Neteller India – How to Open an Account and Deposit Guide

Online gaming and how we make investments have come a long way over the years. Since the advent of the internet and online payment platforms, these industries have skyrocketed and now offer entertainment, services, and convenience you could only dream of. But despite these platforms being the new norm, there are still many people yet to learn how to use them.

If you are one of them, don’t worry. In this guide, we shall take you through a detailed guide of how you can deposit and withdraw money from online gaming platforms and forex brokers.

-

-

Why use Neteller?

First, what is Neteller? Well, it is one of the most popular e-wallets in the gambling industry. To date, it operates in over 200 countries and processes billions every year. As a brand, it dates back to 1999 and is managed by Optimal Payments Limited. It operates with a license from the Financial Conduct Authority in the UK.

So why should you use Neteller? Aside from being a well-known brand, it pays special attention to security. In a world laden with people who love to reap where they did not sow, this is a huge plus.

Using Neteller means your activities on the online gaming platforms, and forex trading remain private. When you deposit funds into your online gaming account through Neteller, your bank account statement or credit card statement will reflect payment to Neteller and not a gambling platform.

If you have multiple online gaming accounts as a lot of Indians do, you’ll have an easier time transferring money from one account to another.

We recommend using Neteller for a couple of reasons:

- It’s one of the most reputable and oldest e-wallets

- It’s regulated by the FCA

- The online transactions are instant

- Attract lucrative offers by using it

- The customer support is excellent

- Up to date encryption protocols are a priority

Note: The FCA is one of the most trusted financial governing bodies in the world as it has strict rules and regulations.Step 1: Open a Neteller India Account

We know it’s scary to try new things and the fact that this is a tech-related new experience doesn’t help the situation. Luckily the process is simple, so don’t let the technical jargon confuse you. Below is a step-by-step guide on opening an account with Neteller and how to leverage it to your benefit.

The whole process is completed online; open your browser and visit the official Neteller website.

If you understand another language and prefer it to English, you can change it by going to the top right corner of the screen and select the language you prefer. Since you are new, click on join free.

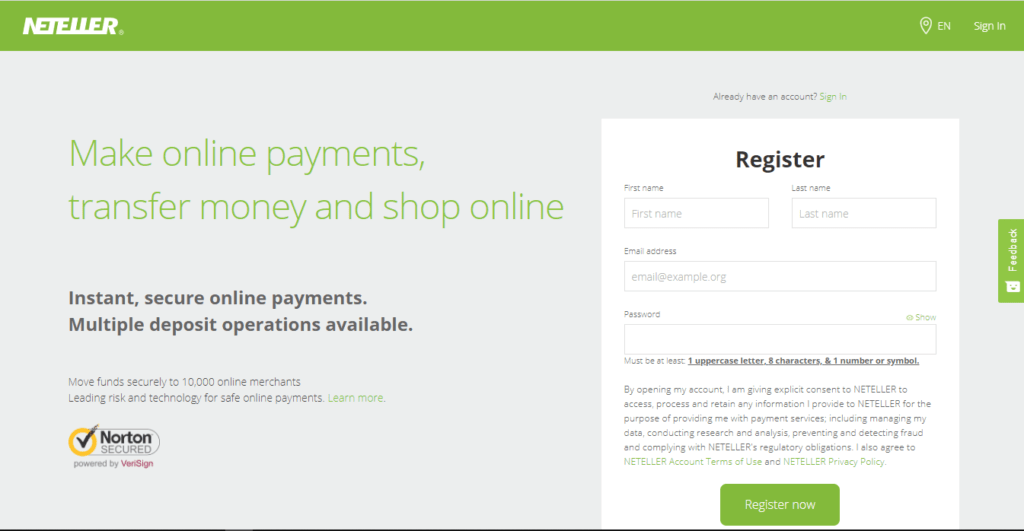

This stage is simple since you only need your names, an email address, and a password. After typing those in, click on register now. However, if you are a sucker for the rules, you can read the privacy policy linked in the small font.

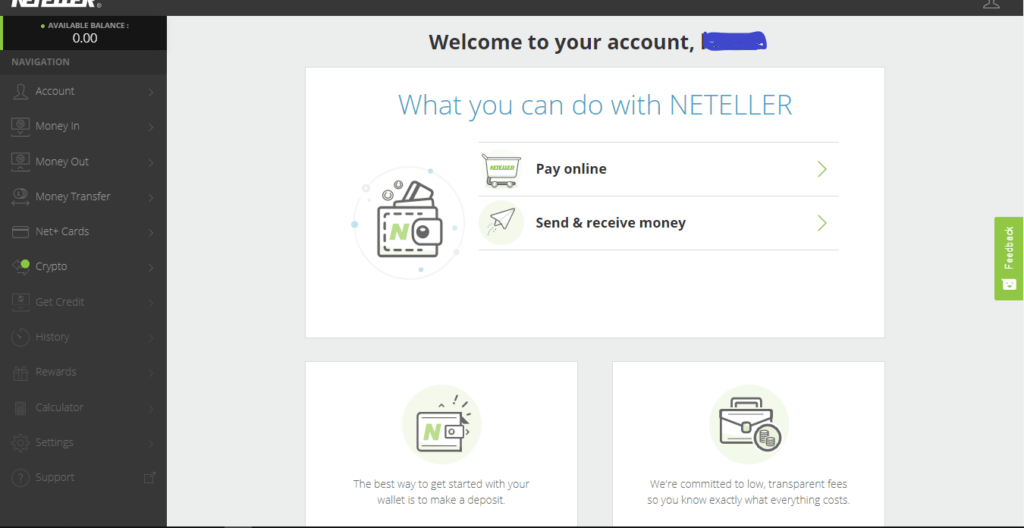

And with that; you have a Neteller account.

Step 2: Fund Your Neteller Account

To start using your Neteller account, you’ll need to fund it. This process is also simple though you’ll need to verify the account. This process is essential for account security.

