IBM (NYSE: IBM) stock price soared sharply after beating revenue and earnings estimates for the final quarter of 2019. IBM share price rally is also supported by positive revenue growth in Q4 after five connective quarters of decline. In addition, the updated outlook for fiscal 2020 added to investor’s sentiments. The company’s strategy of taking benefit from the increasing demand for cloud products is helping in turning things around.

IBM stock price is currently trading around $140, down from 52-weeks high of $150. IBM’s share price looks significantly undervalued considering the price to earnings ratio of 10. The shares are also appearing attractive based on price to sales and book ratios.

Q4 Results and Updated Outlook Could Add to IBM Stock Rally

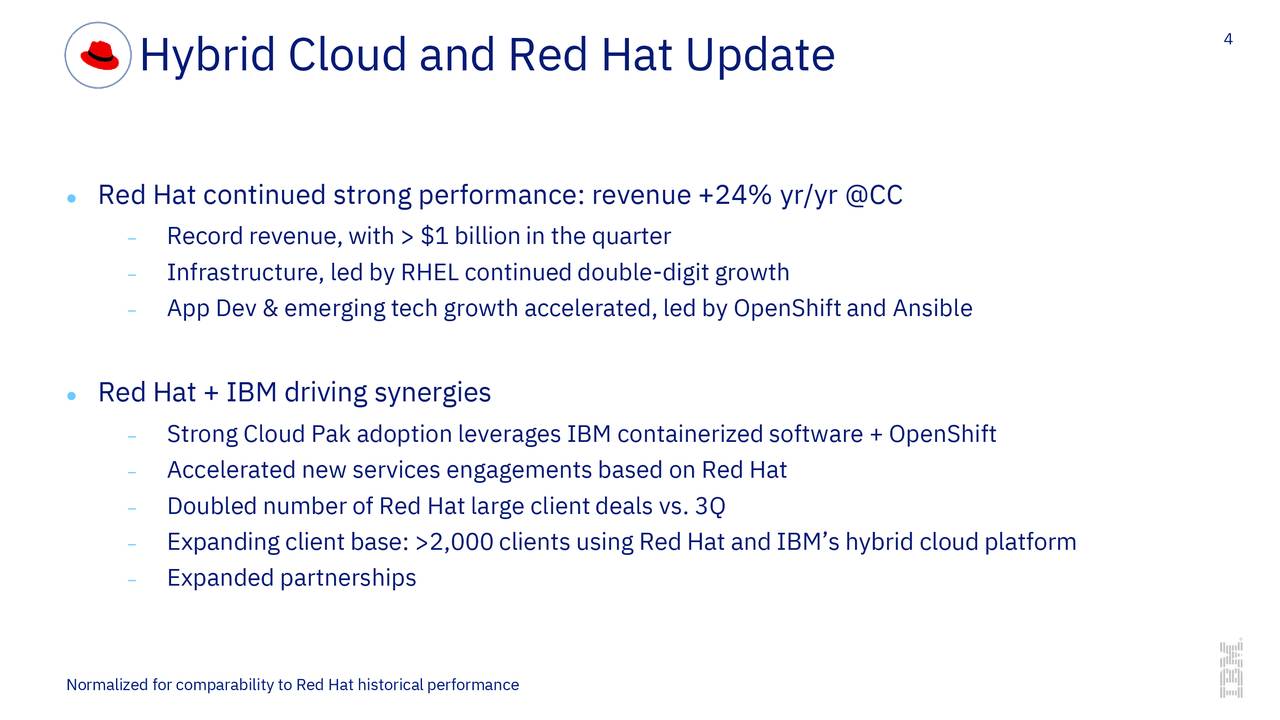

The company topped fourth-quarter revenue and earnings estimate by $160 million and $0.02 per share, respectively. Its Q4 revenue of $21.78 billion increased by 0.1% from the year-ago period. Its revenue grew for the first time in the past five quarters in a row. The revenue growth is driven by Red Hat acquisition and cloud revenue.

