding a license in Canada, Japan, Ireland, and the BVI, AvaTrade is also regulated by the South African Financial Services Board (FSB). Finally, AvaTrade is also home to heaps of other asset classes, all of which come in the form of CFDs. This includes indices, equities, hard metals, energies, and cryptocurrencies.,

Our Rating

- Spreads from just 0.9 pips

- Multiple licenses

- Both MT4 and MT5 supported

- Sparse educational resources

There is no guarantee you will make money with this provider4. IG - Established Forex Trading App With Over 90+ Currency Pairs

IG has one of the strongest reputations in the global brokerage scene. The platform was launched way back in the 1970s, so you will be using a broker that carries a track record of over four decades. Its trusted reputation is further amplified by its strong regulatory standing. For example, IG is licensed with tier-one bodies such as the UK's FCA and Australia's ASIC, alongside a number of other jurisdictions.

In terms of its forex trading arena. IG gives you access to over 90+ currency pairs. This means that you will have the capacity to trade heaps of exotic currencies, including the South African rand. You will, of course, also have access to majors and minors - all of which come with super-tight spreads. In fact, these can go as low as 0.6 pips when trading major pairs.

Best of all, you will not pay any trading commissions at IG, irrespective of the forex pair you wish to trade. When it comes to the mobile app, this is offered across iOS and Android. The specific features that you get will depend on your operating system, so do check this in advance. For example, if iOS version of the IG trading app does not allow you to deposit or withdraw funds, while Android does. Instead, you'll need to do this via the main IG website.

You can, however, place buy and sell orders at the click of a button on both versions of the app, as well as perform in-depth chart analysis. If you do want to use an age-old forex trading app like IG, the platform requires a minimum deposit of £250 (about 5,100 rands). The broker supports debit and credit cards for an instant deposit, or a bank wire for a larger, but slower deposit.

- Spreads from 0.6 pips

- Supports MT4 trading platform

- Excellent research department

- 1% fee when using Visa and 0.5% via MasterCard

There is no guarantee you will make money with this provider.Looking to bag a forex bonus? Check out our guides to the best forex bonus and no deposit forex bonuses in South Africa.Step 2: What to Look for in a South Africa Forex Trading App?

Although we have already discussed some of the most popular forex trading apps in South Africa, we still think that it is important for you to do your own homework. By this, we meaning performing additional research into the broker prior to signing up. In doing so, you can be 100% sure that the forex trading app is right for your needs.

Although we have already discussed some of the most popular forex trading apps in South Africa, we still think that it is important for you to do your own homework. By this, we meaning performing additional research into the broker prior to signing up. In doing so, you can be 100% sure that the forex trading app is right for your needs.To help you along the way, below you will find some of the considerations that you need to make when looking for the best forex trading app in South Africa for you.

Fully Regulated

It is extremely important that you only download and install a forex trading app from a regulated provider. All of the trading platforms that we discussed earlier in this guide are regulated by several bodies.

This includes bodies such as the UK’s FCA, Australia’s, ASIC, and Cyprus’s CySEC, which ensures that you are able to buy and sell currency pairs in a safe, secure, and credible environment.

Automated Forex Trading

Lots of seasoned traders will choose to install an auto trading system into their chosen broker. This comes in the form of a forex EA or forex robot, which subsequently place buy and sell orders on your behalf. This gives you the benefit of being able to trade 24/7 without needing to be sat at your device.

It’s super-useful if you have a mobile forex trading app that allows you to check the performance of your automated systems at the click of a button, so this is something to look out for if autonomous trading is your thing.

Forex Analysis Tools

The only way that you will be able to make money in the forex trading industry is learn and understand how analysis works. After all, the future direction of a particular currency pair is often influenced by historical trends.

At the forefront of this is technical analysis, which sees seasoned trader scan charts with the view of assessing which way the pair is likely to move in the short-term. To some extend, fundamental analysis is also important.

This is where the forex investor will trade on the back of an important news event that will have a direct impact on the value of a currency. As a result, make sure that your chosen South Africa forex trading app gives you access to analyitcal tools.

Intelligence Indicators

Otherwise referred to as technical indicators, intelligence indicators help you perform advanced chart analyze on a specific currency pair. There are over a 100+ indicators that are frequently used by South African forex traders, each of which will focus on a particular metric or trend.

This includes the likes of the:

- MACD

- Fibonacci Retracement Levels

- Exponential Moving Averages

- 200-day Simple Moving Average

- 100-day Simple Moving Average

- Bollinger Bands

It can take many months to get to grips with what intelligence indicators are and what it is they seek to achieve. Nevertheless, it’s crucial that your chosen forex trading app gives you access to them.

