Perfect Money – A Guide on How to Open an Account and Deposit Cash

The 21st Century payment solutions have made life convenient across the board. Today, you can send and receive money without handling it. In fact, you can even send it to family and friends on a different continent for free, but a sure highlight in tech improvement is the fact that they made online gaming and stock investments easier. Even in countries like India, where there are strict rules on these services, you can enjoy the convenience that electronic payment methods offer by understanding how they work.

In this piece, we shall take you through a step-by-step process of creating an account with Perfect Money, adding funds and withdrawals. We’ll also throw in recommendations of companies we know accept Perfect Money.

-

-

Why use Perfect Money India?

First, what is Perfect Money? It is an electronic payment system that supports non-cash payments online. The network came to life in 2007 and is owned by Perfect Money Corporation based in Panama. Initially, it was created to provide secure and instant settlements in the world of business, but it soon became a gem to private users.

What can you do with this platform?

- You can transfer money to other users.

- You can receive payment through the site.

- You can pay for services and products over the internet.

- You can purchase gold, Bitcoin, Euro, and US dollars.

- You can receive and issue loans through the system.

- You can deposit and withdraw money from online casinos and forex brokers.

Why should you use Perfect Money?

- Security – so far, the program toolbox behind Perfect Money security system surpasses the tech developed for payment system cracks. Because of this, they have significantly reduced the risk involved in transacting online. Every user has access to definite security settings

- Speed – As a company, Perfect Money understands the need for speed, and as a result, they have perfected data transmissions and communication channels.

- Universality – Perfect Money is made for the convenience of individuals using the platform to make micro-payments and to businesses with complex structures that handle millions of dollars.

- Support – Available 24/7, 365 days a year. They have qualified staff working in the support center to solve user problems and improve user experience.

Note: You cannot withdraw money directly from Perfect Money into your bank. You always have to use an exchanger; exchangers on Perfect Money’s platform allow you to top up the account through several payment methods, including money transfers, bank wires, credit and debit cards, and others. Users have the liberty of choosing the exchanger they prefer working with.Step 1: Open a Perfect Money Account

So far, you’ve probably picked up on the fact that Perfect Money is not like regular e-wallets. Even then, you don’t have to be a rocket scientist to understand how it works.

Below is a step-by-step guide of how you can sign up to Perfect Money and how you can use it with your favorite online casino and forex broker.

In your browser, visit Perfect Money India and click on ‘Sign Up.’ Yes, this is not the most beautiful platform we have come across, and they probably could do better, but the site is functional.

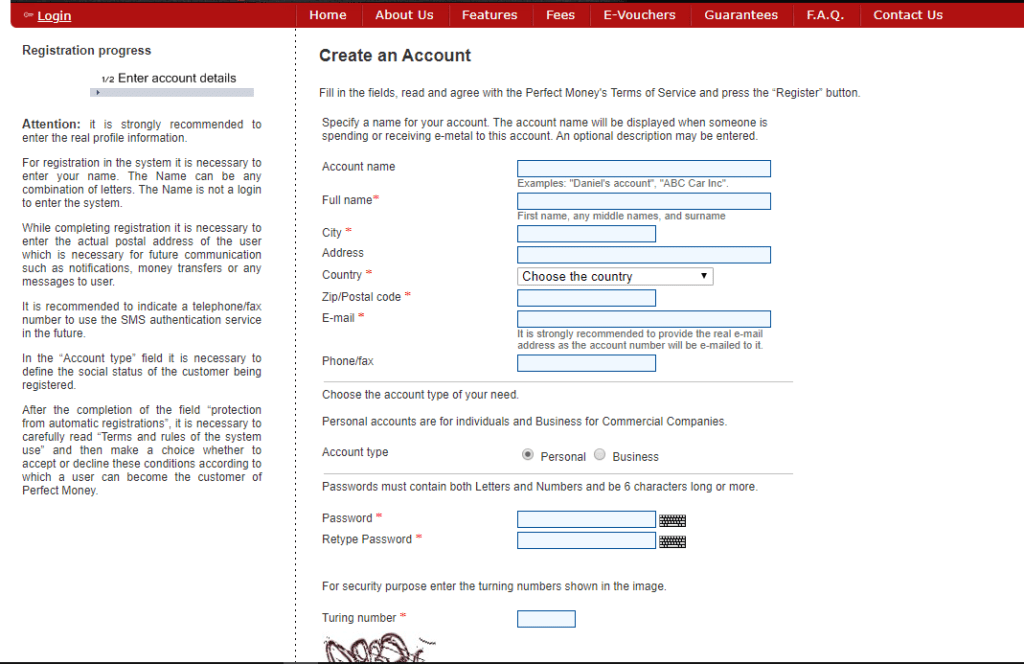

Like with any other account registration, you will provide the following:

- Full name

- Account name – it could be any combination of letters. It is not part of the login requirements

- Address – this should be factual because future communication and verification will consider this information

- Phone – the number you input will be used for authentication later

- Specify the account type

When you are done, read through the terms and rules of using the platform. Since the system has a different model, you don’t want to be on the wrong side of things.

