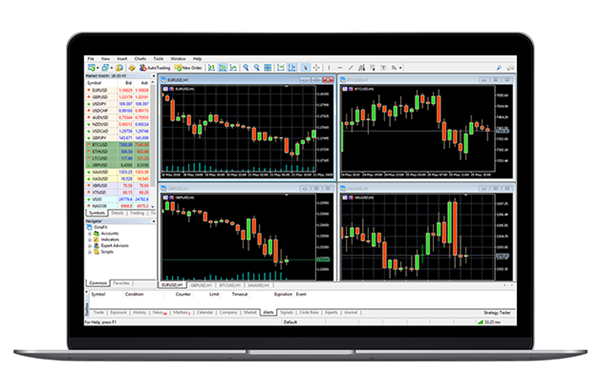

How to Use the MetaTrader Platform in Nigeria

MetaTrader 4 and MetaTrader 5 are popular systems for internet-based trading. Around the world, over 15 million people buy and sell financial instruments online. Many of them prefer these two platforms. Here is an overview of the system and its use in Nigeria.

Currencies, stocks, and other instruments are bought and sold via MetaTrader. This environment works on any device. Desktop, mobile, and web-based versions allow unhindered access 24/7. Wherever you are, global markets are at your fingertips.

Why You Need a Platform

Through a trading platform, users connect to the market. From trend analysis to execution, everything is handled via the software. MetaTrader 4 and MetaTrader 5 have been on the top of industry rankings for years.

Developed by MetaQuotes Software Corp, they serve two categories of traders. Those who set off on their Forex journey prefer MT4. It is perfect for currency trading.

MetaTrader 5 is more advanced and geared towards diverse portfolios. This gives access to stocks, CFDs, spot metals, and more. Clients of Forextime transition to MT5 when they expand their arsenal.

Overview of Features

The system has multiple tabs, windows and buttons. Newbies should practise in the risk-free mode. Metatrader in Nigeria can simulate real trading when profit and loss are only virtual.

You cannot trade well using theoretical knowledge. Rookies are tempted to open a live account straight away. This is not advisable. You need to feel confident using the controls and making decisions.

The platform allows both fundamental and technical analysis. It gives access to the latest financial news and market stats. Without such aids, trading would be challenging.

Trading is not gambling: it must be rational. MetaTrader 4 facilitates analysis, as it has multiple graphs. You can access past price history to make predictions.

Your goal is to buy low and sell high. An important advantage of Forex is that any trends can be lucrative. Traders buy or sell currencies via market execution or pending order. These are initiated similarly.

- Click on the New Order button.

- Choose the currency pair from the drop-down menu.

- Choose ‘Order Type’.

Setting Order with Market Execution

Market orders are used to buy or sell the instrument at its current price. These orders are filled as long as there are willing buyers and sellers. Here is how to set them up.

- Begin by specifying the volume (size of position) in lots. There are 100,000 units in one lot. Therefore, to trade 4,000 units of any currency, you would type “0.04” in the field.

- Include a comment if necessary. You can leave any notes concerning the order.

- Choose to BUY or SELL.

- Wait for confirmation.

Remember to set Stop Loss and Take Profit values for every position. These are essential for risk management. However, if you see that the options are disabled, do not be alarmed. This happens when the price is already moving, so you can enter the trade quickly.

Setting Pending Order

This is another set of instructions for your broker. A pending order informs them of the desired entry and exit points for a position. Basically, it communicates your intention to get in or out of the market at a certain price. If the price is not reached, nothing happens. If it is, the order is executed.

Specify the action for the currency pair. There are four options: Buy Limit, Sell Limit, Buy Stop and Sell Stop. Thus, there are two scenarios for buying and two for selling.

- Use Buy Limit to set a price below the market price, and Buy Stop to go above it.

- On the contrary, Sell Limit allows you to sell your instrument above the market price. To sell below it, use Sell Stop.

Then, specify the other four parameters. These are: entry price, position size, Stop Loss and Take Profit, and expiry date. When you click ‘Place’, the trade will become active. A notification will pop up upon execution.

Editing and Closing

Sometimes, you need to change the parameters of a trade that is already active. Fortunately, the system allows this. Editing is done using the same ‘Trade’ tab. If you cannot see it in the top menu, click on ‘View | Terminal’ (or CTRL + T).

This tab shows all details of the position, so you can edit them easily. There are volume and entry price. You can add or change Stop Loss and Take Profit, which protects you against unfavourable trends.

Right-click on the order you want to change and choose editing/deletion. The system will allow you to enter the desired values in the parameter fields. Click ‘Modify’ to proceed with your choice, and wait for the confirmation window. Finally, to close the trade, right-click on the trade (from the ‘Trades’ tab) and choose the closing option.