EcoPayz India – A Guide to Open an Account and Deposit Cash

The online market place has grown courtesy of the online payment platforms. With the varied options available, you can make secure payments while your privacy is preserved. And though many online payment platforms are serving Indians today, in this piece, we’ve zeroed in on ecoPayz. Though it’s one of the newer payment platforms, it features all services one might need plus more.

Below is a quick guide on how you can leverage it to safeguard your forex trading investments and remain anonymous on the online casino streets.

-

-

Why use EcoPayz?

To appreciate the benefits of the ecoPayz platform, you need to understand how it works. So here goes.

EcoPayz started operations in 2008 and is run by PSI-Pay Limited. It has its base in the UK and has a license from the FCA. In 2009, ecoPayz started working with MasterCard. This partnership allowed ecoPayz to make prepaid debit cards. In 2011, the company introduced business accounts and later renamed to its current name. In the following years, they introduced virtual cards, ecoVouchers, and apps to make online payments even more convenient.

One of the benefits of using ecoPayz is the security and the range of banking services it offers to meet your payment needs. It supports multiple currencies and is widely accepted in online casinos in India.

Currently, ecoPayz has five account types: gold, silver, VIP, classic, and platinum. Each of these levels offers different benefits, services, and attract varying fees depending on how many transactions you complete.

For its loyal customers, ecoPayz offers membership access to online promotions for their ecoAccount and ecoCard. Since it has a partnership with Mastercard, eligible members have access to the Mastercard promotions and offers.

Other benefits include:

- It has a mobile application for iOS and Android tools.

- It has a bankroll tool that helps you to keep track of your transactions and gambling habits.

- Safe and secure courtesy of the TLS and SSL protocols

How to use EcoPayz India

Trying new payment platforms can be daunting, but before you make a decision, you need to be assured it’s easy to use, convenient and above all cheaper in comparison to alternative payments available in your region. In this step-by-step guide, we’ll show you how easy it is to use the platform, and later, how much it will cost you to transfer cash back and forth.

Step 1: Open an ecoPayz Account.

Once on the ecoPayz homepage, click on ‘Open a free account.’ Alternatively, you can click on ‘Sign up’ at the top right corner of the site.

On the next page, enter a username, an email address, and come up with a strong password. You will also be required to share personal information, including your name, birth dates, address, and phone number.

Check the box related to the terms and conditions and then click on ‘Create an Account.’ At this point, your account will be ready for use, and you can log in instantly. However, we advise that you verify your email address before proceeding.

