Fineco Bank Review | Platform, Fees, Pros, and Cons

Looking for a place to open your first brokerage account or want to make the jump from your current broker? Fineco Bank is an Italian broker that serves as both a trading platform and a bank. You can use the platform to trade anything from stocks and shares to commodities and forex, you can also deposit and withdraw money using any Fineco Bank ATM. But is this broker right for you? Read our Fineco Bank review to find out.

This review delves into everything you need to know about Fineco Bank, including its tradable assets, fees and much more. We also take a look at how it stacks up against the competition to help you decide whether Fineco Bank is right for you.

-

-

What is Fineco Bank?

Fineco Bank is an Italian bank and brokerage founded in 1999. The broker was originally a subsidiary of Lombardy-based Banca Popolare di Brescia and became an arm of UniCredit in 2007. Fineco Bank offered its own stock IPO in 2014 and officially ended its subsidiary relationship with UniCredit in 2019.

Today, Fineco Bank has more than 1.3 million investment and banking customers and manages nearly $90 billion in assets. The trading platform has won numerous awards in Europe and the UK and since Fineco Bank is a commercial bank, it’s heavily regulated by Italian, UK, and European authorities to ensure that your accounts are truly safe.

Fineco Bank has grown in popularity throughout Europe because it offers a variety of trading options, many of them very affordable. The platform offers commission-free trading for all stock contracts for differences (CFDs) and at-market-average spreads for most forex pairs. Unlike some other online brokers, Fineco Bank also enables traders to buy and sell stocks, ETFs, and mutual funds directly, as well as to trade bonds and options.

Another neat thing about Fineco Bank is that it’s a bank as well as a trading platform. All account holders can request a Fineco Bank debit card, which you can use to deposit and withdraw money at any Fineco Bank or UniCredit ATM.

What are the Pros and Cons of Fineco Bank?

Pros:

- Multi-currency accounts for trading in any country

- No account fees or inactivity charges

- Commission-free trading for stock CFDs

- Access to Powerdesk trading software and mobile app

- Trading for bonds, stock options, and ETFs

- Highly regulated

Cons:

- Commissions on most assets

- Forex spreads are at or above market average

- Relatively low leverage compared to other online brokers

- Powerdesk requires a monthly fee for low-volume traders

- No commodity trading

What Can You Trade at Fineco Bank?

One of the biggest draws to Fineco Bank is the range of assets you can trade. While this trading platform is based in Italy, it offers access to markets around the world and in fact prioritises trading in the US and UK.

Shares, ETFs, Funds, and Indices

Fineco Bank offers more options than most other brokers when it comes to stock trading. To start, the brokerage covers several thousand international shares, with broad access to major exchanges in London, New York, Tokyo, Hong Kong, and elsewhere. In all, traders can buy shares on 26 global stock exchanges.

What’s interesting about Fineco Bank is that you can trade stock shares either directly or through CFDs. CFD trading is commission-free. As a result, traders can minimise their costs by buying most shares as CFDs and only purchasing shares that offer dividends directly.

The platform also offers traders access to thousands of ETFs traded in the US and UK. These can only be bought as shares, though, and they do come with some trade commissions. While the brokerage offers a series of mutual funds, the access isn’t nearly as broad. In any case, for most traders, ETFs are a better choice than mutual funds.

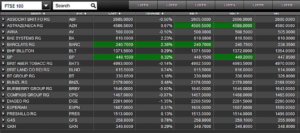

In addition, Fineco Bank gives traders access to CFDs for several major indices around the world, including the S&P 500, NASDAQ, and FTSE 100. Note that these CFDs, like stock CFDs, are commission-free but do come with added spreads. Importantly, the brokerage also enables options trading for these indices. Although the diversity of options offerings is limited, many online brokers don’t offer options trading at all.

Forex

Fineco Bank gives traders access to commission-free CFDs for more than 50 forex pairs, including all major and minor currency pairs. This is about the same diversity as you’ll find at other forex brokers and Fineco Bank charges similar spreads.

