Skrill New Zealand – A Guide on How to Open an Account, Deposit and Withdraw

We all love money and the comforts it affords us. Unfortunately, it doesn’t come easy, and this is why most people are scared of losing it to con artists/platforms. But instead of hoarding money and not enjoying what it can do for you, how about you use trusted payment methods. In this case, Skrill New Zealand.

When you step forth to enjoy online casino games or sports betting, or even decide to invest in forex trading, Skrill New Zealand ensures you are safe and secure. Admittedly, this is excellent news, but before you jump on the opportunity, how about you learn what it has to offer, and how you can leverage it while on these platforms.

In this guide, we shall take you through the setup steps and show you how to deposit and withdraw in minutes.

-

-

Why Use Skrill?

Now, we don’t expect you to take our word for it, so here is a couple of reasons why Skrill is a great payment method option for online casinos and forex trading. But first, what is it?

Skrill is an e-wallet that was started in 2001. Its sole purpose is to facilitate simple, safe, and secure digital payments. You can send money from one Skrill account to another and connect it to your bank account, as we’ll describe in this guide. As a payment method, you can use it on any platform that accepts it, including e-commerce platforms, online casinos, and forex brokers.

Since its inception, it has grown tremendously and continues to push the tech boundaries in the digital payment space. It’s continually improving its security, features, and the convenience it offers. However, note that there’s nothing perfect in this world.

The main benefits include:

- Privacy – completing online transactions through Skrill keeps your information private. Your name and address will not reflect on the online casino database.

- Wide acceptance – Skrill serves millions of clients in over 200 countries. Therefore, it offers over 40 currencies, including the New Zealand Dollar.

- Low fees – like with other online payment services, there are some fees. But despite the convenience, features, and security Skrill offers, their fees are low and, in some instances, ‘nil.’ There is a fee for sending money, but it’s free when withdrawing cash from your online casinos account into Skrill. Moreover, there’s a small fee for withdrawing money into your bank account. In comparison to other e-wallets, Skrill seems to have prioritized affordability as well.

- Quick withdrawals and deposits – once Skrill is set up, usually takes less than 24 hours, the deposits reflect instantly. This means that you’ll be gambling or trading within seconds of your deposit.

Note: if your initial online casino account withdrawal isn’t through Skrill or it’s your first time withdrawing, the money will take longer to reflect. Most online casinos give a 4-5 day estimate, but it’s shorter than this. However, it helps if your account is verified before processing a withdrawal.- Easy to use – the Skrill desktop platform and app are easy to use. The interface is intuitive, and there’s little to no learning curve.

How to Use Skrill New Zealand

Using Skrill all starts with account creation. The process is simple, and like opening a social media account, except there is a verification process.

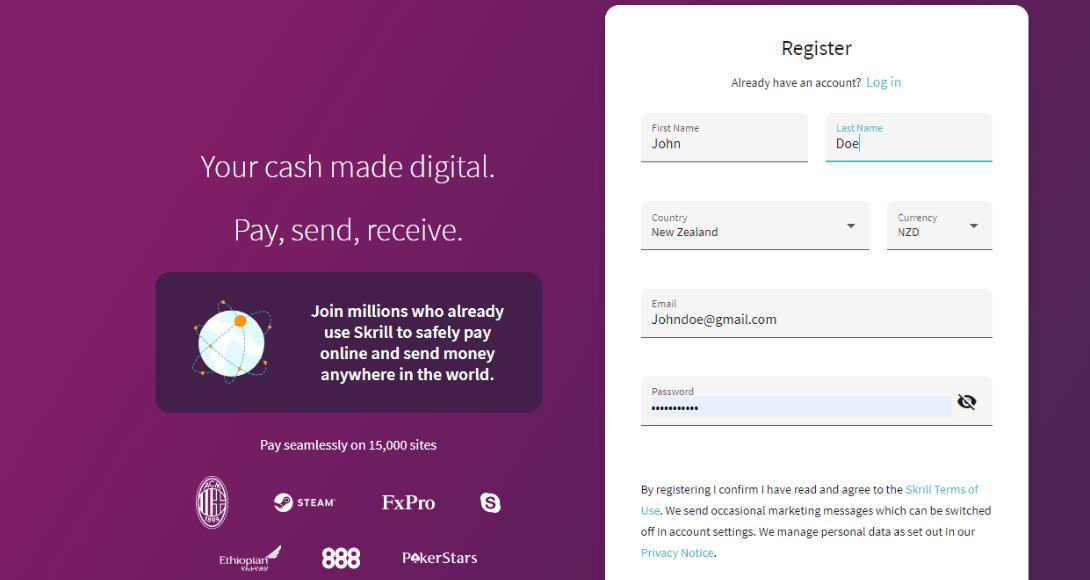

Step 1: Open a Skrill Account

Type Skrill.com on your browser and click ‘Register’ or ‘Open a free account.’ Regardless of your choice, you’ll receive a registration form needing your name, email address, physical address, and password. You’ll also need to specify your country and preferred currency.

