Best New Zealand Forex Brokers for 2025

With forex trading, you can speculate on the future price of a currency and use leverage to make larger trades than your budget would otherwise permit. This is an exciting market with high liquidity and dozens of currency pairings, and the global nature of today’s markets means that currency exchanges are extremely busy. This, in turn, creates plenty of opportunities for traders, but how do you know which New Zealand forex brokers are right for you?

In this guide, we’ll highlight three of the best New Zealand forex brokers for 2025 to help you narrow the field. We’ll also explain everything you need to know in order to choose the forex broker that’s best for your trading style and goals.

Forex brokers are firms or companies that provide a platform through which currency traders can access the international forex exchange markets. They may be independent retail forex brokers advancing their services to smallholder currency traders or large investment banks that offer the service to institutional investors like hedge funds or smaller commercial banks. By providing the trading platform, a forex broker makes it possible for the currency trader to open and close currency trades. Most are online-based and integrate all the important resources needed to help the trader make informed trade decisions within this trading platform. These include trade/market analysis, technical indicators, real update on market data, financial news (Economic calendar), leverage, and adequate risk management tools. A forex broker earns in either of these two ways – or both. First is the bid-ask spread of every currency pair traded on their platform. There is no standard spread for New Zealand forex brokers, and it varies from one platform to another. Secondly, forex brokers may impose a fixed or variable commission (fee) for every trade executed on their platform. When vetting different forex brokers, you have to take into account a host of security, operational, and regulatory measures. The bare minimum qualifications for a good forex broker include: Regulation: A good broker is adequately licensed by different regulatory authorities and adheres to all the security measures stipulated by the operating license. These include encrypting user data and maintaining segregated bank accounts for client funds. Advanced trading platform: A good forex broker should also work consistently towards improving their trading platform. They should include updated trading, market analysis, and risk management tools while maintaining the fastest order execution speeds and supporting a reasonable number of currency pairs. Considerate pricing model: The good forex broker must also be considerate with their fees. In the recent past, most brokers have abolished trade commissions and lowered their bid-ask spreads. Readily accessible: Registering a trading account with a good forex broker should also be easy and straightforward. They should also make it possible to access the account on multiple devices like web trader, desktop and mobile apps on both proprietary and conventional trading platforms like MT4/5. Pros: Cons: With all that in mind, let’s take a closer look at our picks for the top three New Zealand forex brokers.

If you’re interested in trading forex options rather than CFDs, AvaTrade is the best broker for the job in New Zealand. This broker offers options trading for all major and minor currency pairs, as well as CFD trading on a total of 55 currency pairs. Even better, AvaTrade understands that aggressive traders need leverage to make the most out of their forex trades. The broker offers 400:1 margins for trading major pair CFDs and 100:1 for major pair options. We also love that AvaTrade gives you the tools you need to make these big trades pay off. The broker has its own easy to use charting software that includes a variety of common technical studies. It also comes with access to MetaTrader 4, an advanced trade research platform that lets you develop and test custom trading strategies. Both AvaTrade’s charts and MetaTrader 4 are available as mobile apps, enabling you to conduct research and place trades on the go. The only downside to AvaTrade is that you pay for the privilege of trading forex options. The platform charges spreads of around 0.25% for some major currency pairs, which is significantly more costly than some other forex brokers in New Zealand. But, considering all the tools and trading options that AvaTrade comes with, we think these high spreads are fully justified. Our Rating

FinmaxFX accounts trade on the highly advanced MetaTrader 5 platform, providing access to a range of advanced trading tools, and you can choose either the desktop or mobile platform. Here, forex traders don’t just get access to close to 58 currency pairs but are also free to apply leverages of up to 1:200. However, with spreads starting from 3 pips, FinmaxFX is one of the more expensive forex brokers in New Zealand. Registering a forex trading account with FinmaxFX is relatively easy and only requires a minimum initial deposit of $100. You get to interact with some of the most advanced indicators, 250+ trade and market analysis tools, weekly educational webinars, and premium risk management measures and negative balance protection. Our Rating

