Best No Deposit Bonus Forex Offers: Top Bonus Revealed

A forex no deposit bonus is a promotion in which forex brokers provide new traders with tradable funds, free of charge! This means that if you use the welcome bonus and you’re able to make a profit, the money is yours and you may even be able to withdraw it from your account provided you meet the terms and conditions. Sounds good, right? However, with many offers out there, finding the best no deposit bonus forex broker for you isn’t always easy.

In this article, we review the best Malaysian no deposit bonus forex offers, explore how these forex bonuses work, and show you how you can get started with a forex no deposit bonus today.

-

-

How to Trade with a No Deposit Forex Bonus in 3 Quick Steps:

Want to get started with forex trading in Malaysia right away? Just follow these three simple steps to get trading at the best no deposit bonus forex broker:

Best No Deposit Bonus Forex Offers in Malaysia

There are many forex brokers active in Malaysia, and many of them also offer bonuses. However, not every broker with a no deposit bonus is regulated and trustworthy. The providers in the list below are all trusted, secure brokers with excellent features and bonuses. While not all of them offer a no deposit bonus, they’re still excellent platforms with great deals that you should consider.

1. FBS Markets - Offers MYR 400 No Deposit Bonus

FBS Markets is a leading forex broker that offers its services to Malaysian forex traders. It provides a MYR 400 ($100) no deposit bonus to allow you to start making live trades without depositing any of your own money. You can use the bonus to trade and earn real profits, though you’ll need to trade for 30 days and trade 5 standard lots to withdraw profits of up to MYR 400. To get the bonus, you only need to register for an account and provide your basic personal information.

This broker doesn’t offer the most extensive range of forex trading pairs, with less than 30 available, so it may not suit traders looking for a good range of exotics. However, if you’re only interested in majors and a few minors, this shouldn’t be an issue.

FBS offers six different account types, each with special requirements and benefits to address various trading needs. It supports numerous payment methods such as credit/debit cards, Neteller, Skrill, SticPay, Perfect money and Bitwallet. Note that the platform charges a withdrawal fee, which varies based on the transfer method you are using.

One of the highlights of FBS trading platform is its copy trading feature, which allows you to automatically replicate the trades and strategies of professional traders. There is a list of pro traders displayed alongside their profiles, success rate, commissions charged and the number of copiers. You can commit all of your portfolio or just a portion to copying another trader’s forex moves. This broker also offers a good range of educational resources and analysis that you can use to learn the ropes and inform your trading.

- Trustworthy: Regulated by CySEC and IFSC

- Social Trading: Copy other traders

- Excellent Platform: Good variety of research tools

- Limited Forex Pairs: Less than 30

There is no guarantee you will make money with this provider.What Other Types of Forex Bonuses are Available?

Over the years, brokers have been using different types of incentives to attract new clients. A forex bonus is a common type of incentive offered in many ways. For example, some brokers provide the bonus without requiring any form of deposit, while others call for a deposit with certain conditions to reclaim the bonus.

Let’s take a closer look at some other popular types of forex bonuses.

No Deposit Bonus

No deposit bonuses are one of the most popular incentives for forex traders because of their no-strings-attached nature. They are attractive to beginner traders in particular since you can trial the platform and try out some trading, all without putting any money on the line. Many Malaysian forex brokers offer free money with the aim that the trader will continue using the services even after the bonus is exhausted. The best forex no deposit bonuses are similar to a forex demo account, just which actual tradable funds!

The downside to this type of bonus is that you generally cannot withdraw the funds without meeting some terms and conditions. For example, forex brokers will generally require you to place a number of trades with your bonus funds, and after that you may be allowed to withdraw any money earnt. So, always check the terms of a broker’s bonus and make sure there are no restrictions on withdrawing the profits.

Deposit Bonus

With a deposit bonus, you have to deposit your own money into your account to qualify for the bonus. However, that’s not always a bad thing, as deposit bonuses are intended to complement your ability to start forex trading. Be sure to read the fine print, though. Some brokers require certain conditions to claim the bonus money which can make it difficult fo new forex traders to redeem it. However, it’s worth noting that these types of bonuses generally have slightly more friendly terms than no deposit bonuses.

Welcome Bonus

A welcome bonus is exclusively available to newly registered clients. Typically, it is only available once per IP address, which means only one person in a household can claim the free money for forex trading. A welcome bonus can either be a no deposit forex bonus or a deposit bonus.