Step 2: Fund Your Skrill Account

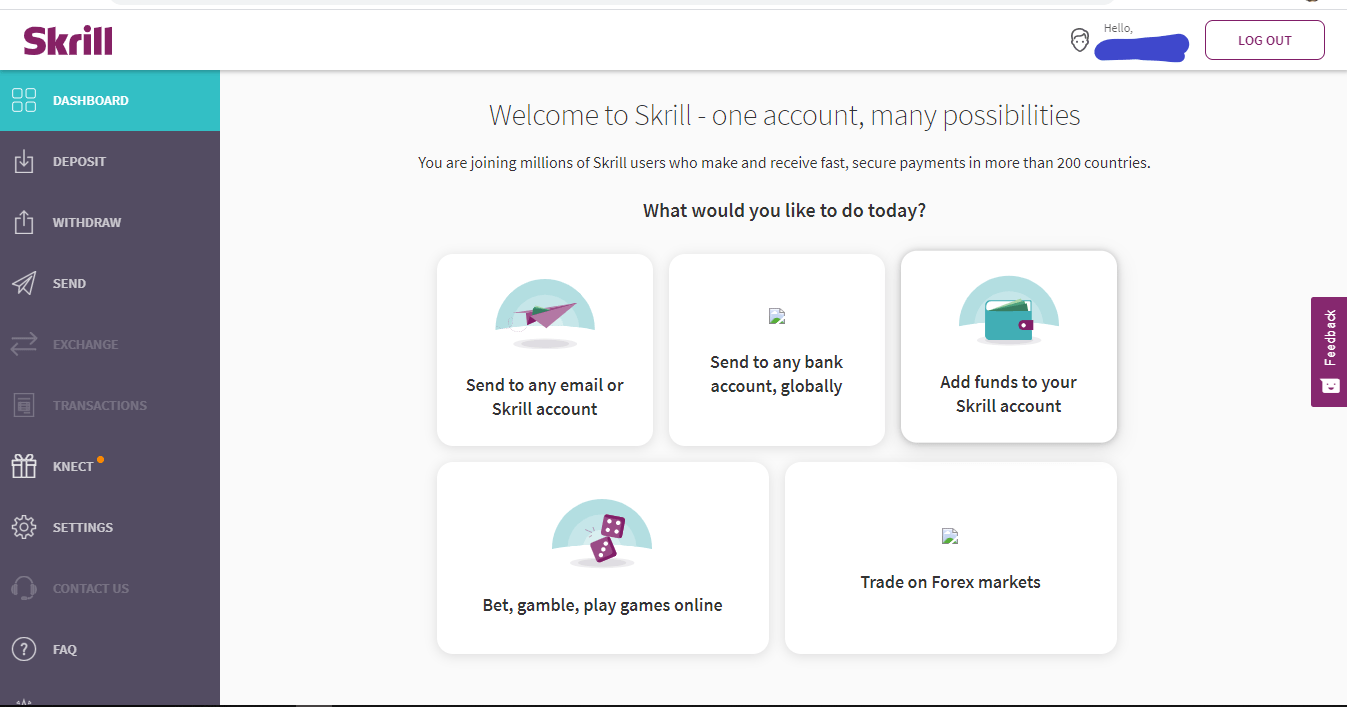

Once you have an account, you’ll be redirected to this page.