Bonds

Traders at Fineco Bank also get access to thousands of bonds. The brokerage offers trading on the Euronext, MOT, HI-MTF, and EuroTLX exchanges only, though, so you’re mostly limited to trading European bonds rather than UK or US bonds,

Commodities

Fineco Bank’s support for commodity trading is extremely limited. The platform only offers CFD trading for gold and light crude oil.

Unfortunately, Fineco Bank doesn’t offer cryptocurrencies. If you’re interested in cryptocurrency trading or want to buy Bitcoin, we recommend using an alternative broker such as eToro.Fees at Fineco Bank

Trading fees at Fineco Bank are somewhat complex, as they vary based on the type of asset you’re trading. Let’s take a closer look.

Trading Fees

The cheapest assets to trade with Fineco Bank are stock CFDs. These are traded commission-free and don’t have any added spread, so you just pay the spread charged by the exchange itself.

If you want to buy and sell shares directly, though, you’ll be subject to trade commissions. Fineco Bank charges £2.95 per trade on the London Stock Exchange, $3.95 per trade on US exchanges, and €3.95 per trade on European exchanges. The same commissions apply for buying and selling shares of ETFs. Bond trades are also charged a flat commission of £6.95 per trade.

For traders who want to buy and sell ETFs frequently, Fineco Bank also offers a dedicated plan option with a monthly fee. This plan lets you hold up to one ETF for £2.95 per month, up to four ETFs for £6.95 per month, and up to 10 ETFs for £13.95 per month. If you choose one of these ‘regular savings plans,’ as Fineco Bank calls them, you won’t be charged trading fees for ETFs as long as you remain within your plan limits.

Trade commissions on options are variable based on the value of contracts you’re trading. For trades up to $499, you’ll be charged $6.95 per lot. Options trades worth between $500 and $9,999 cost $3.95 in commissions, and trades worth more than $10,000 cost $2.50 per lot.

You’ll pay for forex trading and indices trading not through commissions, but rather by spreads added by Fineco Bank to every trade. The spread is the difference between what you can buy a currency or index for and what you can sell it for at the same time. Essentially, it’s a percentage fee applied to every trade.

Fineco Bank charges a spread of 0.8 pips (0.008%) for the popular EUR-USD currency pair and a spread of 1 pip (0.01%) for the GBP-USD and EUR-GBP forex pairs. These spreads are competitive with what other online brokers are charging, although they’re not the cheapest rates out there for high-volume forex traders. Spreads on some of the exotic forex pairs that Fineco Bank offers, such as the EUR-ZAR pair, can exceed 100 pips.

Platform Fees

While Fineco Bank does charge trade commissions for some popular assets, it’s notable that the platform doesn’t charge any platform fees. That means there are no deposit or withdrawal fees, and the debit card provided by the bank with your account is free, although if you need a second card, it will cost £9.95 per year. There are also no quarterly or inactivity fees at Fineco Bank, which many other online brokers charge.

The only platform fee you might need to worry about is for the Powerdesk charting and trading software. Fineco Bank makes this software optionally available for all account holders. It’s free if you place at least five trades per month or have at least €250,000 in holdings. However, if you fail to clear these bars during any month, you’ll be charged €19.95 per month.

Leverage and Margin Trading

Fineco Bank offers leveraged trading for most of the assets available through the platform. Notably, the maximum leverage that retail traders are allowed to have at Fineco Bank are well below what regulators in Europe allow. The margins are also higher, which can make it difficult for traders to establish large or diverse positions with a small initial account balance.

For example, stock and stock CFD trading are limited to leverage of just 5:1 with a 20% margin required in your account balance. By comparison, many other online brokers offer leverage of up to 1:30 with margin requirements of 5% or less. With $1,000 at Fineco Bank, you can create a stock CFD position that is at most $2,500. The same leverage and margin limitations apply to bond trading on the platform.

