Skrill India – A Guide on How to Open an Account and Deposit Cash

Technology evolves fast. In the past century, no one would have thought it would be a reality, but we are here now. If you are still playing catch up, we have dedicated some time to show you how to work an online payment platform like Skrill. You’ll learn how to open a Skrill India account, deposit cash into and use it for sports betting, playing online casino games, and forex trading.

-

-

Why use Skrill?

Skrill is one of the many e-wallets serving the world today. It started as Moneybookers in 2001. It currently has over 36 million users spread out in more than 200 countries.

Okay, so it’s a reputable platform, but is this enough to sign up? If not, it’s a good thing there are more reasons.

Skrill is big in India because it is safe, secure, supports multiple currencies, and keeps your money trail cold. Moreover, it’s one of the most widely accepted payment methods by online casinos and forex websites.

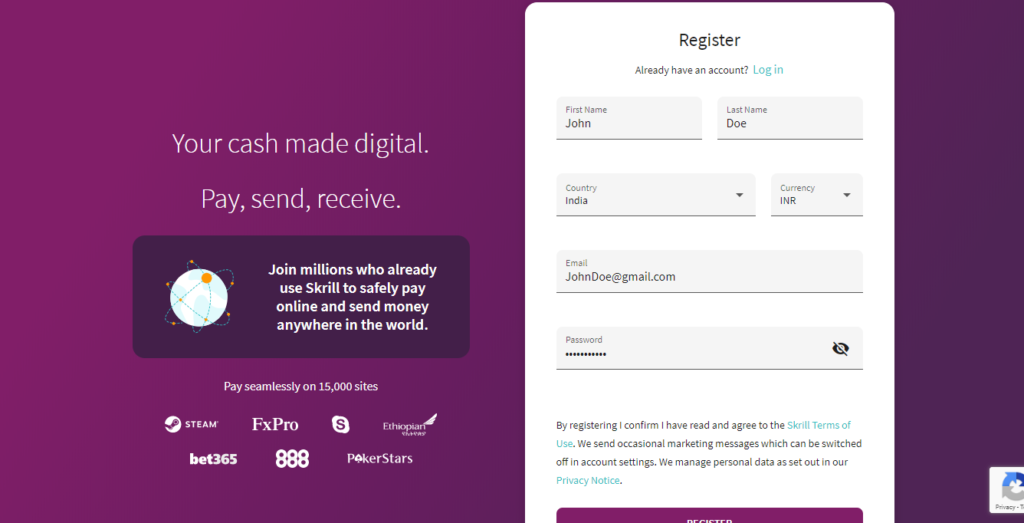

Note: Skrill India has a license from the FCA.Step 1: Open a Skrill India Account

If this is your first time using an e-wallet payment method, it might sound daunting, but it’s not. When you get over the technical jargon and do it one step at a time, it’s easy. Here’s what you’ll have to do.

On your browser, visit the Skill website and click on register. A simple registration form will pop up. In this form, you’ll fill out your name, email address, physical address, and password. You’ll also need to state your country and the currency you’ll trade-in. Once you enter all the details, click on ‘register’ and it’s as simple as that.