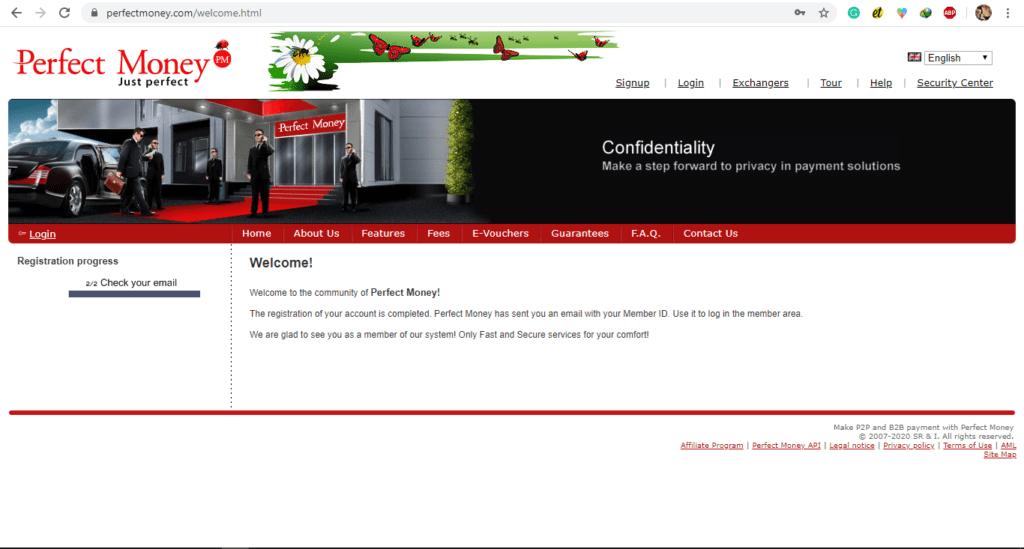

Note: Ensure the details you enter are correct.When you create an account, the following page will pop up.

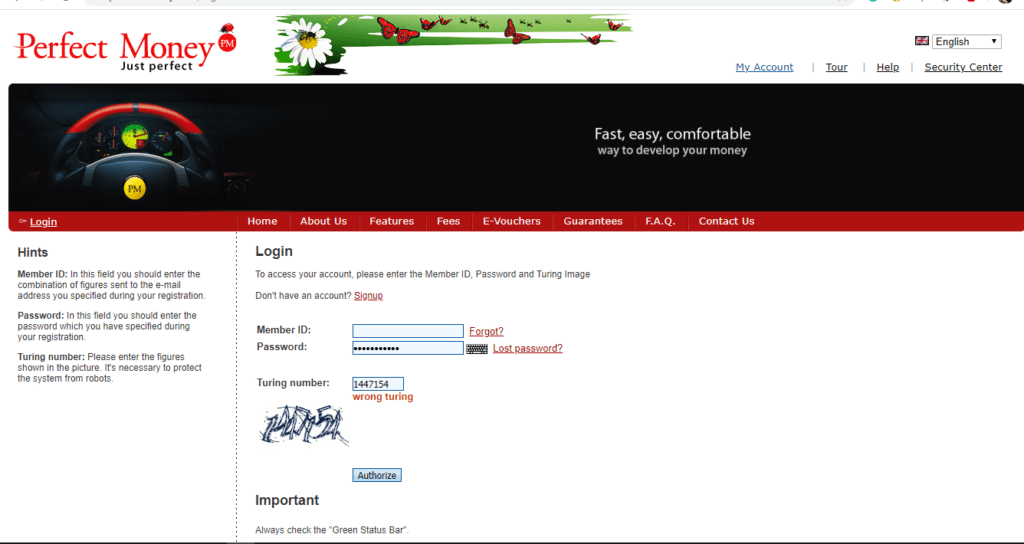

Also, you’ll receive an email with your member ID, which you will use to log into your account.

