Plug Power stock price jumped 11.4% yesterday after the hydrogen and fuel technology company priced a $1.5 billion share offering, seeking to raise funds to further accelerate its hydrogen generation capabilities.

In a press release published early in the day, Plug Power announced that it plans to offer a total of 28 million common stock for $65 a share while granting underwriters an extra 4.2 million shares.

This number represents roughly 8.6% of the 371 million common stock outstanding, as reflected by the company’s earnings report from the third quarter of the year, while the price of the offering was only 72 cents lower than Monday’s closing price.

According to Plug Power, the share offering should be closed on 29 January while the company has appointed American investment bank Morgan Stanley as the sole book-running manager for the issue.

Alongside this announcement, the company also hiked its gross billings estimates for 2021 to $475 million, up $25 million from a previous forecast, while it also ramped up its 2024 target by 40% – now planning to bring in a total of $1.7 billion in gross billings as the adoption of hydrogen as a feasible source of energy around the world seems to have accelerated during the pandemic.

Meanwhile, the New York-based green technology company highlighted that it has already exceeded its 2020 gross billings target, with sales surpassing the $300 million mark by the end of the year.

In regards to these announcements, the company held a business update conference that discussed key information about its activities during 2021 – a transcript of that conference can be found here.

What’s next for Plug Power stock?

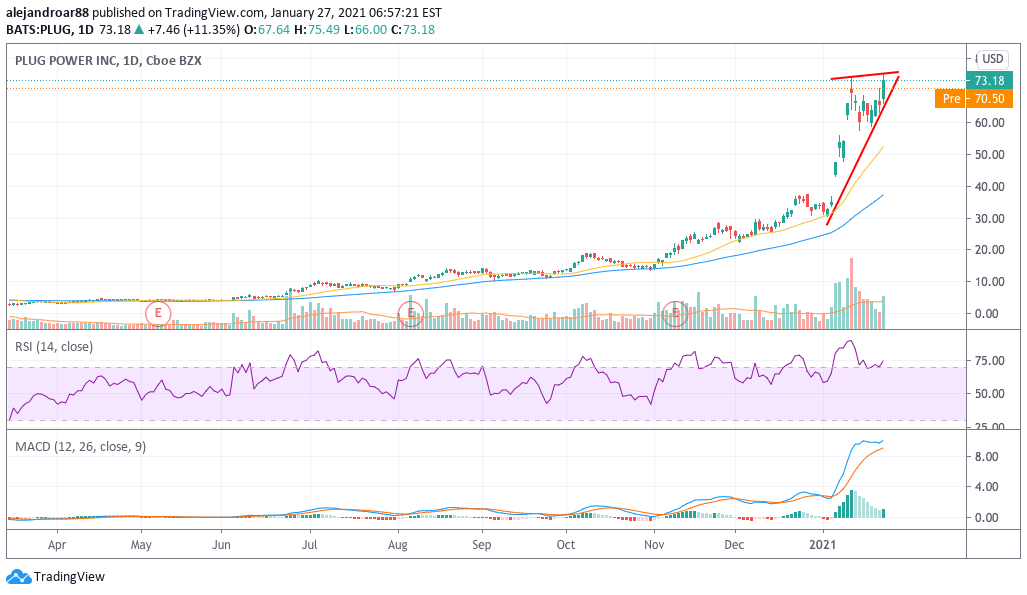

The chart above shows how the price of Plug Power shares has gone basically vertical, which means that it has moved up quite strongly since the year started as the company keeps dazzling investors amid the prospect that it might become a large player in the hydrogen-generation business.

It is interesting to note that Plug Power currently has two key customers which are Amazon (AMZN) and Walmart (WMT), both of which have net-zero carbon goals for 2040. These two significantly large customers can drive significant revenue to the firm if they progressively adopt the company’s hydrogen and fuel cell products within their massive distribution centers and warehouses, while the company is favorably positioned to offer other solutions for other areas of their businesses.

After yesterday’s uptick, Plug Power’s market capitalization jumped to $30 billion – which is 17.6 times the firm’s forecasted 2024 gross billings.

At this point, investors have to decide if they believe that the company can grow its revenues in the future to a point in which those multiples can become less extreme as the market’s current overly optimistic forecasts for Plug Power can increase the stock’s volatility in the short-term.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account