Here you’ll find several options to fund the account. Your choice depends on what you intend to use the Skrill account for. The options you are faced with include:

- Add funds to your Skrill account

- Bet, gamble, play games online

- Trade on forex markets

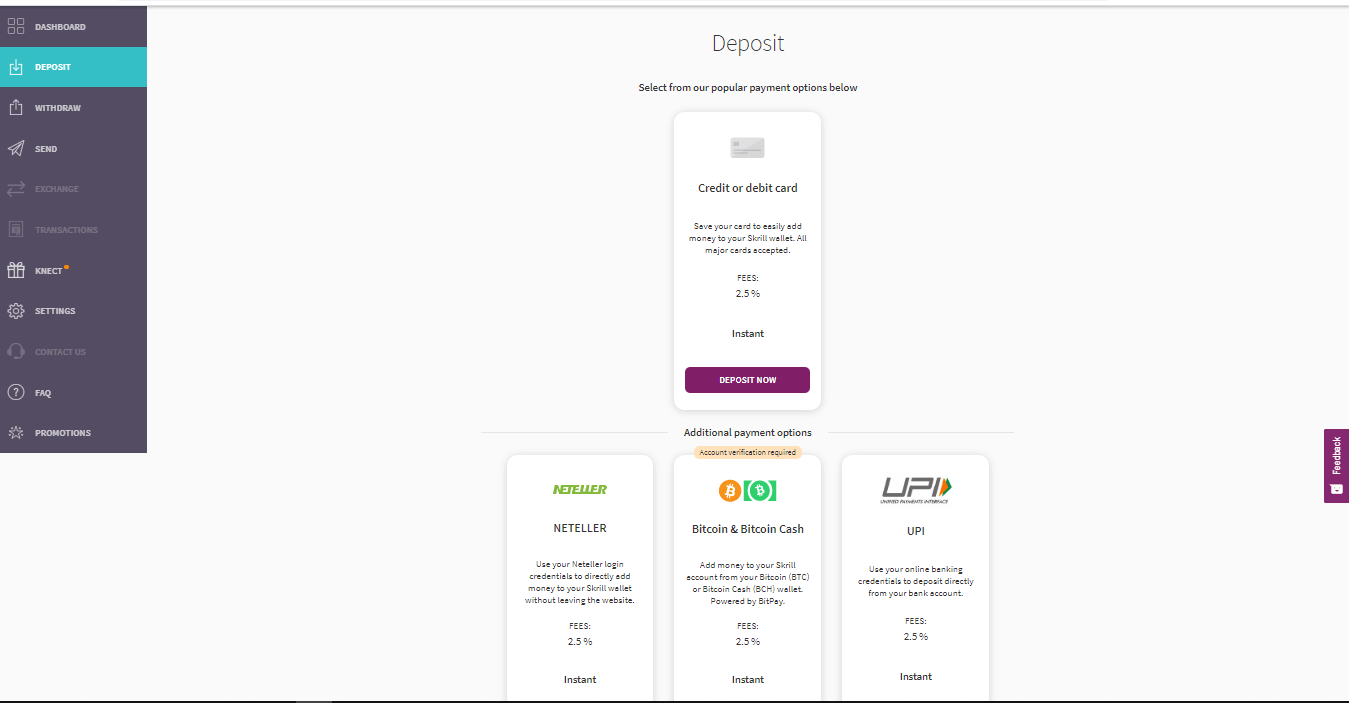

Whichever path you choose, you’ll have a choice of payment methods to use in the funding process. The most popular options are the debit/credit card option, Neteller, and Bitcoin. Though these methods are designed for instant deposit, on the first time, you’ll go through a verification process.

You can choose any option depending on your convenience. But today, we shall take you through the cred/debit card option.