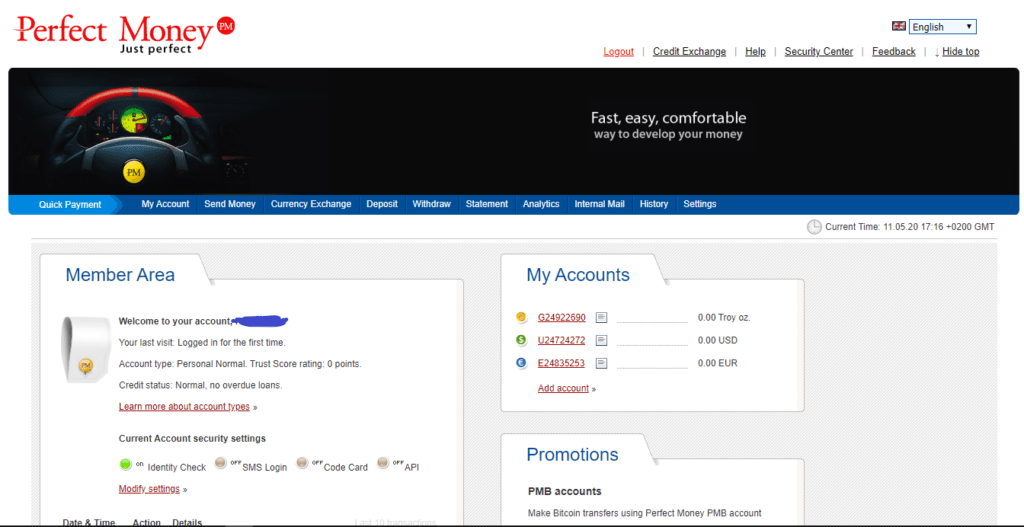

Once you are in this is what you’ll see:

It’s important to go through the verification process. It will reduce the transfer fees that apply and increase your Trust Score on the platform. Here, there are three verification processes.

- Phone verification – enter the code sent to your phone number

- Identity/name verification – you’ll have to upload a clear copy of either your Passport, driver’s license or national ID

- Address verification – upload a clear bank statement or utility bill with the same name and address you provided during registration.

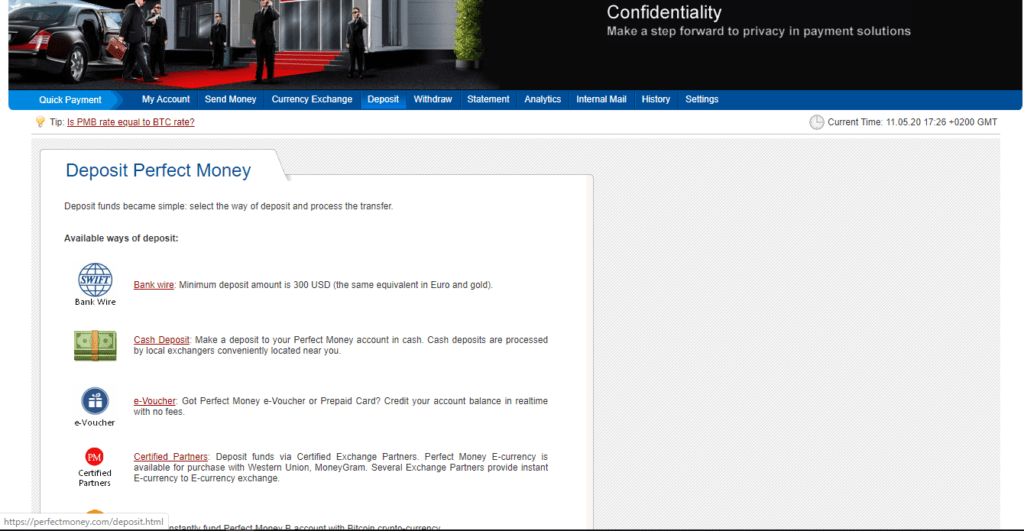

Step 2: Fund the Perfect Money Account

There are several ways you can fund your Perfect Money account. The preview of these funding options is available on the ‘Deposit’ section.

Below are some of the options available:

Internal Transfer

You can fund your account by receiving cash through an internal transfer. This means another Perfect Money user sends you money from their account. To obtain the funds, you need to provide the sender with your email address, account number, and phone numbers that are linked to your Perfect Money account.

Note: The amount you receive will be less than what is sent because of the internal transfer fees.Bank Wire

This option is not available to unverified accounts.

With that said, bank wire transactions are easy because all you need is to fill out a bank wire order form in which you’ll indicate the bank account that will be used for the transaction. You must provide accurate and complete information since it will help to track the status of the bank wire.

Once you fill this form, click on ‘Preview’ and confirm the details you’ve typed in. Also, indicate the primary and secondary certified exchange service from the Perfect Money list of partners and then click ‘Send.’

After 24 hours of the order placement, your primary certified exchange service will receive the order, but if for whatever reason, they cannot process the request, it is moved to the secondary certified exchange provider. Each provider has a maximum of 24 hours to process the order.

Note: You should provide the invoice number in the comment section of the bank wire. Also, the minimum amount you can send through this option is $300 or the equivalent.The process may take five working days to reflect in your account.

Certified Currency Exchange Partners

Take advantage of these partners to deposit cash into your account. The services are listed on Perfect Money’s page under the certified exchange service partners. Before you choose a partner, study the proposal as some companies offer more exchange services than others.

