Share Trading New Zealand – A Beginner’s Guide

Buying and selling shares of a company is one of the most popular forms of trading. You can profit from shares by holding the asset until the value increases and sell the shares to make a margin, and when you buy shares, you’re eligible for dividend payouts and a seat at a company’s shareholder meetings. So there are plenty of potential benefits to share trading in New Zealand.

If you’re wondering how to trade shares in New Zealand, this guide has you covered. We’ll explain everything you need to know about NZ share trading, including how to develop a successful share trading strategy. We’ll also compare the best share trading platforms for 2026 that you can use to open a New Zealand share trading account today.

-

-

How to Start Online Share Trading in NZ in 3 Quick Steps

Can’t wait to start share trading? Just follow these three steps to place your first share order:

Step 1: How to Pick a Share Trading Account in New Zealand?

In order to trade shares in New Zealand, you’ll need a share trading account. Choosing the right New Zealand share broker is key since your broker determines how much trading will cost and what companies you’ll be able to trade.

To help you find the best share broker, let’s take a closer look at our top recommendations:

1. Plus500 - Low Cost Share Trading Platform in NZ

Plus500 is a very low-cost broker that gives you access to hundreds of shares through CFDs. There are no commissions on trades and the spread on shares is very low. Plus, the platform includes built-in charting software that’s easy to get started with if you’re new to share trading.

One of the things we like best about Plus500 is that the platform offers built-in price alerts. If you’re watching a particular share, you can get notifications on your phone or in your inbox if the price drops below your buying threshold. So, you never have to worry about missing a trade opportunity.

Our Rating

- Low cost: Commission-free with tight spreads

- Beginner-friendly: Easy for new share traders to get started

- Price Alerts: Never miss a buying opportunity

- Limited Charts: Not ideal for advanced share traders

- Education: No resources for beginners

80.5% of retail investor accounts lose money when trading CFDs with this provider.2. FinmaxFX - Up to 1:20 Leverage

FinmaxFX may be built for forex trading, but this broker also offers quite a bit of versatility for share traders. It offers CFDs for hundreds of global companies, including from exchanges in places like Moscow and Athens that most other brokers don’t carry.

For beginner share traders, FinmaxFX has a large library of educational content. You can learn about share trading basics and technical strategies, then give those strategies a test run using the trade simulator. The platform also includes a pretty capable built-in trading platform, which is a plus for more advanced share traders.

As FinmaxFX isn’t licensed in Europe, it can offer up to 1:20 leverage on share trading, which is much higher than other brokers. Unfortunately, FinmaxFX isn’t the cheapest option for share trading. It charges up to a 3% fee on withdrawal and a hefty inactivity fee after two months without a trade.

Our Rating

- Global Exchanges: Including lesser-traded shares

- Educational Content: Articles, tutorials, and demo accounts

- Charting Software: Designed for advanced share traders

- High Fees: Withdrawal and inactivity fees

There is no guarantee you will make money with this provider.3. AvaTrade - Includes MetaTrader 5

AvaTrade is one of the best choices for technical share trading. The platform includes its own highly advanced charting platform, which is available on mobile devices as well as desktops. AvaTrade also comes with access to MetaTrader 5, which gives traders the ability to backtest strategies, create new technical indicators, and build trading bots.

On top of that, AvaTrade offers basic copy trading. While it’s not a full-fledged social trading platform, you can still see what other traders are buying and mimic their share trades with some or all of your portfolio.

The downside to AvaTrade is that the selection of shares to trade is somewhat limited. You can only trade shares for around 50 companies, most of which are in the US.

Our Rating

- Mobile Charting: Built-in charting platform is available on the go

- MetaTrader 5: Backtest strategies and create custom indicators

- Copy Trading: Borrow other traders’ best ideas

- US Stocks: Only around 50 shares to trade, mostly from US companies

There is no guarantee you will make money with this provider.4. Forex.com - Low-cost Share Trading

Forex.com might seem expensive at first because it charges commissions on every trade. But, when you do the math, this is actually one of the least expensive options for share trading available. The per-trade commission is around 0.08% and Forex.com keeps its spreads to around 0.01%. Add those up, and trading is still cheaper than what you’ll pay for the spread with a lot of other platforms.

