Global cannabis giant Tilray is set to release its fiscal first-quarter 2022 earnings on Thursday before the US markets open. What’re analysts expecting from the company’s earnings and can the stock recover some of its recent losses after the earnings?

Earlier this year, Tilray and Aphria had merged to create the world’s biggest cannabis company. The company reported its fiscal fourth-quarter results in July which had combined performance for both the companies. However, this would be the first quarter where the full quarterly results for the consolidated company would be released.

Tilray earnings estimates

Analysts polled by TIKR expect Tilray to post revenues of $176.25 million in the fiscal first quarter that ended on 31 August. The revenues are expected to rise over 60% in the quarter. The company’s revenues are expected to rise above 50% year-over-year in all four quarters of the fiscal year 2022. However, analysts expect its annual revenues to be just below $1 billion in the year.

Meanwhile, Tilray management has charted an aggressive growth plan for the company and intends to increase the revenues to $4 billion by the end of the fiscal year 2024. To fund this growth, it would also have to go for acquisitions and the management has got a shareholder authorization to increase the authorized shares.

Synergies

During the previous earnings call, Tilray said that the company has achieved $35 million in synergies from the merger and sounded confident of achieving $80 million in synergies over the next 16 months. Commenting on the financial performance, Tilray CEO Simon Irwin said “These are early achievements but they provide the roadmap for our strategy and priorities moving forward. Tilray is now truly leading the global cannabis industry with low cost of production, leading brands, a well-developed distribution network, and unique partnerships that we believe will drive sustainable shareholder value in the quarters to come.”

Analysts expect Tilray to post an adjusted EBITDA of $11.8 million in the fiscal first quarter, a year-over-year rise of over 56%. However, while the company had posted a net profit in the previous quarter, it is expected to post losses in this quarter.

What to watch in Tilray’s earnings call?

During the previous earnings release, Tilray had said that it managed to increase its market share in Canada on a month-on-month basis in the quarter since April 2021. The management might provide more updates on the market share in Canada. Also, the management would also provide an update on the synergies.

Meanwhile, markets would watch out for any commentary from Tilray management on the Canadian cannabis industry where sales had tumbled last year amid the lockdown. The management might also provide some forward guidance. The company might also offer insights on its investment into Medmen.

Tilray stock price forecast

Tilray is working on an aggressive international growth plan. It intends to increase its retail market share in Canada from 16% to 30% by the fiscal year 2024. It is also aggressively betting on Europe. The combined Tilray has a strong presence in Europe and expects the region to have a potential of $1 billion revenues annually in medical cannabis alone. It is also well-positioned to capitalize if Europe were to legalize adult-use marijuana. The company is also looking at accretive acquisition opportunities and has already invested in Medmen which would provide it with a footprint in the US cannabis market that it estimates is $80 billion annually.

Tilray target price

According to the estimates from CNN Business, only five of the 19 analysts covering Tilray rate it as a buy. A vast majority, 13 to be precise, rate it as a hold while one analyst has a sell rating. However, thanks to the stock’s recent underperformance, its median target price of $14 implies an upside of 25.3%. Its street high target price of $27 is a premium of 141% while the street low target price of $11.50 is also 3% below the current price levels.

Recent analyst action

Last month, Cantor Fitzgerald maintained its overweight rating on Tilray stock while lowering its target price from $19 to $18. Roth Capital had also lowered the target price last month, so did Piper Sandler.

Tim Seymour, founder and chief investment officer of Seymour Asset Management is among those who have a bullish on Tilray after the Aphria merger pointing to “enormous synergies in terms of cost reduction.” He added, “I think a lot of people may be underestimating where that story can go.”

Cannabis stocks have been weak

Meanwhile, all the cannabis stocks have been under pressure over the last six months as the marijuana legalization bill in the US has failed to move ahead. Cannabis stocks saw a rerating after Joe Biden’s election, and the Democratic control of the Senate further ignited hopes of legalization. However, the Biden administration has been doing firefighting on the economic stimulus agenda and marijuana legalization is not something that is on top of the administration’s current priorities.

That said, given the huge illegal cannabis market in the US, and the fact that gradually many US states have legalized cannabis, the Federal government might eventually take a constructive view of decriminalizing adult-use marijuana. Also, the market potential for medical cannabis also looks strong.

Tilray stock looks attractive: Time to buy?

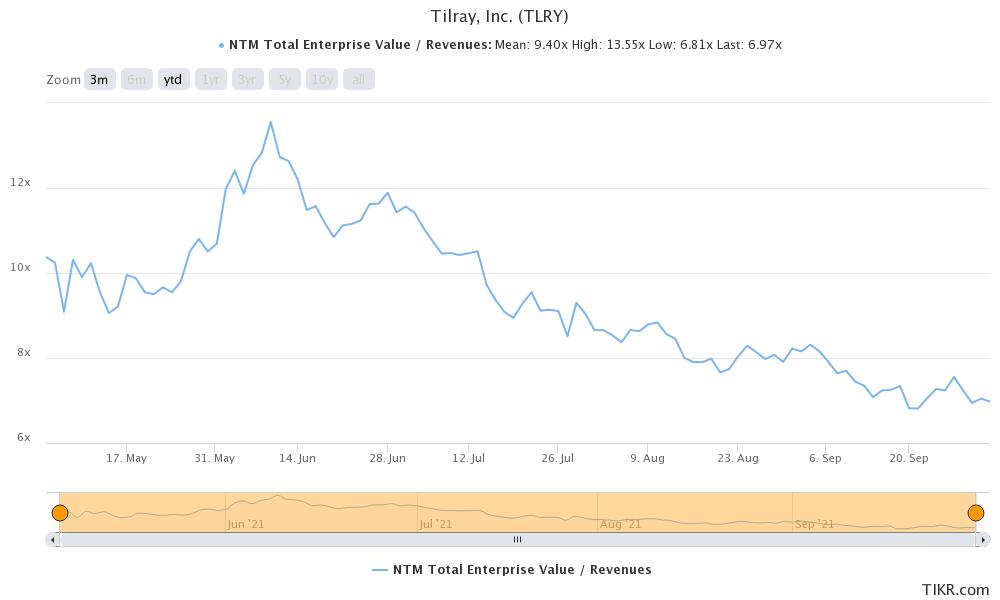

Within the cannabis industry, Tilray stock looks among the best bets after the Aphria merger. The stock’s valuations also appear a lot more reasonable after the crash in the stock. Tilray stock trades at an NTM (next-12 months) EV (enterprise value)-to-sales multiple of around 7x which is not far from the lowest multiple of 6.8x that it has traded at since the merger. To be sure, the cannabis industry has seen a valuation multiple deterioration over the last six months. However, at these prices, Tilray stock looks like a good buy to play the cannabis industry for the medium to long term.

How to buy Tilray stock?

You can invest in Tilray stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in cannabis stocks could be to invest in ETFs that invest in cannabis companies. By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account