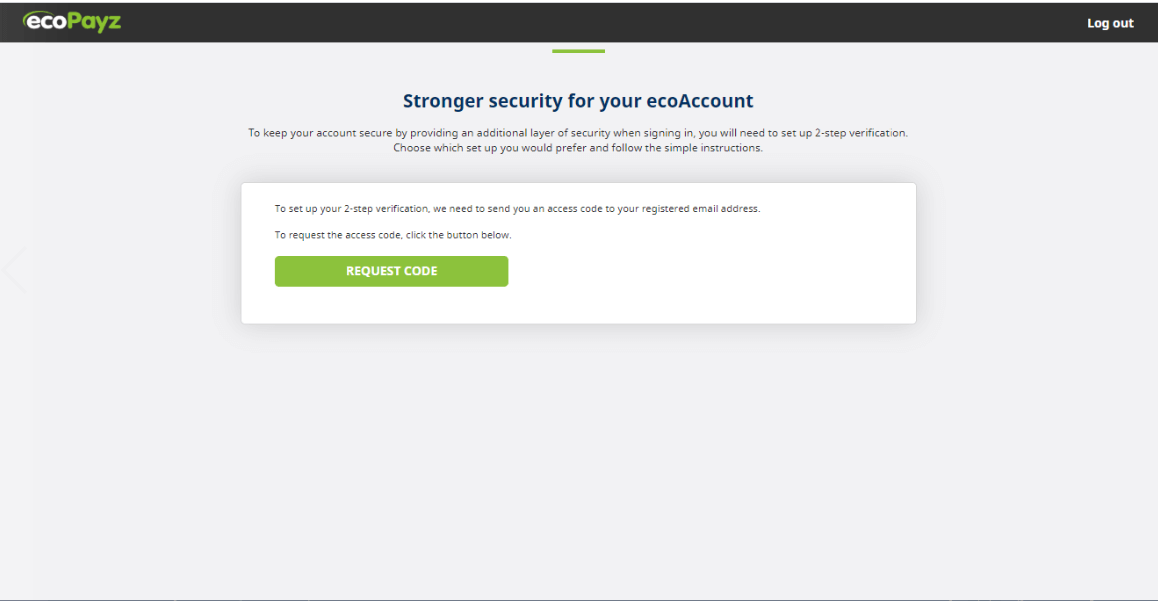

It is a two-step verification process were ecoPayz will send an access code to your email address. The next process is to strengthen your ecoAccount through Google Authenticator or an SMS or voice call.

Note: If you are a digital nomad or aren’t in India when creating your ecoPayz India account, your account might be blocked after creation. Sure, you’ll still have access to it, but transactional functions, including deposits, will be blocked. In this case, you should contact customer support through email and clarify things. This happens when the IP doesn’t match the country you are in. Also, customer support might request for your utility bill as proof of physical address.Step 2: Fund the EcoPayz Account

Before you start using your ecoPayz account for online casino and forex broker funding, you should first fund the account.

Initially, the only ecoPayz deposit option available was through your bank account, but today, there are numerous top-up options, including ecoVouchers, PoLipayments, Klarna, Neosurf, SafetyPay, Bancontact Mister, iDeal, Fast Bank Transfer, Przelewy24, visa cards, iDebit, Trustly, PocketChange, PayU, Tencent, Multibanco, Yandex, UnionPay, and Instadebit. However, not all of these are available in India.