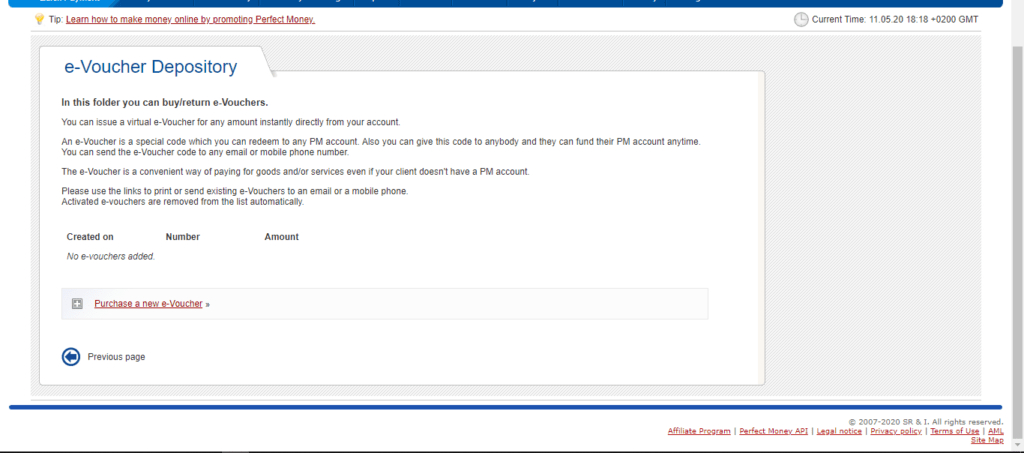

e-Voucher

This is a 16-digit digital certificate that can be used to load any Perfect Money instantly. You can sell or transfer the code to anyone who can, in turn, use it to deposit funds into their account. You can create an e-Voucher in the ‘Statement’ or ‘Withdrawal’ section. No fee is charged for this method. This method is ideal for individuals who don’t want to share their account numbers.

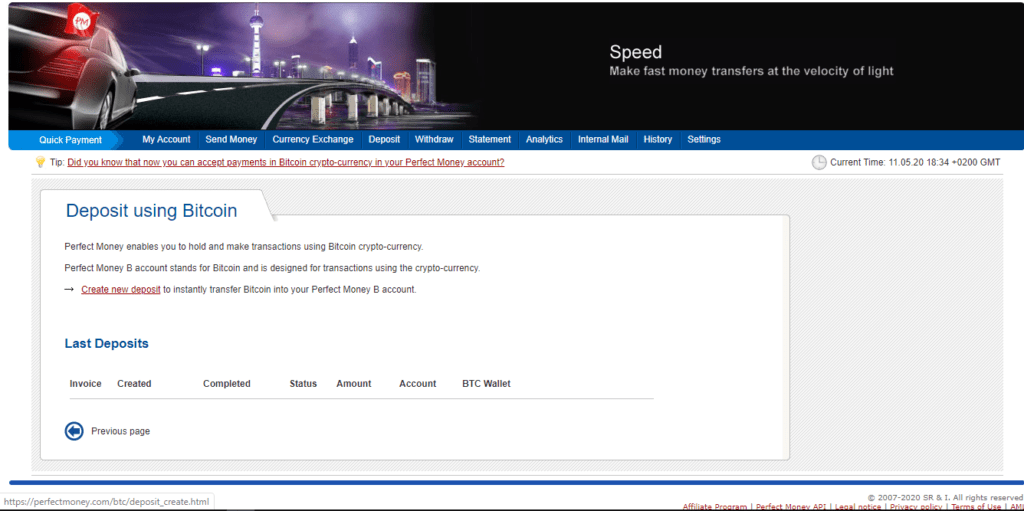

Bitcoin

To make a deposit it into your Perfect Money account, you’ll need to make a deposit order with your account number and the amount you wish to be credited with Bitcoin. You will then preview your order and then submit.

Once you submit the order, the system will provide a Bitcoin address with the specific amount that you need to transfer within a day. For the process to be complete, at least three confirmations are required.

Other deposit options include credit exchange and e-currency.

Step 3: Select Your Perfect Money Casino or Forex

Though there are many ways to use Perfect Money, this guide is about online casino and forex trading. To have a good experience, you’ll need to choose the right platforms to work with.