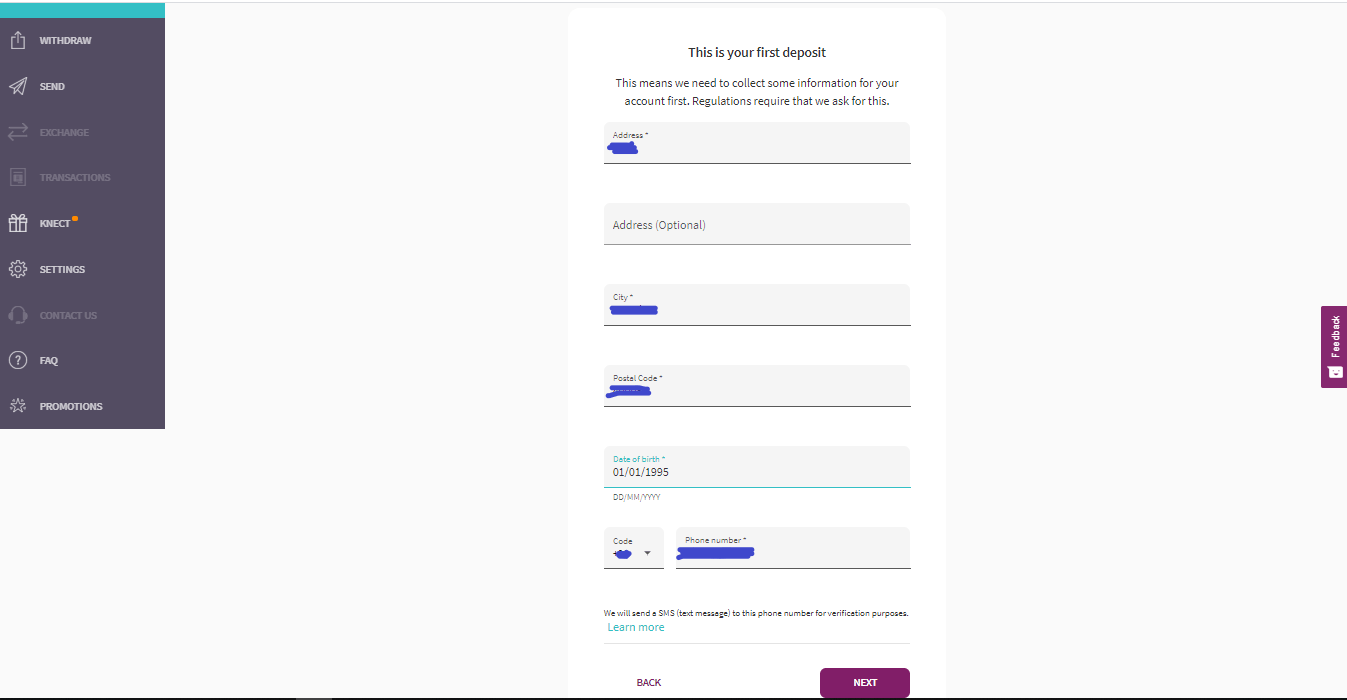

Click ‘Deposit,’ and a form will appear. In this form, type in your address and mobile number.