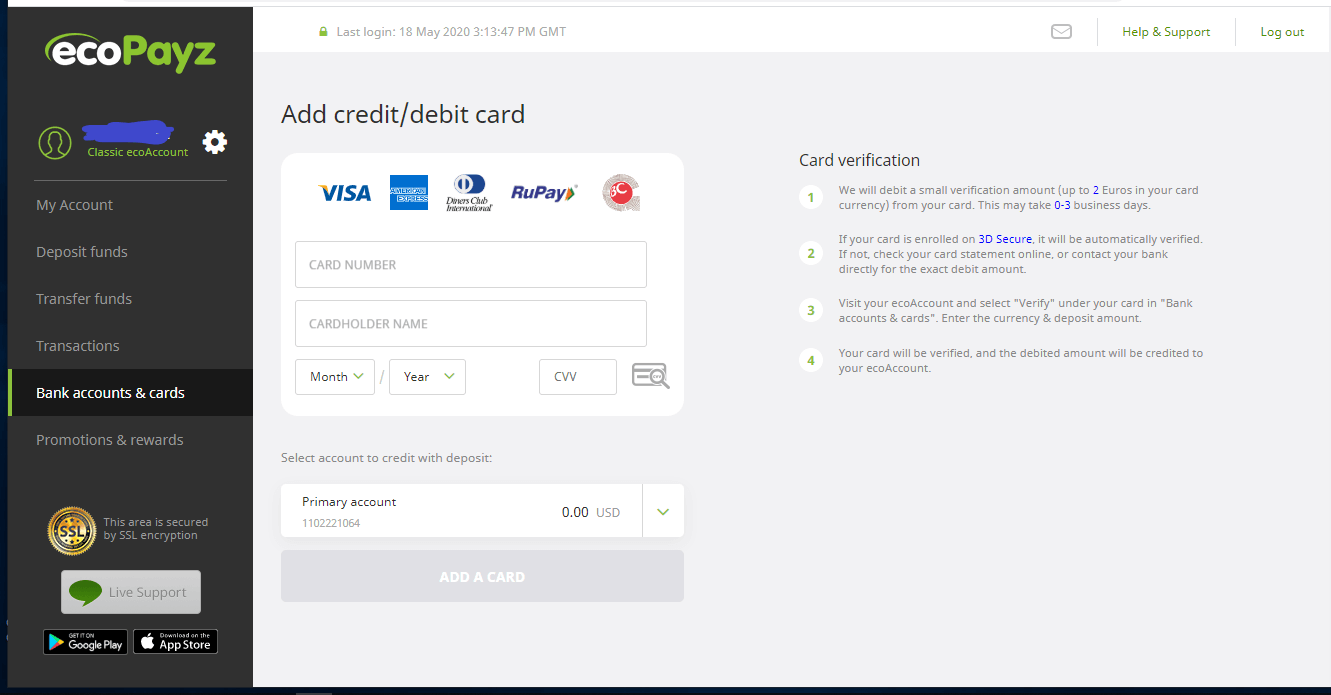

In this guide, we opted to link a card.

On the left side of the screen, click on ‘Deposit.’ Then click on ‘Add Card’ on the page that appears. On this page, you will add a debit/credit card details, including the name, card number, expiry date, and the CVV. Also, you will specify the amount you wish to deposit.

Generally, linking your card makes funding your ecoPayz easier, but since this is the first time, you’ll go through a card verification process which includes debiting an equivalent of 2 Euros in your card currency from the card you are linking. This process will take between 0 and 3 business days. However, if your card uses 3D Secure, then it’ll be verified automatically. If it’s not, you should request for your bank statement or get in touch with your bank account to know the exact amount debited.

Also, you’ll have to log into your account and select ‘Verify’ under the card you are linking. Here, enter the deposit amount and the currency. At this point, your card verification process will be complete. Also, the amount you wanted to deposit will reflect in your account.

Step 3: Select Your EcoPayz Casino and Forex Broker

Once the setup is complete, it’s time to choose the online casino and the forex broker you will work with. In this case, we have chosen 10Cric as our recommended online casino and XM as our recommended forex broker.

Below are quick reviews of what each of these offers.

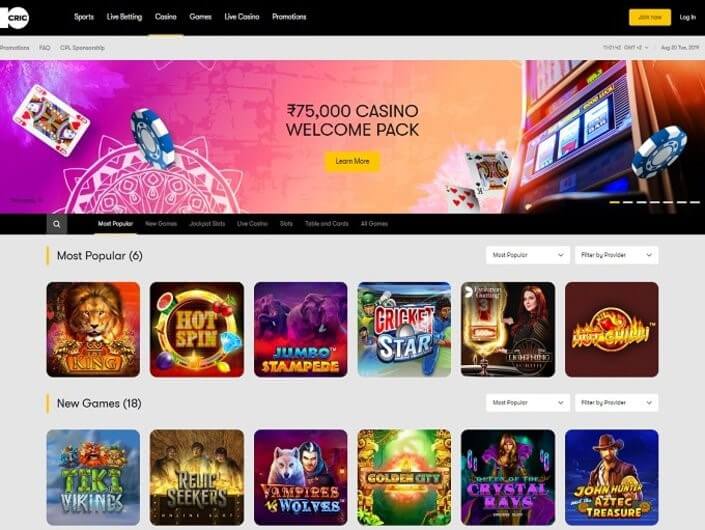

1. 10Cric – Best for Cricket Betting

This is one of the new casinos on the block, but unlike many online casinos in India, 10Cric decided to focus on cricket. This is a huge plus since cricket is the leading sport in India. Now, the casino is run by Chancier B.V and has a license from Curacao, but despite its young age, its management team is experienced and understands the work that goes into building a casino that meets the demands of players in India.

The web design, structure, and navigation will capture your attention when you first visit the casino. The colors blend perfectly, and they are easy on the eyes. Moreover, the site is well organized, with the navigation well placed to avoid confusion. The overall great design trickles down to specific sports, markets, and odds.

When you compare the homepage with what other sportsbooks offer, you’ll be pleased to find that the markets are visible at the top of the website. There’s also a search tool that makes it even easier to find markets you are interested in.