Reload Bonus

In contrast to a welcome bonus, a reload bonus is offered to existing clients who reload their accounts with additional deposits. Usually, a reload bonus is smaller than a welcome bonus and the redemption requirements are more stringent. In addition, some regulators have raised concerns with these bonuses because they encourage traders to deposit more money.

Turnover Bonus

A turnover bonus is tied to a trader’s activity and volume. Essentially, this type of forex bonus is designed to encourage you to trade more and is similar to loyalty schemes offered by other online services. Usually, a broker will require you to trade some number of lots per calendar month to get a specific amount of bonus money. Since you are required to deposit and trade to qualify, some turnover bonuses transferred to your account without any strings attached, though others may have terms to watch out for in regard to withdrawing funds.

Pending Bonus

A pending bonus is a type of bonus offered once you meet a particular milestone with your trading account. It might be related to your total deposits or forex trading volume, for example. Check out your broker’s terms and conditions to find out what milestones you have to meet and the time frame for meeting them to redeem the bonus.

Rebates

Most brokers make revenue by charging commissions or spreads on every forex trade you make. These are expenses that can eat away a significant portion of your profits from trading. That’s why some brokers offer rebates on these trading fees as long as you fulfill certain requirements, similar to ‘cashback’. Many rebates are fair and quite attractive. But, they encourage you to trade more, so make sure to not trade more than is called for by your strategy and budget.

What to Look for in a No Deposit Bonus Forex Trading Account

Since so many forex brokers and forex trading apps now offer no deposit bonuses, this should be just one of the factors you consider when choosing broker in Malaysia. Here, we’ll cover some of the other important things you need to consider when choosing the best no deposit bonus forex broker for you.

Bonus Terms

Some forex brokers specify terms to access a bonus that makes them virtually impossible to redeem unless you completely disregard basic risk management principles. So, when looking for a no deposit forex bonus, always choose a broker that offers realistic terms.

In fact, go for a forex broker with terms that allow you to trade in a relaxed way. Check how long it takes to achieve the bonus requirements. This is a critical factor to consider because some traders make poor trades only to achieve the trading volume needed to unlock a bonus. As a result, the losses incurred from poor trading strategy can actually exceed the size of the bonus itself.

Reliable and Trustworthy Forex Broker

Your broker will be the custodian of your money and will be responsible for fulfilling your trades at the current market price. So, it’s essential that you get a forex broker that you trust and that fills your orders reliably.

To determine whether a trading platform is worthy of your trust, look to see what regulators it falls under. Most Malaysian forex brokers are regulated by the Securities Commission of Malaysia (SCM). But, a lot of brokers are also under scrutiny from international regulators like the Financial Conduct Authority (FCA) in the UK and the Cypress Securities and Exchange Commission (CySEC). We recommend only trading with licensed and regulated forex brokers, like the ones on our list, so you can be sure your account is secure and your funds protected.

Currency Pairs

Different brokers offer different amounts of forex pairs, so you should check your preferred trading options are available before signing up. Of course, virtually all platforms support all major pairs, but when it comes to minors, and especially exotics, there’s a lot more variation.

Some forex brokers offer less than 50 forex pairs, while others offer upwards of 80. If you want to diversify your trading with minors and exotics, you may want to go with a broker that offers a larger selection of trading opportunities.

Brokerage Fees and Costs

Brokerage fees and trading costs can significantly impact your profitability in the long run, especially if your strategy involves frequent trading. While a low-cost forex broker may save you money, a more expensive forex broker is likely to offer you better customer service and other helpful services such as educational materials and market analysis tools, so you need to find the right balance.

Most forex brokers do not charge commissions per trade. Instead, they derive their revenues by charging wider spreads. The tighter the spread, the cheaper it is for you to open and close a position. In most cases, the spread will depend on the liquidity and volatility of a currency pair. Usually, active currency pairs such as EUR/USD have tighter spreads, while exotic and less active currency pairs have wider spreads.

Spreads can either be floating or fixed. A floating spread means that the spread varies according to the market conditions while the buy and sell rate in a fixed spread differ by the number of pips. In most cases, floating spreads are tighter, except when the market is volatile. While some brokers offer their clients a choice, others stick to quoting markets with either fixed or floating spreads. Also, some brokers provide tiered accounts, with spreads narrowing with larger deposits and trading volumes.

Apart from spreads and commissions per trade, other costs incurred in trading include fees for deposits, withdrawals, wire transfers, credit/debit cards and inactivity. Therefore, it is important to read the fine print of the agreement to find out about these charges.