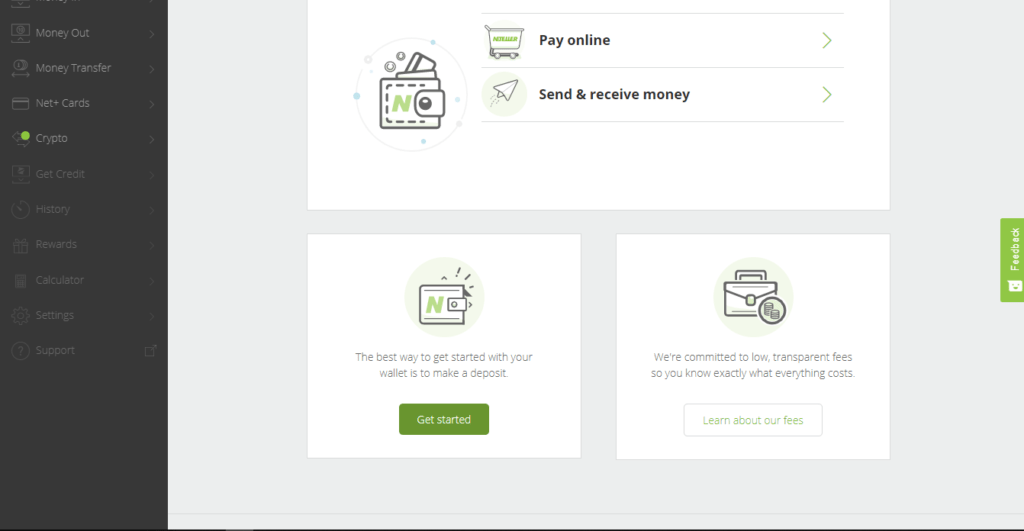

It all starts by clicking on ‘Get Started.’

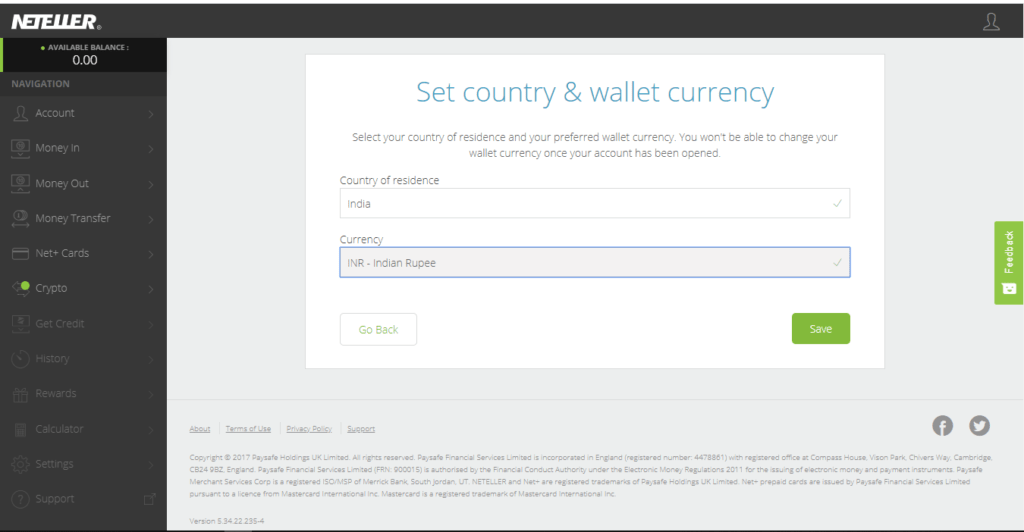

Select your country of residence and currency and then click ‘Save.’

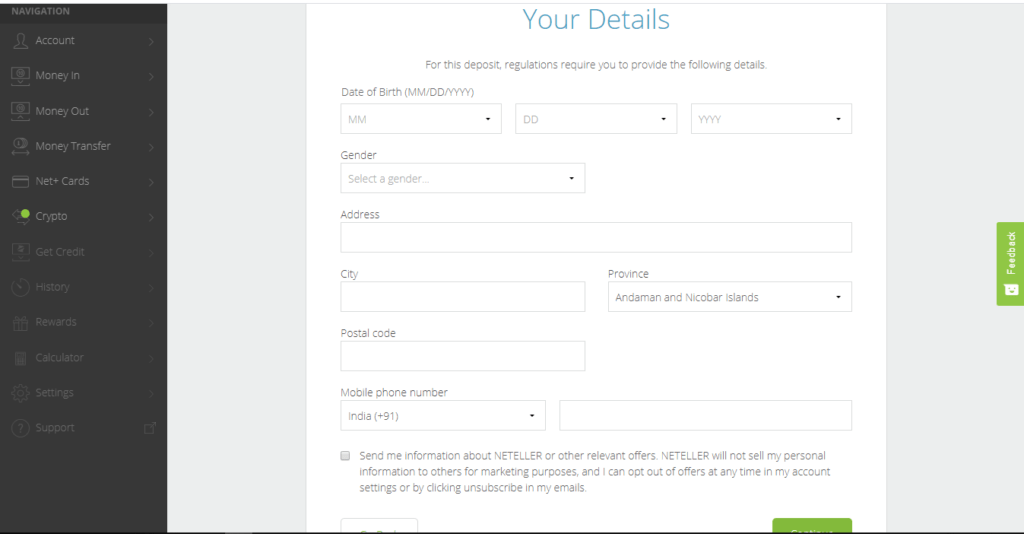

Type in your personal information. This information should be accurate, or you will have trouble verifying the account, and you can run into issues when withdrawing your money.

Some of the information you’ll provide includes your date of birth, gender, address, and contact number. Confirm the details are correct before you click on continue.

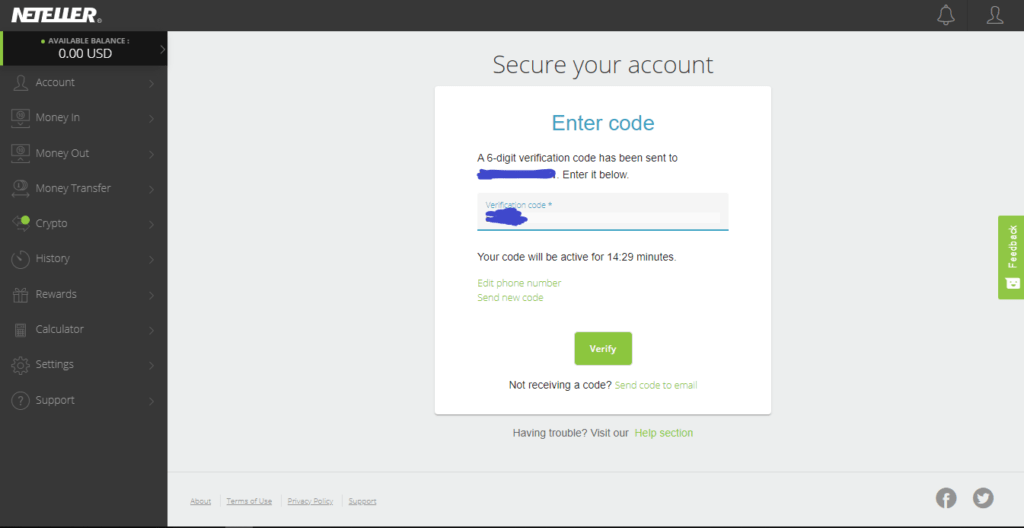

Note: Due to future verification, provide an address that is on your utility bills or your bank statements.Shortly after, you’ll receive a confirmation code on your mobile phone. You’ll need it on the next step. Also, you should keep it safe along with the registration email, the account ID, and your password.