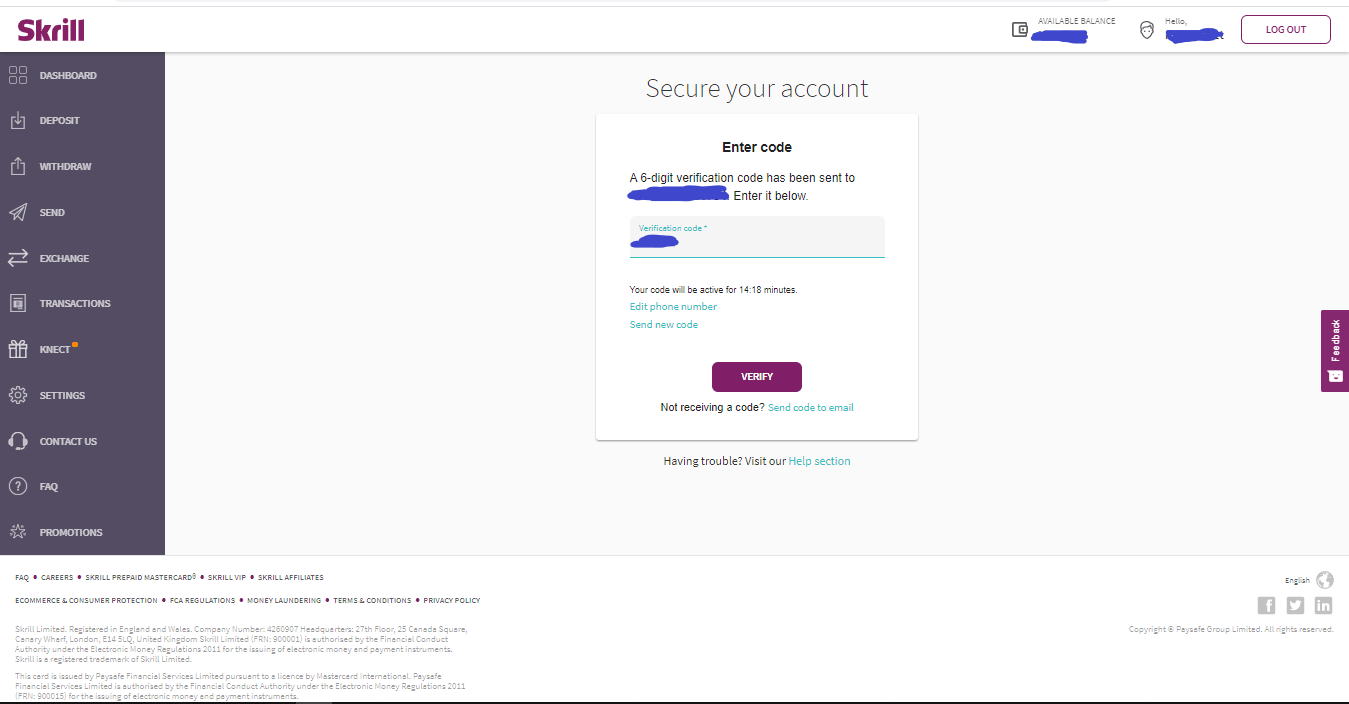

Note: make sure you provide the correct information because it will be used to prove your identity. Your phone number will receive a confirmation code later, and on subsequent logins.After filling this form, click on ‘Next.’ On this stage, you’ll verify the email address and phone number through an automatic code sent to the details you enter. Once you enter the code, click on ‘Verify’ and, on the next step, create a PIN.

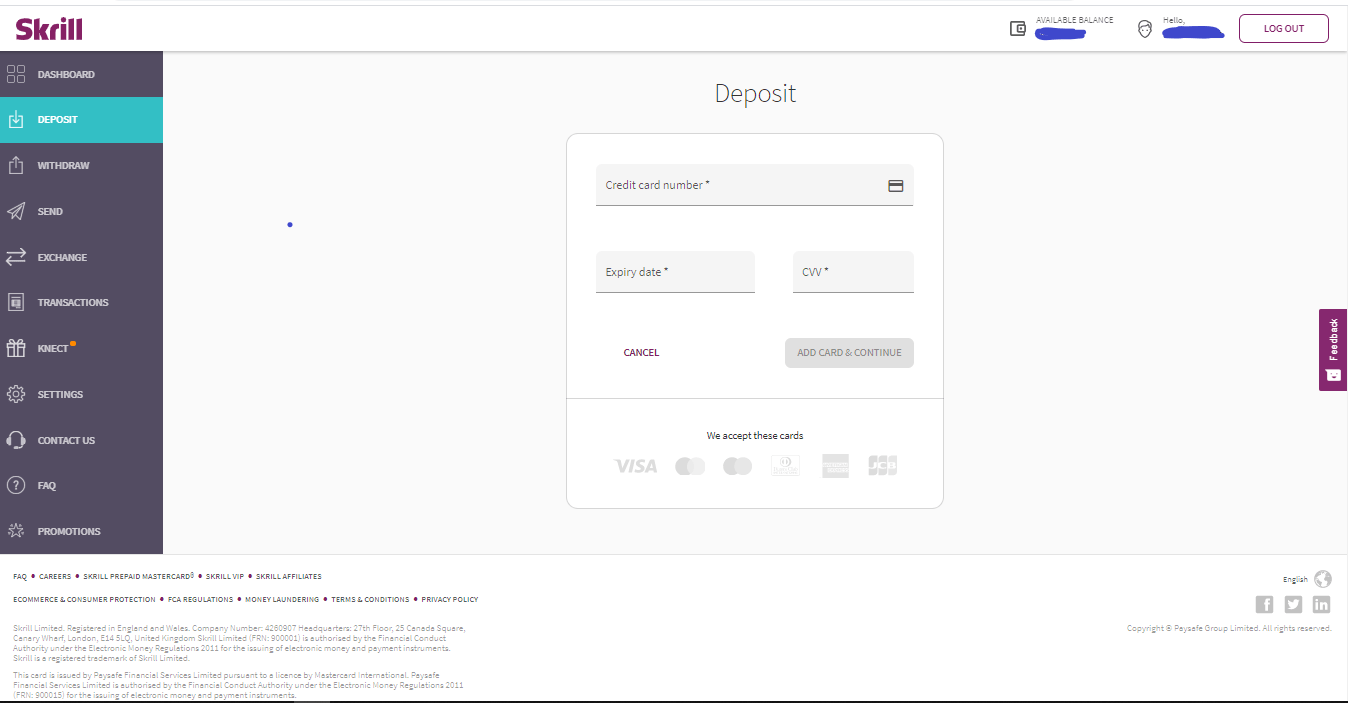

After PIN creation, enter your card details and click ‘Add Card and Continue.’

