The value of the US dollar against a basket of foreign currencies – as reflected by Bloomberg’s dollar index – is tagging a key support this morning as the greenback continues to slide pressured by lower US Treasury yields and higher demand for riskier assets.

The performance of the US Dollar index has been muted during early forex trading activity today, yet the North American currency accumulates a 1.7% slide since 31 March after hitting a 2021 high of 93.232.

US Treasury yields have been dipping this week following multiple auctions conducted by the Treasury Department for long-dated issues including 10-Year Notes, whose yields closed the bidding at 1.680%.

As of this morning, Treasury yields are dipping to 1.617%, their lowest levels in three weeks, as investors’ appetite for government bonds seems to be coming back – bond yields and prices move in opposite directions.

Meanwhile, inflation data from the US Bureau of Labor Statistics indicated an acceleration in core inflation during March, with the annualized core inflation rate landing 10 basis points above analysts estimates at 1.6% while overall inflation ended 10 basis points higher than the market’s forecasts as well at 2.6%.

The Federal Reserve’s accommodative monetary policy along with the upcoming $2 trillion infrastructure promoted by President’s Joe Biden administration could keep weighing on the short-performance of the greenback, as, even though the country’s economy seems to be on track for a strong rebound in 2021, political leaders and policymakers seem decided to keep providing further stimulus until the virus crisis is truly over.

Data on retail sales will be released this morning by the US Department of Commerce, with economists expecting a 5% jump (excluding auto sales) compared to the previous month as stimulus checks received by consumers last month should have resulted in higher spending.

Notably, the dollar’s latest top coincides with the day on which the S&P 500 broke above the 4,000 barrier for the first time in its history, with the two instruments taking divergent paths since then as the stock index has continued to climb for seven of the past nine days while the dollar retreated.

This move reflects investor’s growing appetite for riskier assets in a scenario where the economy is expected to recover from last year’s downturn.

What’s next for the US dollar?

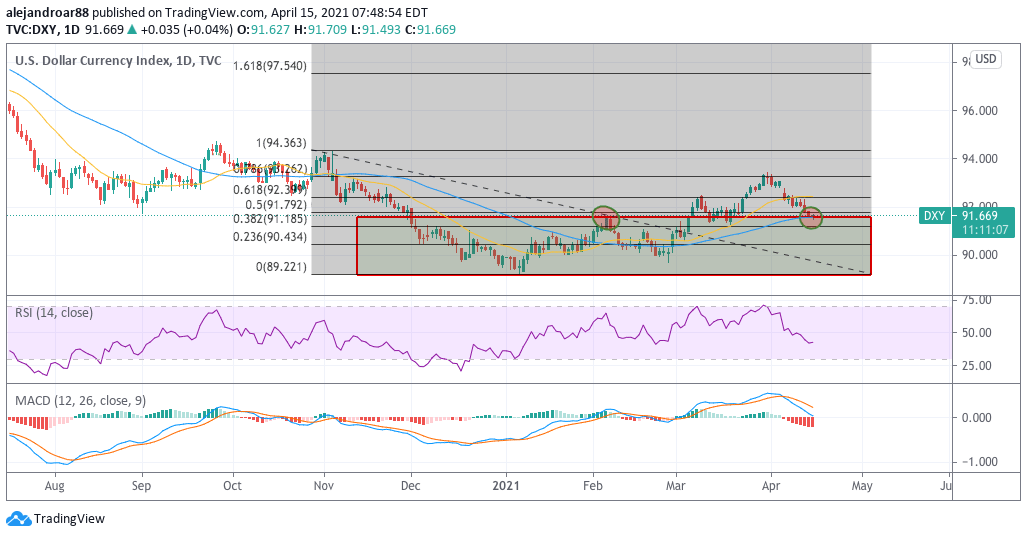

The chart above shows how the latest price action has led the US dollar index to tag a previous resistance that could now be serving as support, while momentum indicators show that there could still be some downside risk ahead.

For now, the situation with US Treasury yields and the short-term performance of the S&P 500 could dominate the narrative in the following days for the dollar. A sustained downtrend in Treasury yields could lead to a plunge in the value of the greenback back to the 90 area while higher equity valuations could also hurt the short-term performance of the North American currency.

That said, stronger than expected retail sales could possibly turn the tables for the dollar as Treasury yields could regain some strength if investors’ estimates about the pace at which the economy is recovering are exceeded.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account