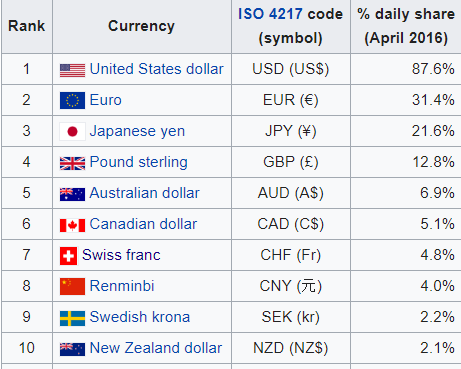

Financial Instruments

You will, of course, need to check what forex trading pairs the brokerage app offers. In most cases, you will find that South Africa forex trading apps give you access to dozens of major and minor pairs. In this sense, there is little variation between platforms.

However, it is the exotic pair department that you need to look out for, especially if you are planning to trade the South African rand.

Market Orders

In order to trade forex pairs from the comfort of your home or via your mobile device, you will need to place some market orders. Irrespective of which forex trading app you use, you will always have access to buy and sell orders, as both are required to enter and exit a position. However, the best trading apps for iPhone and Android will give you access to lots of more sophisticated orders.

This might include:

- Limits Orders

- Stop-Loss Orders

- Take-Profit Orders

- Trialling Stop-Loss Orders

- Guaranteed Stop-Loss Orders

- Good-Til-Cancelled Orders

- Partial Stop-Loss Orders

Ultimately, you’ll want to choose a South Africa forex trading app that offers heaps of market orders. This will allow you to deploy your trading strategy with ease.

Alerts and Notifications

One of the biggest benefits of using a forex trading app is that you can install real-time alerts. For example, let’s suppose that you are interested in trading USD/ZAR, but only when the price hits 16.50. A forex trading app allows you to set up a pricing alert so that you’re notified when the price is triggered.

Alerts and notifications are also useful in letting you know when an order has been triggered. For example, you will likely be placing both a take-profit and stop-loss order when you trade forex, so the mobile app can let you know when one of these has been activated and, thus, your position has been closed.

Demo Account

You should also stick with a trading app that offers a forex demo` account of some sort. This is where you will be buying and selling currency pairs with paper trading money, meaning that you will not need to risk your own funds.

This is ideal if you want to learn the ropes of mobile forex trading or you want to test out a new strategy. Then, once you begin to get more comfortable, you can then consider trading with real money.

Many forex trading apps also support other financial instruments, meaning you can buy shares, buy Bitcoin or try out CFD trading in a single mobile app.Step 3: Open a Trade using a Forex Trading App

If you have managed to make it through our comprehensive guide up to this point, you are now ready to place your first-ever forex trade through a dedicated application.

In order to do this, you will need to open an account with your chosen broker, deposit some funds, and then place a buy/sell order.

Conclusion

Forex trading apps allow you to take your investment endeavours to the very next level. Whether you want to place a last-minute trade or you want to instantly exit a losing position, you can do this at the click of a button no matter where you are located.

In fact, the very best South Africa forex trading apps give you access to the same account features as found on the broker’s main desktop site. Ultimately, we hope that our guide has pointed you in the right direction, especially when it comes to picking a trading app that best meets your needs.

FAQs

Are forex trading apps legit?

Yes, the vast majority of forex trading apps are legit. But, you need to ensure that the underlying brokerage firm offering the app is regulated. In fact, you should stick with brokers that are regulated by reputable licensing bodies like the FCA, ASIC, or FSB.

How do I trade forex on a trading app?

The trading process works in exactly the same as the online version of a brokerage site. That is to say, you need to speculate whether you think the price of a forex pair will go up or down. You will do this by placing a buy or sell order and determining how much you wish to risk.

Do forex trading apps come with leverage?

Yes, forex trading apps do come with leverage facilities. The amount that you can get will depend on several factors. This includes your status (retail or professional trader), the specific currency pair, and the broker itself.

Will I need to provide ID when joining a forex trading app?

If you are using a regulated forex trading app (which you should be), then you will always need to provide some ID. This needs to be a government-issued ID and a proof of address.

Do forex trading apps come with a demo account?

In most cases, yes. But, this will once again depend on the underlying broker that offers the app. All of the providers that have been discussed on this page offer a demo trading account.

How do I withdraw funds from a forex trading app?

You will need to withdraw your balance back to the same payment method that you used to make a deposit. For example, if you deposited funds with your South African bank account, the funds will need to be transferred back to the same account.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up