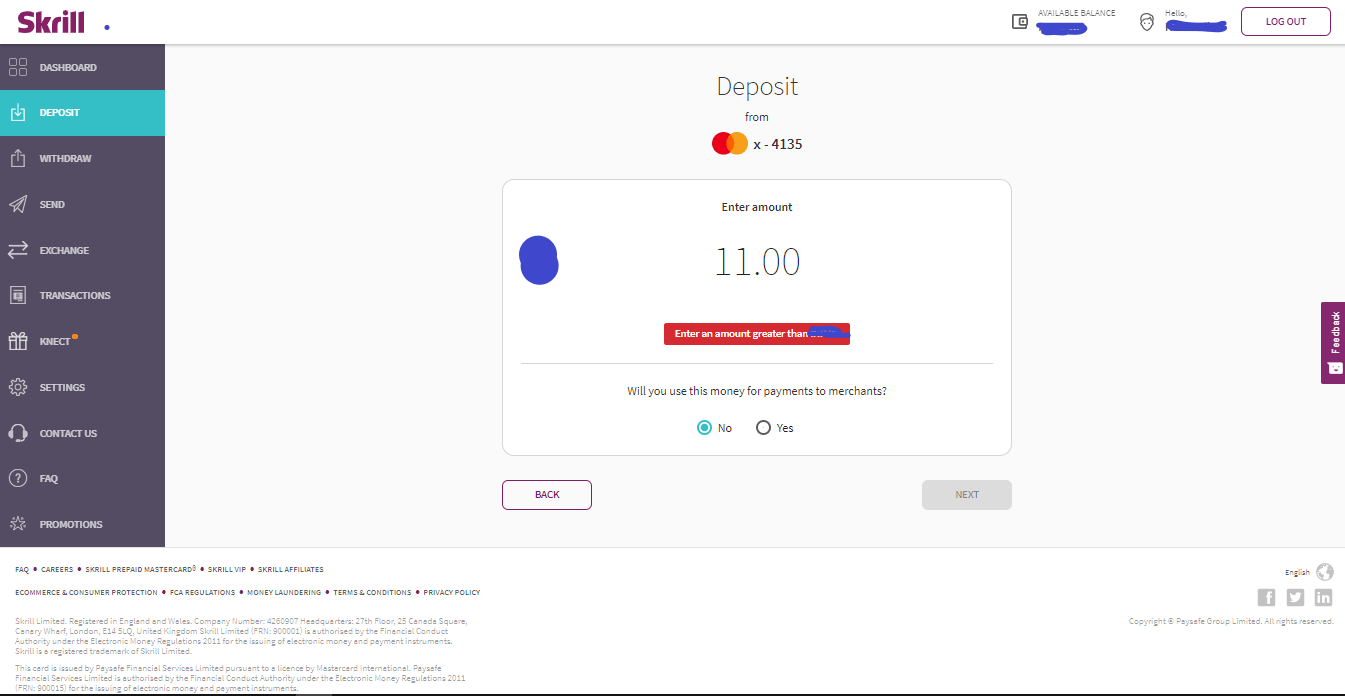

In the next step, enter the amount you wish to fund your account. Bear in mind there is a limit within which you should follow. Also, remember to check either ‘Yes’ or ‘No’ if you will use the money to pay merchants as well. If you choose no, your account might not complete such processes.

Confirm your deposit and then click on next.

At this point, you’ve funded your Skrill account and can proceed to fund your online casino or forex broker in step 3. But before that, let’s take a step back.