On top of that, Forex.com keeps its fees to a minimum. There are no withdrawal fees, and an inactivity fee is only assessed after you haven’t placed a trade for a full year. This broker’s range of share offerings is good, but not great. You get access to trade share CFDs for 220 companies, but they’re all based in the US or UK. So, if you’re interested in accessing emerging markets, Forex.com won’t be able to help you.

Our Rating

- Low-cost Commissions: Less than the spread for other platforms

- Minimal Fees: No withdrawal fee and inactivity up to one year

- US and UK Shares: Trade share CFDs for 220 companies

- No Emerging Markets: Only offers trading for US and UK shares

There is no guarantee you will make money with this provider.5. IG - Over 13,000 Shares

IG is a UK-bases broker that offers a huge selection of more than 13,000 shares and ETFs to trade as CFDs. These shares are from a range of stock markets across the world, including New Zealand, Australia, the US and the UK, so there really is plenty of choice.

Share trading at IG is charged on a commission basis. This ranges from 0.08% to 0.10% depending on the market, while there’s a charge of 2 cents per trade when you buy and sell US shares. It even offers out of hours trading on a number of US shares.

IG offers a range of market insights, trading tools and MetaTrader4 compatibility, so it’s a good choice for advanced traders. You can choose to trade on the desktop platform or the mobile app, and you can choose from a range of payment methods, including PayPal, when you trade shares with this regulated broker.

Our Rating

- Over 13,000 shares from international markets

- Good range of trading tools

- Extended hours for US share trading

- $50 quarterly fee if you make less than three trades

There is no guarantee you will make money with this provider.6. FBS - Multiple Account Types

If you’re looking for flexibility, FBS has it. This platform offers five different types of trading accounts, which vary in the minimum deposit required, the spreads you’ll pay, and the speed of your order execution. While you might not need this flexibility right away, it can be very useful as you grow into a more advanced share trader.

Another advantage to FBS is that it offers access to MetaTrader 5. You can use FBS’s built-in trading platform for basic analysis and share trading, but MetaTrader lets you develop custom strategies and automate your trading.

The only caveat to share trading with FBS is that this broker doesn’t offer many shares to choose from. You can pick CFDs for around 40 companies, all of which are based in the US or UK.

Our Rating

- Multiple Account Types: Pick based on minimum deposit, spread, and more

- Copy Trading: Copy the share positions of successful traders

- MetaTrader 5: Automate your trading and backtest strategies

- US and UK Shares Only: Limited to around 40 share CFDs

There is no guarantee you will make money with this provider.Step 2: Learn How to Trade Shares

While opening a New Zealand share trading account is the first step to trading shares, it’s important to understand the basics before you get started. Here, we’ll cover everything you need to know about how share trading works.

What is Share Trading?

When you trade shares, you’re buying and selling portions of ownership of publicly traded companies. Shares go up and down in value in response to supply and demand, so you can profit when you sell your shares for a higher price than you bought them for. Share prices rise when a company performs well, such as by increasing its profits or revenue.

Of course, there is also some risk in share trading. If demand for a share falls, perhaps because of a public relations issue at the company or a drop in consumer demand, the price of the share will fall as well. When that happens, you can either continue to hold the share in the hope that the price rises again, or you could sell it for a loss.

How to begin Share Trading

In order to trade shares in New Zealand, you must use an online broker. Brokers act as middlemen, taking your order to buy, say, 10 shares of Netflix and delivering it to a stock exchange. On the exchange, your order to buy Netflix shares is then matched with an order from someone else to sell 10 shares of Netflix. The shares are delivered to your broker, which holds them in your share trading account until you’re ready to sell them.

It’s important to note that you can’t just walk into an exchange and buy shares yourself. First of all, the exchanges that share trade on are global, if you want to buy shares of a US company, for example, the shares probably trade on an exchange in New York, not New Zealand. Even then, only licensed brokers, not individual traders, are allowed to buy and sell shares on exchanges.

Once you buy shares, it’s up to you to decide when you want to sell them. We’ll dive more into strategies below, but you can hold shares for minutes, days, or years. The primary thing that matters when it comes to turning a profit is that you sell your shares for a higher price than you paid for them.

Alternatively, you can trade shares CFDs (contracts for difference), meaning you speculate on the price without owning any underlying assets. This allows you to speculate on share prices going down as well as up, and you can also use leverage to borrow capital from a broker and make larger trades.