Leverage on other assets is closer to the limits imposed by the European Security and Markets Authority (ESMA). ESMA allows retail traders to use up to 1:30 leverage for forex trading, while Fineco Bank allows up to 28:1. The 1:20 maximum leverage allowed for gold and index futures is at the limit imposed by ESMA.

However, Fineco Bank still requires much larger margin balances than the regulator demands. Forex traders must keep 3.5% of their positions as cash in their accounts, while gold and index traders must keep 5%. These margin requirements can squeeze retail traders and make it more difficult for low-volume traders to make significant profits with Fineco Bank.

Even for professional traders, Fineco Bank remains well below the regulatory requirements. ESMA limits professional forex traders to 1:500 leverage, for example, while those traders can only create positions leverage at 1:100 using this brokerage.

Platform Features

Fineco Bank’s trading platform offers three main tools for traders: the Powerdesk charting software, a custom stock screener, and the Fineco Bank mobile trading app.

Powerdesk

Powerdesk is a proprietary charting and trading platform developed by Fineco Bank for its account holders. The platform is free to use as long as you place five trades per month or have an account balance of at least €250,000. Otherwise, access to Powerdesk costs €19.95 per month.

This trading software was built with experienced traders in mind and it emphasizes flexibility. You can develop up to eight custom watchlists that are automatically populated based on your own scans. The layout of your dashboard is fully changeable and you can create multiple presets for different styles of trading.

The charts themselves are very advanced, as well. You’ll find more than one hundred technical studies built into Powerdesk and experienced traders can modify any of the default parameters. Helpfully, Powerdesk also supports Heikin-Ashi candlestick charts and enables the Ichimoku indicator for identifying levels of support and resistance.

Of course, the Powerdesk interface is fully integrated with your Fineco Bank trading account. You can place orders directly from your charts, and Powerdesk’s interface gives you more flexibility in specifying your trades than you have when using the standard Fineco Bank order form. For example, Powerdesk’s ordering module lets traders specify stop-loss and take-profit levels, as well as to create trailing stops.

Stock Screener

Fineco Bank also gives all account holders access to an intuitive stock screener. It’s far from the most advanced screener we’ve seen in terms of the parameters available for filtering. But, the screener is user-friendly and is a nice tool for any traders who want to take advantage of the brokerage’s commission-free stock CFD trading.

The screener offers a handful of technical and fundamental parameters to choose from, but there are no options to create custom filters and the studies are much more limited than what you’ll find in Powerdesk. That said, you can screen by sector and country, which is helpful for searching for potential opportunities across all of the major exchanges on which Fineco Bank supports trading. You can also save screens, making this tool usable as a pre-market scanner or end-of-day scanner.

Mobile Apps

The Fineco Bank mobile apps for iOS and Android are a curious mix between a trading platform and banking app. Even if you only use Fineco Bank as your brokerage, not your primary bank, you’ll still be able to track any deposits and withdrawals made through your debit card over time. If you use Fineco Bank for banking, you’ll be able to see all your banking and credit card transactions in the same place as your trades.

The investment apps are, on the whole, easy to use and work well for basic trading. However, they’re designed more for monitoring your account than for serious trading on the go. You don’t have access to the Fineco Bank stock screener in mobile form, and there’s no news feed or other research pages available in the mobile app. All of this makes it a bit difficult to find trading opportunities that you weren’t already monitoring.

Payments at Fineco Bank

Fineco Bank makes opening and funding an account easier than a lot of other online brokers.

Keep in mind that because the platform is regulated by Italian and European agencies, you’ll need to upload proof of your identity and residency during the account opening process. This typically means submitting a copy of your passport or driver’s licence along with a bank or credit card statement as proof of address.

Once your account is open, Fineco Bank will send you a free Visa debit card. You can use this card at any Fineco Bank or UniCredit ATM to deposit money into your account easily as well as to withdraw funds from your balance. There are no fees on these deposits and withdrawals, which is a plus for this broker. Alternatively, if you use the Fineco Bank mobile app, you can withdraw money electronically at any time.