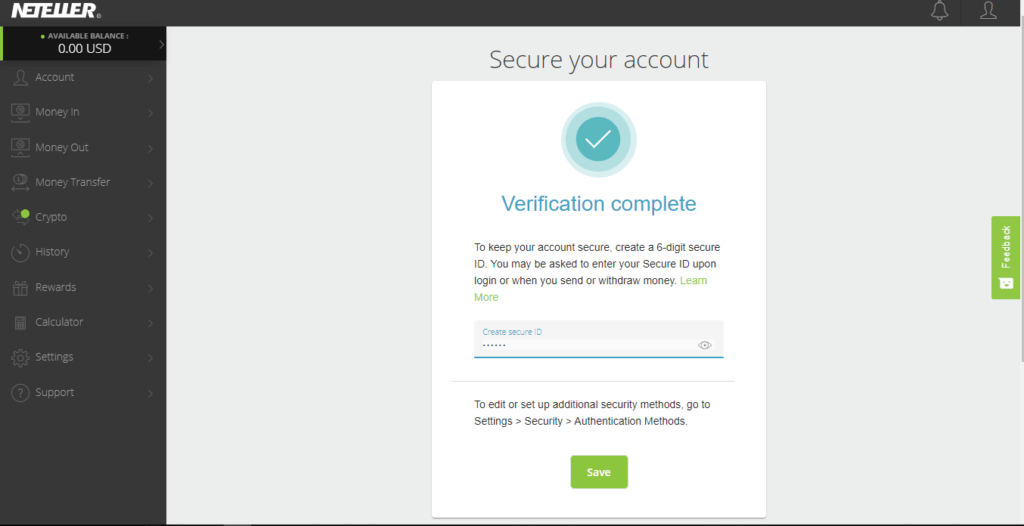

To complete this process, create a six-digit pin. You will use this pin when logging in and during transactions.

At this point, you now have a Neteller account that you can use to send and receive money. However, there is a limit to the transactions and to lift the limitation, you will need to complete the below verification process.

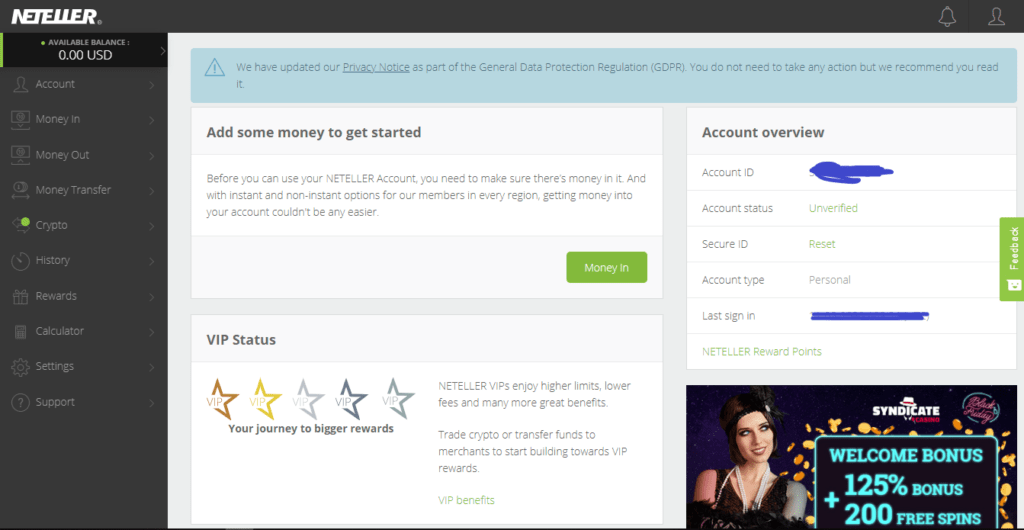

On the right of the screen, you can see ‘Account: Unverified.’ You need to turn this to ‘Verified.’ Click on it to start the process.

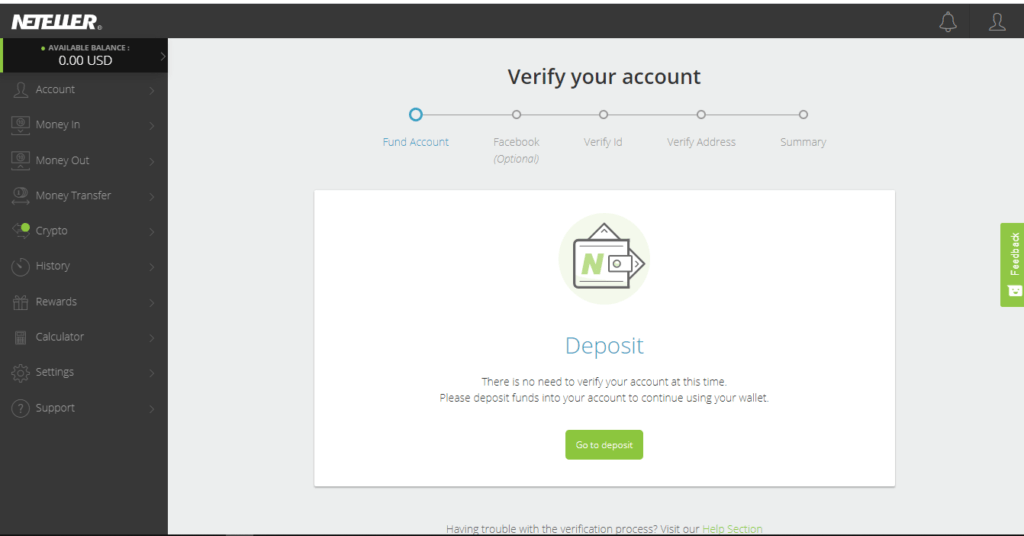

To complete this process, you’ll need to go through four steps, they include;

- Fund the account

- Add your Facebook account – this information is optional, but if you provide it, you’ll save time in the Verify Address and ID steps.

