Bond Interest Rates – Understanding Your Bond Investment

If you are thinking of investing in bonds, you might have come across terms such as flight-to-quality. For good reason, bonds are considered a sort of seatbelt for your diversified portfolio. By virtue of their low risk levels and income generation, they are considered a must-have for every investor.

When you research the options available for investing in bonds, you will have to review three crucial aspects. These are bond interest rates, coupon rates, and yield rates. You might find this investment jargon confusing since the terms are often used interchangeably, but do they mean the same thing or are they completely separate entities?

In this guide, we will delve into the intricacies of bond interest rates and help you figure that out. You will then be better armed to choose your bonds wisely and add value to your portfolio.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

-

-

What are bond interest rates?

Before we define bond interest rates, let us remind ourselves how bonds work. A bond is debt security representing a loan that an investor issues to a borrower. Bonds are fixed-income instruments since they pay a fixed rate to the holder.

Regardless of the type of bond in question, the bond interest rate refers to the percentage return that the holder gets annually. In effect, it is equal to the amount that the lender charges the borrower for the loan.

The bond rate is calculated on the basis of the bond’s face value or par value. A majority of bonds come in denomination of $1,000. If the interest rate is 5%, this means that the holder will receive $50 annually on each bond until maturity. Take note though that the rate does not depend on the market value or issue price. Rather, it may vary based on market interest rates.

How bond interest rates work

Once bonds are traded in the secondary market, their prices usually fluctuate on the basis of various factors. These include prevailing interest rates, market conditions, changes in credit rating and financial matters relating to the issuer.

To illustrate how it all works, consider a 20-year bond with a $1,000 face value and an initial interest rate of 5.0%. If the government raises it by 0.5%, the new interest rate will be 5.5%.

In order to accommodate this change, the bond’s value may be reduced or discounted (below par value). But the bondholder will still collect $50 annually despite of the new interest rate. However, when collecting the principal amount, the bondholder will get the full $1,000. The extra amount per bond will cover the extra interest collected.

On the other hand, if interest rates were to drop, the same bond would now trade at a premium (above face value). A new investor would have to pay more for the bond as it has a negative interest added to it. Similarly, investors who already possess the bonds may choose to trade them in before interest rates increase and value decreases.

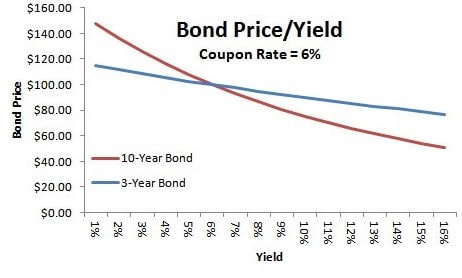

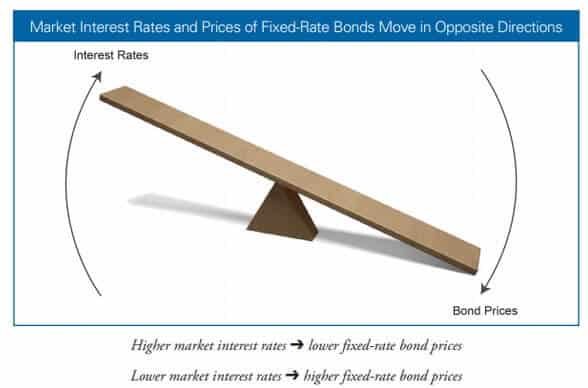

Essentially, when interest rates increase, the bond value decreases and when interest rates decrease the bond value increases.

If a new investor buys the $1,000 par value bond at $1,100 with an interest rate of 5%, they would still collect $50 as interest annually. However, the rate of return in this case would be lower in view of the fact that the cost of purchase was higher.

There are a number of factors that come into play over the lifetime of a bond that could affect how much you can actually earn from them. In order to calculate the accurate value of your bonds at any given time, it is important to understand the differences between the terms bond interest rate, coupon rate and yield rate.

Bond interest rates vs. Coupon rates

The coupon rate of a bond is not the same as the interest rate though the two are related. As mentioned earlier, interest rates may vary to reflect changes in the marketplace. If and when this happens, the value of a bond also changes. However, even after the bond values change, the coupon rate basically lets you know how much the bond paid at the time it was issued. It refers to the fixed interest a bond earns annually, a percentage of the original price.

