US stock markets made several records in 2020, both positive and negative. As we head into 2021, these are the key events that stock markets would watch in the first week of January itself.

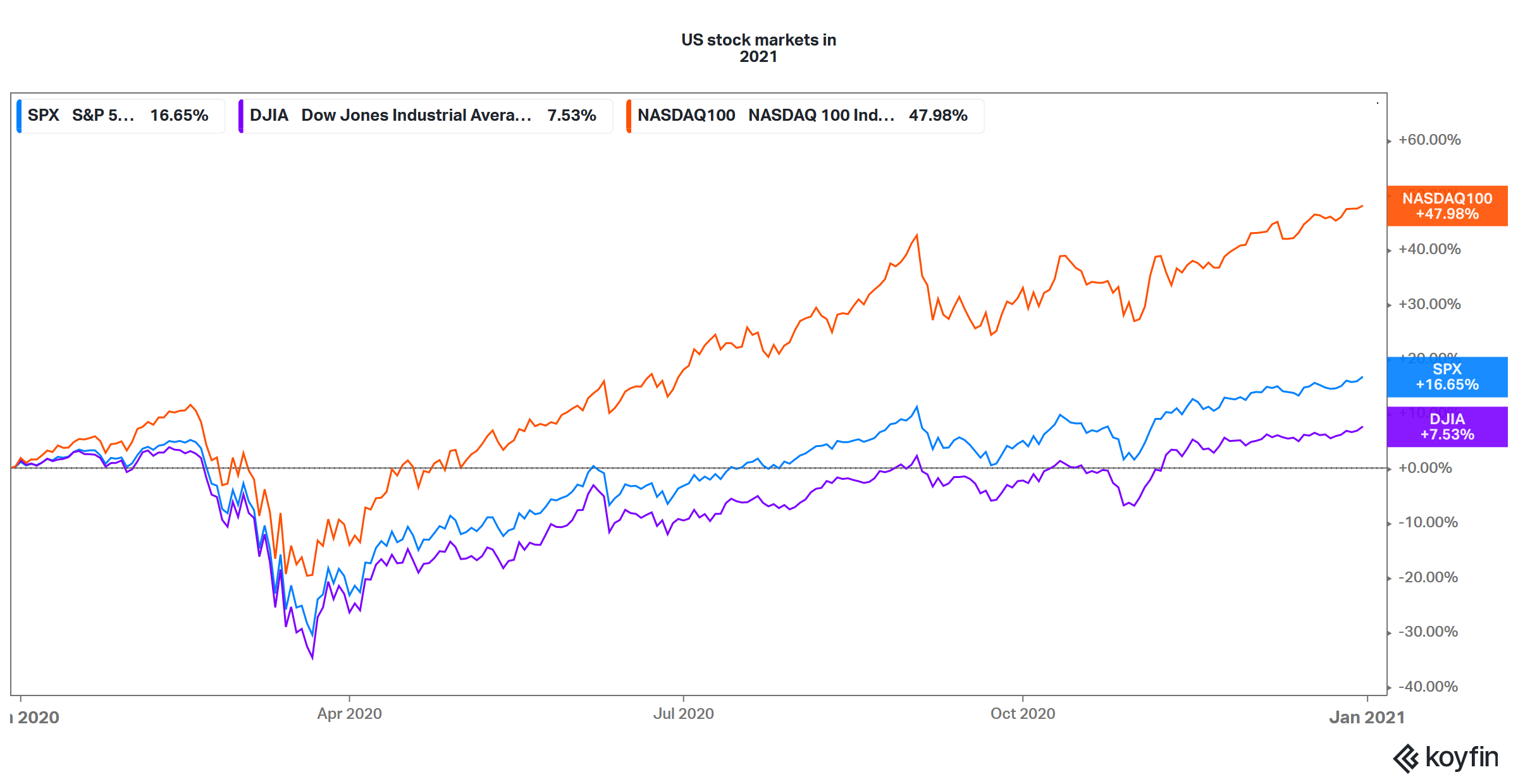

2020 was a good year for US stock markets. The Nasdaq 100 Index gained 48% in the year. The S&P 500 also closed with double-digit gains and rose 16.7% in the year. Dow Jones also made a new record high and gained 7.5% in the year.

Key events in the first week

The first week of January is packed with several economic releases and other events. On Monday, we’ll get the December PMI (purchasing managers’ index) data from IHS Markit. Along with the data for the US, we’ll also get data for other leading economies as well. The data would offer insights into how the US and the global economy fared in December and what business conditions businesses are projecting for 2021.

On Tuesday, we’ll get the ISM Institute for Supply Management). PMI data which would be followed by services PMI and factory orders on Wednesday. The PMI data could have an impact on the US stock markets as it would reflect the state of the US economy.

Could initial jobless claims data impact stock markets?

On Thursday, we’ll get the initial claims data for the last week. In the week ended 23 December, 787,000 Americans filed for jobless claims. Commenting on last week’s initial claims data, Nancy Vanden Houten, lead U.S. economist at Oxford Economics said “While prospects for the economy later in 2021 are upbeat, the economy and labor market will have to navigate some difficult terrain between now and then and we expect claims to remain elevated.”

Claims are expected to fall in 2021

According to Trading Economics, initial jobless claims are expected to average 600,000 in the first quarter of 2021 and fall further to 500,000 in the second quarter of 2021. US jobless claims peaked at 6.9 million in the last week of March and have since fallen. However, they are still elevated by historical standards. Higher than expected initial jobless claims would be negative for the stock markets.

Nonfarm data to be released

On Friday, we’ll get the nonfarm payroll data. After the jump in employment towards the middle of last year, the employment sector has been sagging. In November, the US economy added 245,000 jobs and economists expect that the economy added fewer than 100,000 jobs in December. The nonfarm payroll data would be another economic indicator that could impact the stock markets.

Politics could also impact US stock markets in the next week

US stock markets rallied in November after Joe Biden was elected as the 46th US president. On Tuesday, elections would be held in Georgia that would decide who’d control the Senate. While Democrats control the House, the Senate is still controlled by the Republicans. This split verdict would act as a dampener for the Biden administration if it pursues the tax hikes that Biden talked about during his campaign.

“Georgia is the most important thing to the Biden presidency for the next two years,” said Ed Mills, Washington policy analyst at Raymond James. He added, “It’s going to determine what is the legislative agenda and who can get confirmed by the United States Senate.”

According to Peter Boockvar, chief investment officer at Bleakley Advisory Group, “The market tends to shoot first and ask questions later. There will certainly be a reaction if Democrats win both those seats.”

Where to invest in 2021?

The momentum looks strong for US stock markets as we head into 2021. Vaccination drive in the US coupled with the recently approved $900 billion stimulus package would be headwinds for the stock markets in 2021.

Cyclical stocks could continue their uptrend in 2021. To play the uptrend in cyclical stocks, you can buy stocks of cyclical companies that trade at reasonable valuations You can trade in stocks through any of the best online stockbrokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account