Another nice thing about Fineco Bank accounts is that they support multiple currencies. You can exchange currencies within your account at any time fee-free, just pay the spread for that specific currency pair.

All that said, Fineco Bank doesn’t work seamlessly with many online payment systems, such as e-wallets, which means that it won’t suit all traders. If you do want to use e-wallets, we suggest going for a broker such as eToro, which accepts PayPal, Neteller and Skrill.

Which Regulators Govern Fineco Bank?

As a commercial bank and not just a brokerage platform, Fineco Bank comes under scrutiny from a variety of regulatory perspectives. That’s generally a good thing for traders since it means your account is more thoroughly protected and the company behind the brokerage is restricted from making overly risky bets with any cash in your account.

Let’s take a closer look at some of the key regulators governing Fineco Bank:

Financial Conduct Authority (FCA)

The FCA is the UK’s primary financial watchdog agency and is highly respected in the financial community. Since Fineco Bank offers trading accounts to UK traders, it comes under the authority of the FCA. Importantly, this means that UK accounts with Fineco Bank are protected under the Financial Services Compensation Scheme, which provides retail traders up to £50,000 if Fineco Bank ever becomes insolvent and liquidates its brokerage accounts.Banca d’Italia

Banca d’Italia, or the Bank of Italy, is Italy’s central bank and a member of the European System of Central Banks. Fineco Bank comes under regulation from this authority because its primary business is commercial banking rather than serving as a trading broker. While the trading arm of Fineco Bank is not strongly regulated by Banca d’Italia, the central bank does have a stake in keeping the brokerage platform from self-dealing or engaging in other risky business that could threaten solvency during a crisis.European Security and Markets Authority (ESMA)

Paris-based ESMA is the primary consumer financial regulator for the European Union and plays a major role in regulating Fineco Bank’s brokerage rules. The agency places strict limitations on leveraged trading for retail accounts, although Fineco Bank is more stringent in its leverage requirements than ESMA demands in many cases.Customer Support at Fineco Bank

Fineco Bank offers customer support via phone from 8am to 9pm Central European Time, Monday to Friday. There’s a dedicated number for calling within the UK as well as an international number for all other account holders.

If you need help opening a new account, the bank also offers support via live chat on its website. There is also a 24/7 emergency phone number, which you can use to report a lost or stolen debit card.

For questions about Fineco Bank’s trading platform and tools, the company offers weekly video webinars that are archived on the site. However, documentation of Powerdesk is lacking, your only option for help with the charting software is to dig through the 142-page user manual.

Getting Started with Fineco Bank

Fineco Bank makes it easy to open a new account and doesn’t require any minimum balance. However, there are a few steps required during the setup process to verify your identity. Here, we’ll walk you through the steps needed to create a Fineco Bank trading account.

Step 1: Open an Account

To open a brokerage account with Fineco Bank, simply navigate to the brokerage website and click ‘Open an Account’. You’ll then be prompted to enter your personal information, including your name, address, birth date, and contact information. You’ll also be asked about why you are opening an account so that Fineco Bank can better tailor the platform to meet your needs.

Note that while Fineco Bank makes it simple to open an account online, you also have the option to create your new account by phone or in person at a Fineco Bank branch.

Step 2: Upload Verification Documents

The financial regulators that govern Fineco Bank require that you verify your identity when creating a new account. To do this, you’ll need to upload a proof of identity in the form of a passport, driver’s licence, or national ID card. Second, you’ll need to upload a tax document or another financial statement from within the past three months in order to verify your listed address.

Step 3: Fund Your Account

Fineco Bank doesn’t require any minimum deposit, so you don’t necessarily need to fund your account right away. That said, you will need to make a deposit before you can start trading.