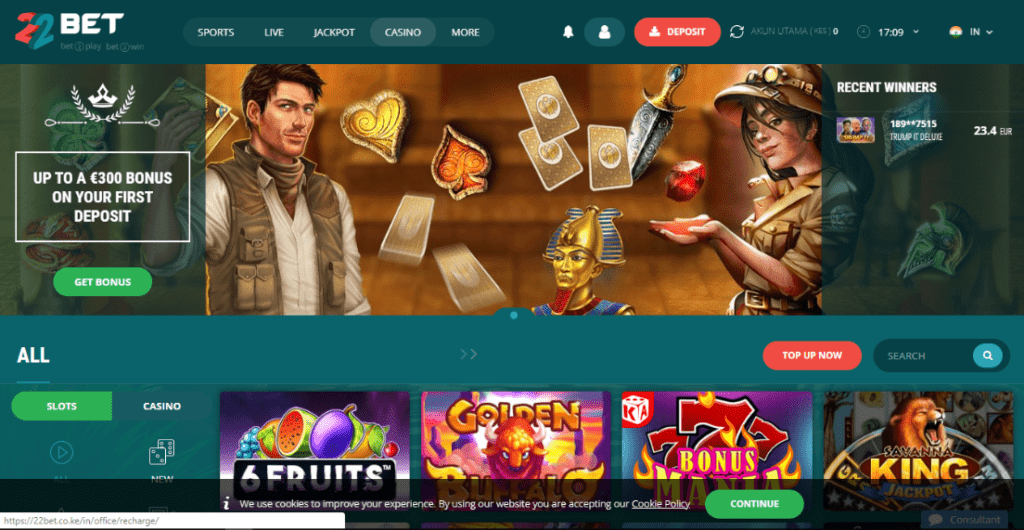

1. 22Bet – One of The Largest Collection of Slots Games

22Bet is an international gambling platform that is based in Cyprus. It has a casino and a sportsbook. Since you are a casino lover, you’ll fall in love with the 1,000+ slots available as well as table games, jackpot progress games, and the live casino.

Even though it is not the oldest casino in India, it has brought its A-game and gives the top-dogs in the industry a run for their money. But this is partly because they partnered with reputable gaming software developers. These software developers ensure that they not only have a lot of games but that their catalogue is up to date and has exciting categories to choose from.

When you first create an account, you’ll be offered a 100% deposit bonus capped at INR 25,000. Though there are rules governing this bonus, it’s a great way to start your journey on a new site. To claim this bonus, you have to deposit INR 100. You can deposit Perfect Money or any of the other supported platforms, including Skrill and Neteller.

And if you are always on the road, 22Bet has an app compatible with Android and iOS devices for added convenience.

Our Rating

- Supports multiple payment options

- Has great customer support

- Have a live casino and a sportsbook section for added fun

- The customer support could use some work in response

- The platform can be slow at times

2. FBS - The Highest Leverage In The Global Forex Trading Industry

This is Forex, as well as a CFD broker. FBS offers its trading services to investors across the globe. It started in 2009, and it has since blown through the roof. You can trade in metals, stocks, CFDs, and currency pairs. Moreover, it supports 18 languages and multiple currencies.

In the time they’ve been in operation, they have built their platform to more than 12 million traders, all from different continents and 190 countries. Aside from this, they claim that they have 7000 new traders sign up every day.

Part of their success they enjoy is because they have a low barrier to the market. In addition to this, FBS makes use of a hybrid broker model. The model consists of Electronic Communications Network and straight-through processing. With this mode, they did away with the dealing desk, and now the orders go directly to the system of liquidity providers and actual market prices. Consequently, requotes are not a possibility.

To assure you of transparency and security, FBS is regulated by the IFSC and CySEC.

Our Rating

- Has great trader education

- Low capital to open an account

- You have access to investor compensation in the event of fraud

- The leverage is too high

- The spreads are high for many retailers

Step 4: Fund Your Casino

Before you start enjoying your favorite games or you start trading, you will need to deposit funds into your casino account. Below is how you do this using Perfect Money.

22Bet

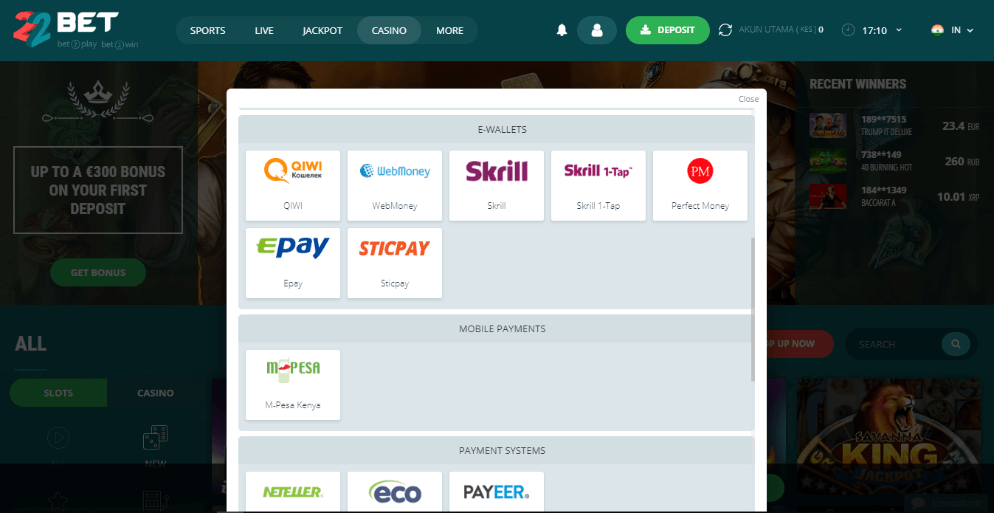

Log into the 22Bet Casino and click ‘Deposit’ on the right side of the screen

Navigate to the ‘e-Wallets’ section and then click on Payment Money.

