Best Forex Brokers in Vietnam in 2026 – Top Broker Revealed

If you’re based in Vietnam and you wish to trade currencies online, you will need to use a forex broker. Fortunately, there are lots of regulated forex trading sites that accept Vietnam residents – many of which offer zero-commission, tight spreads, and lots of local payment methods. But how do you know which Vietnam forex brokers are right for you?

In this guide, we explore the best Vietnam forex brokers for 2026. We also give you some handy tips on what you need to look out for prior to opening a brokerage account, and the steps you need to take to get started today!

-

-

Our Recommended Vietnam Forex Broker

Don’t have time to read our guide all of the way through? Below you will find our top Vietnam forex brokers!

The Best Forex Brokers in Vietnam

There are many Vietnam forex brokers that allow you to buy and sell currencies at the click of a button. With that said, knowing which trading platform to sign up with can be challenging. For example, you need to ensure the broker is regulated by a tier-one licensing body, and that it accepts your preferred payment method. Similarly, you also need to check what the broker charges in fees, commissions, and spreads.

To help you along the way, below you will find a selection of the best forex brokers in Vietnam.

1. Plus500 - Low Cost Forex Trading platform

Plus500 is a heavily regulated online CFD provider that accepts Vietnam residents. On top of stocks, indices, hard metals, cryptocurrencies, and energies, the platform also offers a fully-fledged forex department. This includes heaps of major and minor currency pairs, as well as a number of exotics. Best of all, you can trade the Vietnam rand against the US dollar (USD/ZAR).

Each and every currency pair can be traded with leverage. When it comes to the trading platform, Plus500 has built its own web-trader. This means that you can trade forex at the click of a button - with no requirement to download or install any third-party software. You can even trade via your mobile phone, as the platform offers a mobile trading app on iOS and Android. Both the web and mobile platforms come packed with technical indicators and chart reading tools.

In terms of the fundamentals, Plus500 requires a minimum deposit of £100. You can get money into the platform with your local debit/credit card, bank account, or Paypal. There are no fees to deposit nor withdraw at Plus500. In the regulation department, Plus500 is a PLC listed on the London Stock Exchange. It holds licenses with the FCA, ASIC, CySEC, and MAS.

Our Rating

- Regulated by the FCA and ASIC

- 0% trading commissions

- Mobile forex trading app available

- No educational material

80.5% of retail investor accounts lose money when trading CFDs with this provider.2. FXCM – Choice of Forex Trading Platforms

FXCM, short for Forex Capital Market, was established back in 1999 and is one of the leading providers of forex CFD trading. This broker is regulated in a number of jurisdictions and holds licenses from the FCA in the UK, ASIC in Australia, America's CFTC, and CySEC in Cyprus.

This broker is known for its competitive, fast order execution, and useful trading tools. There are 39 forex pairs to trade, which isn't the largest selection, but should be more than enough for beginner traders. FXCM does not charge trade commissions or deposit or withdrawal processing fees.

Trading on FXCM is accessible via three of the most impressive trading platforms: TradeStation, FXCM's own proprietary trading platform, NinjaTrader, and the all popular MT4. These feature a wide range of advanced trading and market analysis tools, provide access to the latest forex market data, and critical market news.

- Platforms: Choose from MT4, Trading Station and NinjaTrader

- Trusted: ASIC, FCA, CySEC regulated

- Low minimum deposit

- Lower range of pairs: 39 available

There is no guarantee you will make money with this provider.3. Forex.com - Trade Over 80 Currency Pairs

Forex.com is a specialist forex broker that providese access to more than 80 different pairs. This includes all majors and minors, and lots of exotics. Forex.com is also notable because the trading platform is suitable for both newbies and seasoned investors.

For example, you can get started with a deposit of just $50, and accounts take just minutes to set up. You can use a traditional debit or credit card to fund your account, so deposits are instant. For those of you with advanced trading requirements, Forex.com offers heaps of chart reading tools and technical indicators. As the broker utilizes the MT4 platform, you can also customize your trading screen however you wish.