Step 2: Fund Your Skrill Account

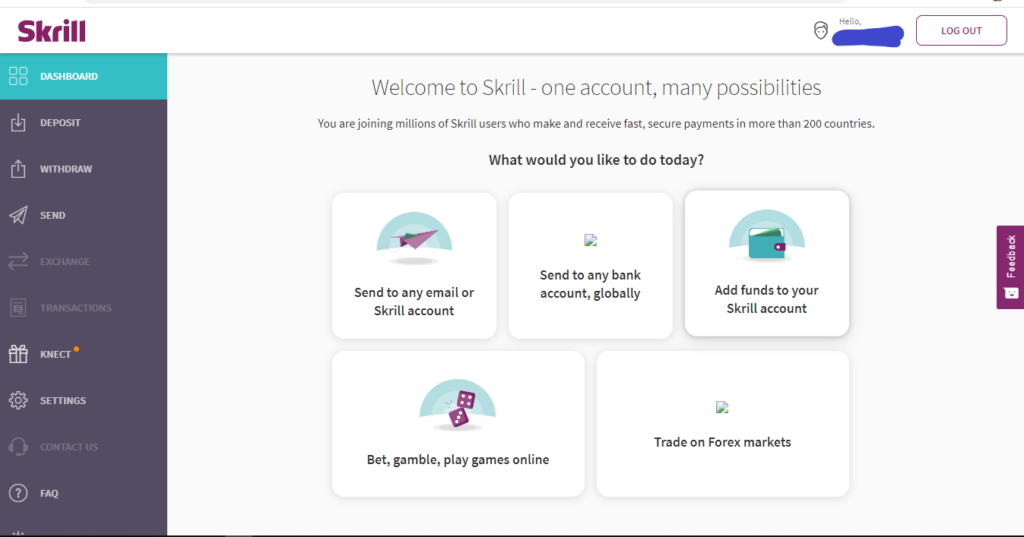

Once you have an account, this page will pop-up.

On this page, you have several options to fund the account. You could choose to click on ‘Add Funds to your Skrill Account,’ ‘Bet, Gamble, Play games online,’ or ‘Trade on Forex Markets.’

With all three options, you will receive several payment methods to use to fund your Skrill account. These options include;

- Credit or debit card; the most popular payment option

- Neteller

- Bitcoin and Bitcoin Cash

- UPI

- AstroPay Net Banking

With all options, cash reflects on your account instantly. However, with Bitcoin and Bitcoin Cash, you will have to verify the account.