The easiest way to do this is to transfer money electronically from another bank account to your Fineco Bank brokerage account. Alternatively, you can wait for the debit card to arrive at your home and then deposit money using any Fineco Bank or UniCredit ATM. Fineco Bank also accepts wire transfers.

Once your account is funded, you’re ready to start trading!

Fineco Bank vs eToro

Fineco Bank is a popular broker and certainly has a lot going for it, but when it comes to looking at how it stacks up against the competition, we think it lags a little behind the very best UK brokers.

For example, while Fineco Bank offers a decent range of assets, it only offers two commodities and no cryptocurrencies whatsoever. eToro, on the other hand, supports just about every asset you can think of, from shares and forex to commodities, crypto and more.

With regards to trading tools, Fineco Bank’s Powerdesk is impressive, but it comes with a fee unless you meet certain requirements. At eToro, all users have access to the broker’s innovative social and copy trading features at no extra cost. eToro’s social features all you to interact with other users, while its copy trading tools allow you to copy the entire portfolios of top traders and investors!

Also, while Fineco Bank charges a commission for many of its assets, eToro is entirely commission-free, so you only pay the spread. Another aspect in which eToro has the edge is when it comes to payments, as it supports a diverse range of methods, including PayPal.

Overall, while Fineco Bank certainly isn’t a bad investment platform, it simply doesn’t match up to eToro, which is our recommended UK broker.

Conclusion

Italy-based Fineco Bank is one of the most popular brokers in Europe, in large part because it brings together banking and trading in a way that’s largely seamless. The ability to use a debit card to make ATM deposits and withdrawals from your brokerage account is very unique and makes it easier to actively manage your account balance. The lack of platform fees at Fineco Bank is also a major draw.

While Fineco Bank hasn’t gone completely commission-free yet like some other online brokers, the fees it charges are largely competitive. The bigger issue that traders may face with this platform is its margin requirements for leveraged trading. Fineco Bank is very conservative in this respect, which can make it more difficult for traders with small balances to establish large or diverse portfolios.

Still, this caution may appeal to some traders. The brokerage is extremely trustworthy since it’s also a major retail and commercial bank. Fineco Bank is regulated by several highly respected agencies, including the central bank of Italy, the FCA, and ESMA.

The lack of leverage is also less concerning when you consider the variety of assets for which Fineco Bank enables trading. Few competitors allow ETF, fund, and bond trading to the same degree. For many traders, access to these investments may push Fineco Bank over the top.

If you’re looking for the very best broker in the UK, we recommend eToro over Fineco Bank. With a wider range of assets, lower fees, more payment methods, and innovative trading tools, eToro is a superior platform and is our pick for the top brokerage for UK traders.

FAQs

Does Fineco Bank offer access to MetaTrader?

Fineco Bank does not offer traders access to MetaTrader software, although you can use the software without linking your brokerage account. Instead, Fineco Bank provides its own Powerdesk trading platform. This is free as long as you place at least five trades per month.

What currency is my Fineco Bank account balance held in?

Fineco Bank brokerage accounts support multiple currencies, meaning you can choose what currency your balance is in or whether it is held in more than one currency. The brokerage also offers fee-free currency conversions seven days a week, 21 hours a day. You only pay the spread to convert between currencies in your trading account.

Do I have to have a bank account at Fineco Bank to open a trading account?

No, anyone can open a brokerage account with Fineco Bank. You do not need to be a customer of the company’s retail banking arm first. Note that the debit card you receive is only linked to your brokerage account, not to a checking or savings account (even if you already have one with Fineco Bank).

Is there an account minimum at Fineco Bank?

Fineco Bank doesn’t require you to keep any minimum balance in your brokerage account unless you’re trading with leverage. In that case, the minimum balance needed will depend on the size of your trade and the margin requirement for the asset you’re trading.

Alan Draper Lewis

View all posts by Alan Draper LewisAlan is a content writer and editor who has experience covering a wide range of topics, from finance to gambling.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up