Share Trading Terminologies for Beginners

Share trading comes with a lingo all its own, which can be confusing for beginners. So, let’s define some of the most important share trading terms you need to know:

- CFD – Contract for difference. This is a derivative that gives you exposure to a share’s price without actually buying shares.

- Dividend – A payment, usually made quarterly or annually, that companies make to shareholders. Some companies pay dividends, but many do not.

- Leverage – Increasing how many shares you can buy by borrowing money from your broker.

- Limit Order – An order through your broker to buy shares at or below a specific price.

- Market Order – An order through your broker to buy shares at their current market price.

- NZX – The New Zealand Exchange, which is the exchange your broker will go to in order to buy and sell shares of New Zealand companies.

- Return – Your profit or loss on a share trade, usually expressed as a percentage of your initial investment.

- Spread – The difference between what you pay for a share and what you can sell it for at the same time. Your broker pockets the spread on every trade.

- Stop Loss – A price below a share’s current price. If the share’s value drops to your stop-loss price, your broker will sell some or all of your shares of that company.

What are the Best Tips When Trading Shares?

There’s a lot to think about when you’re just starting out with online share trading in New Zealand. But keeping some important tips in mind can help you navigate the market and consistently profit.

- Set Stop Losses

It’s easy to get carried away by the potential reward if a share trade goes well, but what happens if a company doesn’t perform as you expect it to? Always protect your trades with a stop loss so that you can never lose more than 10-20% on any single trade. - Buy and Sell Gradually

In addition, you can reduce risk by building positions gradually. For example, instead of buying 100 Twitter shares at once, buy 20 shares each week for five weeks. That way, if Twitter’s share price goes up and down over those weeks, some purchases will end up profiting and offset any small losses. - Diversify

You shouldn’t put all your eggs in one basket when it comes to online share trading. By that, we mean investing in just one or two shares. By spreading your budget across a more diverse range of shares, you can reduce the impact of a share price dropping on your portfolio. - Take Advantage of Limit Orders

Another good tip is to use limit orders. Whereas a market order executes your trade immediately at the current share price, a limit order puts a cap on how much you’re willing to pay for a share. Using limit orders is a good way to buy shares when the price dips slightly, as opposed to overpaying and suffering a loss during a short-term dip. - Tread Carefully with Leverage

Leverage can be very alluring to new traders. Essentially, you can borrow money from your broker to buy shares than you can otherwise afford. With 10:1 leverage, for example, you can buy $10,000 worth of shares with only $1,000 in your trading account. Be very careful with leverage. A 1% drop in share price means a 10% loss when you trade at 10:1. Plus, you have to worry about keeping a minimum amount of cash in your account and interest charged by your broker when trading shares with leverage. Beginner share traders should generally steer clear of leverage until you gain more experience.

What Not to Do When Trading Shares

Just as there are plenty of things you should do when trading shares, there are plenty of things you should avoid doing.

- Don’t Take Tips from Strangers

Heard about an exciting investment opportunity on Twitter? Think twice. There are plenty of scammers out there who want to trick people into buying shares of a company for their own benefit. There are also plenty of people who give advice, even if they don’t know much about share trading themselves. If you need tips for which companies to buy shares for, stick to reputable sources and professional services. - Don’t Trade Without Research

Whether you’re buying shares or trading CFDs, there’s always the risk that you can lose money, particularly if you’re unprepared. We recommend researching the market, looking at factors like companies’ fundamentals, historic price movements and future outlooks before you risk your money. The more research you put in, the better informed your trades will be. - Don’t Hold at Any Cost

When you buy shares, it’s typically because you think they’re going to rise in value. But if they fall, it’s easy to get emotionally attached to your trade. Many share traders will hold onto shares even as they lose 20% or more of their value, essentially sinking with their ship for no good reason. Be objective about a bad trade, after all, they happen even to professional traders. Set a maximum amount you’re willing to lose on a single and stick to it.

New Zealand Share Trading Accounts Fees

The main fees you need to worry about when trading shares in New Zealand are commissions and spreads.

Commissions are per-trade fees that are assessed every time you enter a buy and sell order. They are either a percentage of each trade or a flat amount, which can sometimes depend on your trading activity in the previous month. Thankfully, many New Zealand share trading accounts no longer charge commissions.

The spread is the difference between what you can buy a share for and what you can sell it for at the same time. This is usually around 0.1%, but it varies between brokers. The spread is essentially a percentage-based fee on every trade.