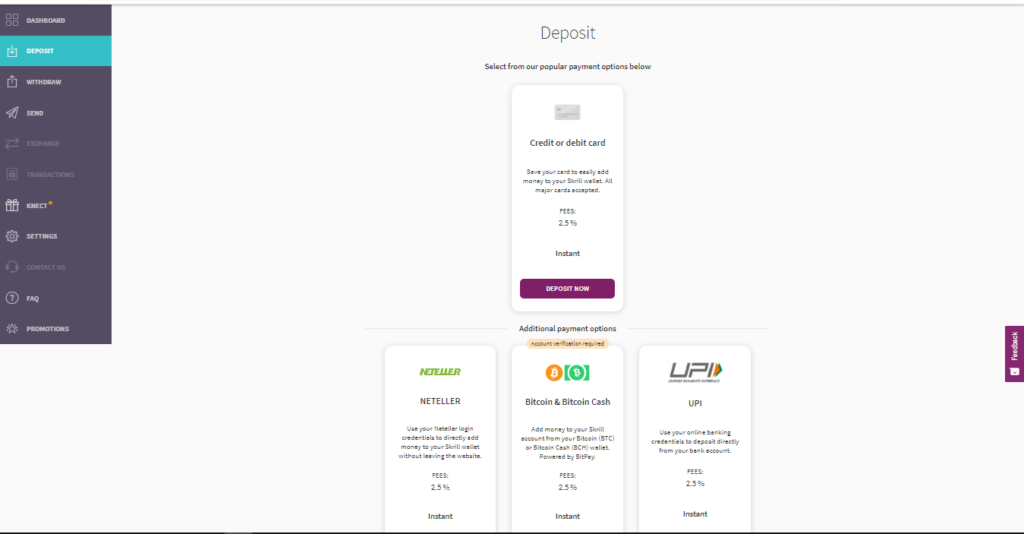

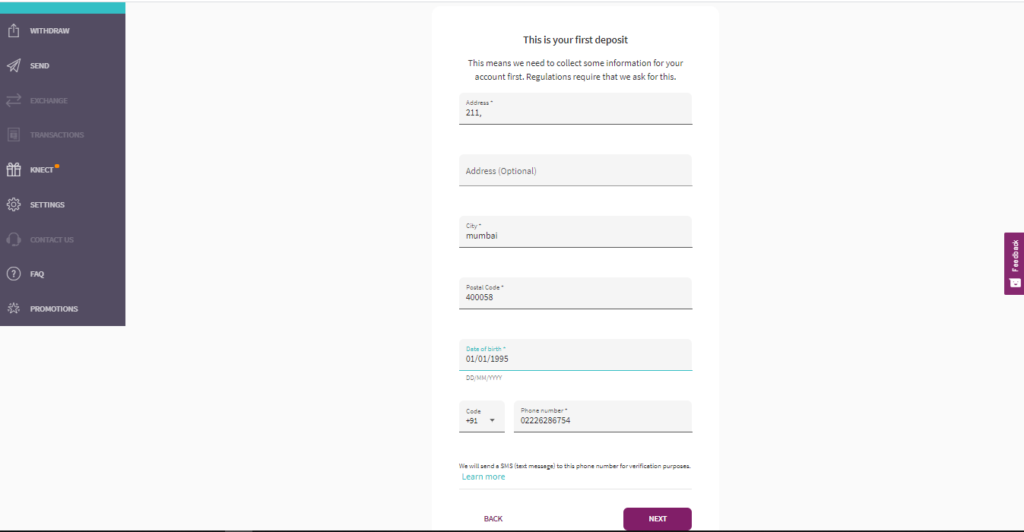

Though you can use any payment method you fancy, let’s take the credit/debit card payment option. When you click on deposit, you’ll have to enter your details, including phone number.

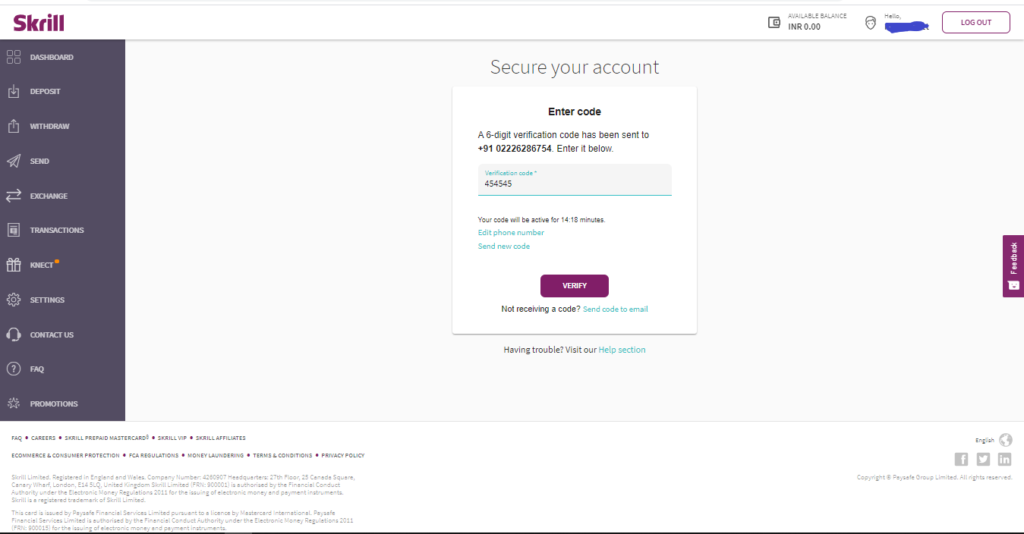

Enter your details and then click next. In the next stage, you’ll verify your phone number or email address through a code sent to either system. Next, you’ll create a pin.