FXCM, also known as Forex Capital Market, was established in 1999 and is one of the pioneers in the Forex CFD trading niche. It has a solid reputation for its transparent fees, fast order execution speeds, and competitive trading fees. The broker is highly regulated by several tier-one financial authorities like FCA in the UK, ASIC in Australia, America’s CFTC, and CySEC in Cyprus. Registering and verifying a forex trading account with the broker is easy. And the account is accessible via two of the most sophisticated trading platforms; FXCM’s proprietary trading platform – TradeStation – and the all popular MT4. The broker platforms feature hundreds of advanced trading and market analysis tools, give you real access to the forex market data, updated economic calendar, critical market news, and a demo account to practice and perfect your strategy. FXCM does not charge trade commissions or deposit or withdrawal processing fees. Our Rating

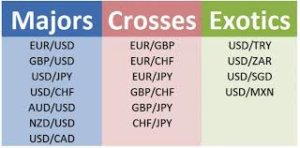

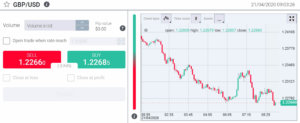

If you’re just starting out with forex trading, Investous can help. This broker has a more limited selection of currency pairs than some of its competitors. But, in a way, that helps steer new forex traders towards more liquid major and minor pairs and away from risky exotics. Investous also focuses on CFD trading rather than options trading, which makes getting started significantly easier. Investous offers low, yet reasonable leverage levels. For major currency pairs, you can trade on margins of 50:1. In addition, we like that this broker includes built-in technical charts with essential drawing tools and technical studies. They’re not the most comprehensive charts for advanced traders, but they are approachable for newer traders. Perhaps the best thing about Investous is that the spreads are extraordinarily low. For major currency pairs, you’ll pay around 0.025% per trade. That can end up saving you a lot of money as you get deeper into forex trading. Just watch out for inactivity fees at Investous, which are charged if you don’t place a trade for a period of three months or more. Our Rating Before we dive into reviews of our top NZ forex brokers, it’s important to understand a little bit about how forex trading works. But when you buy a currency, you purchase it in a pair. For example, you may purchase the US Dollar-Great British Pound pair. In that case, you could profit in two cases; if the dollar rises in value, or if the pound falls in value. All prices in currency trading are relative. There are hundreds of currency pairs that you could trade, but in fact, just seven pairings make up the vast majority of forex trading. The major pairs, as they are known, pit the US Dollar against the world’s other widely used currencies. Major pairs include the USD-GBP, USD-Japanese Yen, and USD-Euro. The minor pairs make up most of the remaining forex trading volume each day. These pair the alternative currencies in the major pairs, as well as pair the US Dollar with the world’s less widely used currencies. There are between 20 and 40 minor currency pairs, depending on what trader you ask. Finally, there are the exotics. These currency pairs measure the value of one less commonly traded currency against another. For example, a South African Rand-Mexican Peso pairing is considered an exotic. These forex pairs typically have much lower liquidity than either major or minor pairs. The other key thing to know about forex trading is that currency pairs are typically traded through derivatives. Traders rarely buy and sell currencies directly, since doing so requires costly currency conversions and can trigger some regulations like currency controls. The two different types of derivatives used for forex trading are contracts for differences (CFDs) and options. CFDs allow you to speculate on the relative price of a currency within a pair just as if you were buying the currency itself, but without owning the underlying assets. Options, on the other hand, require you to select an expiration date for your trade. That brings time in as a variable in the value of your investment. When trading options, you need to be right not only about the magnitude of a price movement but also when it will occur. The advantage of trading options is that you can hedge bets by trading options for the same currency pair over multiple timeframes. Both CFDs and options also enable you to trade with leverage. Leverage lets you multiply the effective size of your investment by effectively borrowing capital from your chosen New Zealand forex broker. For example, if you invest $100 with 100:1 leverage, it’s as if you invested $10,000 in a currency pair. Leverage is especially important for forex trading, since currencies rarely move more than 0.1% relative to each other in a single day. To make money with forex trading, you need a large effective investment size. Now that you know a bit more about how forex trading works and our three best forex brokers in New Zealand, let’s talk about how to choose the broker that’s right for you. The best place to start is by thinking about what currencies you want to trade and how you want to trade them. Most