For the beginners, the site offers a 100% match bonus capped at INR 10,000. The welcome bonus also includes 100 free spins for the Kin Slot. To claim this bonus, you use the code ‘WELCOME.’ However, to claim the bonus, you need to deposit a minimum of INR 1,000 and wager 12x on games with odds above 1.60.

If you are into live gaming, you will enjoy the variety of games 10Cric offers, including Live Baccarat, Roulette, Monopoly, Sic Bo, Lightning Dice, Football Studio, and more. These games have high graphics, and the user experience is through the roof courtesy of software gaming companies like Evolution Gaming and Ash Gaming.

And as for the payment methods, there is a variety to choose from, including Visa, Skrill, Neteller, Bitcoin, MasterCard, and ecoPayz. Last but not least, the support team is available through telephone and email.

Our Rating

- It has a generous welcome bonus

- Accepts many payment methods

- Has a simple web design and navigation

- The site is slightly slow

2. XM – Great Customer Support

XM Group is actually a group of forex brokers that offer WebTrader currency MT5 and MT4 trading platforms. XM.com offers more than 55 currency pairs as well as CFDs on stocks, metals, stocks, commodities, equity indices, energies, and cryptocurrencies.

As part of being a diverse platform, XM offers services and experience for experts and beginners. Therefore, they offer a real trading account and a demo account with up to $100,000 of virtual money to practice with. Along with the practice money, the platform offers educational material to take you through the trading process.

When you are confident enough to shift to the real account, you are not charged hefty commissions or fees. The platform executes your trading fast, which improves your odds of making more money.

For safety, the platform is regulated by Cyprus Securities and Exchange Commission and the IFSC.

Last but not least, their customer support is proactive. They get in touch once you set up and account and ask how best they can serve you. They offer email and live support in case you get stuck on the platform.

Our Rating

- Accepts numerous payment methods

- Has minimal fees

- It's safe and secure

- Has an app

- It charges an inactivity fee

- It has average FX fees

Step 4: Fund Your Online Casino and Forex Accounts

After choosing the platforms to choose in either industry, it’s time to fund the respective accounts and has some fun.

10Cric

Like with other online casinos, the process is simple.

- Navigate to ‘Deposit’ and choose ecoPayz as your deposit option.

- To deposit money directly from your account, select ecoPayz.

- Enter the relevant information and the amount you’d like to deposit and then confirm

- The transaction will be processed immediately, and you can start betting.