In terms of the fundamentals, Forex.com offers a number of different account types. If you think you'll be trading large volumes, you can get the spread on EUR/USD down to just 0.2 pips + commissions. Other account types allow you to trade on a commission-free basis, but the spreads are higher. Finally, Forex.com is regulated by a number of US bodies, including the CFTC and NFA.

- Spreads from just 0.2 pips

- Supports MT4

- More than 80 pairs

- $40 wire withdrawal fee

- $15 monthly inactivity fee

There is no guarantee you will make money with this provider.4. FBS – Up to 1:3000 Leverage

If you're looking for high leverage, be sure to check out FBS. With leverage set at 1:3000, this broker offers one of the highest rates in the industry. This broker also offers just under 30 forex pairs, which you can trade commission-free and tight spreads from just 0.5 pips.

FBS supports both MT4 and MT5 and offers a collection of trading tools in addition to some highly effective automated trading systems. It also offers access to news and market analysis, in addition to educational resources such as webinars and video lessons.

This broker also has a long list of trading account types, and each is specially designed to suit a particular class of traders. The most popular account type is the micro-lot trading (CENT) account for beginners, and the high-volume (ECN) account for scalpers. There's also Islam-friendly account options that comply with Sharia law, and a very low minimum deposit of just $1.

- Hosts Sharia law compliant accounts

- Low minimum deposit

- Supports MT4 and MT5

- Less than 30 forex pairs

- Some accounts don't have a stop-loss feature

There is no guarantee you will make money with this provider.How to Choose a Forex Broker in Vietnam?

Although we have already discussed some of the most popular Vietnam forex brokers active in the market, it is important for you to do your own research prior to signing up. This can be a time-consuming process, so we’ve listed some tips below to point you in the right direction.

Regulation and Safety of Funds

The main financial regulatory agency in Vietnam is The State Bank of Vietnam, which is the country’s central bank. In 2014, the State Bank of Vietnam, also known as SBV, banned forex trading in order to control the Vietnamese Dong.

However, SBV allows residents to trade with offshore online brokers that are regulated by well-known authorities (in particular in Asia) such as the Australian Securities and Investment Commission (ASIC), the Monetary Authority of Singapore (MAS), the Financial Service Agency (FSA), the UK Financial Conduct Authority (FCA), or the Cyprus Securities and Exchange Commission (CySEC).

Note that all of the brokers on our list of best Vietnam forex brokers are highly regulated and well-reputed.

Language – Brokers that Support Vietnamese

Some online brokers offer customer support in a particular language. This ensures that all traders from Vietnam can access the platform and fully understand the terms and conditions, the account details, and all the relevant information. Moreover, few of the brokers offer an online chat or a phone number in Vietnamese.

Selection of Accounts – Islamic Accounts for Vietnamese Traders

Another important factor to consider is the selection of accounts provided by the broker. Some brokers offer one Standard account for all levels of traders, while others offer a selection of accounts suitable for all types and levels of traders.

Currency Pairs

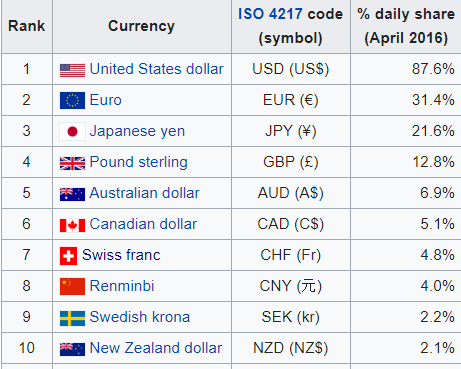

First and foremost, you need to check what currency pairs the forex broker supports. In the vast majority of cases, the broker will host all majors and minors.

However, if you are looking to trade an exotic currency pair like USD/ZAR, you need to check whether or not this can be traded at the platform. You can check this out before opening an account by browsing through the broker’s website.

Website and Trading Platform

You then need to assess what trading platform the forex broker offers. In some cases, the broker will offer its own proprietary trading platform that you can only access via its website.

In other cases, the broker will partner with third-party platforms like MetaTrader 4/5. It’s always useful when your chosen broker gives you the option of both a proprietary and third-party platform. You should also check whether the broker supports a forex trading app.