From the popup, enter the amount you want to deposit. Click on ‘Confirm,’ and from the window that you are redirected to, click ‘Make Payment.’ But first, make sure the details are correct.

FBS

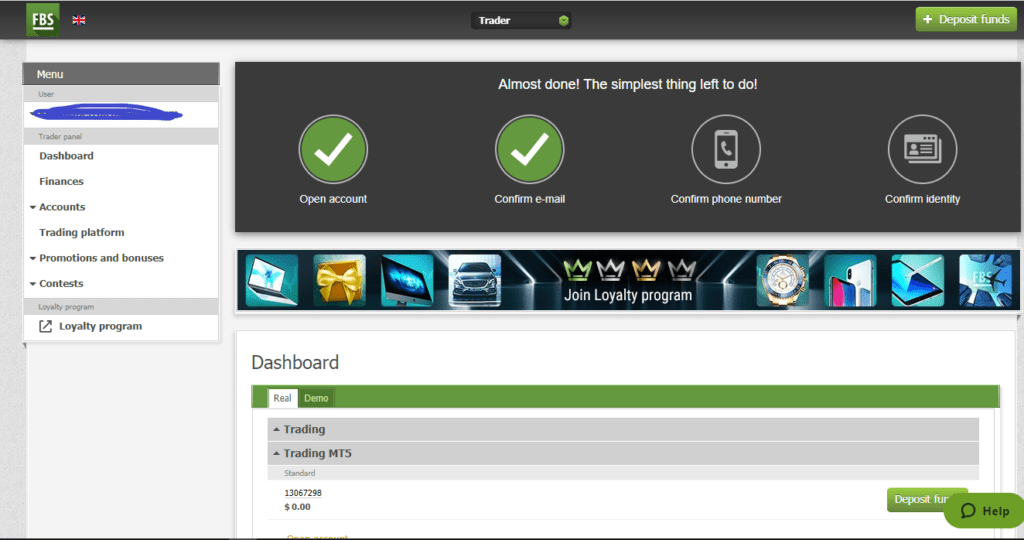

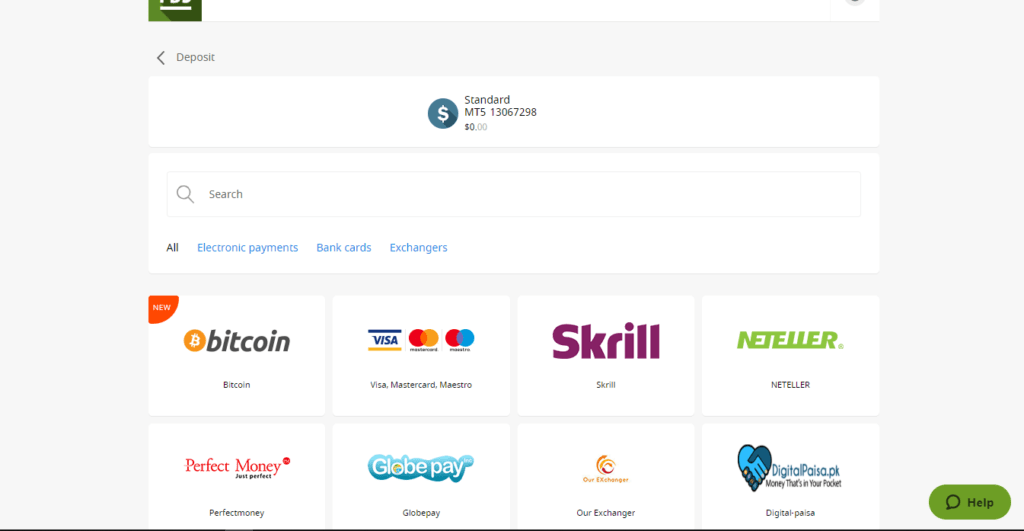

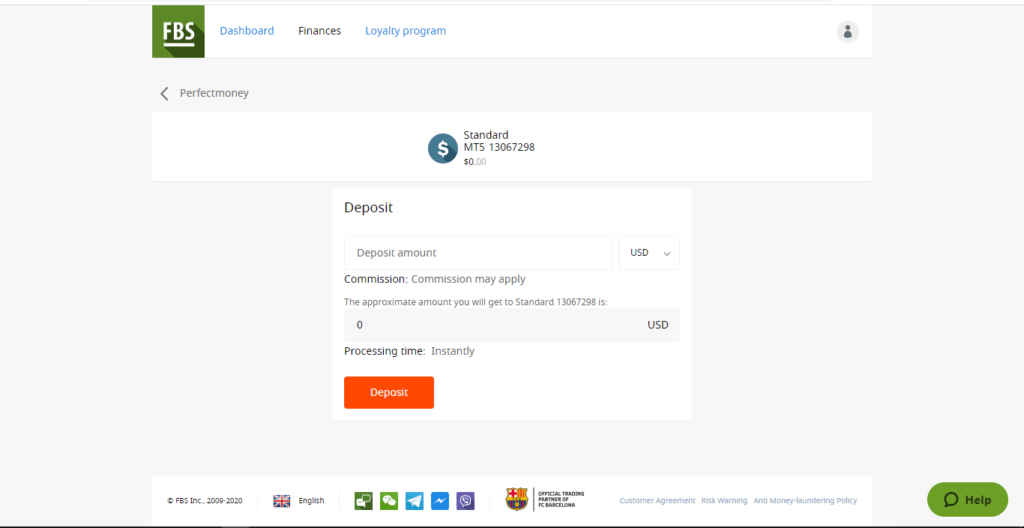

The process of funding FBS is also simple.

On the left side of the screen, click on ‘Finances.’