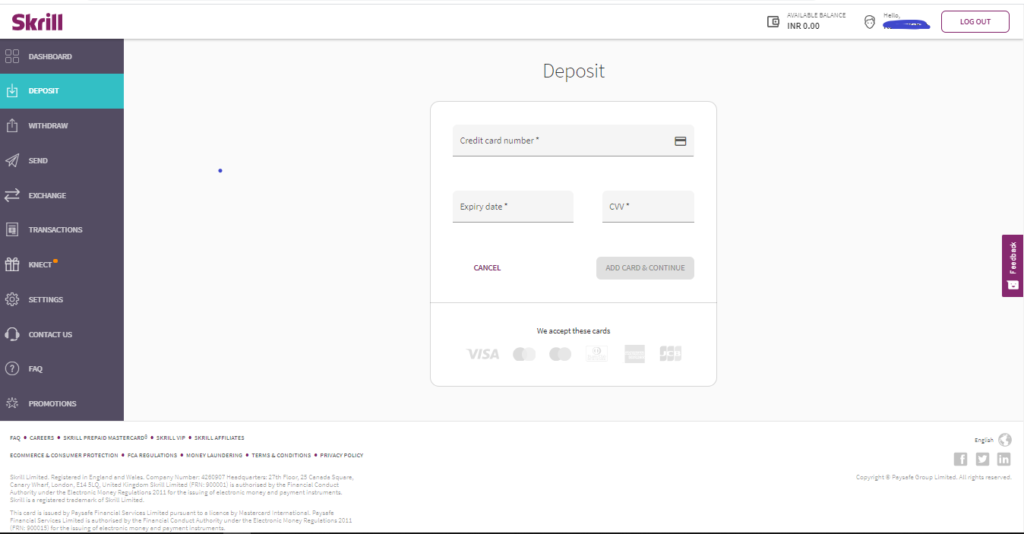

Enter your card details and then click on ‘Add Card and Continue.’

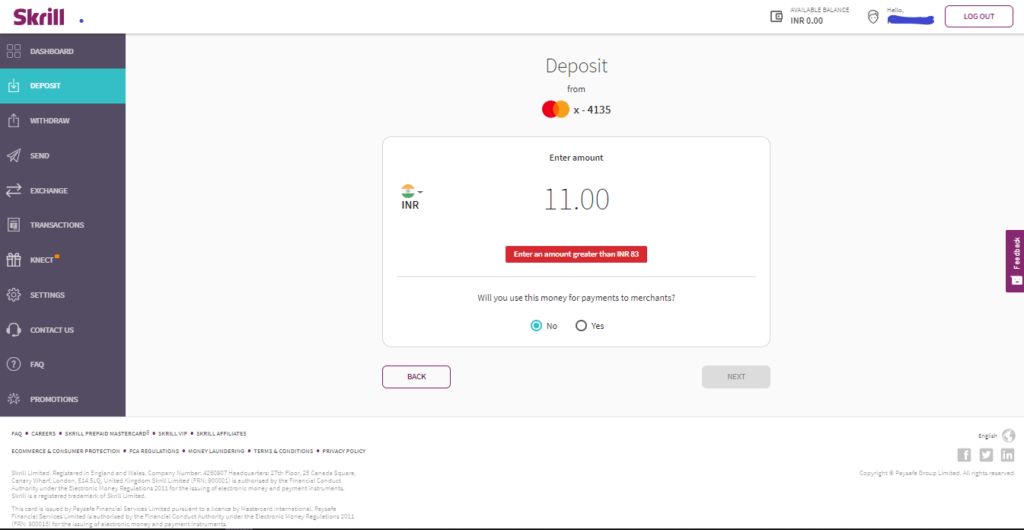

Enter the amount you wish to deposit. It should be more than INR 83 and less than INR 61,542. Also, check ‘No’ to answer ‘Will you use this money for payments to merchants?’

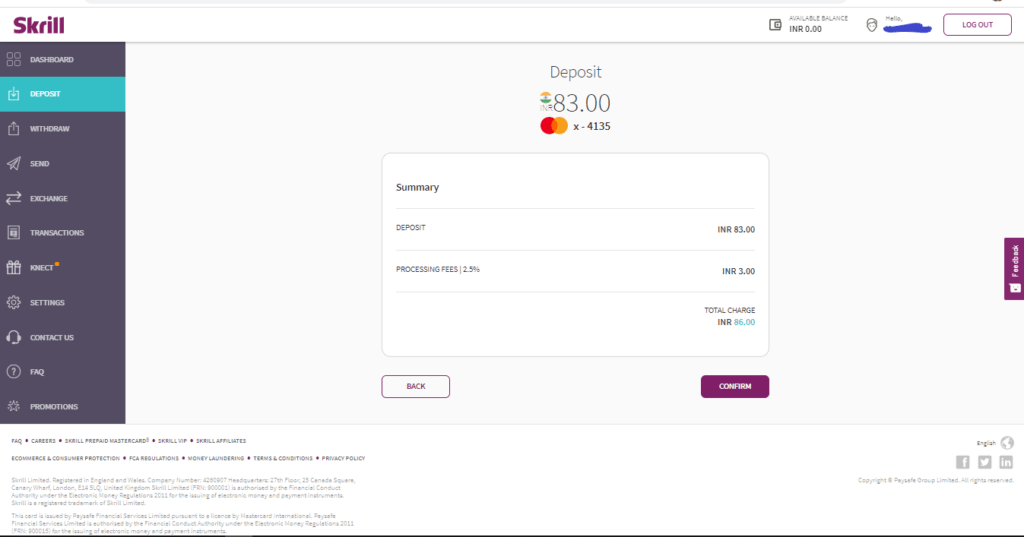

Confirm your deposit. A 2.5% deposit fee applies for every deposit. In this case, for INR 83, the charge is INR 3, which brings the total to INR 86.