- Verify your identity – you can verify your account using your Passport, Driver’s License, or an Identity Card.

- Verify your address – the verification is either through geolocation or by uploading an address document. For geolocation, you’ll turn on the browser’s location and let Neteller pick up on your location automatically. With an address document, it could be tuition receipts, a bank statement, or utility bill.

Note: Though geolocation is fast, you need to be using the laptop close to the place you registered the account from.

Adding Funds

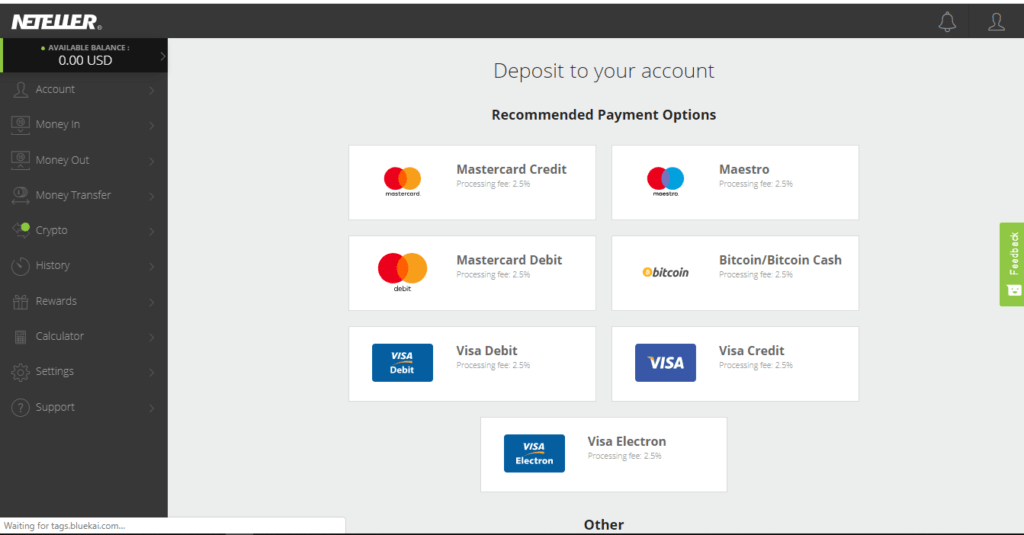

If you don’t want to verify your account immediately, you can add funds by clicking on ‘Money In’ and then choosing your preferred deposit option from the list provided. You can use:

- Mastercard Credit

- Maestro

- Bitcoin/Bitcoin Cash

- Mastercard Debit

- Visa Debit

- Visa Credit

- Visa Electron

- Skrill

Note: All the above options have a 2.5% processing fee.

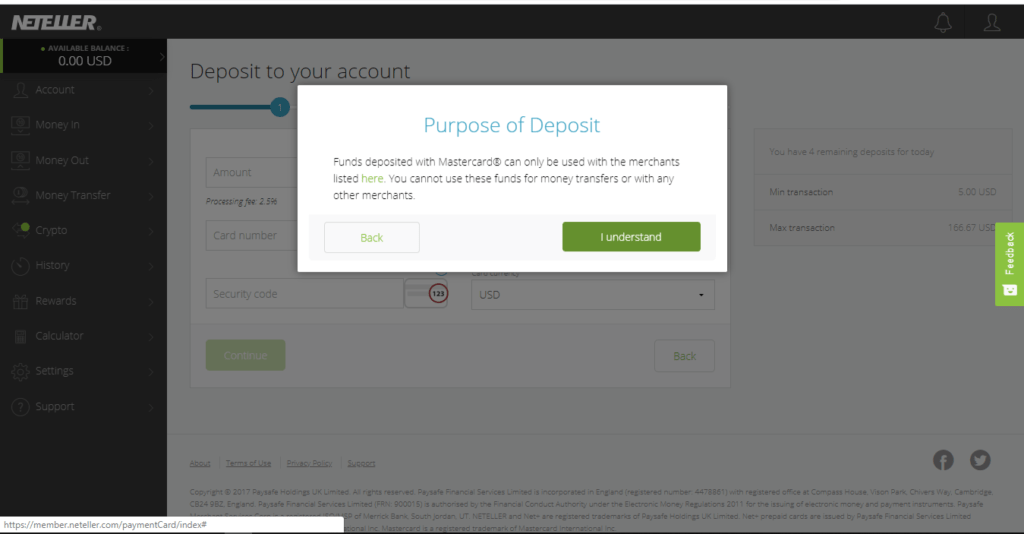

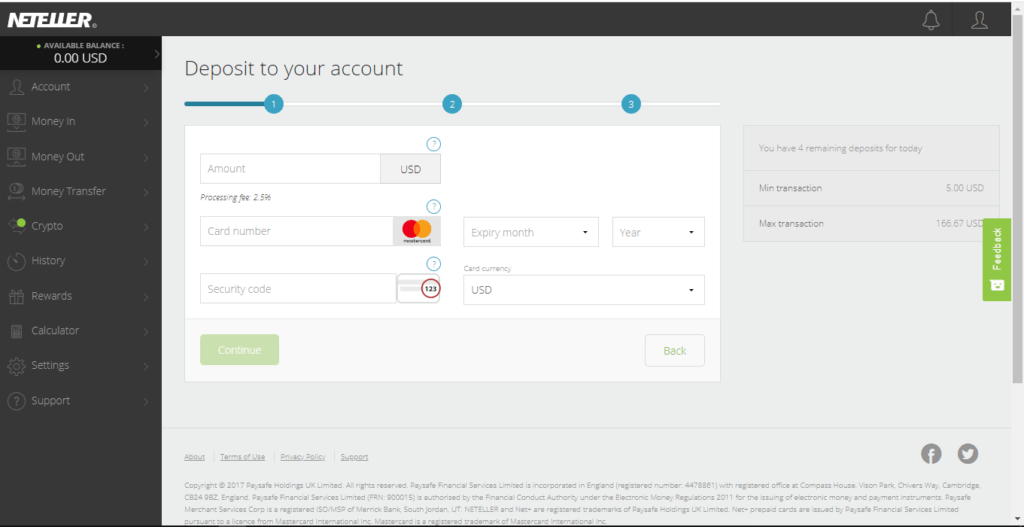

For this guide, we shall use the Mastercard Credit, but with this option, you can only work with a specified list of online gaming sites and forex brokers.