In fact, the use of the term “coupon” is drawn from the use of actual coupons in the past which were for periodic interest payments. When investors bought bonds, they would get a sheet of coupons. To collect payments, they would return the paper coupons on a pre-specified date and get cash in exchange. Today, the entire process is digital but the concept is more or less the same.

Once the coupon rate is set on the date of issuance, it remains the same and bondholders receive that amount at a pre-set time frequency.

In the case of the aforementioned $1,000 bond with a 5% initial interest rate, the coupon rate will remain at 5%, equivalent to $50, no matter how much the interest fluctuates. The holder can expect to receive the same amount every year per bond for the entire 20-year lifetime.

However, most bonds trade in the secondary market after issuance. As a result, its price will fluctuate virtually every day for the whole 20 years but the coupon rate will not change.

Bond interest rates vs. Yield rate

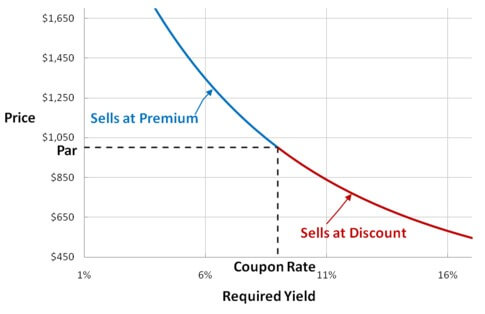

The yield rate is the value of a bond calculated on the basis of changing bond values. It refers to the rate of return that a bond generates based on the secondary market sale price. Investors calculate it based on what they paid for the bond, not based on the par value.

In some instances, the value of the two could be the same. For example, when the initial purchaser is the current holder of a bond, the rates will be the same.

The yield rate takes into consideration the fact that bond prices on the secondary market change on a daily basis.

In our example, if investor B buys the $1,000 bonds for $1,100 during a market downturn, the coupon rate remains at 5% or $50 annually. However, the yield rate is lower, 4.5%. On the other hand, if investor C buys the same bonds at $900, the rate would be higher, 5.5%.

To summarize the relationship between yield and bond price, when bond prices go down, yields go up and vice versa. The two have an inverse relationship.

Types of bond interest rates

Fixed Interest Rate

This is the most common type of bond interest rate. As its name implies, this interest rate remains static throughout the lifespan of the bonds in question.

A fixed rate bond comes with the previously mentioned coupon rate, which does not change. The rate is specified at the time of issuance and remains constant as well as non-negotiable. Investors receive interest payments at specific times before the bond matures, at which point the investor gets the principal amount back.

Floating Interest Rate

Also known as a variable interest rate, this value resets periodically. It comes with a variable coupon that keeps changing until bond maturity. It usually resets every quarter to a specific amount in relation to a reference rate that matches current market rates.

This rate rises for the duration of the bond but because it is tied to short term rates, the eventual gains may be lower than with fixed-rate bonds.

Bonds with variable rates tend to have unpredictable coupon payments. To reduce the level of risk, some issuers fix a floor and cap. Based on this, investors have an idea of the minimum and maximum interest rates payable.

In the US, floating rate bonds are typically offered by companies that have a rating of below investment grade. As such, you need to be aware of the inherent risks before making an investment.

Is yield to maturity the same as market interest rate?

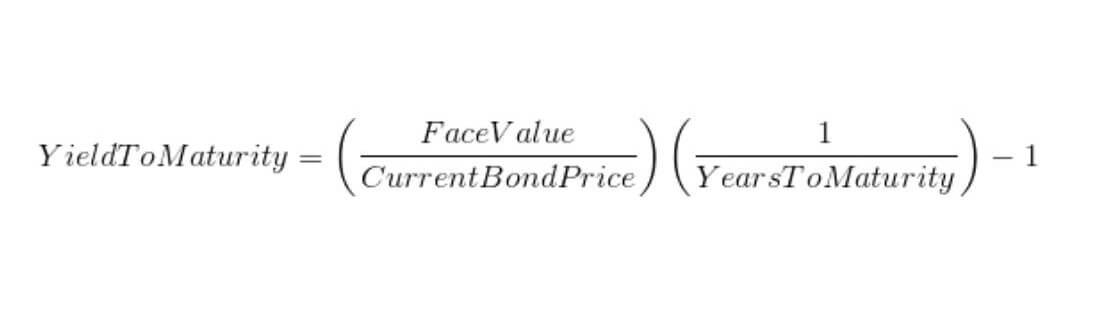

Another term that you will come across when investing in bonds is the yield to maturity (YTM). It refers to the total return that an investor anticipates if they hold on to a bond until maturity and is therefore not the same as market interest rate. Though it is considered a long term gain, it is calculated as an annual rate.