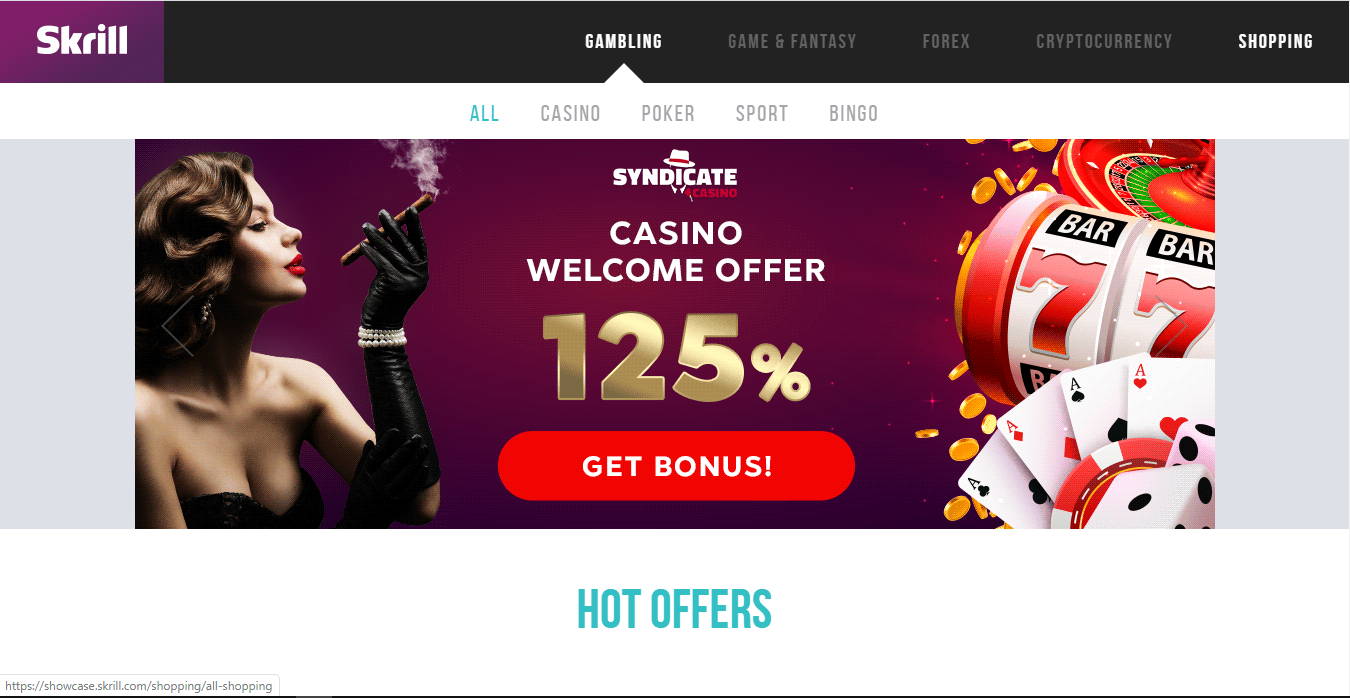

If you choose ‘Bet, gamble, play online,’ you’ll receive a list of online casinos with lucrative welcome bonuses that apply when you deposit money through Skrill. However, choosing this option offers the same payment methods, as mentioned above. The benefit of this option is that you get to know the different offers available.

On the flip side, if you desire to invest in forex trading, then click on Trade on the forex market’. Like with the gambling option, you’ll also get a list of forex brokers with generous welcome offers.

Step 3: Select your Skrill Casino or Forex Broker

By now, you have an idea of the forex broker or online casino you will work with. But is it the best in the industry? And will they position you for success? We are unsure of your pick, but here are our top options that have a clean record of impeccable service.

1. Casimba – Generous Welcome Bonus

Casimba was founded in 2017, which makes it one of the newest platforms in the industry. But this doesn’t mean it doesn’t have anything to offer. Like its name, logo, and inspiration, the platform seeks to be the ‘king of the jungle.’ Its success is almost guaranteed by White Hat Gaming Empire – a big player in the online casino industry.

Aside from working with a mighty name in the industry, Casimba has partnered with 62 popular software providers, including NetEnt, Play’n Go, and Microgaming. Courtesy of this partnership, the platform has new games/slots launching every day.

Speaking of slots, you enjoy a variety of over 1,000 slots on the desktop platform and over 700 on the mobile app. Some of the slots are high-risk, and others are designed for more cautious punters. And if you are in search of a more thrilling experience, the live casino is perfect.

To get you started, you receive a three-part welcome bonus of NZD6,500 plus a 125 free spins. When you make your first deposit, you’ll receive a 200% match deposit bonus capped at NZD5,000, 50 free spins, and 500 loyalty points.

On your second deposit, you will receive a 25% match deposit capped at NZD1,000, plus 50 free spins. And to top it all off, on your third deposit, you receive a 50% match deposit bonus capped at NZD500.

Note: the bonus you receive by the third deposit depends on how much money you deposit.

You can make your deposits through several options, including Neteller, Skrill, iDEAL, Paysafecard, and bank wire transfer.