To view the list, click on the hyperlink ‘Here.’ If you are okay with the information shown on their pop up, click on ‘I Understand.’

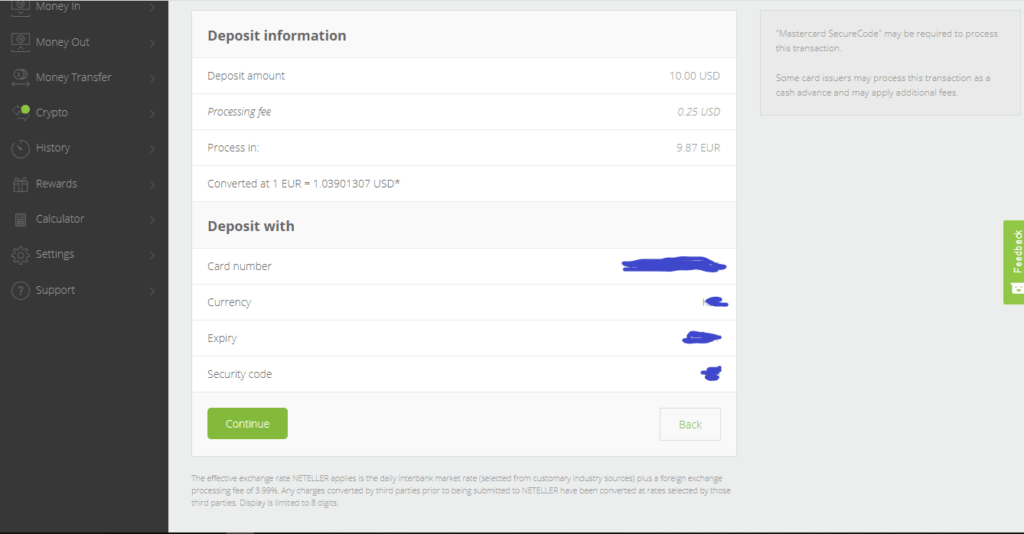

Enter your card details above and click continue. In the next step, confirm the details and then click continue to finish the process.

But if the information has a mistake, click on ‘Back’ to edit.

Step 3: Select Your Neteller Casino or Forex Broker

Once you have Neteller is set up, it’s time to choose an online casino or a forex broker depending on what you are into.

Below are short reviews of the brand we found to be worth your time.

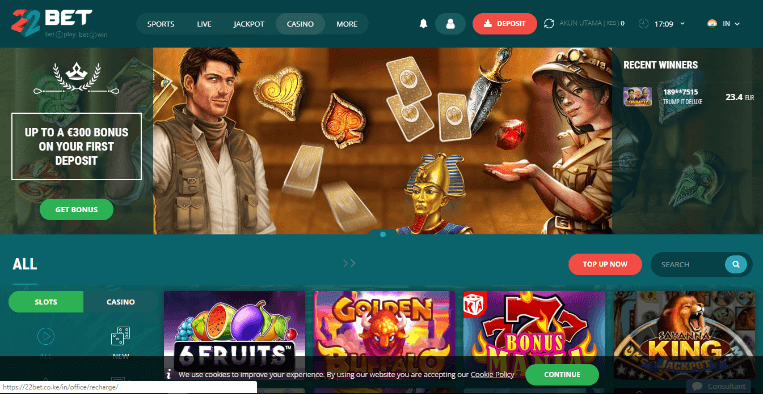

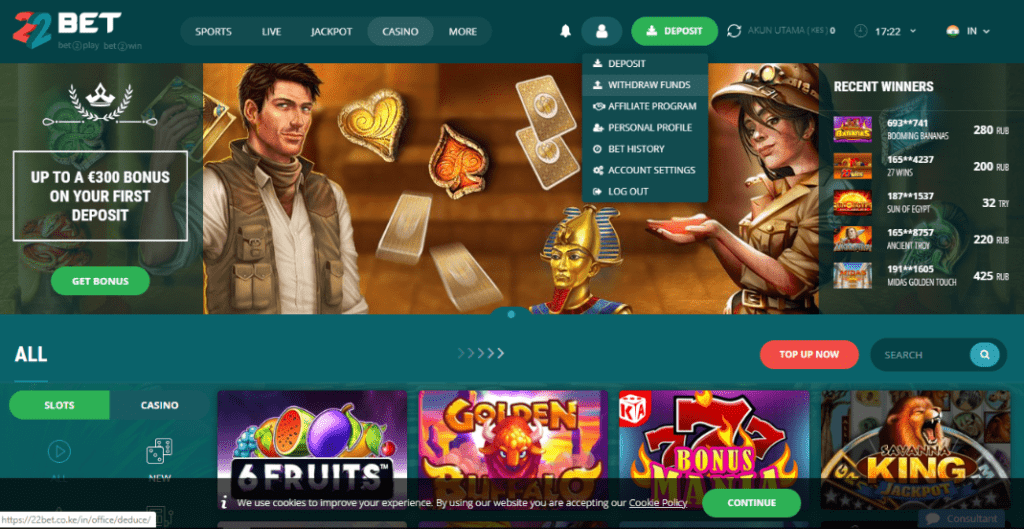

1. 22bet Casino – Has a Sportsbook Too

22bet Casino is all about making a great first impression. It has a simple and easy to navigate website, but despite its simplicity, it has the backing of popular software developing companies in the industry, including Microgaming, Play N’ Go, and NetEnt. In addition to the casino, it has a sportsbook option as well. To ensure your security, it is has a license from the UKGC and implements 128-bit encryption.

22bet casino offers a range of over 1,000 slot games that are not only trendy but full of life. They include video slots, jackpots, live casino, and Jandi Munda. What makes the casino even more impressive is the ability to play the four games simultaneously through the screen split feature they have.

As for the bonuses, the casino offers a 100% welcome bonus on your first deposit. The bonus is capped at INR 25,000. You can deposit your money through Neteller, bitcoin, Payeer, ecoPayz, Skrill, Sticpay, Webmoney, and Qiwi.

And when you are on the road, you can use their mobile app, which mimics the desktop gaming experience. However, fewer games are available on the app.

Our Rating

- It works with reputable gaming software providers

- Numerous banking methods including Neteller

- Supports different currencies

- It lacks a loyalty program for the returning customers

- It has a mobile app for Android and iOS

2. FBS – Low Barrier to Market Entry

FBS is a CFD and Forex broker that attends to clients worldwide. It was established back in 2009, and it has since grown into a beast in the industry based on capacity, size, and technology. On the platform, you can trade currency pairs, stocks, CFDs, and metals. Even better, it accommodates over 18 languages.