Going back to our previous example, the 5% $1,000 bond pays out $25 on June 1 and December 1 until it matures in 20 years. If the current market interest rate is 6%, the current value of the bond will be worth approximately $830.

The yield to maturity, in this case, will take into consideration that the bondholder will receive $1,000 at the end of 20 years on an investment that is worth only $830 at the maturity date. It will also factor in that the investor is receiving $50 annually on the same investment. Note that the value will keep changing to accommodate changes in market rates.

How market interest rates affect bond interest rates

During the issuance of new bonds, government-controlled interest rates largely affect coupon rates. If for instance, the government sets the minimum interest at 6%, no entity may issue new bonds with a rate below this.

When it comes to fixed coupon rates, no matter what the national interest rate is, bonds pay out-static amounts for their entire lifetime. So when new bonds come into the market with more attractive interest rates, they become the more appealing choice for investors. In order to remain competitive, the value of the bond has to change to reflect market changes.

In our illustration, an investor looking to sell the $1,000 bonds whose interest rate is 5% would have to take into consideration the forces of demand and supply. The only way to sell the bonds would be by reducing the price. By selling them at around $830, the yield rate would be 6% and thus good enough to match prevailing market rates.

Conversely, if the general interest rate drops to 3.5%, then demand would inevitably increase. Investors would want in on the bond offering the highest returns. Consequently, the heightened demand would drive the price up. The same bond could sell for as high as $1430 and still remain competitive.

Why do these values matter? They make a significant impact on the total value or yield of a bond. Given that every bond returns its full face value upon maturity, it is possible to increase profits by buying at a discount (below par value).

The investor who buys the $1,000 bond at $830 gets coupon payments every year. But over and above these, there is an additional yield of $170 per bond once they mature.

In summary, when market interest rates rise, the interest rates of current bonds drop and so does their face value. In turn, this raises the yield on older bonds so as to place them on par with new bonds that are being issued with higher coupon rates.

As bonds trade on the secondary market, with prices and yields changing continuously, yields tend to converge. At the end of the day, the result is that investors get approximately the same profit for the same risk level.

These dynamics keep the bond market in check ensuring that an investor does not buy bonds with an 8% yield while another one buys the same with just 2%.

How rising interest rates can impact your bond portfolio

Up to this point, you might have imagined that the bond market is a risk-free investment option. On the basis of the above, however, there are some inherent risks associated with fluctuating interest rates.

Bonds trading in the secondary market have to keep readjusting yields and prices in order to match current market interest rates. Discerning investors have the opportunity to reap gains from both the yield and capital appreciation. However, unwitting investors can lose their principal due to market changes. During the market downturn that shook the economy between 2000 and 2002, many fled from stocks to bonds to cushion their portfolios against erosion. But once the market started on an uptrend, the value of their bond portfolio inevitably suffered a blow.

When the interest rate movements are significant, the effect can be profound on an investor’s portfolio. To protect your investment against such blows, take a look at market conditions that could lead to higher interest rates:

- High risk appetites prompting investors to sell low-risk, low-return investments

- Mounting speculation that the Fed will at some future point raise rates

- Rising inflation

- Strong economic growth

What goes down eventually comes up. Being prepared for any of the above eventualities allows investors to capitalize on these opportunities to increase income.

How to protect your bond portfolio from rising interest rates

Consider some ways to protect your portfolio and avoid being caught unawares by changes in interest rates:

Reduce Bond Exposure

Long-term bonds are much more sensitive to rate increases than short and medium-term options. Hence, when the market conditions seem to suggest a rate increase, it is time to reduce long-term exposure and beef up the alternative positions.

Note though that this move is not without its repercussions. Short-term bonds offer lower profit-making potential than their longer-term counterparts. So be careful when pairing up your short-term positions with other investment vehicles. Ensure that these are not sensitive to rising interest rates.