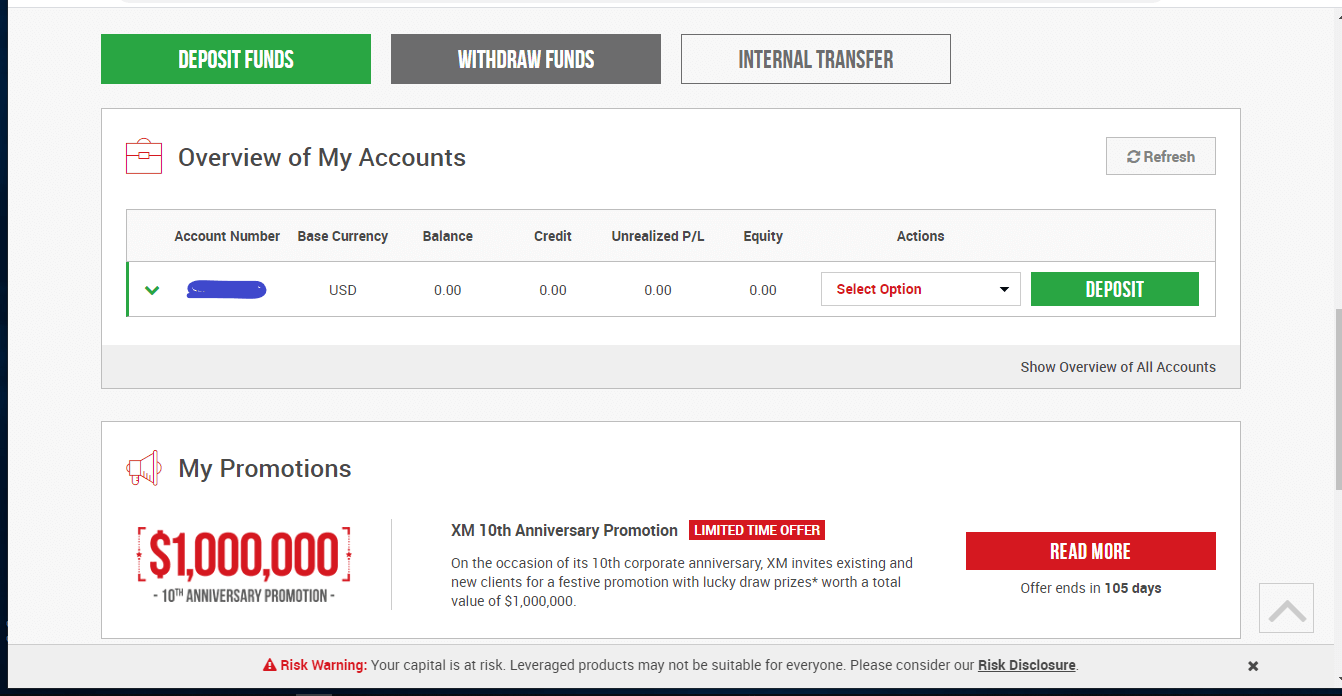

Note: If it’s your first deposit, you can claim the welcome bonus. But this bonus is subject to meeting the terms and conditions.XM

You will first have to create an account and verify it. If you are an expert, you can start with the real account, however, if you are still learning the ropes, then the demo account is advisable. When you’re confident you can upgrade to the real money account and start earning some real cash.

Once you are ready to start, click on ‘Deposit’ on the platform and then navigate to ecoPayz. The site will prompt you for your ecoPayz account number, the currency, and the amount you wish to deposit before you complete the process.

Note: XM allows creating multiple trading accounts.

Note: XM allows creating multiple trading accounts.Step 5: How to Withdraw Funds to EcoPayz

The process on both platforms is easy and straight forward.

Simply navigate to withdrawal and select ecoPayz from the withdrawal services available. Next, specify the amount you wish to withdraw, enter relevant information (including your ecoPayz account) and then confirm the transaction.

Note: Withdrawing directly to your ecoPayz account will take a maximum of 48 hours to reflect.Step 6: How to Withdraw From EcoPayz to your Bank