So far, FBS has over 12 million traders for about 190 countries, and they claim that 7000 new partners and trader accounts are being opened daily. While we cannot verify this, the reason is believable is because it has a low barrier to market entry, which is attractive to beginners and experts alike.

To accommodate different kinds of clients, FBS has five different types of accounts including;

- Cent

- Micro

- Standard

- Unlimited

- Zero spread account

FBS uses a hybrid broker model of STP (Straight through processing) and ECN (Electronic Communications Network). As such, they don’t have a dealing desk. With this model, requotes are not possible.

Our Rating

- It is regulated by IFSC

- Great trader education

- Low capital needs

- A variety of research tools

- The spreads are higher in comparison to other retail brokers

- The leverage on the global brand is high

Step 4: Fund your Casino Account and Forex Account

After creating a Neteller and 22bet account, the next step is to fund the account. Below is how to do it.

22Bet

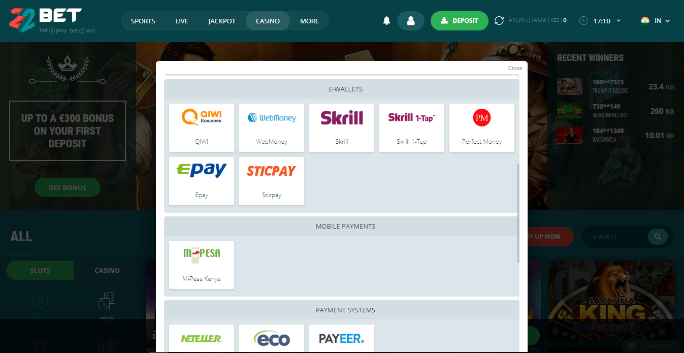

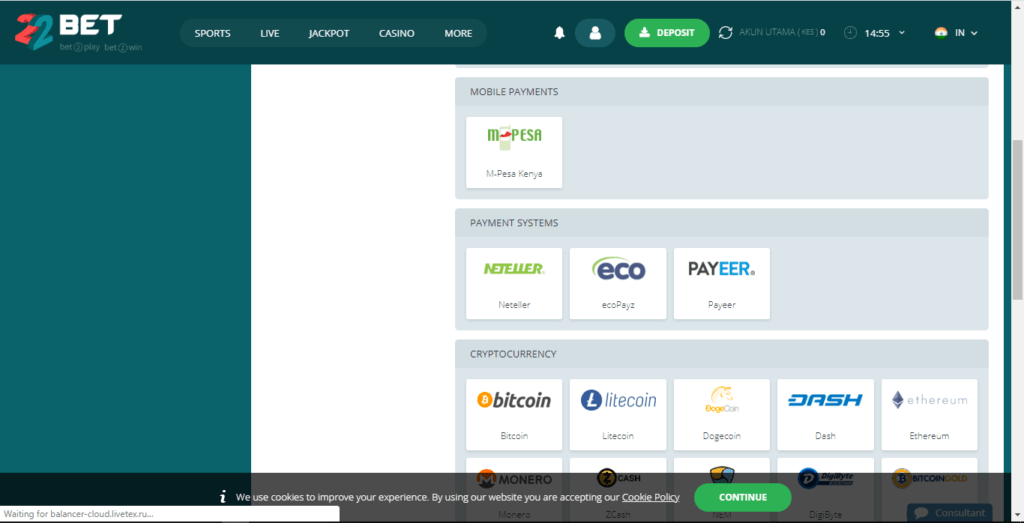

Log in to the account and click on ‘Deposit.’

Then navigate to ‘Payment Systems’ and click on ‘Neteller.’

Enter the amount you want to deposit and click ‘Confirm.’ This process assumes you already have a Neteller account. If not, you should click on ‘Create a Neteller Account’ and follow the prompts. Alternatively, you can follow the process we’ve described above.