Make Use of Bond Ladders

A bond ladder refers to a series of bonds maturing at regular intervals, possibly every 3, 6, 9 or 12 months. With rising rates, you can reinvest each of the mature bonds at the new, higher rates.

For example, an investor is holding $100,000 in a position earning 1% and realizes that rates will rise soon. He moves $80,000 into 4 separate bond ladders that mature every 3 months. Every 3 months, he again moves the maturing bond into another ladder paying a higher rate.

Avoid Inflation Hedges

Inflation hedges mostly take the form of tangible assets like precious metals. However, these tend to perform well when inflation is high and rates are low. But when interest rates start increasing, they often flop because of high rates and lower inflation.

Floating-Rate Bonds

Unlike fixed-rate bonds, these pay amounts that reset periodically. In contrast with traditional bonds, these are to some extent exempt from interest-rate risk. In fact, bonds with a floating rate pay higher when the market rate rises, making a viable investment choice.

The pace at which the interest rate on this type of bond rises depends on the performance of the benchmark rate mentioned earlier. As such, they may to some extent still be subject to interest rate risk, which can arise if the bond’s rate underperforms the general market rate.

Note that the bond’s rate has the capacity to adjust to match market conditions and have lower volatility levels and fluctuations in price. In a rising rate market, this type of bond avoids price volatility since bondholders do not have as much opportunity cost as with fixed-rate bonds.

Convertible Bonds

Like traditional bonds, convertible bonds pay out a fixed interest semi-annually, albeit at a lower rate. However, the key difference is that bondholders have the right to convert them to stocks in the issuing company.

Due to their sensitivity to movements in the stock market, they tend to move positively in relation to economic uptrends. As such, when the bond market bows to pressure from rising rates, they are likely to increase in value.

High Yield Bonds

Being on the high risk end of fixed income investment instruments, it stands to reason that high yield bonds will perform well when interest rates rise. However, their primary risk is credit risk, the possibility of having the issuer default.

This group of bonds tends to perform well when rates rise because they have shorter lifespans. They are less sensitive to interest rates than bonds with similar maturity periods.

Another point to their favor is that their yields are considerably higher. So even a negative impact from rising interest rates will not eat much into their profit advantage compared to a regular bond.

Emerging Market Bonds

Just like high yield bonds, emerging market bonds have a higher credit-sensitivity than their rate sensitivity. Investors generally consider the fundamental fiscal strength of the country issuing them and ignore the prevalent rates.

By virtue of this, economic growth at times has a positive effect on debts in emerging markets while increasing rates in the developed world. Keep in mind though that this is not always the case.

Conclusion

If you are new to investing in bonds, it may seem like a relatively steep learning curve ahead. Though through reading this article we hope that understanding bond interest rates has been found to not be as complex as it sounds. Bond Interest rates certainly play a crucial role in maximizing your return on investment, so take care to put the above pointers into consideration, protecting your portfolio against sudden changes and making the most of arising opportunities.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

FAQs

Why do bond prices decrease when interest rates increase?

When interest rates increase, demand will be low for a bond with a lower interest rate. Since most bonds have fixed rates, it will be necessary to reduce the price to effectively raise the interest rate.How do I calculate a bond coupon rate?

To calculate the coupon rate, divide the sum of the annual coupon payment by the par value of the bond.What is the par value?

Par value refers to the face value of a bond when it is issued.How do I calculate bond yield rate?

The bond yield rate is calculated by dividing the annual coupon payment by the current bond price.See Our Full Range Of Bonds Resources – Bonds A-Z

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING:

För att använda sidan måste man vara minst 18 år. Om du behöver hjälp eller rådgivning angående spelproblem, vänligen kontakta Stödlinjen.

Vi kan ibland inkludera affiliatelänkar i vårt innehåll. Genom att klicka på dessa länkar kan vi erhålla en provision – utan extra kostnad för dig.

Det är viktigt att notera att innehållet på denna webbplats inte ska betraktas som spelråd. Spel är en spekulativ verksamhet där ditt kapital är i risk. Vi erbjuder denna webbplats gratis, men vi kan få provision från de företag som vi presenterar här.Copyright © 2022 | Learnbonds.com

Scroll Up