Educational Resources

One of the most crucial factors to consider when choosing a forex broker is the education materials it can provide you, especially if you are a beginner trader. Most reputable forex brokers offer an extensive selection of educational resources such as seminars, e-courses, webinars, articles and videos without charging you extra fees. These materials can cover topics like day trading, forex trading signals, algorithmic trading, and more.

However, the quality of the materials depends on the broker you select. So, you must choose a broker that offers high-quality educational materials. Some Malaysian forex brokers offer access to premium educational services to its clients who have top-tier accounts. The premium services cover fundamental and technical analysis as well as advanced trading strategies and insights. In fact, other forex brokers even assign a dedicated specialist to provide their top clients with face-to-face training to help them in their trading activities.

Trading Platform

A trading platform is your portal to the market. So, it would be best if you choose a forex broker that offers a user-friendly and intuitive trading platform filled with features and enough power to meet your trading needs. Most forex brokers provide demo accounts that you can use to familiarize yourself with the live trading accounts before signing up.

The MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms are the top forex trading platforms because they are highly programmable and customizable. In addition, they offer a rich selection of backtesting and charting tools. They also have a low latency that facilitates fast order execution.

Some forex brokers offer proprietary web-based trading platforms that will allow you to trade through the browser only, eliminating the need to download software. This can be ideal for traders who trade using their personal PC. On the downside, most proprietary platforms tend to have fewer features and have only basic trading and charting functions.

Additionally, the use of social trading platforms is increasingly becoming popular. These will allow you to replicate the trading activities of professional traders and even discuss and learn trading strategies with your peers.

Lastly, almost all reputable forex brokers offer mobile forex trading apps that will allow you to trade on the go. Most of these apps are available for free on both Android and iOS devices and have the same features as the web-based platforms.

Payment methods

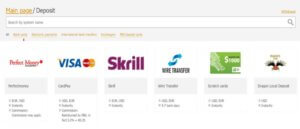

Does your forex broker let you deposit with your preferred payment method? Are the withdrawal times quicker than average? And are there any fees for depositing and withdrawing from your account.

These are all things to consider to help choose the best no deposit forex bonus account for you. While most brokers accept debit card, credit card and bank transfer, other payment methods like PayPal are less widely accepted.

Customer Service

Regardless of your trading experience level, it is always important to choose a forex broker that can offer you reliable customer support. This ensures that you can quickly and effectively solve a problem when it arises.

If you are a new trader, good customer support should help you with opening your account, navigating the trading platform and processing deposits or withdrawals.

When possible, you should choose a broker with customer support that has round the clock availability. Some of the common ways to contact a forex broker’s support team are through live chat, phone support, email and social media.

Interested in other types of trading? Read our guides on Bitcoin trading, CFD trading and how to buy stocks in Malaysia.Open a No Deposit Bonus Forex Account

To help you get started with opening a forex no deposit bonus account, we’ll walk you through the process with FBS. We like FBS because it offers a MYR 400 no deposit bonus and a wide range of forex pairs at spreads that are generally lower than market average. Plus, you can fund easily your account using e-wallets like Neteller and PayPal.

If you want to open an account with another forex broker, the process for opening an account and placing your first trade should be similar.

Create an Account and Verify Your Identity

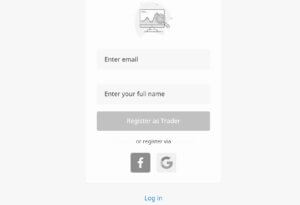

To create an account with FBS, click on ‘Open Account’ and enter your name and email. Then enter your address, and other personal information. If you use Google or Facebook, you can also sign up for a new account through those services.

To complete the registration process, you’ll need to verify your identity and address. You can upload a copy of either your driver’s license or passport as well as a copy of a bank or credit card statement or utility bill.

Deposit Funds

You don’t have to deposit funds before you can start trading on FBS. That’s the beauty of a no deposit forex account.

But if you do want to add funds to your account, you can do so through multiple methods. These include credit or debit card, bank transfer, Skrill, Neteller, PayPal or wire transfer.

Trade Forex

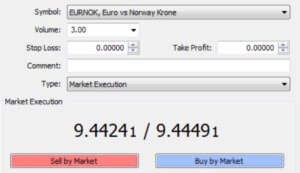

To open your first forex trade, open MetaTrader 4 through FBS and click ‘New Order’. Choose which currency pair you want to trade from the drop-down menu. In the order form, you can specify how much money you want to trade and whether to apply leverage to your trade. You can also set a stop loss or take profit level if desired. When you’re ready to open your position, click ‘Buy by Market’.

