Tech stocks are set to drop for a second day today as indicated by the performance of E-mini futures of the Nasdaq 100 index, which are sliding 1.4% at 13,176.5 in early futures trading action.

Inflation concerns, an ongoing sectorial rotation, and an uptick in US Treasury yields may be responsible for the decline in the price of technological shares, with investors setting their eyes on consumer price index (CPI) data to be released tomorrow to determine if these fears are well founded.

Moreover, the federal government will also be auctioning $68 billion in long-term Treasury bonds on Tuesday and the results of the auctions could have an effect on both Treasury yields and tech stocks for that matter. In this regard, given the latest negative correlation between the two instruments, chances are that weaker-than-expected appetite for Treasury notes could cause a spike in yields and a subsequent prolonged drop in tech issues.

As of this morning, 10-year Treasury yields are advancing 1.1 basis points to 1.615% while they have gone up 4.7 basis points from their 1.568% low from last week.

The SPDR Technology Select Sector ETF (XLK) tells the story of how bad things have been for tech stocks in the past few days, with the fund declining 5.5% since making a double top on 26 April at $143.43 per share. So far this year, the fund is up 4.5%.

In the past 6 months, this exchange-traded fund (ETF) has reported net outflows of $1.16 billion – a period that coincides with the release of positive data on the vaccine front by Pfizer.

Meanwhile, the so-called FAANG stocks, an acronym that recollects the initials of the five of the largest tech issues in the US stock market including Facebook (FB), Netflix (NFLX), and Amazon (AMZN), have gone down 6.3% combined based on a hypothetical portfolio comprised of 20% each.

In contrast, virus-battered sectors of the markets including energy and financials have outpaced the gains of these former growth stocks, with the SPDR Energy Select Sector ETF (XLE) reporting a 43% advance while the SPDR Financials Select Sector ETF (XLF) is up 28.6% since the year started.

Why are tech stocks down?

According to data from Koyfin, analysts are expecting a strong jump in inflation rates by the end of April, with the annualized inflation forecasted to land at 3.6% while core inflation is estimated to end the past twelve months at 2.3%.

These estimates produce a general sense of uncertainty in regard to the actions that the Federal Reserve could take if inflation spins out of control, including an abrupt and earlier-than-expected rise in interest rates.

Such a situation could possibly trim the somehow lofty valuation multiples extended to tech firms lately as a result of the pandemic tailwind, while investors are also worried about how inflation could affect real earnings produced by companies that rely on subscription models and whose pricing power might not be strong enough to keep up with the deterioration in the dollar’s purchasing power.

Questioned about how investors should respond to this downtick in tech issues, Neal Shearing, chief economist for Capital Economics, responded as follows: “I’m still very much of the mind that we’re in the very early stages of this cycle”.

He added: “This cycle’s going to play out over a long period of time. The Fed’s not going to be raising rates and inverting the yield curve for years to come. And so inflation that’s likely to emerge in the summer could create what we’d call a so-called ‘freak-out’ moment in the market, but would represent a buying opportunity”.

What’s next for tech stocks?

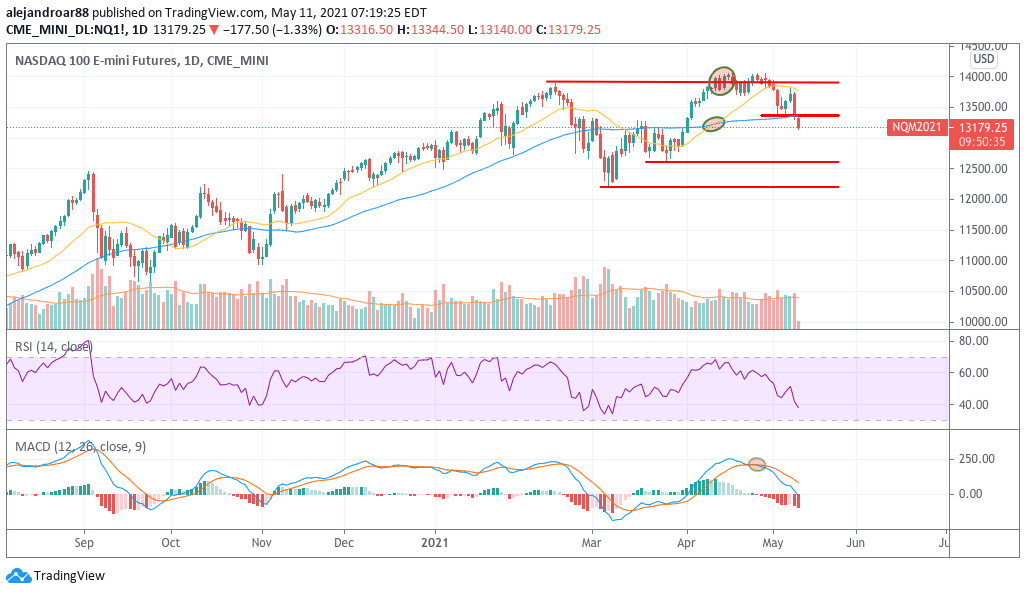

A closer look at the price action in the front-month futures contract of the tech-heavy Nasdaq 100 index shows us that intraday lows from last week have already been broken along with the index’s short-term moving averages.

These two breaks are quite important as they are signaling that we are probably due for a prolonged downtick. Now, based on the chart, the next support to watch is found at 12,600, which coincides with a 10% correction of the index’s all-time high of 14,050.

If the price holds and bounces off that level, this would be just a temporary – and possibly healthy – correction and investors could take advantage of it to average down their cost basis or to snap a few shares of their favorite companies at a lower price.

However, if the drop goes beyond the 12,200 level, there could be a fundamental weakness that has not been fully identified just yet. In that case, the index could go much lower but that is a scenario that remains unlikely in the absence of tangible evidence that supports it.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account