Alternatively, if you prefer to use your Skrill account to bet, you can choose the ‘Bet, Gamble, Play online’ option. From this section, you can view several different online casinos where you can deposit cash into your betting account with Skrill. Clicking on ‘Getting Started’ provides you with the same payment options above.

And if you intend to use the Skrill account to trade on forex markets, then the ‘Trade on Forex Market’ is the best option since it also provides you with a kick-starter list of forex traders with generous offers.

Step 3: Select Your Skrill Casino or Forex Broker

By now, one thing is clear; you can use your Skrill account for personal use or online trading and transacting on online casino platforms. As an e-wallet, you can use it to process payments in any platform that supports it. But in this piece, we’ll focus on two activities; online casinos and forex trading.

Before you open an online casino account or a forex trading account, you should make sure it supports Skrill and caters to your needs. Here are the two platforms we recommend in either industry.

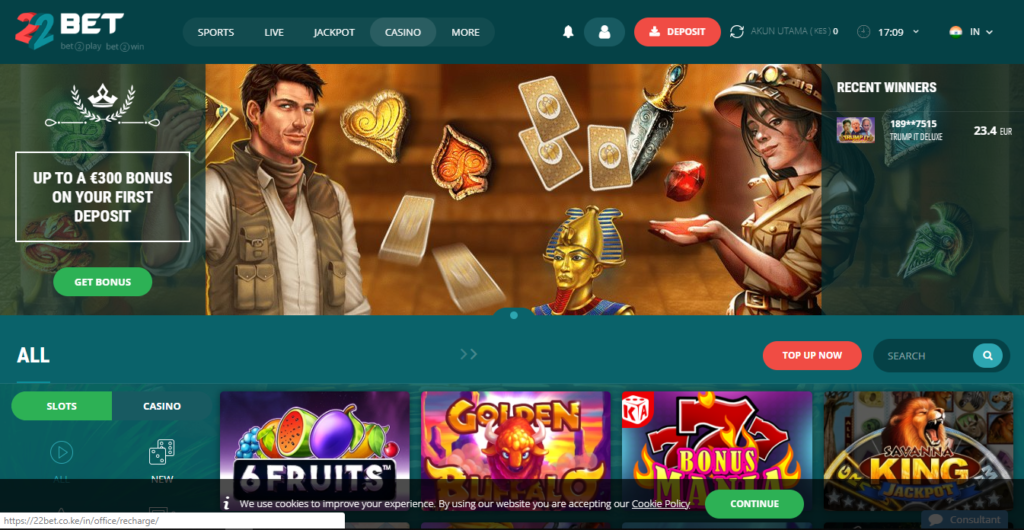

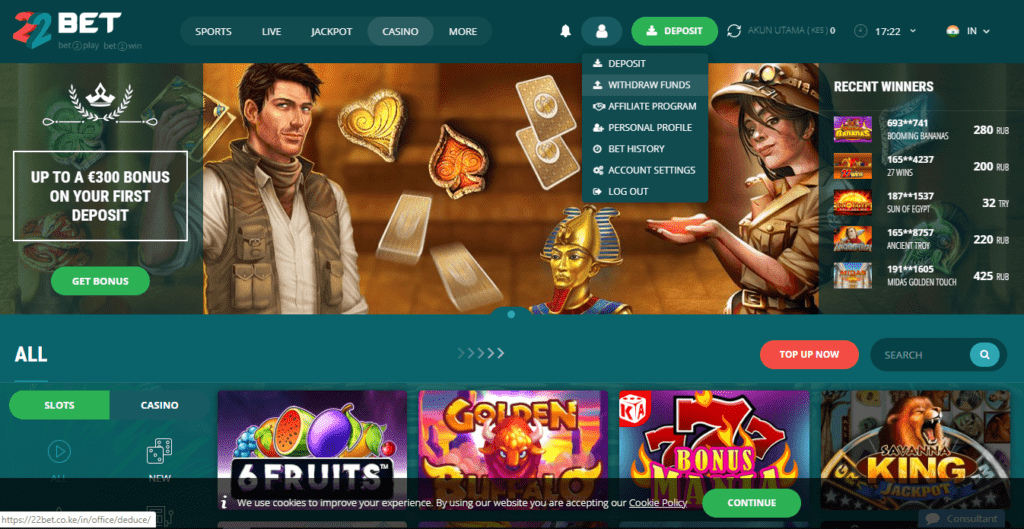

1. 22Bet – Generous Welcome Bonus

This is an international online gambling platform. The platform has its ease set on sports betting, but it also has a decent casino that comes with live casino. 22Bet Casino supports more than 50 different languages, including Hindi.