Leverage

Although the vast majority of Vietnam CFD trading sites offer leverage, you might need to check what limits are in place if you have a higher appetite for risk. Some brokers offer up to 1:200. Just make sure you understand the risks of applying leverage before risking your money.

Fees

Fees and commissions are a crucial component to consider when choosing a forex broker. At the forefront of this is the amount of commission the broker charges when you trade forex. Most of the trading platforms that we discussed earlier in this guide offer 0% commissions, so it’s just the spread that you need to pay.

You do, however, need to assess how competitive the spread is, too. If you can get the spread below 1 pip on major pairs, you’ve found yourself a well-priced forex broker.

Trading Tools

All seasoned forex traders utilize research tools to help them evaluate which way a particular currency pair will move. Without them, you are essentially ‘guessing’.

As such, be sure to check what trading tools the broker offers. This should include an in-depth selection of technical indicators and drawing tools, and the ability to customize your screen.

Educational Resources & News

If you are just starting out in the world of online forex trading, you should choose a broker that offers a wealth of educational resources. This might include how-to guides, webinars, and video explainers.

Irrespective of your skill-set, you should also stick with platforms that offer real-time financial news. This will arm you with the required fundamental knowledge to determine how a currency pair might react to a new development.

Customer Service

Customer service is also important, as there might come a time when you need assistance on your brokerage account. As most Vietnamese traders use forex brokers located overseas, it’s best to use a platform that offers customer support via live chat. This will avoid the need to make an expensive phone call to an international toll-number.

Step 4: Open a Forex Trade

If you have read our guide up to this point, then you should now have the required tools to start trading forex in a fully-informed manner.

Select one of our recommendations above to begin the account opening process.

After this has been done, placing a Forex trade should be relatively straightforward.

Conclusion

With forex trading becoming more and more popular in Vietnam, it makes sense that there are now dozens of brokers to choose from. No two brokers are the same though – which is why you need to do your homework before signing up. For example, while some specialize in 0% commissions and low spreads, others appeal because they offer MT4/5. Either way, you need to ensure that your chosen broker is regulated by a reputable body like the FCA or ASIC.

FAQs

Is it safe to trade with online brokers in Vietnam?

Yes, as long as you choose an offshore broker that has been operating in the industry for decades and is highly regulated by top-tier regulators, then you are safe. Once you’ve entered into an agreement with a broker, it’s important to note that the broker must comply with any regulators’ requirements as well as the promises made on its website and trading contracts.

What leverage ratio do Vietnamese forex brokers offer?

The leverage ratio offered by Vietnam forex brokers varies depending on the regulatory framework of a certain broker. As regulators come in many different types and enable different terms and conditions. For example, CySEC maintains stricter leverage limits for CFDs (1:30 for retail clients), and therefore you will have to check the regulator’s restrictions to determine what is the allowed leverage ratio.

What is the minimum deposit required to start trading with a forex broker in Vietnam?

Vietnam forex brokers maintain a minimum deposit requirement which varies from broker-to-broker. From the choices above, AvaTrade and Plus500 maintain a minimum deposit requirement of $100.

What will you need to open an online trading account in Vietnam?

The majority of the offshore brokers in Vietnam require similar information and documentation that include personal details, trading experience, and your financial status. In addition, most regulated brokers require you to submit documentation that verifies your identity such as a government-issued ID or passport, and utility bill.

Can I Trade the Vietnamese Dong (VND)?

No, the Vietnamese central bank sets daily exchange rates for the Vietnamese Dong (VND), meaning it is fixed and cannot be traded. However, the relationship between the US dollar and Vietnamese Dong is crucial as the VND is pegged to the US dollar and therefore, traders in Vietnam follow the US dollar movements versus other major currencies as well as currencies in East Asia.

Is it legal to trade forex in Vietnam?

Yes. There are no rules against trading forex with offshore brokers such as Plus500.

Alan Draper Lewis

View all posts by Alan Draper LewisAlan is a content writer and editor who has experience covering a wide range of topics, from finance to gambling.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up