Then click on ‘Deposit.’ on the next page, navigate to ‘Perfect Money.’

Follow the prompt, which includes filling in the deposit amount and clicking on ‘Deposit.’

Step 5: How to Withdraw Funds

How to Withdraw funds to Perfect Money

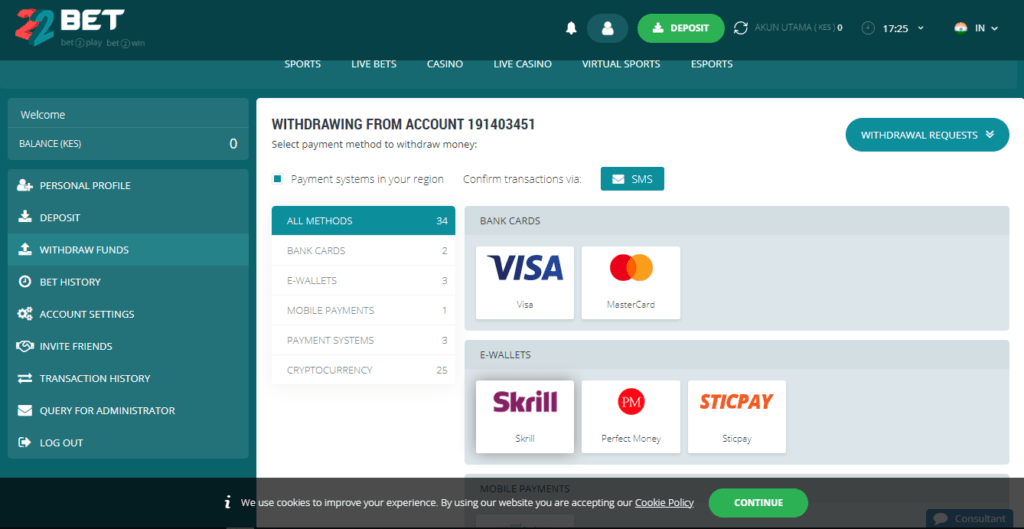

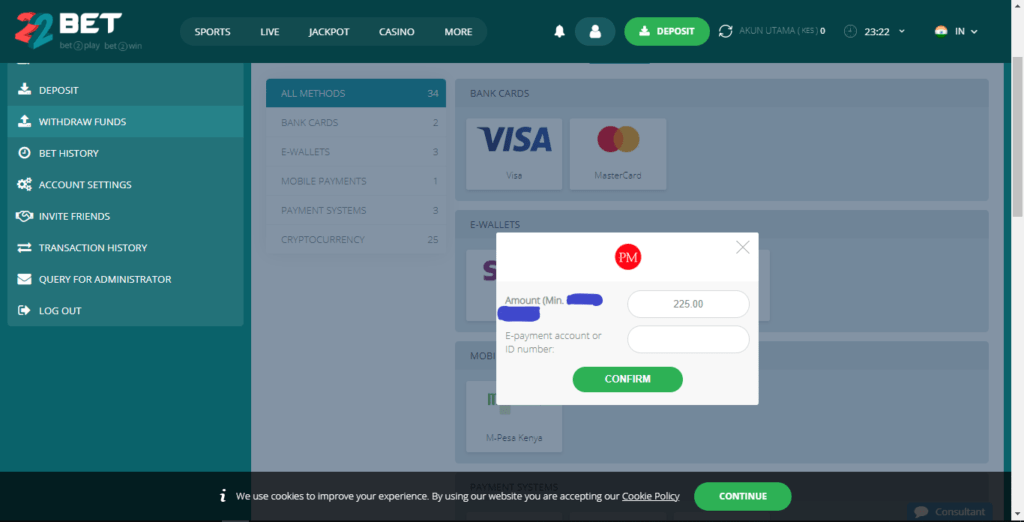

From 22Bet

Log into the 22Bet account and click on withdraw from the ‘My Account’ icon.