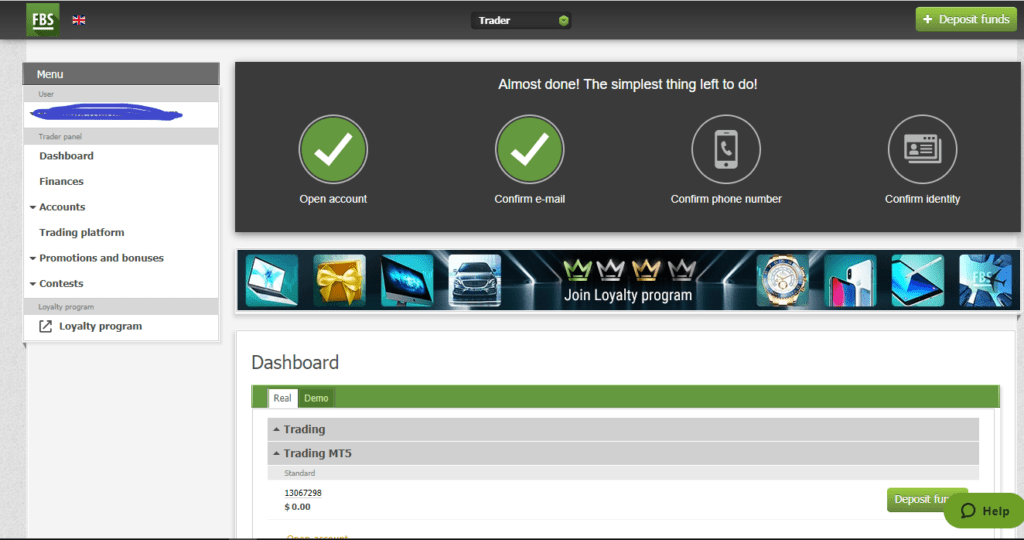

FBS

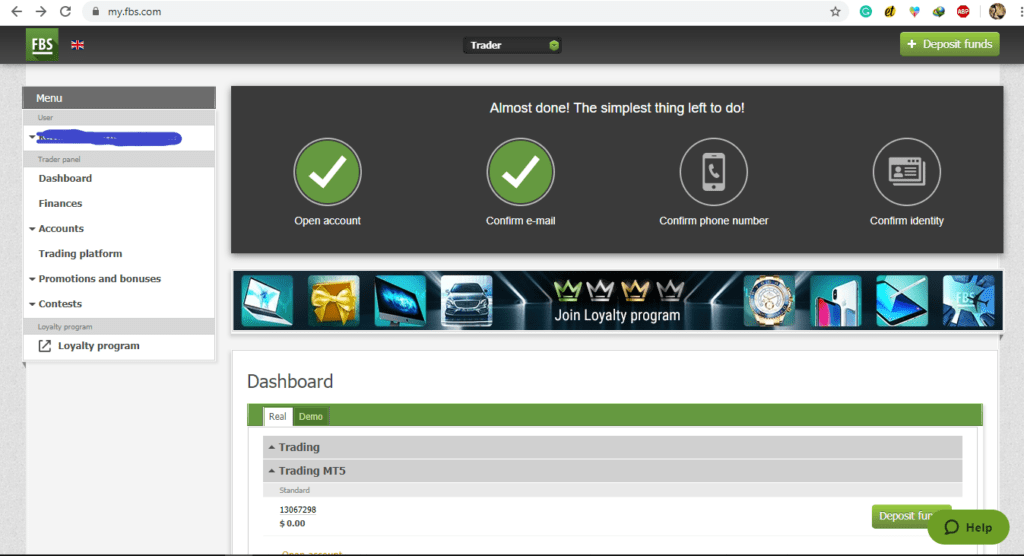

Step one is account creation. Luckily, the process is straight forward.

After getting an account, proceed to the funding.

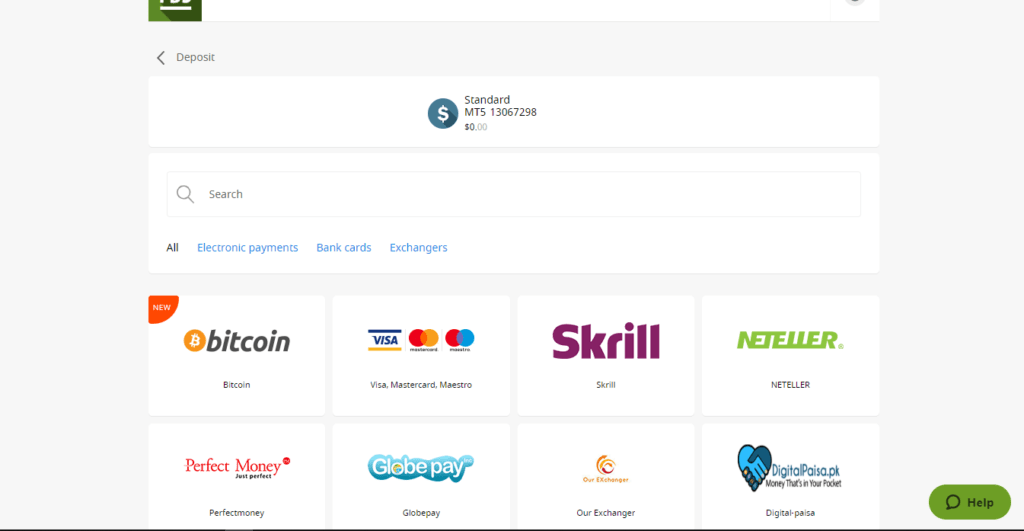

Click on ‘Deposit Funds’

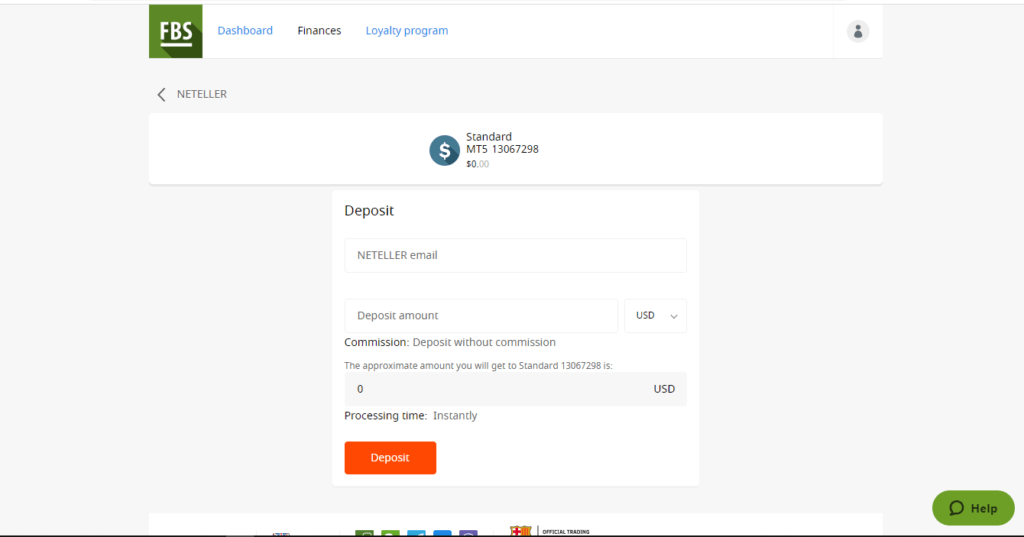

Navigate to Neteller.

Enter the amount you wish to deposit.

The amount should reflect immediately.

Step 5: How to Withdraw Funds

How to Withdraw Funds from Neteller

22Bet

The withdrawal process is also as easy as the deposit. However, for your first withdrawal, 22Bet will complete the verification process. Because of this, the process might be longer. After this, it will be a simple click-through experience, as shown below.

Head to ‘My Account’ and click on ‘Withdraw.’

Navigate to Neteller

Within the pop-up, enter the amount you wish to withdraw, enter your Neteller email address, then click on ‘Confirm.’