Pros and Cons of No Deposit Bonus Forex Brokers

Pros

- Trade for free – A no deposit bonus enables you to make real trades and potential profits on the live market without making any initial deposit.

- Compare brokers – If you are struggling to choose between two brokers, you can take advantage of the no deposit bonus to gauge which offer better services.

- Try other currency pairs – If you are used to trading with a certain currency pair like USD/MYR, you can use the no deposit bonus to try new currency pairs like EUR/USD.

- Hone your trading skills – No deposit bonuses allow you to practice your first trades and correct early mistakes before risking your money.

- Build a decent amount of capital – If you play the long game and trade wisely, you can potentially use the no deposit bonus to build a decent amount of capital.

- Build confidence – A no deposit bonus will allow you to make mistakes while learning how to trade. This will help sharpen your trading skills and build your confidence.

Cons

- Often not available for withdrawal - Usually, it is not possible to withdraw the bonus itself, and some brokers have put withdrawal restrictions on profits made from the bonuses.

- Small bonuses - In some cases, the no deposit bonus can be as small as MYR 200 ($10).

[/one_half_last]

Conclusion

No deposit bonuses offer an opportunity for new Malaysian forex traders to get started on the forex market without putting their own money on the like and a great way to try out different brokers while still enjoying a real-money trading experience. When choosing a Malaysian forex broker that offers no deposit bonus, make sure that it has reasonable requirements and that it allows you to easily withdraw the profits you earned by trading the no deposit bonus.

If you're looking for 2020's best no deposit bonus for forex in Malaysia, we suggest signing up for FBS. Simply click the links below to sign up and get started today.

FBS: Best No Deposit Bonus Forex in Malaysia

Our Rating

- MYR 400 no deposit forex bonus

- Six account types

- Analytics & educational resources

- CySEC regulated

There is no guarantee you will make money with this provider.Resources

To ensure we bring you the most reliable and accurate information possible, our writers use primary sources to support their content. These include studies, government resources and commentary from industry experts.

- Bank Negara Malaysia. "Framework for Electronic Trading Platforms." https://www.bnm.gov.my/index.php?ch=57&pg=150&ac=859&bb=file. Accessed June 8, 2020.

- Financial Times. "Malaysian Central Bank Liberalises Foreign Exchange Policy." https://www.ft.com/content/f4a585e2-a1d5-11e8-85da-eeb7a9ce36e4. Accessed June 8, 2020.

FAQs

Does the no deposit bonus mean free money?

Yes. The deposit bonus account offers you free money to start trading on the live markets risk-free. Note that it is not free money that you can withdraw as soon as you create an account. Depending on the bonus promotion’s conditions, you are supposed to trade with the money and then may be able to withdraw the profits.

Why do brokers offer free bonuses?

Due to the popularity of forex trading, the number of forex brokers today has increased tremendously. Each of them is competing to attract new clients and investors. Many brokers are offering free bonuses to gain a promotional edge and to introduce new traders to the world of forex trading.

Who is qualified for the no deposit bonus?

Most brokers offer a free bonus only to new clients. After registering and meeting the requirements, new traders are offered a welcome bonus. You can use the bonus to trade on the live markets and even withdraw the profits you make. However, when it comes to the subsequent deposit bonus, you will have to deposit some funds in your account to withdraw your profits.

Can I get a free bonus without going through the verification process?

In most cases, brokers require you to upload proof of identity and address to validate your account. However, there are some brokers that give no deposit bonus without requiring identity verification.

What is the benefit of using a no deposit forex bonus?

It is advisable to start forex trading using a no deposit forex bonus. The forex market is very complicated, and you will require a certain level of experience to start making profits. If you are a beginner, the no deposit bonus is a good way to trade risk-free and gain insights about the forex market.

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

Latest News

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Some forex brokers specify terms to access a bonus that makes them virtually impossible to redeem unless you completely disregard basic risk management principles. So, when looking for a no deposit forex bonus, always choose a broker that offers realistic terms.

Some forex brokers specify terms to access a bonus that makes them virtually impossible to redeem unless you completely disregard basic risk management principles. So, when looking for a no deposit forex bonus, always choose a broker that offers realistic terms. Different brokers offer different amounts of forex pairs, so you should check your preferred trading options are available before signing up. Of course, virtually all platforms support all major pairs, but when it comes to minors, and especially exotics, there’s a lot more variation.

Different brokers offer different amounts of forex pairs, so you should check your preferred trading options are available before signing up. Of course, virtually all platforms support all major pairs, but when it comes to minors, and especially exotics, there’s a lot more variation.