PayPal Malaysia – How to Open an Account and Deposit Guide

PayPal is one of the most recognizable online payment options that has been around in recent years. It has been at the forefront of the e-wallet scene since launching in 1998, with countless people using it every day to conduct online transactions.

Its ease of use, great reputation and security features all make for a great all-round offering. This guide will walk you through the process of using PayPal to fund an online forex broker account for those people who are in Malaysia.

-

-

Why use PayPal?

There are many different benefits associated with using PayPal. It was one of the very first e-wallets to come to popularity as online payments started taking off at the turn of the 21st century. It is now a go-to option for millions of people across the world, relying on it on a daily basis. People in Malaysia have been using it for many years to fund their online forex broker account for this reason.

Ease of use

One of the best aspects of using PayPal as a payment provider is how easy it is to use. The account opening process is very easy and adding and withdrawing funds couldn’t be simpler.

To receive funds, you only need to give someone your corresponding email address. The process of making a PayPal payment on an online forex broker is as simple as entering your PayPal email address and the corresponding password. The platform itself couldn’t be easier to use.

Strong security

PayPal has built up a great reputation over the years as it is a safe and secure platform. You do not have to share sensitive financial or personal data with an online forex broker when you are using PayPal as a deposit method.

All you need to do is use the secure portal to enter your username and password. This decreases the risk of your financial data getting into the wrong hands. When receiving money, all you need to do is prove your email address, which is also ideal for security reasons.

Fast and accessible

Sending and receiving payments via PayPal is extremely fast. These funds will be processed almost instantly, making it very quick and easy to add or withdraw funds from an online forex broker. This compares to much slower times for other payment methods. There is also a great PayPal app for mobile devices that allows you to quickly manage payments on the go, no matter where you may be.

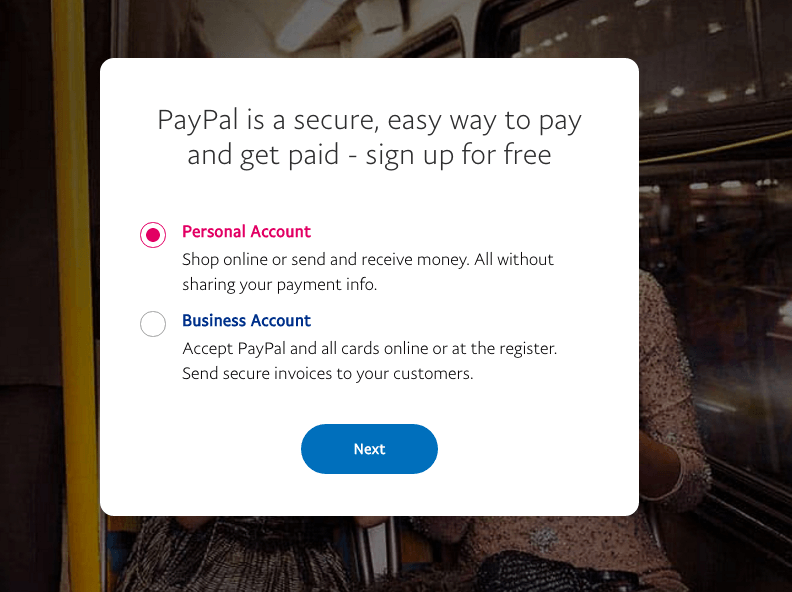

Step 1: Open a PayPal Malaysia Account

If you are ready to get started with a PayPal account, you will need to go to the website and select the ‘Sign Up’ option. For funding an online forex broker account, you will want to choose the ‘Personal Account’ option.