As for safety, Casimba uses up to date SSL encryptions, has a license from the UKGC (the United Kingdom Gambling Commission) Curacao, and Malta Gaming Authority.

Our Rating

- Beautiful and easy to use website

- Over 1000 slots

- Generous welcome bonus

- Loyalty points favour the slot players over table game players

Step 4: Fund Your Casino and Forex Trading Account

At this point, you have a funded Skrill New Zealand account. Great, let’s proceed to fund your online casino and trading accounts.

Casimba

Of course, you’ll need to have an account with Casimba to complete this process.

So, log into your account and click on ‘deposit.’

From the page that pops up, navigate to Skrill, and then enter the amount to deposit and confirm the transaction.

Note: if you don’t have a Skrill account, now is a great time to create one.Step 5: How to Withdraw Funds to Skrill

From Casimba

The withdrawal process is straight forward.

- Log into your account and navigate to ‘Withdraw.’

- Choose Skrill from the payment options, specify the amount you wish to withdraw, and confirm the process.

Note: there is a minimum amount you can withdraw.Step 6: How to Withdraw from Skrill to a Bank Account

Once the money you withdraw hits your Skrill account, usually between 2 and 5 days for the first time, you can transfer to other Skrill users or withdraw to your bank account. This process is easier if you deposited funds through your credit card. This means your account is already linked.

It’s as simple as:

- Click ‘Withdraw’ on your account

- Choose ‘Bank Account’ and specify the account you wish to withdraw to (if you have multiple linked accounts)

- Enter the amount to withdraw and then click ‘Next.’

- Review the summary details and click ‘Confirm.’

Note: to complete the process; you’ll enter the PIN you created for your account.Skrill Fees and Other Expenses

The convenience Skrill offers comes at a cost. The costs are as follows.

Deposits

Deposits from local and global payments, including Neteller, JCB, Mastercard, Credit card Diners, Credit Card Amex, Paysafecard, VISA, and Bitcoin, attract a 2.5% fee of the money transacted.

Withdrawal

Withdrawals from local payment methods like VISA attracts a 7.5% fee. On the other hand, for global payments like SWIFT, the fee is NZD 9.83.

Transfers

When sending money to an international bank account, it’s free, but for domestic transfers, Skrill charges up to 2% of the money sent.

Sending money between Skrill accounts is free, as is sending money to online casinos.

Inactivity

Skrill requires some activity within 12 months. If you are dormant, an equivalent of EUR 5 is deducted from your account.

Currency conversion

If your transactions involve currency conversions, there is an additional 3.99% fee charged on the wholesale exchange rates. These rates vary and apply without notice.

Conclusion

There are numerous e-wallets to choose from, but overall, Skrill is a great option. There are many online casinos you can choose from, that reward you with Skrill bonuses. Aside from this, Skrill is a stickler for banking laws and ensures you are safe regardless of what becomes of the service.

Our Recommended Skrill New Zealand Casino

Our Rating

- Offers a generous match deposit bonus of up to NZD 6500 plus free slot spin.

- Partners with over 20 reputable game software developers with over 500 games.

- Offers Live Dealer games.

- Supports multiple payment methods.

- Licensed by the UKGC and Malta Gaming Authority.

FAQs

Are there deposit limits?

Yes, there are. For most online casinos, it’s between $1 and $500. These limits recharge daily.

Are the Skrill transactions truly instant?

Well, depending on the online casino, the transaction will take between a couple of seconds to 15 minutes. But if you compare these times with what other payment options offer (not e-wallets), then it’s safe to say the transactions reflect instantly.

Does Skrill come with an app?

Yes, it does. The Skrill app is available for both Android and iOS.

Is withdrawal from Skrill to PayPal an option?

Unfortunately, it’s not. Quite frankly, very few e-wallets have such collaborations. If you want to transfer money from Skrill to PayPal, you’d have to send it to your bank account and then upload it to PayPal.

How do I report suspicious activity with the account?

If you have reason to believe all is not well with your account, you should report it immediately. You can fill out an online form or reach out to customer support through email, phone, or web contact form.

What can prevent a successful Skrill deposit?

Generally, you should follow several tips for a successful deposit. First, you should have the pop-up window feature on your browser enabled. You should also not be using IP masking services, a proxy, or a VPN. Last but not least, ensure that your internet connection is stable and that your web browser is up to date.

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up