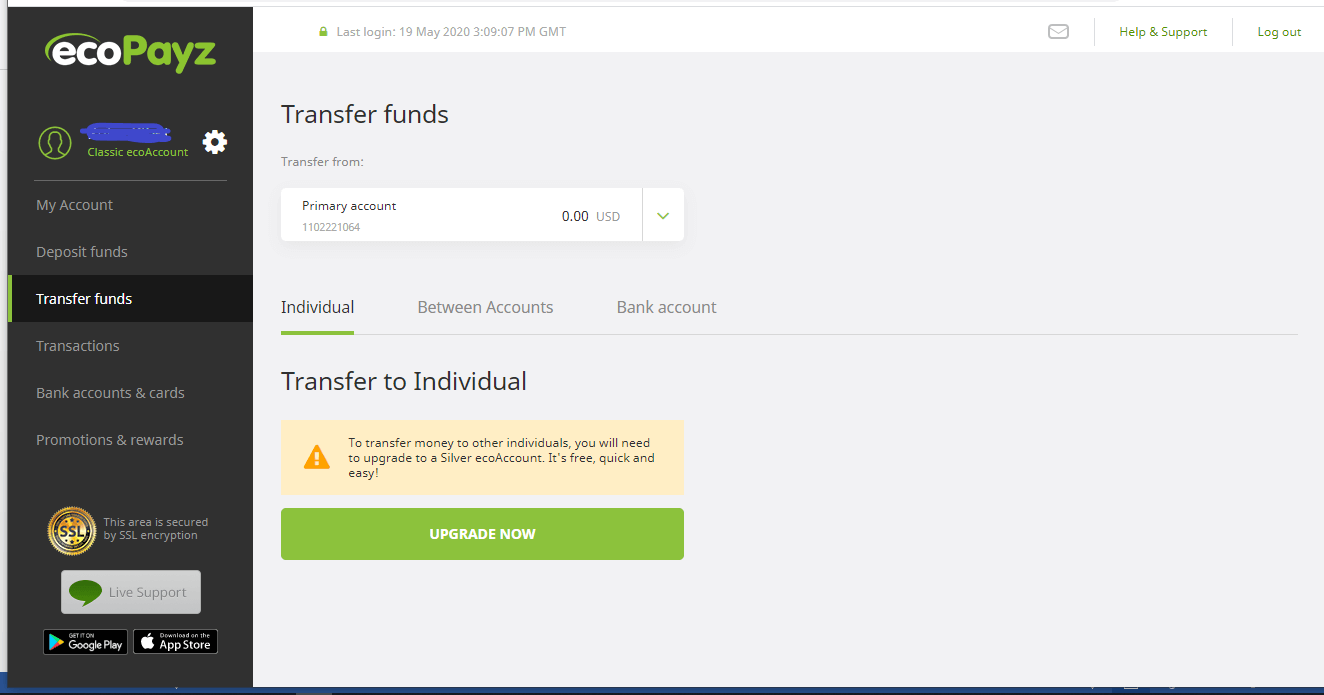

Like the deposit process, this process is also straight forward.

Navigate to ‘Transfer Funds’ on the left side of the site.

On the page that pops up, choose the bank account, and follow the prompts.

Note: You can also transfer it to an individual or another account. However, for these transfers, you need to upgrade to the Silver ecoAccount.