Another charge to consider is overnight fees, which is a fee that you pay to hold leveraged CFD trades overnight. Some brokers also charge withdrawal and inactivity fees. Watch out for these, as they can add up over time. Understanding when these fees are assessed by your broker may help you avoid them.

Step 3: Choose a Trading Strategy and Start Trading

A key ingredient to successful share trading is a good strategy. There are many different ways to approach online share trading, so we’ll take a look at some of the most popular strategies.

Day Trading

Day trading is a strategy by which you buy and sell shares within the course of a single day. You buy shares in the morning, hold them for a few hours, and then sell shares in the afternoon. Day traders rarely, if ever, hold a position overnight.

Swing Trading

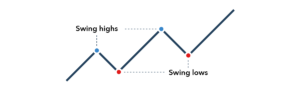

Swing traders look for changes in a share’s price momentum. If a share had been steadily falling in value, a swing trader might look to buy just as it begins a new uptrend.

Swing trading can be tricky, since it’s critical that you get the timing of your trades right. Most swing traders rely heavily on technical charts and expect to hold positions for a few days or weeks.

Position Trading

Position traders are similar to long-term investors, but they don’t hold forever. Typically, position traders will invest in shares that are expected to rise in value slowly but steadily. They may hold these shares for weeks or months, as long as an uptrend continues.

Scalping

Scalping is a fast-paced strategy that involves placing a huge number of small-value trades. Basically, scalpers will buy a stock and hold it for just a few minutes or even seconds, waiting for the price increase by a few cents. The price changes that scalpers look for aren’t necessarily due to big trends, but rather due to the back and forth of traders buying and selling shares throughout the day.

Step 4: Open a Share Trade

Now, all that is left to do is open an account with one of the brokers listed above and execute a share trade through the terminal.

Pros and Cons of Share Trading

Pros

- Income Potential—By buying and selling shares at a profit, you can potentially make capital gains.

- High Liquidity—If you want to buy shares, you’ll always find a seller. When you’re ready to sell, you’ll always find a buyer.

- Global Reach—Invest in shares for companies around the globe with a single broker.

- Diversified Portfolio—Trading shares for companies in multiple market sectors is a great way to diversify your portfolio.

Cons

- Risk—When share trading, there is a chance that the share price falls and you lose money.

- Time Investment—Researching companies and managing your share trades takes a significant amount of time.

Conclusion

Whether you're buying shares or trading CFDs, online share trading can be an attractive proposition, due to the opportunity to make capital gains and diversify your portfolio. However, share trading comes with risks, so we recommend doing your research and developing a strategy before you put your money on the line.

FAQs

Can I trade shares for New Zealand companies?

You can trade shares for New Zealand companies, but only if your broker is a member of the New Zealand Exchange (NZX).

What can I do if my broker doesn’t offer share trading for a company?

If your broker doesn’t offer share trading for a specific company, your best option is to buy shares of a similar company for which your broker does offer trading, or to sign up to a broker that offers the shares you're looking for.

What are share CFDs and how do they work?

Share CFDs are derivatives that gives you exposure to changes in a share’s price. When you buy a CFD, you don’t own the share itself, but you can profit when its price increases or decreases. One major advantage to CFD trading is that you can go short, meaning you can speculate on the price falling as well as rising.

What are share dividends?

Dividends are portions of a company's profits that are paid out to shareholders. As they're paid out either quarterly or annually, they're only relevant to investors looking to hold shares for a long time, rather than traders looking to make quick profits.

How much money do I need to begin online share trading in New Zealand?

This depends on the minimum deposit of your chosen broker, which usually ranges from $100 to $200.

Haydn Squibb

Haydn Squibb

A journalist, with experience writing across the UK financial and professional service sector. Haydn holds a degree in Media Writing and enjoys covering about a wide range of topics from financial markets and current affairs to home, health and lifestyle. Haydn's work has been published on a number of top tier websites.View all posts by Haydn SquibbWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

When you trade shares, you’re buying and selling portions of ownership of publicly traded companies. Shares go up and down in value in response to supply and demand, so you can profit when you sell your shares for a higher price than you bought them for. Share prices rise when a company performs well, such as by increasing its profits or revenue.

When you trade shares, you’re buying and selling portions of ownership of publicly traded companies. Shares go up and down in value in response to supply and demand, so you can profit when you sell your shares for a higher price than you bought them for. Share prices rise when a company performs well, such as by increasing its profits or revenue.