brokers offer major and minor currency pairs, but the number of pairs available varies. If you want to trade exotics, then you’ll need to look specifically for a forex broker that offers them. In addition, you’ll need to consider whether you want to trade CFDs or options. Some brokers, like AvaTrade, offer both, which gives you the most flexibility. However, you may end up paying more for trading at brokers with options that you don’t need. Another thing to consider is how much leverage a broker offers. As we discussed, leverage is critical to forex trading since currencies rarely move by more than 0.1% in a day. So, you need large positions in order to see a sizable return.vBrokers vary widely in how much leverage they offer. When thinking about leverage, you’ll also want to look at a broker’s overnight interest rate and its margin requirement. The overnight interest rate is the amount you’ll be charged each night for borrowing money to trade on leverage. This is especially important if you plan to hold leveraged CFD positions for weeks at a time rather than just a day or two. The margin requirement is how much money you need to have in your account relative to your leveraged position. The lower the margin requirement, the more you can use the money in your account for other trades. Trading fees are of course a key consideration when choosing a brokerage. None of the three top New Zealand forex brokers we recommended charge trade commissions, but many brokers do. Avoid these whenever possible, since commissions add up quickly and make it costly to scale in and out of positions. The spread is where many low-cost brokers make their money. Spreads can vary widely, from just 0.025% at Investous to more than 0.2% at AvaTrade. Also note that spreads vary between major and minor currency pairs, and are often significantly higher for low-liquidity exotics. Many brokers don’t charge other fees, but it’s important to check. You’ll find that some online brokers charge deposit or withdrawal fees. There are also inactivity fees that are assessed if you don’t place a trade at least once every few months. For many forex traders, a broker is more than just a trading station. It’s also a hub for currency research and education. Some brokers offer advanced charting tools and online academies for traders, while others leave these resources out entirely. It’s up to you to decide how much you want to rely on your broker for these resources. Having charts integrated with your trading account may be especially important for day traders, since you need to be able to place orders as quickly as possible. Beginners may prefer simpler charting interfaces and a heavier emphasis on educational articles and demo accounts. Forex is an exciting market with a lot of opportunities for traders, but getting the most out of your currency trading requires having the best broker for the job. You need to consider the tradable currency pairs, the trading format, fees and research tools, among several other factors. Whether you should trade forex CFDs or forex options comes down to your risk tolerance and trading goals. In general, options are riskier than CFDs because they have leverage baked in and because options can lose all of their value when a trade goes bad. However, you can also potentially make a lot of money very quickly with a successful options trade. Keep in mind that trading CFDs with leverage can be just as risky or profitable as trading options. Your choice of leverage for any trade will depend on your confidence in that trade, your risk tolerance, and your goals. Leverage is a double-edged sword. If a trade goes well, you multiply your profits. But if it goes poorly, you multiply your losses. Start out trading with small amounts of leverage—10:1 or less— and add leverage over time as needed. Yes, you can use a third-party charting software. In many cases, you can even link a third-party software to your brokerage account so that you can still place trades instantly. However, be sure to check whether your chosen software offers this option and whether it is compatible with your broker. In general, you should have at least several hundred dollars to trade forex. This ensures that you’ll be able to meet your broker’s minimum deposit, as well as any margin requirements associated with trading with leverage. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Copyright © 2022 | Learnbonds.com

What is a Forex Broker?

What Makes a Good Forex Broker?

What are the Pros and Cons of New Zealand Forex Brokers?

Best New Zealand Forex Brokers for 2025

1. AvaTrade - Best for Forex Options Trading

2. FinmaxFX – Best MT5 trading platform

3. FXCM – Best for No Banking Fees

4. Investous - Best for Beginner Forex Traders

How Does Forex Trading Work?

Currency Pairs

CFDs vs. Options

How to Choose the Best New Zealand Forex Broker

Currencies, CFDs, and Options

Leverage

Fees and Spreads

Research and Education

Conclusion

FAQs

Should I trade forex CFDs or options?

How much leverage should I use?

Can I use charting software outside my New Zealand forex brokerage account?

How much money do I need to trade forex in New Zealand?

Haydn Squibb

Haydn Squibb