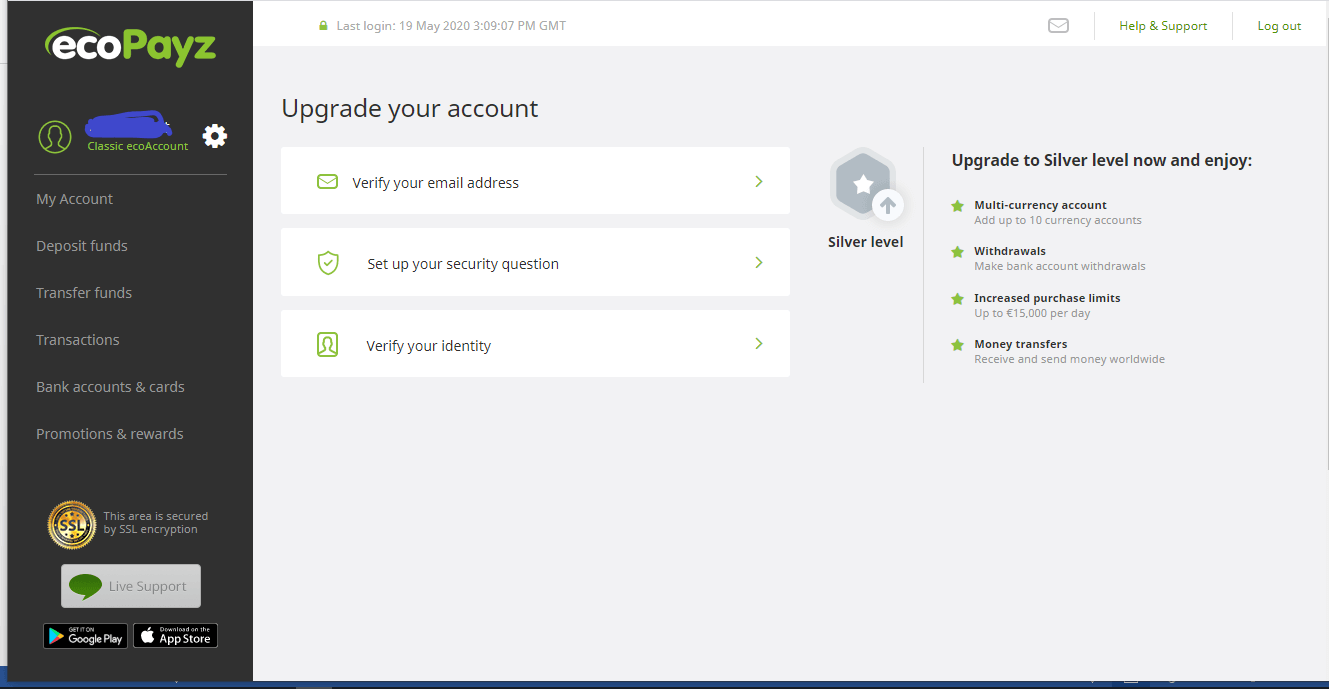

Note: You can also transfer it to an individual or another account. However, for these transfers, you need to upgrade to the Silver ecoAccount.To upgrade to the silver account means verifying your email address, setting up a security question, and verifying your identity. On the silver level, you will enjoy the perks below:

- Multiple currencies

- Withdrawals

- Increased transactional limits

- Send and receive money.

EcoPayz Fees and Expenses

EcoPayz offers five account levels, as mentioned earlier. Signing up to the different accounts is free. However, the difference comes in the services available and the fees charged. Generally, the higher the account levels, the lower the fees.

The classic ecoAccount is the lowest level account, and it doesn’t allow withdrawal to your bank account, transfer of funds to an individual, or another ecoAccount. To enjoy these services, you need to upgrade to a silver account, as explained in the previous section.

As for the fees, the deposits into your online casino are charged between 0 and 7%. On the other hand, credit card deposits are charged between 1.69 and 2.90%. Withdrawal to a bank account attracts a charge of between $6.44 and $10.91. Withdrawals from an online casino to ecoPayz are free.

How Does EcoPayz Compare to PayPal?

The main difference between the two platforms is the fact that ecoPayz is a prepaid platform. You can only send what is available in your account. With PayPal, once you link to your bank account, you can pay through it, but funds are deducted from the linked bank account or credit card.

Conclusion

So far, ecoPayz is just as good as Neteller and Skrill. Although the number of online casinos that support ecoPayz isn’t as large as the one that accepts Neteller and Skrill, the number is increasing. As for fees, they are acceptable and the customer support is one of the best.

Our Recommended EcoPayz India Casino

Our Rating

- Great Welcome Offer: 100% Match Bonus of Up To INR 10,000

- 100 Free Spins for The Kin Slot For New Customers

- Best Odds On Cricket in India

- Supports Visa, Skrill, Neteller, Bitcoin, MasterCard, and ecoPayz

Our Recommended EcoPayz India Forex

Our Rating

- Highly Adaptive Trading Platform And a Friendly User Interface

- Fastest Trade Execution Speeds, Eliminating Requotes And Slippage

- Highly Attractive Leverages of 1:888

- Has a Full-Service Education On Forex for Beginners

FAQs

How long does a deposit take to reflect on my online casino account?

Like with other online payments, and ecoPayz transaction is instant. This allows you to place bets or start playing slots and live casinos immediately.

What currencies can I transact in?

EcoPayz supports several currencies, including USD, GBP, EUR, and CAD.

Is ecoPayz a safe payment method?

Yes, it is. EcoPayz employs high security and safety standards for withdrawals and deposits. Moreover, your details are encrypted to protect your privacy.

Is there a maximum amount I can deposit through ecoPayz?

The maximum deposit through ecoPayz depends on the service you use. If you have an ecoAccount (the example we used in this guide), an ecoVirtualcard, or an ecoCard, the limits are different. Moreover, the account tier also matters. For instance, those with ecoCards can deposit up to $1000 into silver accounts and $2500 into VIP, Platinum, and Gold accounts.

Can I use ecoPayz in the Mobile Casinos?

Yes, you can. In 2014, ecoPayz launched an app for Android and iOS devices, making transfers through mobile gadgets a breeze.

How do I transfer money to Skrill?

Unfortunately, Skrill and ecoPayz don’t have such a partnership. If you need to transfer money to Skrill, you’ll first have to transfer it to your bank account and then fund Skrill.

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

Latest News

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up