On top, the company also experienced a 190 basis point improvement in its operating margins. Its earnings per share from continuing operations stood around $4.11 per share.

“Looking ahead, this positions us for sustained revenue growth in 2020 as we continue to help our clients shift their mission-critical workloads to the hybrid cloud and scale their efforts to become a cognitive enterprise,” said Ginni Rometty, IBM chairman, president, and chief executive officer. ”

Returns are Safe

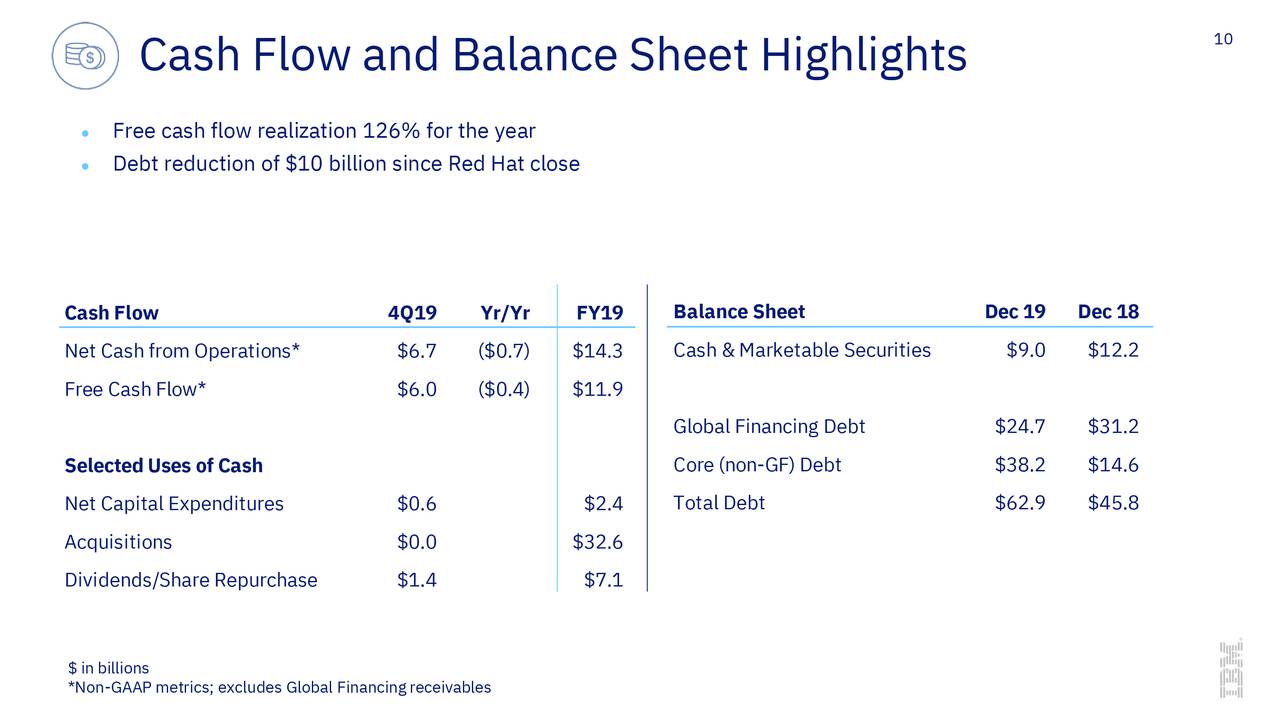

The growth in financial numbers would help in enhancing cash returns for investors. The company has increased dividends in the past 20 consecutive years. Investors should expect a mid-single-digit dividend increase by the end of the first quarter. Its cash flow generation potential is strong enough to cover dividend payments and investments in growth opportunities. The company had generated a free cash flow of $11 billion in fiscal 2019.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account