US stock futures are sliding as US Treasury yields have kept climbing to their highest levels since the pandemic started, with yields of the 10-year note reaching 1.667% this morning in early bond trading action.

Bond traders seem to be reacting earlier to the upcoming press conference of Federal Reserve Chairman Jerome Powell after the two-day meeting held by the Federal Open Market Committee concludes, as the latest spike in Treasury yields could prompt the central bank to take action.

As a result, E-mini futures of the S&P 500 are heading down 0.22% at 3,943 in early futures trading action as they keep struggling to advance toward the 4,000 level, while futures of the tech-heavy Nasdaq 100 index are down 0.8% at 13,040.

Meanwhile, futures of the Dow Jones Industrial Average (DJIA) appear to be indifferent to the spike in Treasury yields, although that could change based on Chairman Powell’s statement.

Earlier this morning, the managing director of Wells Fargo Securities, Michael Schumacher, told CNBC that 10-year Treasury yields could hit 2.25% by the end of the year citing the combination of vaccine rollouts and massive amounts of fiscal stimulus as the potential catalysts that could push rates higher without necessarily triggering concerns within the central bank ranks.

“Our view at Wells Fargo is he will not really try to slow it down”, he concluded.

Schumacher’s view is shared by other institutional players, with the consensus being that the Fed’s approach will remain dovish, meaning that they won’t act in a way that disrupts the market’s status quo.

That said, it is still unclear how the market would react if this uptrend in US Treasury yields were to continue without the central bank intervening to cap its advance as borrowing costs could surge for companies that are not necessarily in the best shape to secure new loans at higher rates.

Last year, research from Bloomberg indicated that nearly 739 organizations among the largest 3,000 corporations in America are currently considered ‘zombie companies’, a term assigned to entities that are unlikely to survive if they are unable to refinance their debt at low interest rates.

If the ‘risk-free’ interest rate – as US Treasury yields are often viewed – moves higher, so will the rate that these companies will have to pay to issue new corporate debt or to refinance its existing one.

That particular scenario could mean trouble for this large group of businesses, which is the reason why Wall Street seems skeptical about the possibility that the Federal Reserve will just let rates move higher without intervening.

Powell’s press conference might shed some more light on the central bank’s opinion about these latest developments in the bond market. The FOMC meeting is set to conclude at 2:00 p.m. ET today followed by a speech from Chairman Powell.

What’s next for US stock futures?

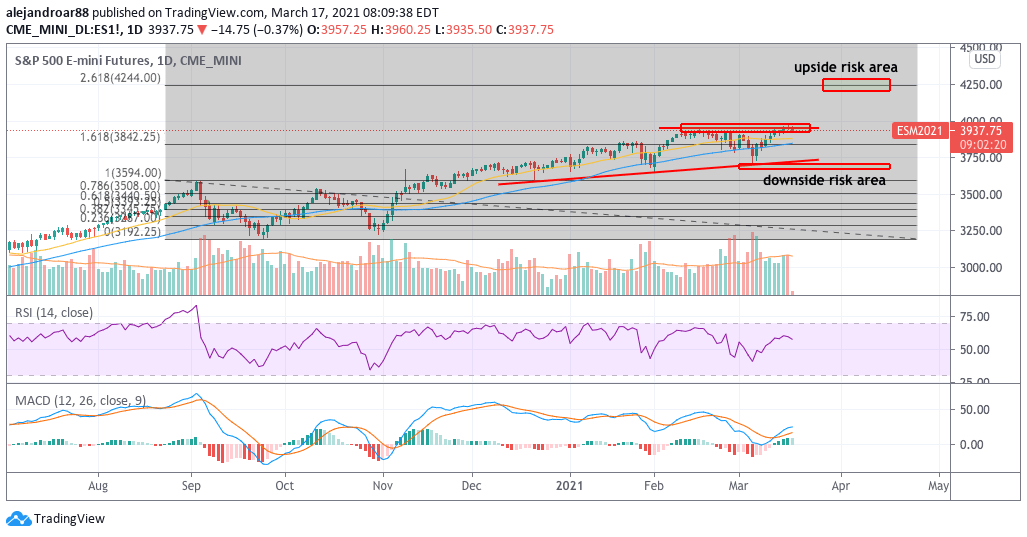

The risk of a double top formation in the S&P 500 remains on the table as the benchmark has failed to clear the 3,900 level in the past few days – possibly amid this jump in the yield of Treasury notes.

That said, both the RSI and the MACD have not sent any kind of signals that the latest positive momentum has ended, although Powell’s speech could change the narrative quickly.

For now, if the bull run were to continue, chances are that the index could jump quickly to the 4,250 level after breaking this 3,900 ceiling.

On the other hand, if the situation with yields gets out of hand as a result of the Fed’s apparent inaction, chances are that the index could retest its 3,700 support.

If that were to happen, traders could see that as a buying opportunity based on the fact that although the Fed might not actively intervene to address the spike specifically, its accommodative policy is likely to continue as-is in the near future.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account