From FBS

The process is as follows:

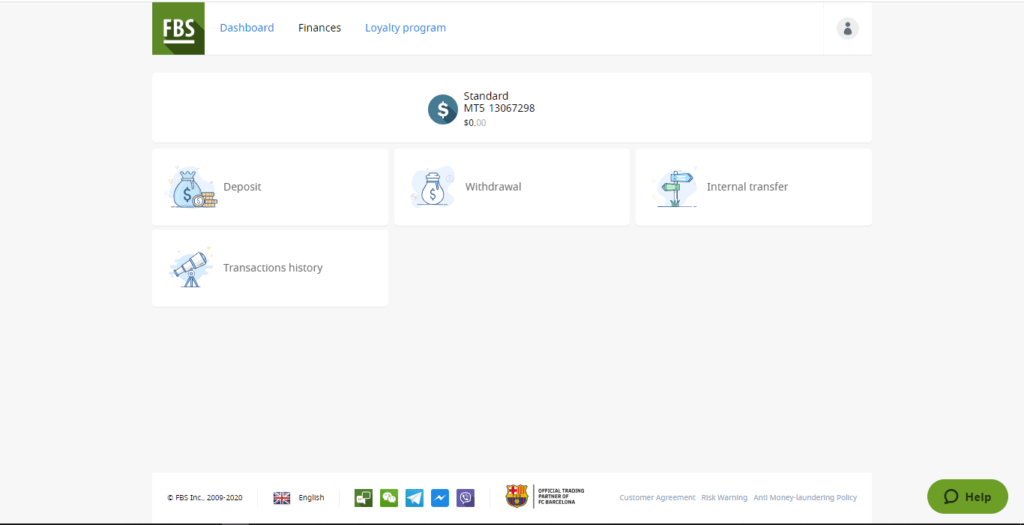

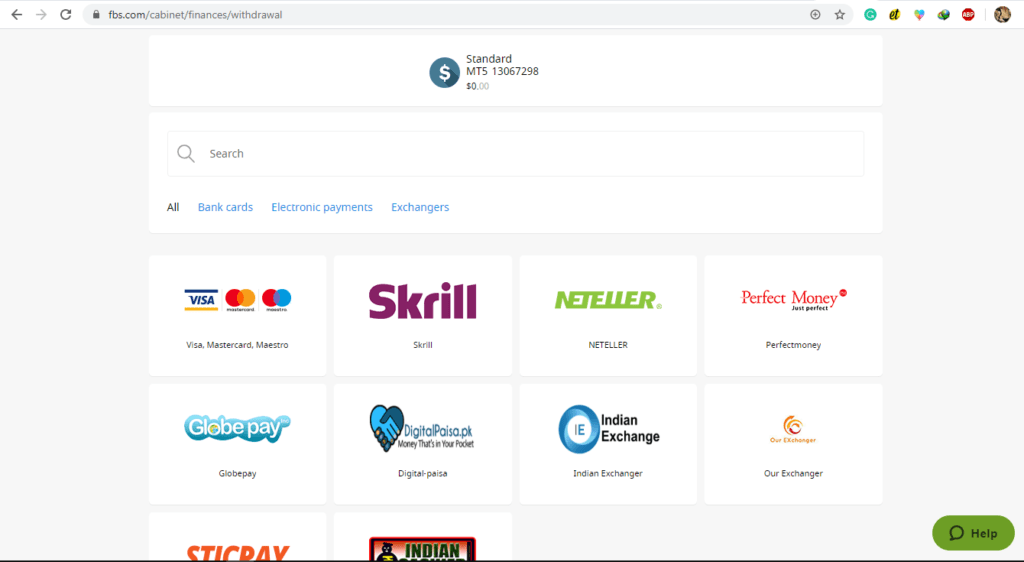

Click on ‘Finances’ on the left side of the screen.

Click on ‘Withdraw’.

Navigate to Neteller and follow the prompts.

Note: To withdraw, you’ll need to verify the account first.

Note: To withdraw, you’ll need to verify the account first.How to Withdraw From Neteller to your Bank

For Neteller India withdrawal, follow the following steps.

- Click on ‘Money Out’ on the left side of the screen

- Choose ‘Bank Withdrawal.’ The process is intuitive. However, if you had not added your card or bank details, you have to do so first.

To link your bank, add the bank details, and confirm. If you are unsure of the details, contact your bank. When the details check out, some amount will be deposited into the bank account. This automatic deposit is received in between two and five business days. To confirm the deposit, you can request a bank statement.

When you receive the deposit, take note of the amount. You will then enter the digits (amount deposited) into the relevant field before you check out.

Note: A bank transfer is only feasible with a personal bank account.Also, once the process starts, you cannot stop it. You will have to wait for the money to hit your bank account and then deposit it back into your Neteller account.

Other options include:

- Neteller wallet – it is done like a deposit. This transfer reflects immediately.

- Neteller money transfer – it is only available to Neteller members.

Neteller Fees and Other Expenses

A bank withdrawal costs $10 or its equivalent in INR. Also, bank transfer takes about 3-5 business days. In addition to this, you will incur a 3.99% foreign exchange fee if your Neteller account and your bank account are in different currencies.

Remember that deposit into an online casino is free, so this is a plus.

Conclusion

Neteller is a popular e-wallet in India, but it clearly has a lot more going on for it than just popularity. It is easy to use, and its costs are affordable. From the guide above, you can tell, the process doesn’t take ages. If you have the required documentation at hand, it will take 5 minutes.

And the fact that Neteller doesn’t charge you to deposit cash into your online casino account means that you can take advantage of casino bonuses and promotions effective. You can deposit a specific amount and use it in all casino accounts you have. You just need to ensure you are gambling responsibly. Responsible gambling means that you do not spend money that you cannot afford to lose. If you need to take a break, you can suspend the account.

Our Recommended Neteller India Casino

Our Rating

- 1,100+ Casino Games

- Top-Quality Live Dealer Casino

- Great Welcome Bonus Offer

- Knowledgeable Customer Support Team

Our Recommended Neteller India Forex

Our Rating

- Advanced trading technology eliminates any incidences of slippage and requotes

- Supports expert advisers and other automated trading tools

- Hosts Sharia law compliant accounts for Islamic traders

- Huge collection of trading tools and highly effective automated trading systems

FAQs

Can I withdrawal from Neteller to PayPal?

Unfortunately, you cannot withdraw from Neteller to PayPal directly. The only option is to use a trusted 3rd party company that accepts Neteller funds.

Which banks support Neteller?

Almost all banks in Indian support Neteller transactions. But if you want faster processing, you should prefer ICIC Bank. Other banks that support Neteller include HSBC, State Bank of India, and Bank of Baroda.

Is Neteller safe to use in India?

Yes, it is. The fact that popular banks in India accept it supports this claim.

Does Neteller have withdrawal limits?

The withdrawal limit is not definite. It varies with the local bank limits and whether you have verified your Neteller account or not.

Is there a Neteller App?

Yes, there is. The app is available on Android and iOS stores as well.

Do I get a debit card with Neteller?

Unfortunately, you cannot. Before February 2011, Neteller distributed cards to Indian residents, which granted them access to their balances through ATMs. But Neteller policies have since changed and led to the stoppage of the debit cards in India. But this should not be mistaken as Neteller not operating in India.

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

Latest News

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up