As for games, it features over 1,000 slot machines and a good number of table games. When you sign up to the account, you are eligible to a 100% match deposit capped at INR 25,000, but you have to deposit a minimum of INR 100 through Skrill or any payment options.

22Bet Casino is, without a doubt, a great place to start a betting career. You can sign up here to start your journey.

Our Rating

- Top-Quality Live Dealer Casino

- Great Welcome Bonus Offer

- 1,100+ Casino Games

- Knowledgeable Customer Support Team

- Slow payments processing times during weekends

Note: You can indulge in forex trading in India. However, when it comes to retail forex trading, there are limitations. With these limitations, you can trade forex in India with the Indian exchanges including BSE, and NSE. However, trading with non-INR Forex pairs is an offence, according to the FEMA act.Step 4: Fund your Casino Account

Once you have cash in your Skrill, making a deposit is a quick process. Let’s use 22Bet to illustrate this section.

22Bet

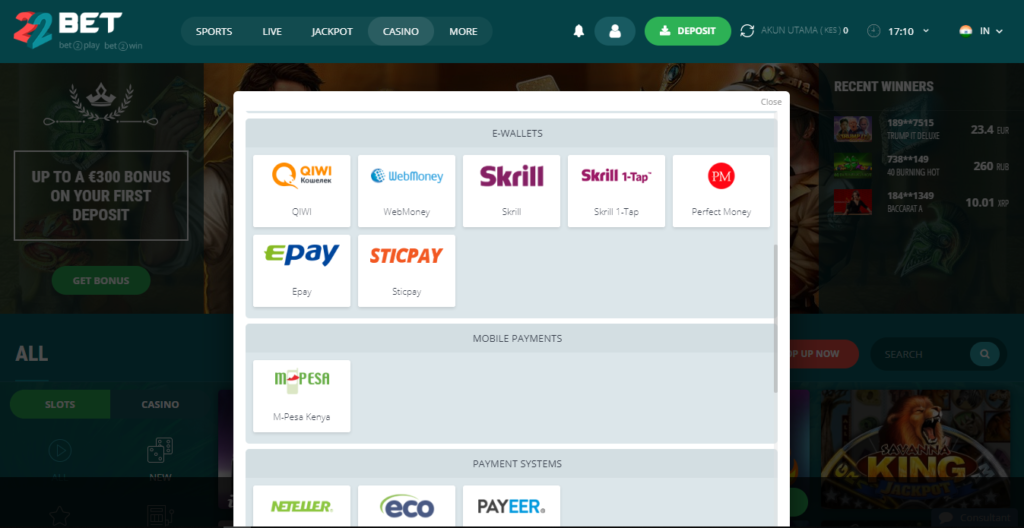

Log into your 22Bet Casino account and click on deposit.

Navigate to e-wallets and click on Skrill.

Then enter the amount you wish to deposit and click on confirm. If at this point you don’t have a Skrill account, you can click on ‘Create a Skrill account now’ and follow the screen prompts.

Also, you will have to choose the method of payment. If you have money in your Skrill account, click on ‘Skrill Wallet.’ But if not, then you can choose the other payment options. With the other payment methods, you’ll still be rerouted to Skrill, but you’ll first have to fund your Skrill account.