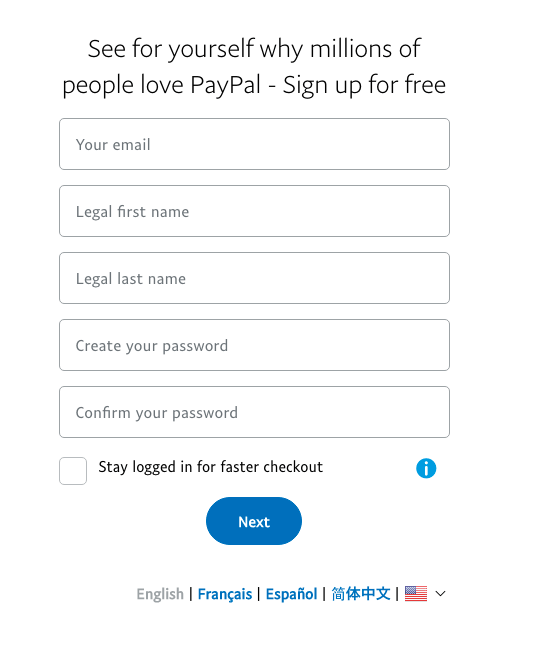

You then need to enter your email address, full name and create a password. The next step will ask for your full address, date of birth and nationality. You will then be asked to confirm your phone number through a PIN code that will be sent to you via SMS. You also need to verify your email address by clicking the link that has been sent to you.

Step 2: Fund Your PayPal Account

To get started with using PayPal to make online payments, you will need to add funds to your account. Before doing so, you will have to link a checking account. There will be a test transaction that will see a very small sum (a few pennies) transferred by PayPal to your linked account.

You can verify your account or debit card by confirming the exact amount that was deposited. This process can take a day or two to be completed as you will have to wait for the transferred funds to reach your checking account. These days, most banks will thankfully process PayPal payments almost instantly.

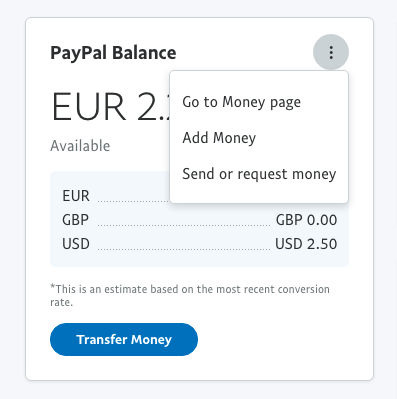

Once this has been completed, you can select the ‘Add Money’ option to fund your PayPal account. You can do so directly via a bank transfer or by using a debit card. Simply enter the relevant details like you would for any other online payment using this method and how much you wish to deposit. These funds should hit your PayPal account almost instantly.

Step 3: Select Your PayPal Forex Broker

Once you have funded your PayPal account, you will be ready to choose an online forex broker. There can be many different areas that you will want to look at when conducting an assessment of the various offerings. We have handpicked the best options for you that accept PayPal for traders in Malaysia:

Best Forex Broker in Malaysia using PayPal

1. Forex.com - Very Low Trading Fees

Forex.com first entered the online forex broker space in 2001 and it has grown into one of the market leaders. Its parent company is listed on the New York Stock Exchange and Forex.com is regulated by numerous leading authorities across the world.

There is a diverse selection of products to choose from, withs CFDs, precious metals, indices, shares, commodities and cryptocurrencies all being available for you to trade.

It has one of the better selections of currency pairs in the space today, with more than 80 variations on offer. All of the pricing for these products is very clear and competitive, with the forex fees being particularly low. You have different trading platforms depending on if you are using a desktop or mobile device, with the platform design being very user friendly.

The research and analysis features are also very good, being ideal for more experienced traders in particular. Customer support is available 24 hours per day from Monday to Friday, with all issues being quickly resolved. Overall, Forex.com is a great fit for all types of traders.

- Large selection of tradable instruments

- Great range of currency pairs

- Very good trading fees

- No 24/7 customer support

2. Plus500 - Ideal for Beginner Traders

Plus500 is a company that is listed on the London Stock Exchange and is open to traders in Malaysia. It is well-respected, having licenses all across the world with leading regulatory bodies.

There are about 70 different currency pairs for you to trade, with a selection of stocks, indices, ETF and commodity CFDs for you to trade. Finally, there are also 14 different cryptocurrencies that you can trade. For CFD trading the fees are generally nice and low, with the forex fees being about average for the sector.