Click on ‘Perfect Money’ from the options. Like with other payment options, in the pop up, specify the amount you want to withdraw and then click on ‘Confirm.’

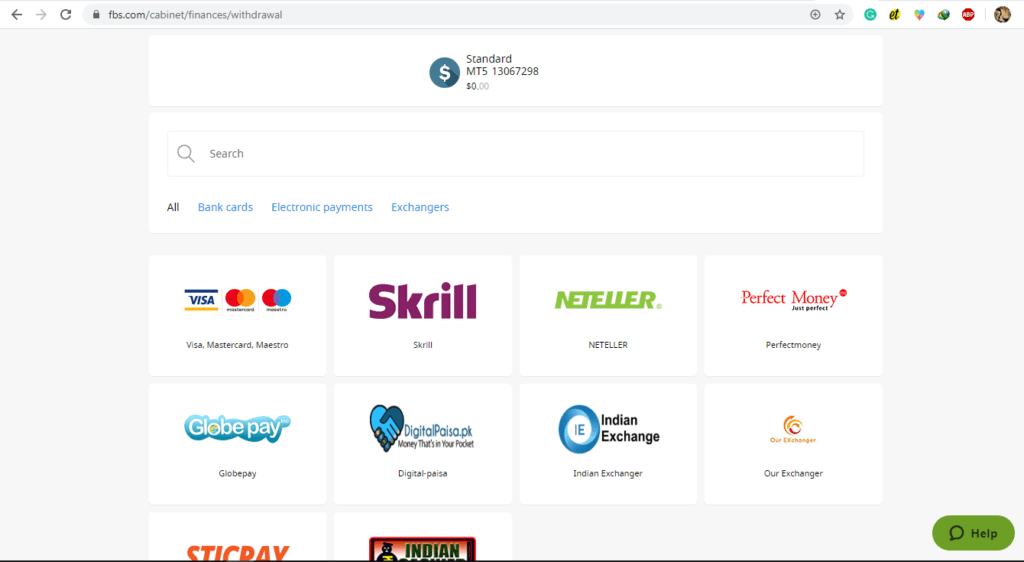

FBS

The withdrawal process here is simple, as well. Simply click on ‘Finances,’ withdraw, and then Perfect Money. To complete that process, you need to verify your FBS account.

How to Withdraw from Perfect Money to Your Bank

The same options available for deposit are available for withdrawal. In this step, click on ‘Withdraw’ and then choose your withdrawal option. The process is intuitive and guided, depending on which option you choose.

If you do a bank withdrawal, you’ll have to provide a SWIFT code. If you are unsure of the code, contact your bank.

Perfect Money Fees and other Expenses

The platform offers quality service and a great experience. However, it is not free, below are some fees that apply.

- Account restoration $100

- Wire transfer – starting from 2.85%, excluding the banking fees.

- Bank wire transfer – 0%.

- The currency conversion depends on the market rates

- The e-voucher attracts a 0.5% standard fee for verified accounts and 1.9% for unverified accounts.

What is the Difference Between a Premium and a Partner Account?

The Premium account comes with exclusive features, including reduced fees and specialized customer support. However, to get to the premium status, you need to fulfill some requirements. For instance, you should have been with the platform for a year. Also, you should have deposited no less than $100,000 or its equivalent in INR.

A partner account is one that is owned by a payment or exchange system. This status is given by the Perfect Money Administration and it helps with B2B processing.

Simply put, Premium and Partner statuses are for individuals and businesses, respectively.

Conclusion

To top it all off, there is a Perfect Money app which offers convenience. It has all the basic features available on the desktop platform and is just as secure. From the app, you can make P2B or P2P payments, view transactions, and receive money.

If you do not want to share your bank details and wish to remain anonymous in the online finance world, you should consider Perfect Money.

Our Recommended Perfect Money India Casino

Our Rating

- 1,100+ Casino Games

- Top-Quality Live Dealer Casino

- Great Welcome Bonus Offer

- Dedicated Support - available 24/7, 365 days a year

Our Recommended Perfect Money India Forex

Our Rating

- Advanced trading technology eliminates any incidences of slippage and requotes

- Supports expert advisers and other automated trading tools

- Hosts Sharia law compliant accounts for Islamic traders

- Huge collection of trading tools and highly effective automated trading systems

FAQs

Is trading legal in India?

Trading is not illegal, but trading with pairs that are not those defined by RBI is illegal. And the worst thing is that forex trading through online brokers is an offense that doesn’t warrant bail.

What is a Trust Score?

In Perfect Money’s system, the Trust Score is used to characterize the individuals’ activities on the platform. It is updated daily, depending on several conditions, including system usage, and fund movement.

Does Perfect Money have an age limit?

Yes, it does. You need to be above 18 years to transact. This is a no brainer; you need to be 18 years to have a bank account.

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

Latest News

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up