Note: it’s better to go through Skrill than a direct bank deposit since your statements will not reflect your betting deposits. Instead, they will show the money was sent to a Skrill account.Step 5: How to Withdraw Funds

Below we show you how to withdraw your funds back into Skrill and then into your bank account.

How to Withdraw Funds to Skrill

From 22Bet

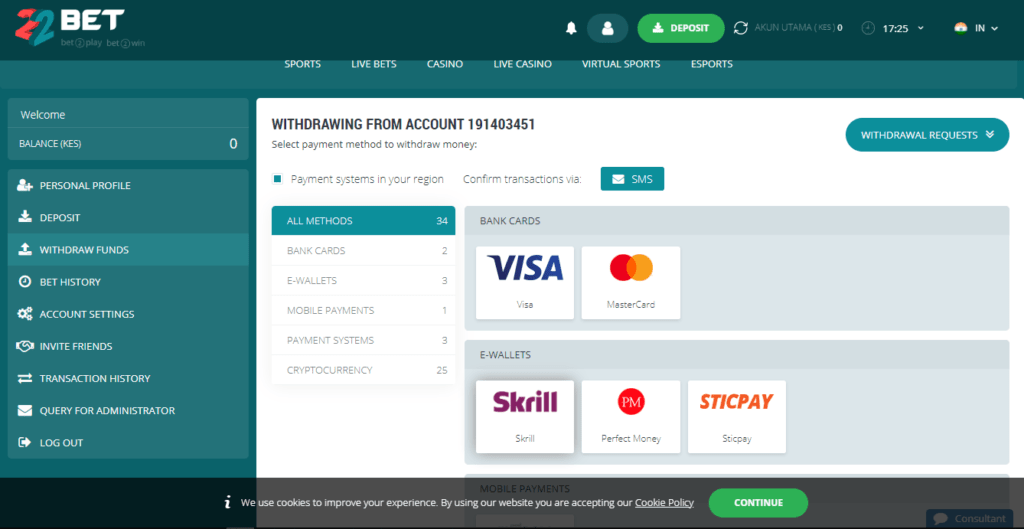

The withdrawal process to Skrill is also easy; log into your account and hover on the ‘My Account’ button.

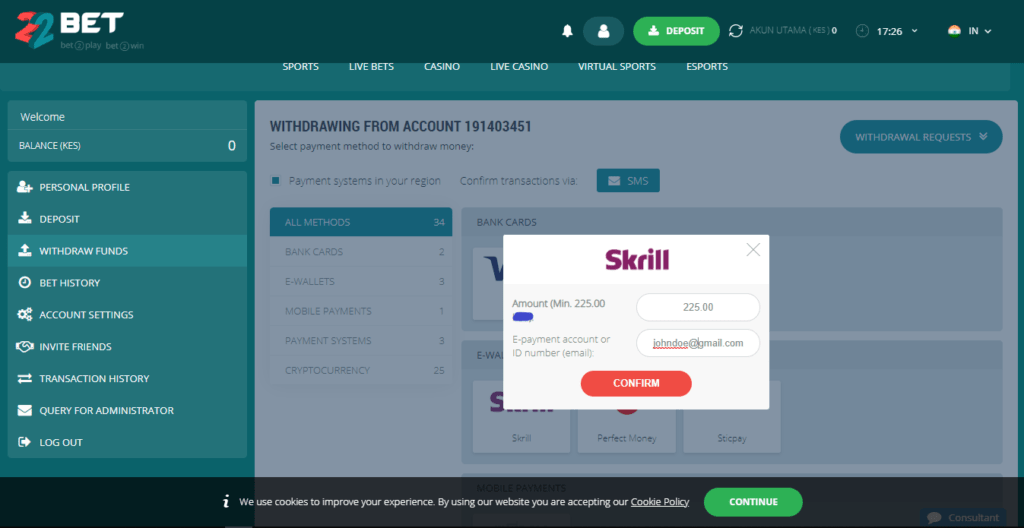

Click on ‘Withdraw’ and navigate to ‘Skrill’.

Click on ‘Skrill’ and specify the amount to withdraw to your Skrill account; bear in mind there is a minimum amount. Click on ‘Confirm’.