There is a proprietary trading platform you can use which is useful for beginners as it is very simple and straightforward to use. Advanced traders may not enjoy the limited customization options that are on offer.

You can use this platform in many different languages. While the charting capabilities are good, fundamental news flow is not great. Finally, there is 24/7 customer support, but there is no option to ring the team by phone.

Overall, Plus500 is a great fit for more casual or beginner traders.

- Decent selection of tradable instruments

- Competitive trading fees

- Easy to use trading platform

- Customer support available 24/7

- Not much customization options for advanced traders

Step 4: Fund your Forex Broker Account

Once you have chosen your online forex broker, you will be ready to send funds from your PayPal account to these respective accounts.

you can top up your PayPal with a credit card or bank transfer to make the transaction. The funds should appear within 2 – 5 business days.

Step 5: How to Withdraw Your Funds

If you have made some profitable trades, you may then want to withdraw these funds from your respective account to PayPal.

Some providers charge small withdrawal fees. The withdrawal process should be swift and easy.

Step 6: How to Withdraw From PayPal to Your Bank

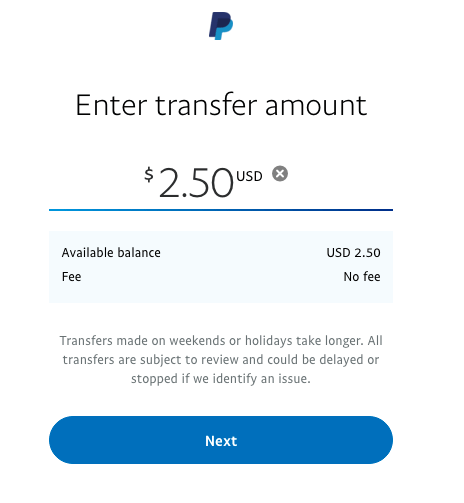

If you want to withdraw funds from your PayPal account to your bank, this is a very easy step. You simply need to select the ‘Transfer Money’ option. You will then see what bank accounts you have linked to PayPal.

You select your preferred destination for these funds, enter how much of a given currency you want to withdraw and then confirm the transaction. It’s as easy as that. While processing times are different depending on your bank, usually these funds will process within a few hours.

PayPal Fees & Other Expenses

Naturally, there are going to be some fees that you need to consider when you are using PayPal as a way to conduct online payments. When you are sending funds to an online forex broker, you will not be charged a fee by PayPal for doing so.

When it comes time to withdraw funds to your PayPal account, you will normally have to pay a fee of 5% of the transaction amount, with the minimum fee having a cap on it of just a few dollars. Therefore, it is a pretty cost-efficient way of conducting transactions that are easy to do, secure and ultra-fast to process.

Conclusion

As you have seen, there are many great advantages associated with using PayPal to add and withdraw funds from your online forex broker account. You can conduct these transactions on both desktop and mobile devices in a safe and secure manner.

It is one of the quickest ways to conduct these transactions also, you will not have to wait numerous days for the withdrawn funds to hit your PayPal account in Malaysia. You can’t go wrong with using PayPal as a payment method.

FAQs

How fast is a PayPal withdrawal from an online forex broker?

Sometimes the forex broker may take up to 24 hours to approve your withdrawal request. However, once this has been done, your funds should hit your PayPal account within a few hours.

How long does it take a PayPal withdrawal to your bank account?

This will vary depending on the bank, but for most major institutions this will only take a few hours before the funds show up in your account.

Do most forex brokers accept PayPal as a payment method?

These days, a lot of online forex brokers in Malaysia do not accept PayPal as a payment method but this may change in the future.

How long does it take to verify a PayPal account?

PayPal will deposit a small sum to your linked bank account, with this step sometimes taking a few hours and other times taking a day or two depending on your bank. Once you confirm this transaction through your PayPal account, you should be good to go.

Andrew O'Malley

Andrew O'Malley

Andrew has been writing about the gambling industry for more than five years, covering everything from sports betting to casinos and poker. With the sector constantly evolving, he loves nothing better than staying up to date with the latest movers and shakers in the space.View all posts by Andrew O'MalleyLatest News

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up