How to Withdraw From Skrill to your Bank

When the money reflects on your Skrill account India, you can withdraw/transfer to your bank account. To do this, you will have to link your bank account to Skrill. For this process, you’ll need your account number and the bank’s swift code in hand; a swift code is an international bank code that is used to complete wire transfers. They are often comprised of between 8 and 11 alphanumeric characters. If you don’t know the swift code for your bank, you will need to call them to obtain this information.

When linking your bank account, Skrill will verify your account. It will do this by wiring some cash into your bank account, along with a special code. Enter this code on Skrill’s site to complete the verification process.

Note: Skrill payment to your bank account will take between 2 and 5 days.Skrill Fees and Other Expenses

Using Skrill India is affordable and easy for both withdrawals and deposits. However, this convenience isn’t free, below are some fees Skrill will charge you for the transactions.

Fees for the common funding options are as follows

- Credit Cards: 1.9%

- Bank Transfers via Swift: free

While we are on it, we should point out that Skrill accepts Diners Club, American Express, Visa, and MasterCard.

Transferring To and From Online Casinos

Usually, Skrill doesn’t charge for transferring to and from online casinos. As such, you can rotate your money from one site to another without worrying that the fees will eat into your gambling cash. With this convenience, you can take advantage of the best bonuses and promotions.

Transferring Money to Other Accounts

When sending money to another personal account, Skrill charges 1% of the amount transferred or INR 662.03. The fee that applies depends on which is less.

Withdrawal from Skrill India

Withdrawing cash to an Indian bank account attracts an INR 195.30 fee.

What If Skrill Blocks my Deposits?

From time to time, even if you follow the rules, your deposits may still be blocked; this block is put by the bank that issued the credit card. Below is how you can solve the problem.

First, you can try alternative payment methods are described above. Second, you could try reaching out to the customer support team for help. As a last resort, you can open a Neteller account that you will not use for gambling, fund it, and use it to transfer funds to your Skrill account. Yes, the process is a little lengthy, and you may incur additional costs, but it will solve the blocking problem.

Note: Do not try opening another Skrill account as this could lead to the closure of both accounts and leave you stranded.How Does Skrill Compare to PayPal and Neteller in India?

They are all e-wallets, and one would think they are interchangeable, but some quick research reveals you are better off with Skrill in India than PayPal or Neteller. Below is how they compare to each other.

Skrill vs. Neteller in India

Skrill and Neteller are similar since Paysafe Group runs both and they are widely accepted in online betting platforms in India. But what differentiates them is the fact that Skrill credit card deposits fees stand at 1.9% while Neteller fees are at between 1.9% and 4% making Skill a cheaper option.

Skrill vs. PayPal in India

For Indian gamblers, Skrill is a better option than PayPal. Firstly, because it is accepted by more Indian betting sites than PayPal is and secondly, PayPal is a more expensive account to use; charges are at a 2.9% fixed rate.

Conclusion

Gambling in India can be fun if done sensibly, but also if you have the best betting site and your payment systems are up and running. Funding your account through Skrill is an easy option and the fact that you can use Indian Rupees directly is a huge plus.

Our Recommended Skrill India Casino

Our Rating

- 1,100+ Casino Games

- Top-Quality Live Dealer Casino

- Great Welcome Bonus Offer

- Knowledgeable Customer Support Team

FAQs

Can I withdraw from Skrill to PayPal?

Unfortunately, there is no direct way of withdrawing money directly between these two platforms. As it is, the two e-platforms are competitors and haven’t partnered to allow this. If you don’t mind the lengthy process, you can withdraw money to your bank account and then transfer to PayPal.

Do all Indian banks support Skrill?

Currently, Skrill appears to work great with major banks that offer credit cards. However, some Indian users have had problems with some debit cards from Axis and ICICI banks.

Does Skrill come with an app?

Yes, it does, you can download it on Google Play store or the Apple Store. Through these apps, you can manage your deposits and withdrawals to and from your betting site.

How can I receive money from Skrill?

Skrill withdrawals are primarily transfers to your bank account. However, if you use cryptocurrency, you can use this as an option too.

How does Skrill compare to PayPal and Neteller in India?

Despite the fact that they are all e-wallets, research reveals you are better off with Skrill in India as it has the lowest fees.

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

Latest News

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up